The African Marine Environment Sustainability Initiative (AMESI) has called on Nigeria's government and private sector to institutionalise ESG frameworks, warning that without formal systems the country risks capital flight and governance failures.

The initiative argues that embedding ESG in investment decisions and corporate governance is now a strategic imperative for Nigeria's sustainable development.

Nigeria's ESG Call to Action

A prominent advocacy group has urged the immediate institutionalisation of Environmental, Social and Governance (ESG) frameworks in Nigeria. According to a recent report in Punch Newspapers, AMESI has asked both the federal government and private-sector actors to make ESG a core instrument for governance, investment and accountability.

With global investors increasingly favouring ESG-compliant firms, Nigeria's lag in formalising frameworks could impair access to capital and hamper sustainable business practices.

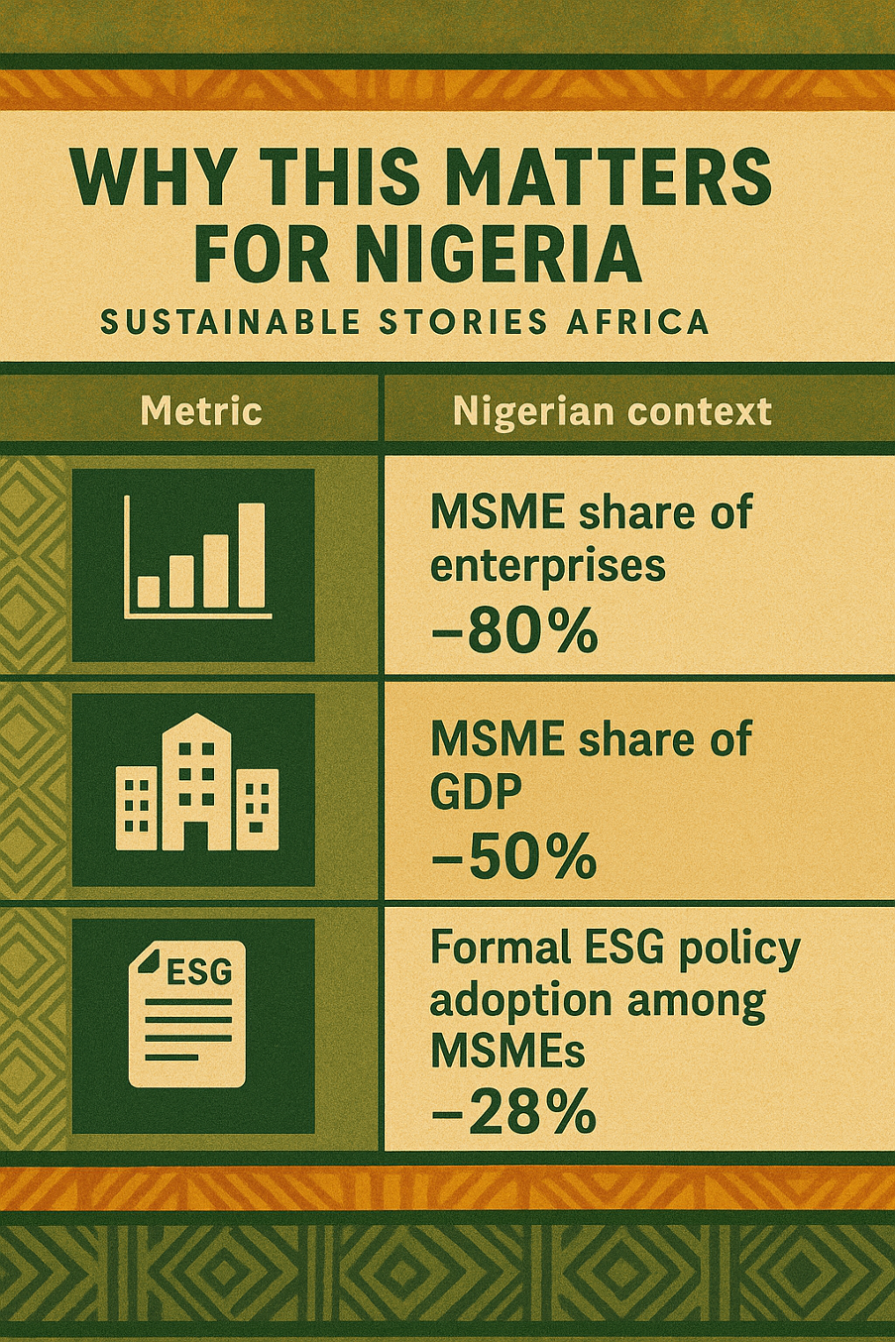

Why This Matters for Nigeria

Institutionalising ESG frameworks matters because it ties corporate and public-sector behaviour to measurable sustainability outcomes and investor expectations.

AMESI emphasises that without such systems, Nigeria may struggle with opaque disclosure, weak governance and missed investment opportunities.

In Nigeria, MSMEs alone account for over 80 % of enterprises and contribute roughly half of GDP, meaning that weak ESG integration extends risk across the economy.

| Metric | Nigerian context |

|---|---|

| MSME share of enterprises | ~80% |

| MSME share of GDP | ~50% |

| Formal ESG policy adoption among MSMEs | ~28% |

Unlocking Strategic Advantages

When properly institutionalised, ESG frameworks promise multiple gains: stronger governance, higher investor trust, alignment with global capital flows, sustainable growth and improved resilience.

