Ethiopia has signed its first private sector transmission agreement, marking a structural shift in how the country finances and expands its national grid.

The deal introduces private capital into a segment dominated by state utilities, signalling deeper reforms for the electricity market.

For investors and development financiers, the agreement could unlock a new phase of grid modernisation across East Africa.

Ethiopia Signs First Private Sector Transmission Agreement

Ethiopia has formalised its first private sector participation in electricity transmission, a landmark step in the country’s power sector reform agenda.

The agreement propels private capital to finance, develop, and potentially operate high-voltage transmission infrastructure, traditionally the exclusive domain of state utilities.

The deal reflects Addis Ababa’s broader efforts to liberalise segments of its energy market, attract foreign investment, and strengthen grid capacity to support expanding generation assets, including hydropower, wind and solar.

For a country positioning itself as a regional energy exporter, transmission reliability is now as strategic as generation capacity.

Grid Reform Signals Structural Shift

Transmission infrastructure forms the backbone of power systems. Without adequate high-voltage lines and substations, generation assets remain stranded.

Ethiopia’s move to introduce private participation signals recognition that public balance sheets alone cannot finance the scale of grid expansion required.

Electricity demand is increasing, while the country’s renewable generation portfolio continues to grow.

The agreement represents a policy pivot: from state-led grid development to blended capital participation.

Financing, Capacity and Regional Integration

Ethiopia has invested heavily in generation capacity over the past decade, particularly in hydropower.

However, grid bottlenecks have constrained optimal distribution and cross-border export potential.

