The European Union is preparing to anchor a 90% emissions reduction target into its climate policy architecture. The move signals one of the most ambitious mid-century transition frameworks globally.

For businesses, the implications extend beyond Europe’s borders. Supply chains, capital allocation and carbon pricing strategies may soon recalibrate to meet stricter regulatory expectations.

For Africa, the ripple effects could reshape export competitiveness and climate finance flows.

EU’s 90% Emissions Target Redefines Climate Business Trajectory – Europe Raises Climate Ambition Bar

The European Union is advancing plans to adopt a 90% net reduction target in greenhouse gas emissions by 2040, intensifying its trajectory toward climate neutrality by 2050.

The proposed milestone would significantly tighten the bloc’s current climate pathway, sending a strong policy signal to markets, industries and global trading partners.

For African exporters and climate policymakers, the implications are strategic rather than symbolic.

Ambition Escalates Ahead Of 2040

A 90% emissions reduction target would represent one of the most aggressive climate benchmarks among major economies.

The proposal builds on the EU’s existing 55% reduction target by 2030 and its 2050 legally binding net-zero objective under the European Climate Law.

Such ambition is not merely environmental; it is economic. Climate policy is quickly shaping industrial policy.

Policy Signals Reshape Global Markets

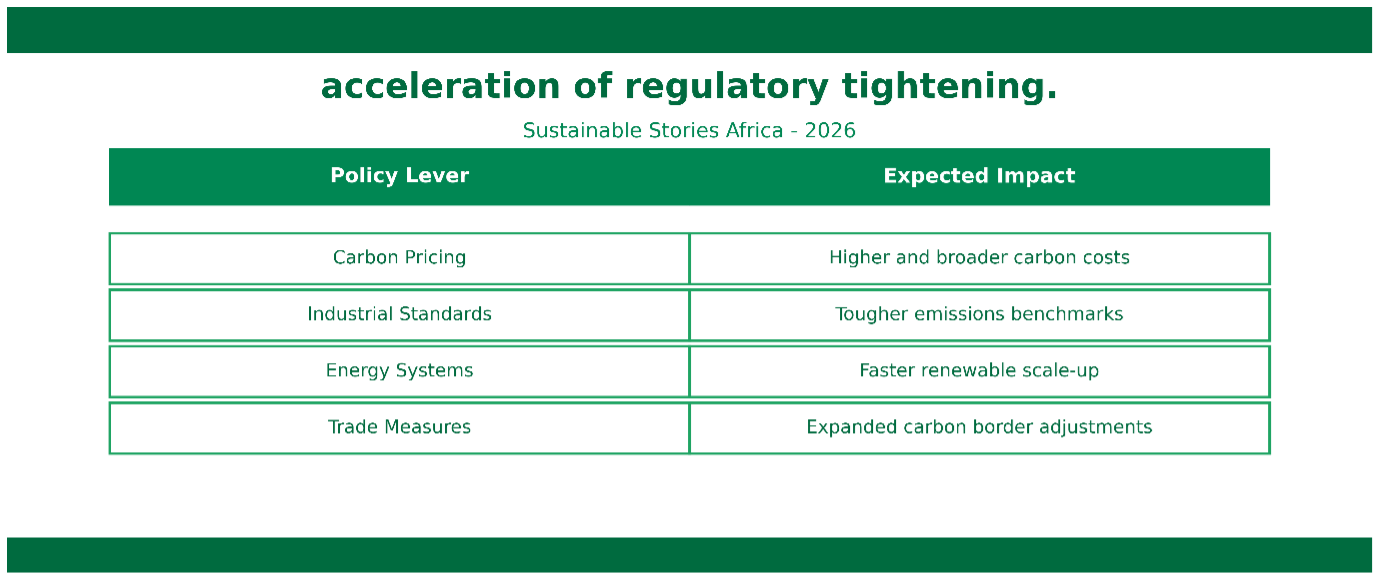

The proposed target will likely accelerate regulatory tightening across:

Policy Lever | Expected Impact |

|---|---|

Carbon Pricing | Higher and broader carbon costs |

Industrial Standards | Tougher emissions benchmarks |

Energy Systems | Faster renewable scale-up |

Trade Measures | Expanded carbon border adjustments |

For businesses operating within or exporting to Europe, transition planning becomes imperative.

The EU’s Carbon Border Adjustment Mechanism (CBAM) already places reporting obligations on certain imports. A 90% target could expand compliance depth and enforcement intensity.

For African economies currently exporting steel, cement, fertilisers or energy-intensive goods, carbon competitiveness will matter increasingly.

Climate Certainty Unlocks Investment Flows

Clear long-term targets reduce regulatory ambiguity.

Investors prefer policy stability. A defined 2040 pathway strengthens forward visibility for renewable energy, green hydrogen, grid infrastructure and clean manufacturing.

Potential upside effects include:

- Accelerated green capital mobilisation

- Stronger innovation incentives

- Expanded sustainable finance instruments

- Enhanced corporate transition clarity

For Africa, alignment with EU climate frameworks may unlock blended finance opportunities and strengthen participation in clean supply chains.

However, the opportunity depends on preparedness.

African Policymakers Must Anticipate Shifts

The tightening of European standards should trigger a proactive strategy across African governments and corporates.

Recommended actions include:

- Strengthening carbon accounting systems

- Aligning ESG disclosure frameworks with global standards

- Investing in renewable generation capacity

- Supporting export-sector decarbonisation

Without strategic alignment, exporters risk facing rising compliance costs and potential market exclusion.

Conversely, early movers could secure a competitive advantage.

PATH FORWARD – Align Policy, Capital, And Competitiveness

European climate ambition is accelerating. African policymakers and businesses must integrate carbon competitiveness into trade, industrial and fiscal strategies.

By aligning standards, strengthening disclosure systems and investing in clean infrastructure, Africa can transform regulatory pressure into an investment opportunity, positioning itself within emerging low-carbon value chains rather than outside them.

Culled From: https://www.linkedin.com/pulse/climate-business-193-90-emission-reduction-target-eu-new-jordanova-ayaqe