Africa receives only about 25% of the climate finance it requires to meet mitigation and adaptation goals.

Despite contributing minimally to global emissions, the continent bears disproportionate climate risks.

Experts warn that without structural reform in funding flows, resilience and growth prospects could narrow sharply.

25% Funded, 75% Missing

Africa is securing roughly 25 % of the climate finance it needs, leaving a widening funding gap that threatens both adaptation and energy transition ambitions.

The continent, responsible for less than 4% of global greenhouse gas emissions, faces rising temperatures, erratic rainfall and intensifying extreme weather events.

However, capital inflows for mitigation and resilience remain far below required levels.

The imbalance signifies a structural challenge: climate vulnerability is accelerating faster than the financing solutions.

Where the Gap Persists

Estimates suggest Africa requires hundreds of billions of dollars annually to align with climate targets and protect critical infrastructure, agriculture, and urban systems.

However, available funding remains fragmented, project-based and heavily skewed toward mitigation rather than adaptation.

A significant portion of inflows also arrives in the form of debt rather than grants, increasing fiscal pressure on an already constrained sovereign balance sheet.

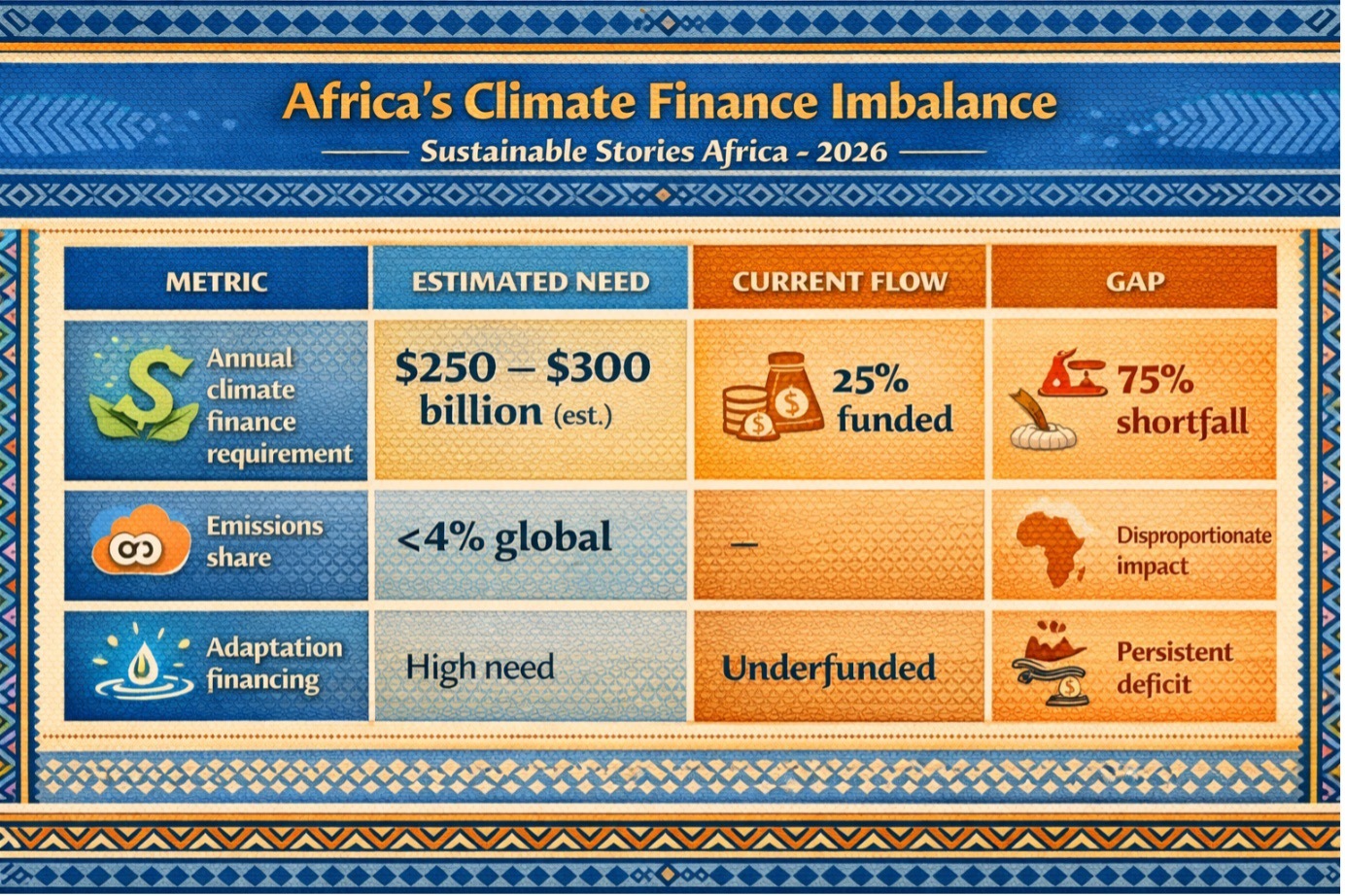

Africa's Climate Finance Imbalance

| Metric | Estimated Need | Current Flow | Gap |

|---|---|---|---|

| Annual climate finance requirement | $250 – $300 billion (est.) | 25% funded | 75% shortfall |

| Emissions share | <4% global | — | Disproportionate impact |

| Adaptation financing | High need | Underfunded | Persistent deficit |

Panel analyses and expert commentary highlight three structural bottlenecks:

- Limited bankable project pipelines.

- High perceived investment risk.

- Complex global funding mechanisms.

The result is delayed renewable deployment, insufficient climate-proofed infrastructure, and constrained green industrialisation.

Unlocking Africa's Green Potential

Despite the gap, Africa holds vast renewable potential, including solar corridors across the Sahel, geothermal capacity in East Africa and wind resources in coastal zones.

Experts argue that de-risking instruments, blended finance structures, and stronger regional capital markets could mobilise significantly more private sector participation.

Redirecting capital flows toward adaptation

Redirecting capital flows toward adaptation, including water systems, climate-smart agriculture and resilient cities, could protect livelihoods while stimulating job creation.