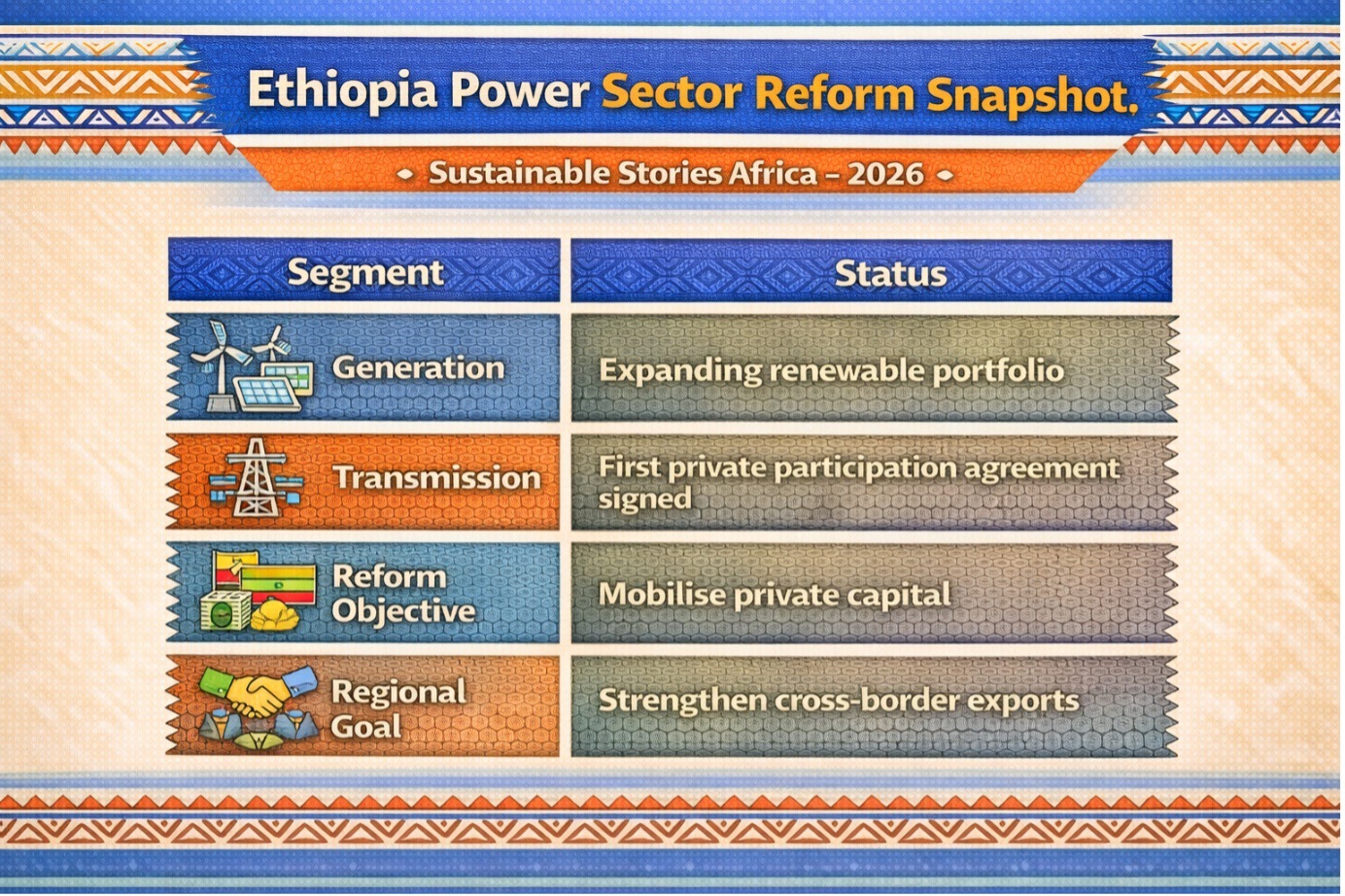

Ethiopia Power Sector Reform Snapshot

Segment | Status |

|---|---|

Generation | Expanding renewable portfolio |

Transmission | First private participation agreement signed |

Reform Objective | Mobilise private capital |

Regional Goal | Strengthen cross-border exports |

Transmission projects are capital-intensive and long-gestation. Private sector participation can accelerate deployment, provided tariff structures and regulatory clarity ensure predictable returns.

For East Africa’s regional power pool, strengthening Ethiopian transmission lines enhances cross-border electricity trade, particularly with neighbouring countries seeking affordable renewable imports.

However, investor confidence will depend on contract enforceability, currency risk mitigation, and sovereign credit stability.

Unlocking Grid-Led Growth

Private transmission investment could deliver several systemic gains:

