Lagos taxpayers have been granted additional time to file annual returns. The Lagos State Internal Revenue Service has extended the deadline to February 7, offering employers and individuals temporary relief.

The move follows operational and compliance pressures that threatened to overwhelm filers.

For Africa’s largest commercial hub, the extension reflects both administrative flexibility and fiscal urgency.

Filing Window Stretched Amid Compliance Pressures

The Lagos State Internal Revenue Service (LIRS) has extended the deadline for filing annual tax returns to February 7, granting employers and individual taxpayers additional time to meet statutory obligations.

The extension comes amid heightened filing activity and reports of operational challenges on digital platforms, which risked late submissions and penalties.

For Lagos, Nigeria’s commercial nerve centre, the decision underscores the delicate balance between enforcement discipline and administrative responsiveness.

Deadline Extension Signals Responsive Tax Administration

Tax compliance deadlines are rarely flexible. Yet LIRS’s decision signals a recognition of system bottlenecks and taxpayer concerns.

By shifting the filing cut-off to February 7, the agency aims to prevent avoidable defaults and preserve voluntary compliance levels.

For businesses already navigating economic headwinds, even a brief reprieve can reduce administrative strain.

Compliance Pressures Meet Digital Transition

Annual returns filing in Lagos requires employers to declare employee income and tax deductions for the preceding fiscal year, in line with Nigeria’s Personal Income Tax Act.

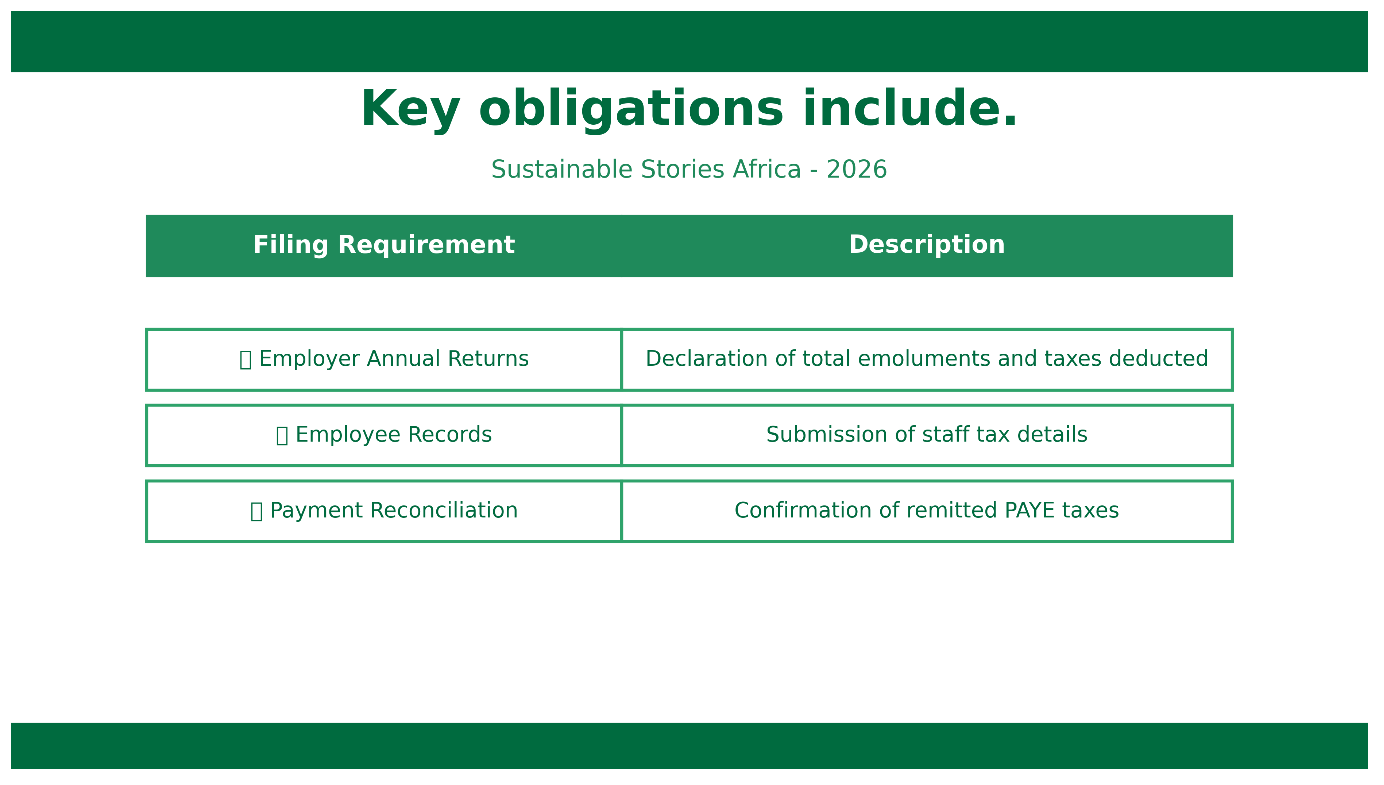

Key obligations include:

Filing Requirement | Description |

|---|---|

Employer Annual Returns | Declaration of total emoluments and taxes deducted |

Employee Records | Submission of staff tax details |

Payment Reconciliation | Confirmation of remitted PAYE taxes |

The extension reflects practical realities:

- High filing volumes close to the deadline

- Digital platform traffic congestion

- Risk of late penalties for compliant employers

Lagos accounts for a significant share of Nigeria’s internally generated revenue (IGR), making efficient tax administration critical to state budgeting.

For SMEs and corporate taxpayers, the extension reduces immediate compliance risk while preserving revenue timelines for government planning.

Strengthening Trust Through Administrative Flexibility

Flexible enforcement can strengthen institutional trust.

When tax authorities respond pragmatically to operational constraints, compliance culture improves over time. Employers are more likely to meet obligations voluntarily when penalties are not perceived as arbitrary.

Potential benefits of the extension include:

- Reduced penalty disputes

- Improved data accuracy

- Higher overall filing completion rates

- Sustained revenue credibility

In a city driving Nigeria’s fiscal innovation, from e-tax systems to revenue digitisation, maintaining taxpayer confidence is essential.

A rigid deadline amid technical challenges could have undermined that trust.

Taxpayers Urged To File Before New Deadline

LIRS has urged all employers and taxable persons to utilise the extended window and complete submissions before February 7.

Procrastination remains risky. Late filings beyond the revised date may attract statutory penalties under existing tax regulations.

Tax consultants advise businesses to:

- Confirm PAYE reconciliation status

- Review employee schedules carefully

- Ensure portal submission confirmation receipts are saved

The extension is not a waiver; it is a final opportunity.

PATH FORWARD – Building Predictable And Efficient Compliance Systems

LIRS is expected to continue strengthening its digital tax infrastructure to manage peak filing periods more efficiently.

System capacity improvements and clearer pre-deadline communication could reduce future bottlenecks.

For taxpayers, the lesson is clear: compliance planning should begin early. The February 7 extension offers relief, but sustainable tax administration requires both institutional efficiency and proactive corporate discipline.

Culled From: LIRS extends deadline for filing of annual returns to February 7 - Businessday NG