Lagos State has taken a major leap into sustainable development financing by issuing its first green bond alongside a record-breaking conventional bond, raising a combined N244.8 billion. The dual issuance signals investor confidence in Lagos's governance credentials and its ambition to finance infrastructure through ethical and innovative capital-market instruments.

In doing so, the state positions itself as a model for inclusive sub-national financing in Africa, linking infrastructure expansion with climate resilience and public-sector reform.

Approach and Issue – What's at Stake

Lagos State expanded its developmental-financing toolbox through a maiden green bond of N14.815 billion (5-year at 16.00%) and a conventional bond of ₦230 billion (10-year at 16.25%). Book-builds for both were oversubscribed: the green bond was 97.71% oversubscribed to the amount N29.29 billion, whilst the conventional bond was oversubscribed by 34.81% to the amount of N310.06 billion.

This issuance occurs in a context of Nigeria's sub-national entities seeking to access capital markets more robustly, while aligning with the SDG 11 "Sustainable Cities & Communities" and SDG 13 "Climate Action" agendas via green financing. The question: can Lagos convert market confidence into scalable infrastructure and inclusive growth, rather than simply piling debt?

Where the Money Goes

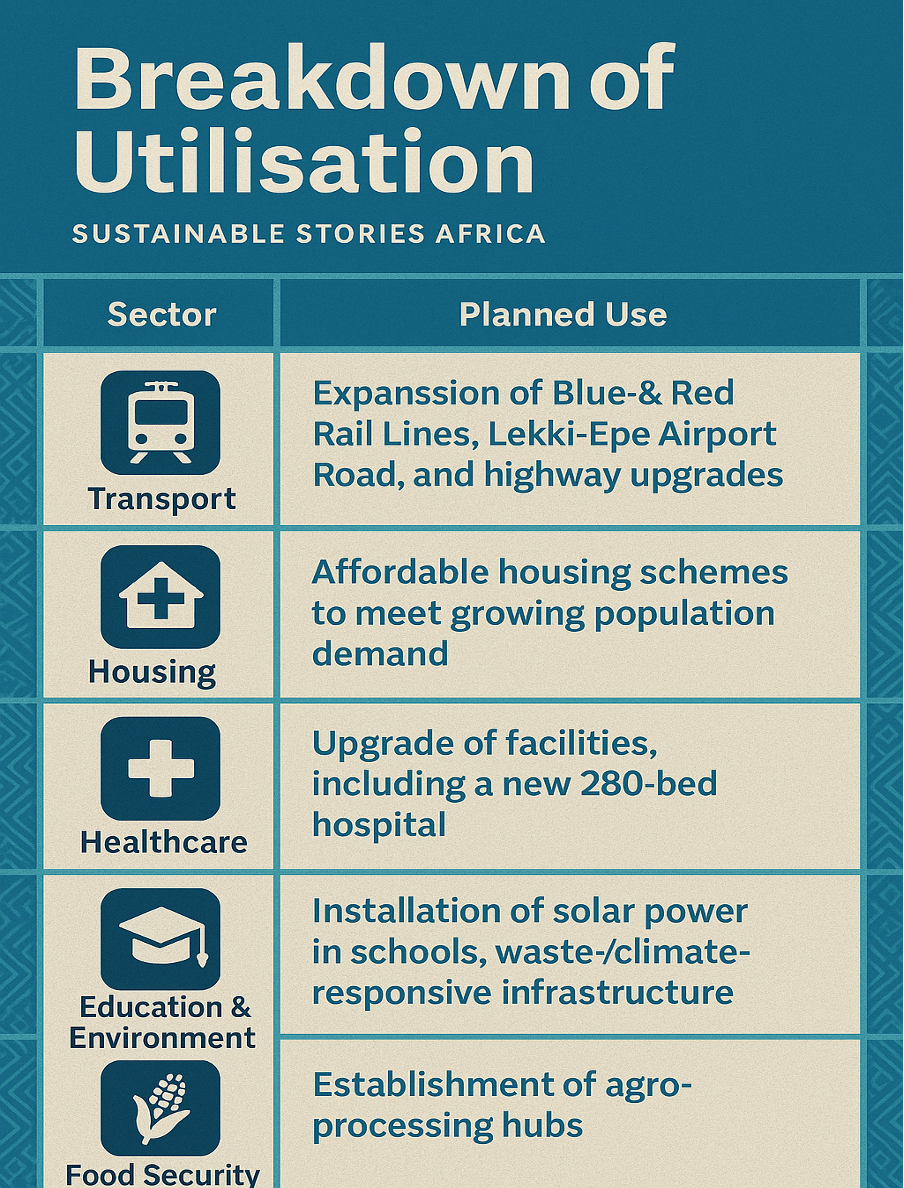

The combined N244.8 billion will be channelled into critical infrastructure across transport, housing, healthcare, education, environment and food security.

Breakdown of Utilisation

| Sector | Planned Use |

|---|---|

| Transport | Expansion of Blue & Red Rail Lines, Lekki-Epe Airport Road, and highway upgrades |

| Housing | Affordable housing schemes to meet growing population demand |

| Healthcare | Upgrade of facilities, including a new 280-bed hospital |

| Education & Environment | Installation of solar power in schools, waste-/climate-responsive infrastructure |

| Food Security | Establishment of agro-processing hubs |

This resource allocation signals a shift toward ethical finance, using instruments like green bonds, which tie proceeds to projects with measurable ESG outcomes.

The state also secured a second-party opinion and certification by the Climate Bonds Initiative for the green bond.

For investors, the message is clear: Lagos is not only borrowing, but issuing high-discipline, market-tested debt, raising its national long-term senior unsecured rating to AA-(NG) by GCR Ratings.

What Made It Happen

Several factors underpin the success:

- A solid revenue base – Lagos's tax revenue rose from N679 billion in 2023 to N1.04 trillion in 2024; total revenue grew over 100% to N2.34 trillion.

- Strong governance – Continuity of leadership and fiscal discipline elevated the state's reputation among capital-market investors.

- Strategic partnership – Collaboration with the UK Government via the UK Foreign Commonwealth Development Office helped develop the green bond framework.

- Market appetite – Oversubscription illustrates domestic investors' demand for sub-sovereign, ethically tagged bonds.

Risks and Opportunities

Opportunities

- Sets a benchmark for other Nigerian states and African sub-nationals to tap capital markets with ESG-tagged instruments.

- Mobilisation of large-scale funding supports multiple development goals simultaneously, potentially accelerating Lagos's transformation into a regional financial hub.

Risks

- Execution risk – Deployment of proceeds must be timely and transparent, or investor confidence may erode.

- Currency and macro exposure – Although the debt is local-currency, Nigeria's macro-economic volatility may pose indirect risks, especially for infrastructure with foreign-exchange components.

- Reputational risk – Green bonds must deliver measurable climate/ESG outcomes—or risk labelled "green-wash".

Path Forward – Aligning Lagos infrastructure to future markets

To capitalise on this momentum, Lagos should:

- Publish regular transparency reports on use-of-proceeds and impact metrics, aligned with global green-bond standards.

- Expand its green-bond framework to raise further tranches.

- Integrate digital public dashboards to track project delivery and citizen outcomes, enhancing accountability.

- Continue capacity-building in project design, procurement and fixed-asset management to ensure the infrastructure funded yields productivity.

If Lagos can deliver tangible outcomes from this funding, it will not only transform its infrastructure base but also embed a replicable model of innovative, inclusive sub-national financing across Africa.

Culled From: https://thenationonlineng.net/lagos-harnessing-innovative-finance-for-infrastructural-development/