For Nigeria, this means the potential to tap green finance, enhance supply-chain credibility and foster regulatory certainty.

Conversely, lagging may expose Nigerian firms and the economy to elevated climate, social and governance risk and reduce competitiveness.

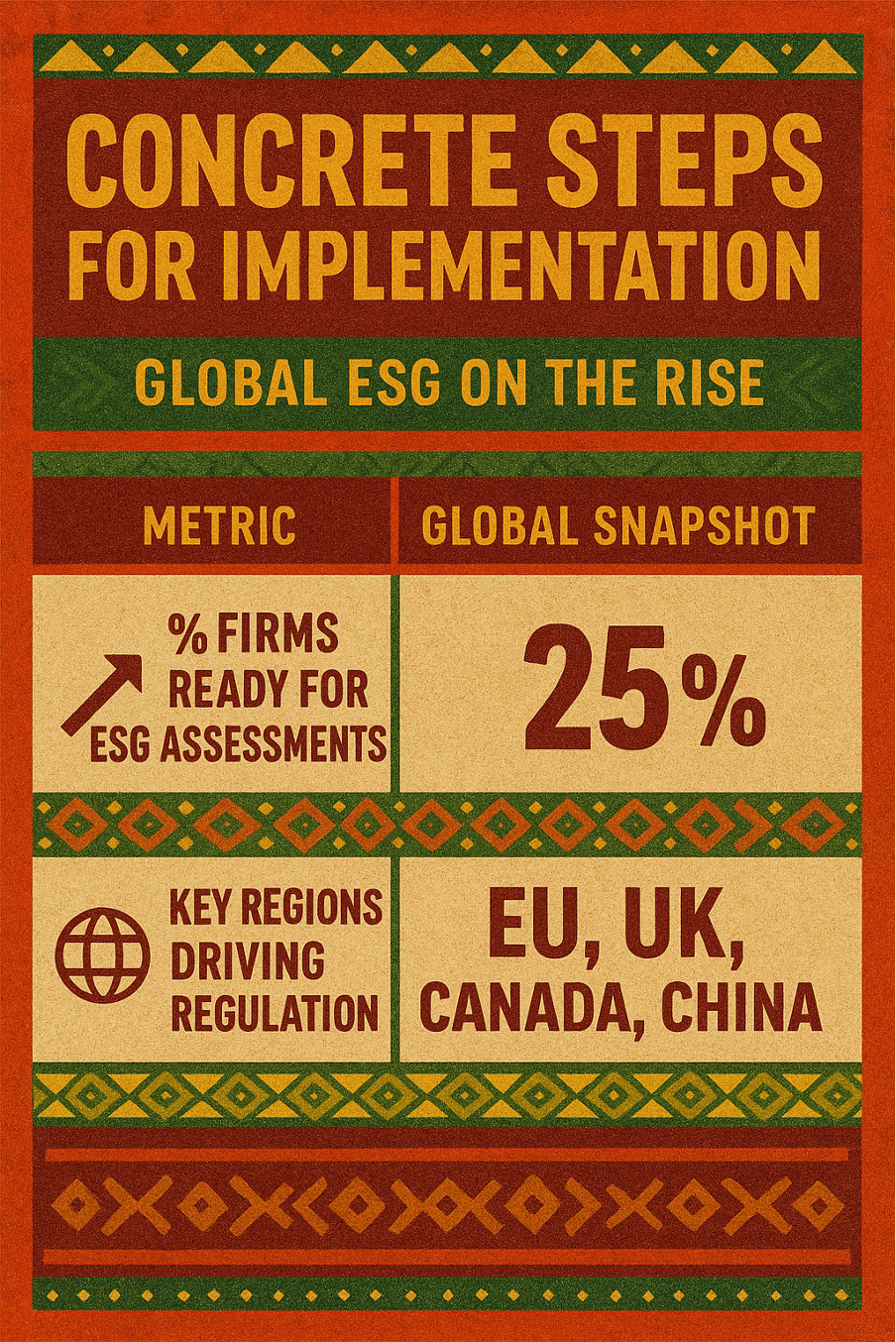

Concrete Steps for Implementation

To set the stage for transformative progress in Nigeria, the journey must begin with a few pivotal actions.

- Create clear national frameworks: government must set binding regulation and guidelines for ESG integration and disclosures.

- Build capacity and awareness: companies (especially MSMEs) need training, toolkits and reporting templates to embed ESG into operations.

- Provide enabling finance and incentives: blended finance, ESG-linked loans, tax incentives or grants can catalyse adoption.

Path Forward – Accelerate Nigeria's ESG Institutionalisation Now

Institutionalising ESG frameworks is a strategic imperative that Nigeria cannot afford to delay. With global capital shifting toward sustainability-aligned investments and regulatory regimes strengthening abroad, Nigeria's window of opportunity is finite.

By aligning policy, finance and corporate governance around ESG, the country can attract investment, boost enterprise competitiveness and embed accountability across sectors.

Milestones for Nigeria's ESG Institutionalisation

| Year | Milestone | Notes |

|---|---|---|

| 2025 | National ESG policy launched | The government issues a regulation/standard |

| 2027 | Public disclosures mandatory for large firms | Firms must report ESG metrics annually |

| 2030 | The majority of MSMEs adopt formal ESG policies | Target ~50% adoption among MSMEs |

Culled From: https://punchng.com/group-advocates-institutionalisation-of-esg-framework/