2026 is not about introducing ESG. It is about scaling it.

Across African boardrooms, sustainability has moved beyond policy statements and glossy reports.

The pressure now is execution, embedding ESG into capital allocation, governance oversight and risk management. The coming year is shaping up as a decisive inflexion point.

2026: The Year ESG Moves From Policy to Scale – ESG Enters Its Execution Era

After years of awareness-building and voluntary disclosures, 2026 is emerging as the year ESG transitions from aspiration to operational reality in African markets.

Regulators are tightening sustainability reporting rules. Investors are embedding climate and governance metrics into due diligence frameworks. Boards are under growing scrutiny to demonstrate measurable impact, not narrative compliance.

The question confronting corporate Africa is no longer whether ESG matters but whether organisations can scale it effectively.

From Disclosure to Integration

Over the past decade, ESG adoption in Africa has progressed steadily, particularly among listed banks, telecoms firms and multinationals.

Sustainability reports aligned with global frameworks such as the GRI and the TCFD are becoming increasingly common.

However, scaling ESG demands deeper integration.

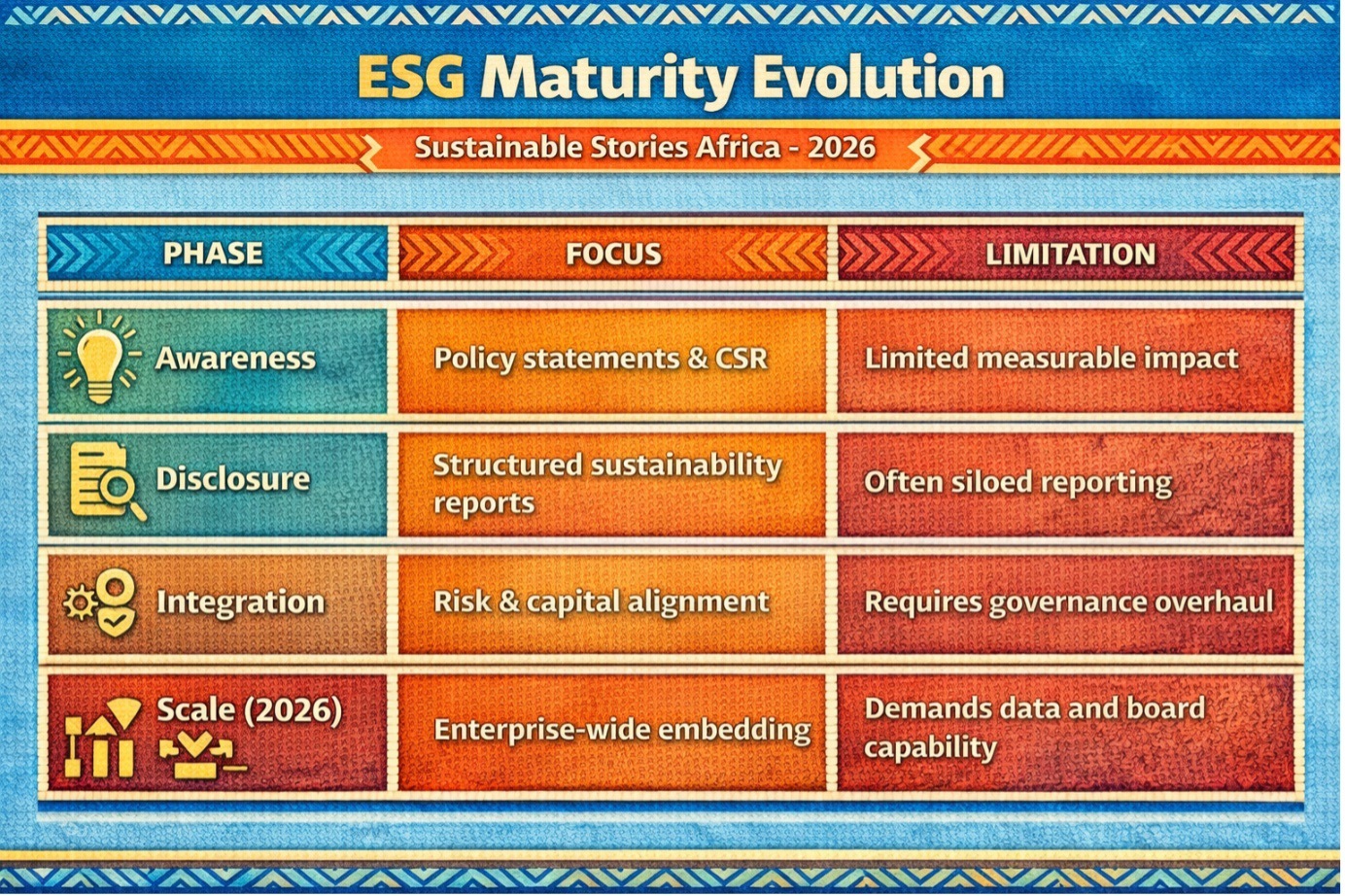

ESG Maturity Evolution

| Phase | Focus | Limitation |

|---|---|---|

| Awareness | Policy statements & CSR | Limited measurable impact |

| Disclosure | Structured sustainability reports | Often siloed reporting |

| Integration | Risk & capital alignment | Requires governance overhaul |

| Scale (2026) | Enterprise-wide embedding | Demands data and board capability |

The shift now is toward embedding ESG metrics into strategy, executive remuneration, risk committees and capital budgeting decisions.

Investors are rewarding firms that demonstrate credible climate transition plans and transparent governance structures. Conversely, superficial compliance risks reputational damage and capital exclusion.

