Governments internationally are now under clearer pressure to measure, disclose and manage climate risk.

The International Public Sector Accounting Standards Board (IPSASB) has launched its first climate-related reporting standard for governments and public entities.

For Africa, where fiscal pressures and climate vulnerability intersect, the move could reshape public finance transparency.

The question is no longer whether governments should report climate risks, but how quickly they can align.

IPSASB Climate Standard Raises Public Sector Disclosure Bar – Global Climate Disclosure Enters Public Finance

A new chapter in public financial accountability has begun. The IPSASB has formally launched a climate-related reporting standard designed specifically for governments and public sector entities.

The move brings sovereign and sub-sovereign climate disclosure closer to the rigour already emerging in corporate reporting under frameworks such as the International Sustainability Standards Board standards.

For African economies balancing debt sustainability, climate adaptation needs and investor scrutiny, the implications are structural rather than symbolic.

Public Climate Reporting Enters Formal Era

IPSASB’s new standard establishes a structured framework that requires public entities to disclose climate-related risks, governance arrangements, strategy, and financial impacts.

The objective is clear: embed climate considerations directly into public financial reporting, rather than treating them as peripheral sustainability narratives.

This signals a shift from voluntary environmental statements to integrated fiscal disclosure.

Aligning Public Finance With Climate Reality

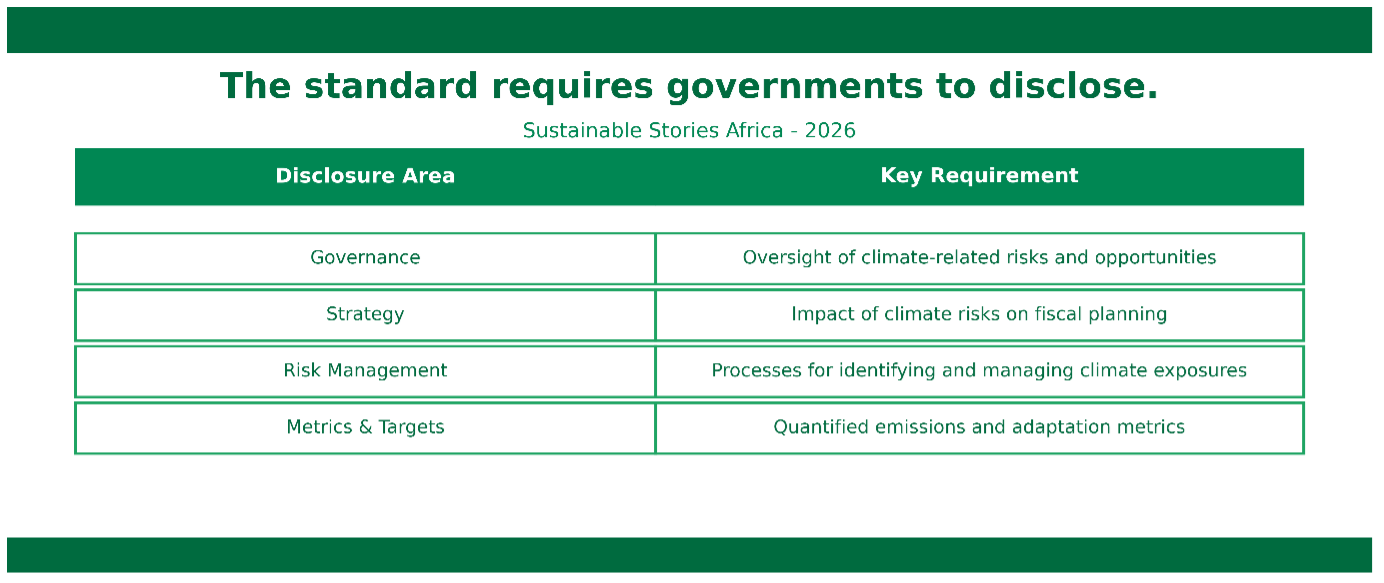

The standard requires governments to disclose:

Disclosure Area | Key Requirement |

|---|---|

Governance | Oversight of climate-related risks and opportunities |

Strategy | Impact of climate risks on fiscal planning |

Risk Management | Processes for identifying and managing climate exposures |

Metrics & Targets | Quantified emissions and adaptation metrics |

The structure mirrors that of the private-sector sustainability reporting, enhancing comparability across markets.

Importantly, the framework is designed for integration with existing public sector accounting standards. It does not replace financial reporting; it deepens it.

For African governments, where climate shocks are increasingly affecting budgets through floods, droughts, energy disruptions and infrastructure damage, embedding climate risk into fiscal frameworks could improve both resilience planning and investor confidence.

Development finance institutions and sovereign bond investors have long sought greater transparency around climate liabilities. This standard provides a formal pathway.

Stronger Transparency, Lower Sovereign Risk

The potential upside is significant.

Enhanced climate disclosure may:

- Improve sovereign credit assessments

- Strengthen access to climate finance

- Reduce information asymmetry in bond markets

- Support structured adaptation planning

In frontier markets, opacity often inflates risk premiums. Clear climate reporting could help narrow those spreads over time.

For Africa, which accounts for a small share of global emissions but faces disproportionate climate vulnerability, credible public disclosure frameworks could strengthen its case in international climate finance negotiations.

Moreover, alignment with globally recognised standards enhances credibility in blended finance, green bond issuance, and multilateral lending negotiations.

This is not merely an accounting reform; it is a signal for capital markets.

Implementation Capacity Will Determine Impact

Adoption alone will not deliver outcomes. Capacity constraints remain significant across many public finance systems.

Key implementation challenges include:

- Data collection gaps

- Weak emissions inventories

- Limited inter-agency coordination

- Budgetary integration complexity

African governments may require technical assistance to translate disclosure requirements into operational systems.

Regional bodies and audit institutions could play a catalytic role in harmonising approaches, ensuring climate risks are reflected in medium-term expenditure frameworks and sovereign debt strategies.

The next phase will significantly highlight whether political commitment aligns with the ambition of the framework.

PATH FORWARD – Building Climate Accountability Into Public Budgets

Governments must prioritise strengthening institutional capacity, upgrading data systems, and aligning audit practices to effectively operationalise the climate framework issued by IPSASB.

Regional cooperation and technical partnerships will be critical.

If implemented adequately, climate disclosure could evolve from a compliance exercise to a fiscal stabilisation tool, strengthening investor trust while embedding resilience directly into Africa’s public finance architecture.

Culled From: IPSASB Launches Climate-Related Reporting Standard for Governments, Public Sector - ESG Today