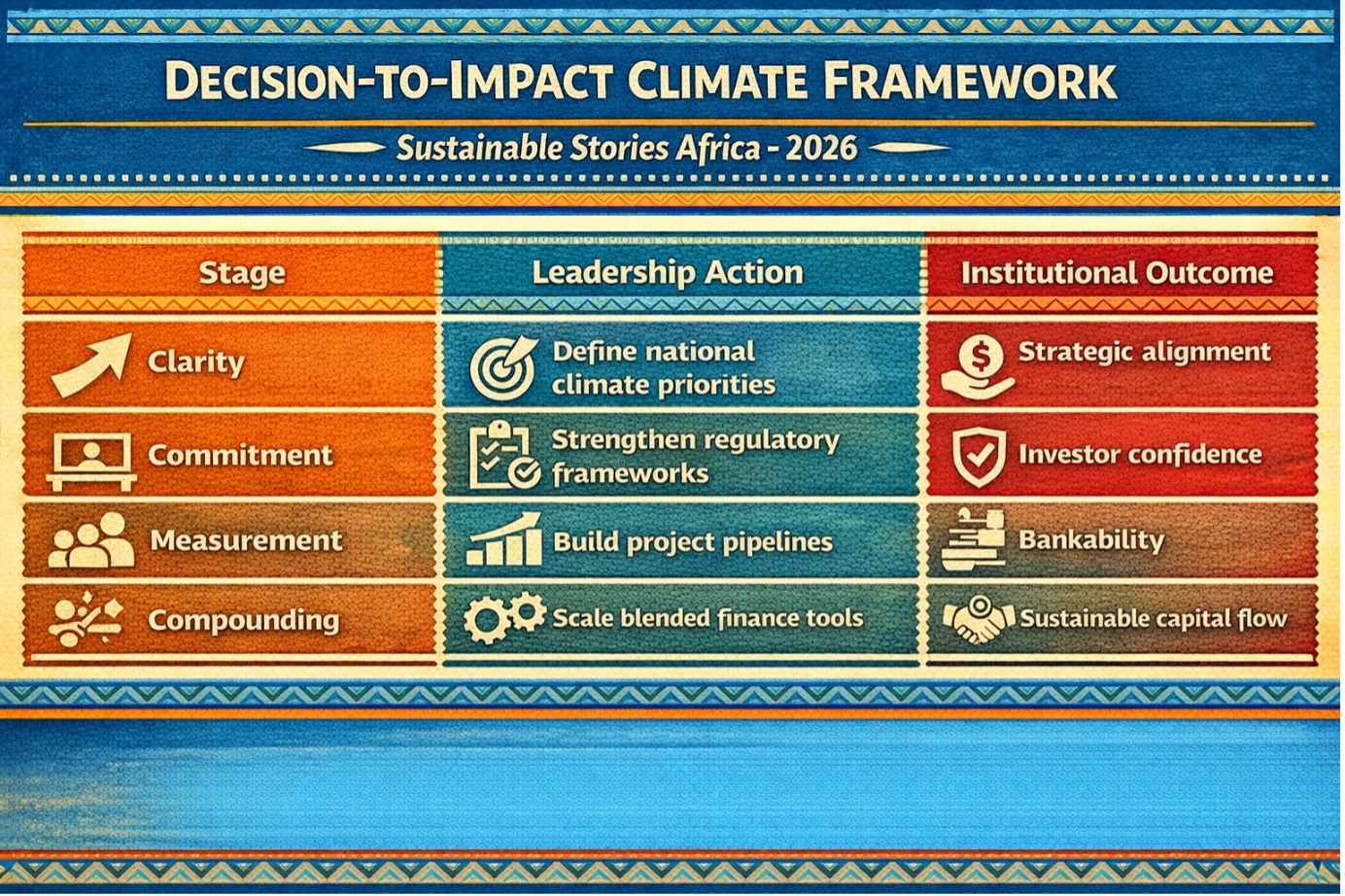

Decision-to-Impact Climate Framework

| Stage | Leadership Action | Institutional Outcome |

|---|---|---|

| Clarity | Define national climate priorities | Strategic alignment |

| Commitment | Strengthen regulatory frameworks | Investor confidence |

| Consistency | Build project pipelines | Bankability |

| Measurement | Track adaptation outcomes | Transparency |

| Compounding | Scale blended finance tools | Sustainable capital flow |

Experts emphasise that climate finance is not solely environmental — it is economic. Closing the gap could catalyse energy access, industrialisation and infrastructure modernisation.

Failure to close it risks locking economies into high-cost, climate-vulnerable trajectories.

Reforming Flows, Building Capacity

Policy leaders are calling for simplified access to multilateral climate funds, expanded use of guarantees, and deeper collaboration between development finance institutions and local banks.

Stronger data systems and ESG-aligned reporting standards are also viewed as essential to improving transparency and reducing risk premiums attached to African projects.

The broader implication is systemic: climate finance reform must match the urgency of the situation.

For African governments, this means prioritising institutional capacity and regulatory predictability. For global partners, it requires recalibrating allocation frameworks in areas of equity and vulnerability metrics.

Path Forward – De-Risk, Scale, Institutionalise Climate Finance

Africa must strengthen project pipelines, regulatory clarity and blended finance mechanisms to unlock larger pools of global climate capital.

By aligning national climate priorities with transparent governance and scalable investment structures, the continent can transform climate vulnerability into a catalyst for sustainable, inclusive economic growth.

Culled From: https://africasustainabilitymatters.com/why-africa-is-securing-only-a-quarter-of-the-climate-finance-it-needs/