Scaling ESG Unlocks Competitive Advantage

Scaling ESG is not merely regulatory compliance; it is strategic positioning.

Companies that integrate sustainability into their supply chains, energy efficiency systems and workforce inclusion stand to lower operational risks and strengthen resilience against climate shocks.

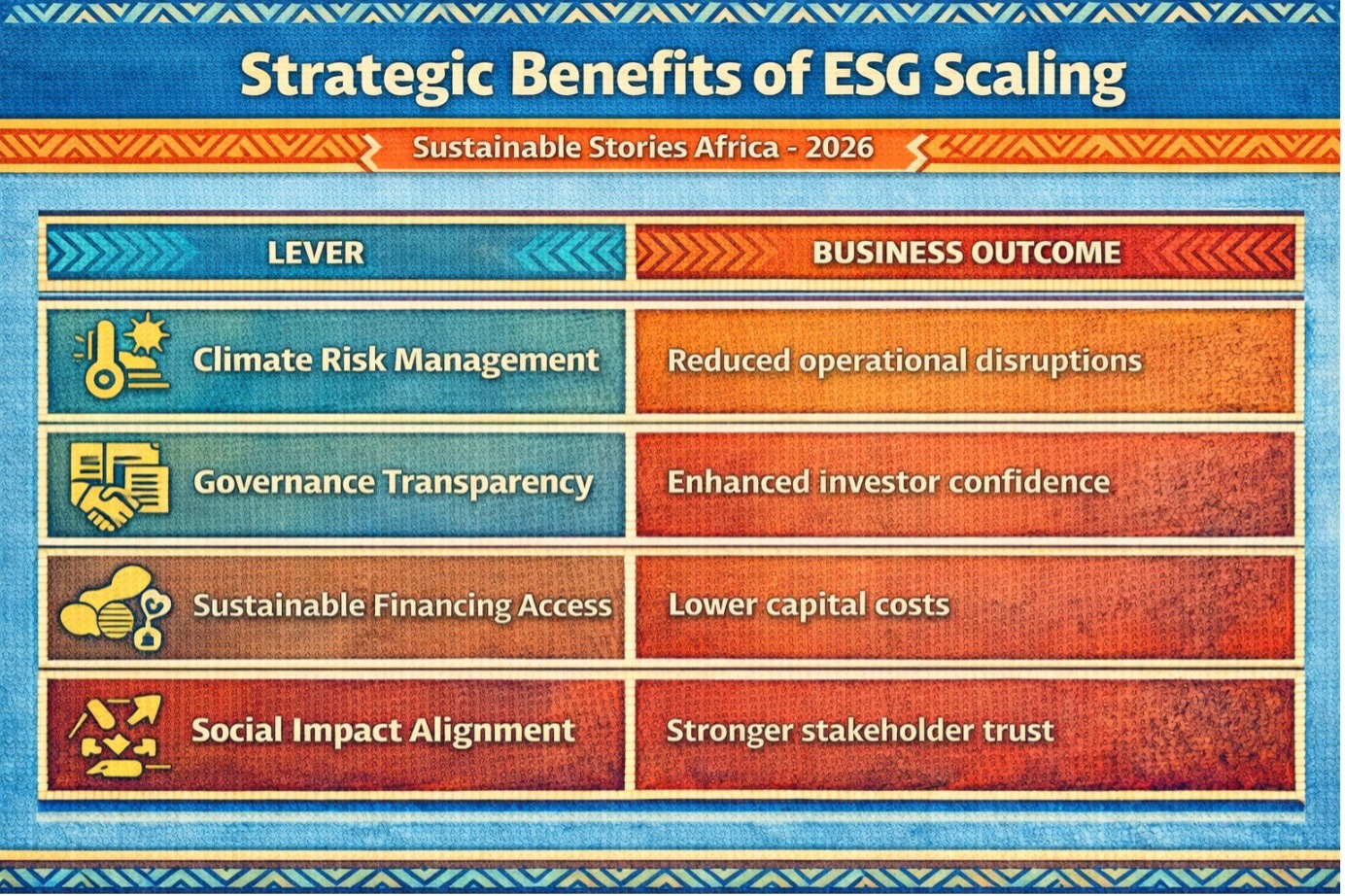

Strategic Benefits of ESG Scaling

| Lever | Business Outcome |

|---|---|

| Climate Risk Management | Reduced operational disruptions |

| Governance Transparency | Enhanced investor confidence |

| Sustainable Financing Access | Lower capital costs |

| Social Impact Alignment | Stronger stakeholder trust |

For African economies navigating currency volatility and global trade fragmentation, ESG credibility may increasingly influence cross-border investment flows.

Boards that institutionalise ESG oversight will likely attract long-term capital seeking stability and transparency.

Build Systems, Strengthen Oversight

Scaling ESG in 2026 requires structural upgrades across organisations:

- Board-Level Competency – Directors must strengthen literacy around sustainability metrics and climate risk governance.

- Data Infrastructure – Reliable, auditable ESG data systems are critical to credibility.

- Regulatory Alignment – National frameworks should harmonise with international standards such as ISSB while reflecting local realities.

Executives are encouraged to integrate ESG into enterprise risk management and performance evaluation systems rather than treating it as a standalone function.

The year ahead will test whether corporate Africa can translate sustainability ambition into measurable enterprise value.

Path Forward – Embed Governance, Institutionalise Measurable Impact

2026 demands that ESG move from reporting to institutional integration. Boards must embed sustainability within risk, strategy and remuneration structures.

Scaling ESG will require credible data systems, regulatory coherence and leadership commitment to measurable outcomes that align governance with long-term value creation.

Culled From: https://businessday.ng/opinion/article/welcome-to-2026-the-year-to-scale-esg/