Africa is not short of resources. It is short of mobilisation.

A policy analysis argues that the continent holds substantial domestic capital from natural assets to pension funds and remittances, which remains under-leveraged for development.

As external financing remains limited, the debate is shifting from aid dependency to activating internal capital.

Mobilising Africa's Resources: A Shift from External Aid to Domestic Capital Activation – Rethinking Africa's Development Financing Model

Africa's development debate is undergoing a structural reset. With global aid flows tightening and debt vulnerabilities rising, policymakers are increasingly focused on mobilising domestic resources to finance infrastructure, industrialisation and social development.

Africa possesses significant untapped financial capacity, including mineral wealth and sovereign assets of institutional savings pools, that could reshape development trajectories if strategically deployed.

The urgency is clear: reliance on volatile external capital is no longer sustainable.

Untapped Wealth, Structural Constraints

The continent's resource base is substantial. Africa holds critical minerals central to the global energy transition, expansive agricultural land and growing financial institutions managing pension and insurance assets.

However, mobilisation remains constrained by structural bottlenecks.

Africa's Resource Mobilisation Landscape

| Resource Category | Potential Contribution | Core Constraint |

|---|---|---|

| Natural Resources | Export revenue & value addition | Commodity dependence |

| Pension Funds | Long-term infrastructure finance | Risk aversion & governance |

| Remittances | Household investment capital | High transaction costs |

| Tax Revenue | Fiscal expansion | Informal sector dominance |

Tax-to-GDP ratios across several African economies remain below global averages, limiting fiscal space. Meanwhile, pension funds are getting increasingly sizable in countries such as Nigeria, Kenya and South Africa, and are often restricted by conservative investment mandates.

The analysis argues that strengthening domestic financial systems could unlock significant pools of capital which are currently sitting idle or invested offshore.

Domestic Capital as Growth Multiplier

Mobilising internal resources is framed not merely as a fiscal necessity, but as a strategy to enhance sovereignty.

Deploying pension assets into infrastructure bonds could accelerate energy and transport projects.

Reforming tax systems could expand social spending without exacerbating debt burdens.

Leveraging mineral wealth through local value addition could improve Africa's standing in global supply chains.

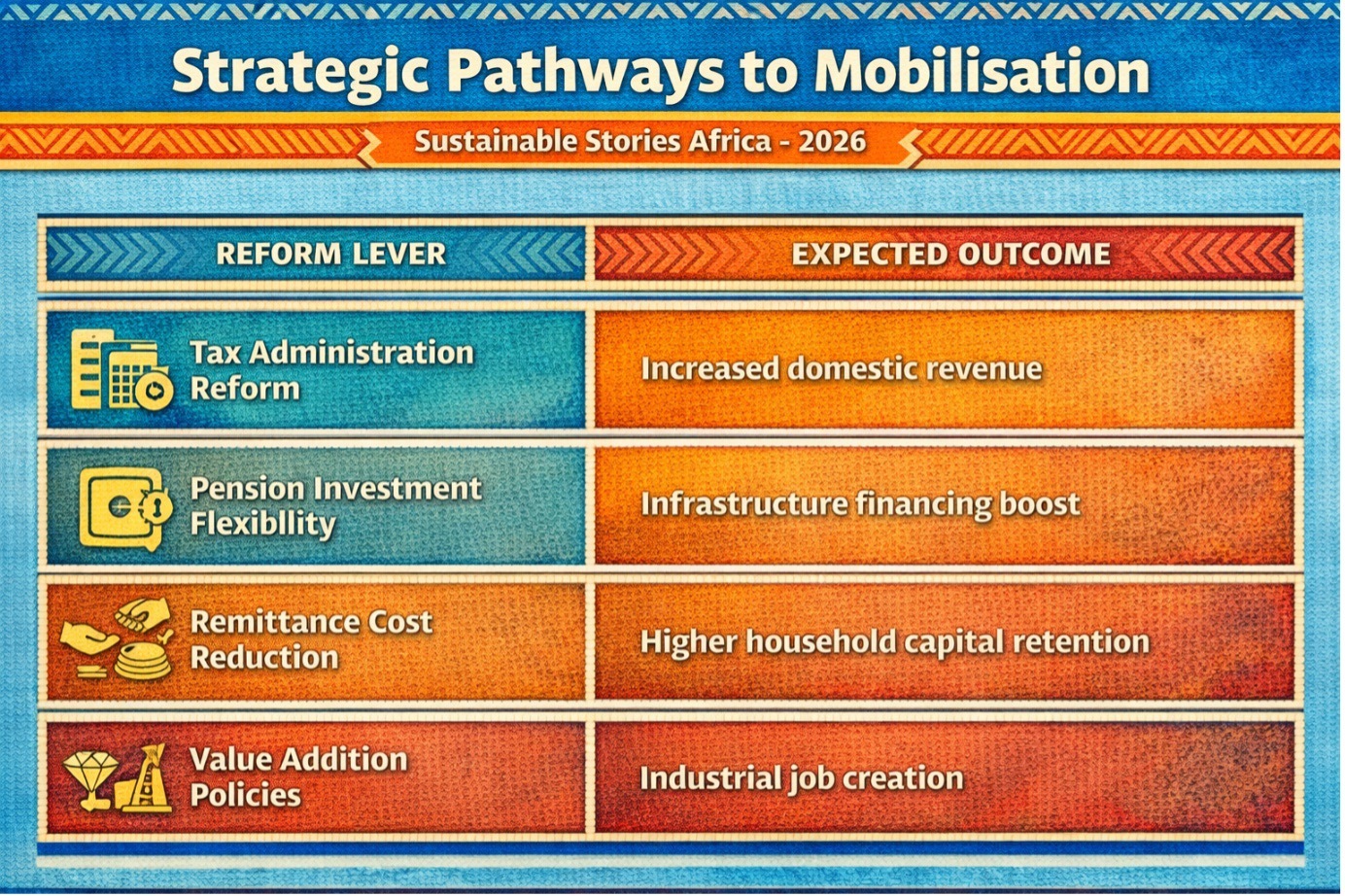

Strategic Pathways to Mobilisation

| Reform Lever | Expected Outcome |

|---|---|

| Tax Administration Reform | Increased domestic revenue |

| Pension Investment Flexibility | Infrastructure financing boost |

| Remittance Cost Reduction | Higher household capital retention |

| Value Addition Policies | Industrial job creation |

The economic multiplier effects are significant. Infrastructure expansion reduces logistics costs. Industrialisation generates employment. Improved fiscal capacity enhances social stability.

Failure to act, however, risks perpetuating debt cycles and dependency.

Governance Reform and Policy Coordination

The report emphasises that resource mobilisation hinges on governance credibility.

Transparent fiscal management, predictable regulatory frameworks and investor confidence are critical to attracting both domestic and diaspora capital. Governments are encouraged to modernise tax systems, strengthen public financial management and improve mineral contract transparency.

Regional coordination under frameworks such as the AfCFTA could also expand market depth and reduce capital fragmentation.

International partners retain a role, particularly in supporting technical assistance and de-risking instruments, but leadership must be domestic.

Path Forward – Strengthen Governance, Deepen Domestic Capital Markets

Africa's development strategy must pivot toward domestic resource activation through tax reform, pension mobilisation and value addition. Institutional credibility and regulatory transparency will determine success.

The goal is clear: convert Africa's wealth into sustainable growth engines driven from within.

Culled From: https://www.brookings.edu/articles/mobilizing-africas-resources-for-development/