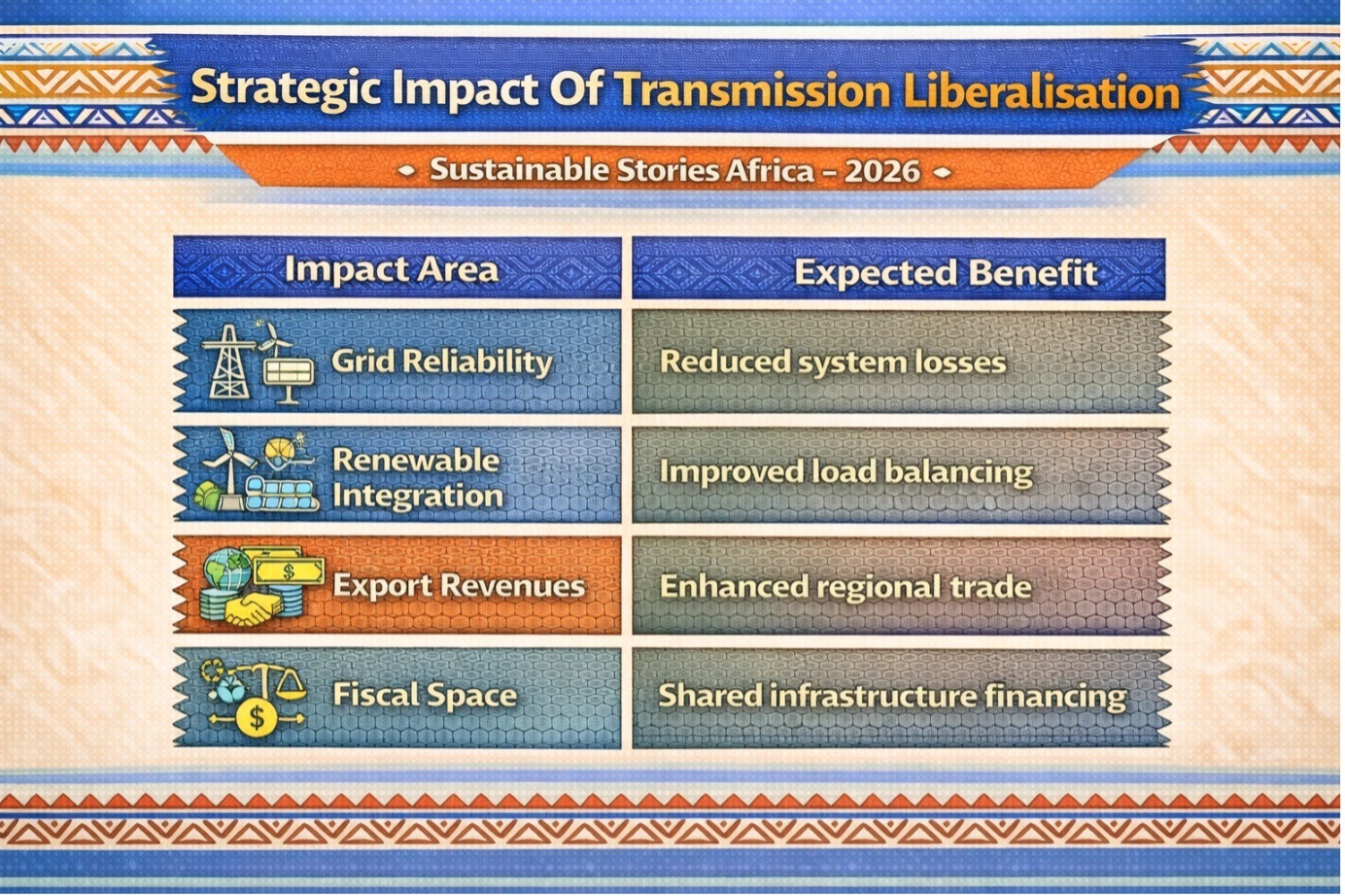

Strategic Impact Of Transmission Liberalisation

Impact Area | Expected Benefit |

|---|---|

Grid Reliability | Reduced system losses |

Renewable Integration | Improved load balancing |

Export Revenues | Enhanced regional trade |

Fiscal Space | Shared infrastructure financing |

A stronger grid supports industrialisation. Manufacturing zones, urban expansion and electrified transport all depend on reliable transmission capacity.

Moreover, integrating private capital diversifies funding sources. Development finance institutions (DFIs) often co-invest in such arrangements, lowering perceived risk.

The reform also aligns with continental trends. Several African countries are exploring independent transmission projects or public-private partnerships (PPPs) to bridge infrastructure gaps.

Building Regulatory Confidence

The success of Ethiopia’s first private transmission deal will hinge on execution. Transparent procurement, independent regulation, and cost-reflective tariffs are critical.

Policy consistency remains essential. Investors seek assurance that regulatory changes will not undermine long-term contracts. Strengthening institutional capacity within energy regulators will be central to maintaining credibility.

If implemented effectively, the model could expand beyond a single project, catalysing additional private participation across Ethiopia’s grid network.

For development partners, the deal provides a replicable template for financing transmission, often the most underfunded segment of African power systems.

PATH FORWARD – Institutional Reform Drives Grid Expansion

Ethiopia is prioritising regulatory clarity, investor protections and tariff reform to anchor private transmission participation. Strengthening grid governance will determine scalability.

If institutional reforms align with capital mobilisation, Ethiopia could accelerate regional power integration while easing fiscal pressure on public utilities.

Culled From: Ethiopia signs first private sector transmission deal