Africa's regional development banks are primed for a new era of growth as strengthened capital buffers and innovative financing strategies unlock up to $800 billion in new lending capacity.

New Era – Africa's Development Banks Set for Lending Surge

Africa's principal development lenders are positioned to expand sovereign and private sector loans as S&P announces upgraded capital adequacy.

With up to $800 billion in fresh lending capacity, these institutions could shape the region's economic recovery, climate investments, and digital leap forward amid tight global liquidity and rising debt burdens.

Stronger Buffers, Greater Impact – What's Behind the Surge?

Recent balance sheet reforms and capital injections have lifted risk-adjusted capital ratios by around 10%.

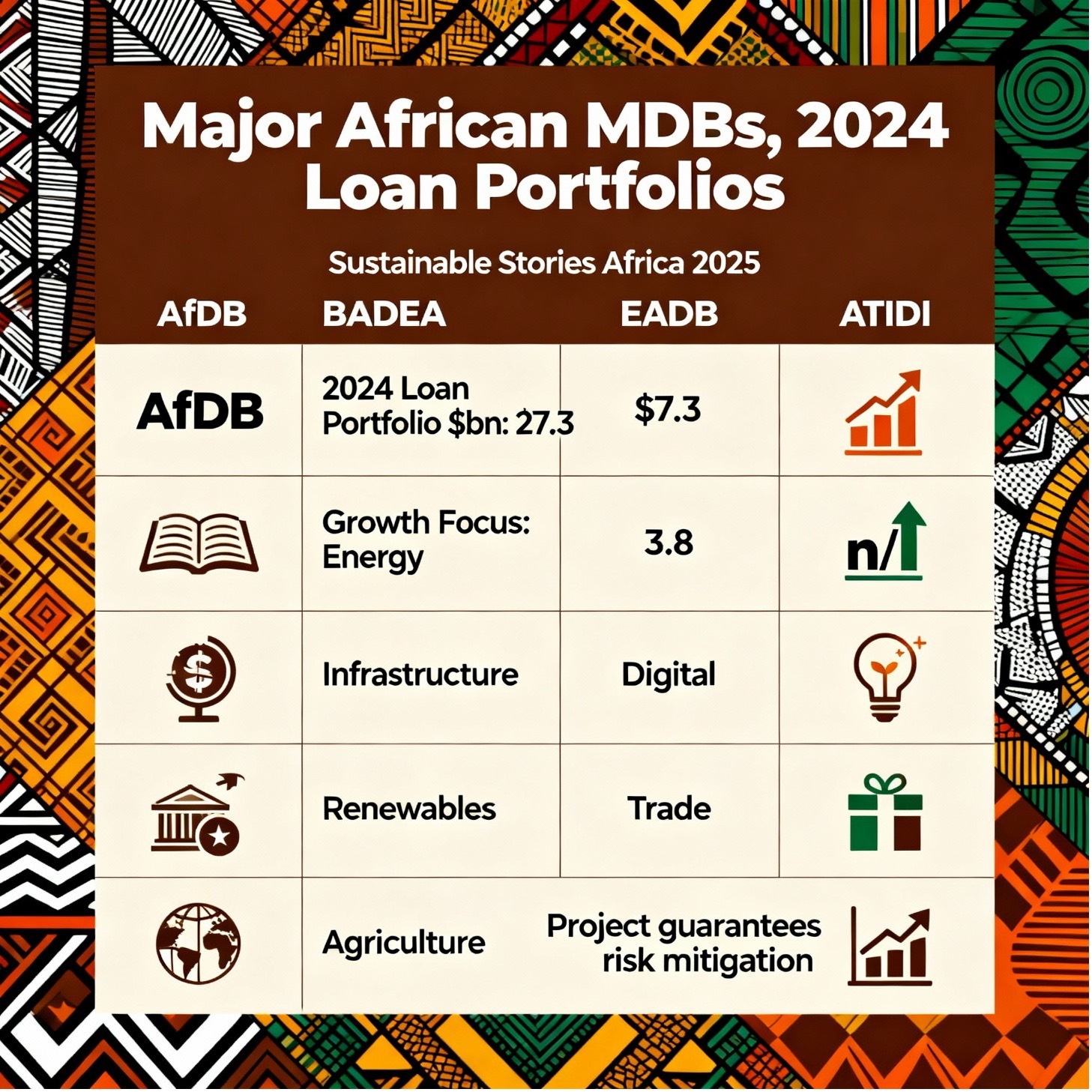

Four leading institutions - AfDB, EADB, ATIDI, and BADEA - are at the heart of Africa's new investment push.

The AfDB remains a AAA-rated anchor, with a $27.3 billion loan book for 2024, poised to ramp up climate, transport, and digital financing. BADEA and its peers are also focusing on trade, renewables, and regional integration.

| Major African MDBs | 2024 Loan Portfolio ($bn) | Growth Focus |

| AfDB | 27.3 | Energy, Infrastructure, Digital |

| BADEA | 3.8 | Trade, Renewables, Agriculture |

| EADB, ATIDI | n/a | Project guarantees risk mitigation |

Why It Matters – Bridging Africa's Financing Gap

Mainstreaming hybrid capital and risk-sharing deals lets banks absorb shocks, support sovereign borrowers, and maintain strong ratings in turbulent markets.

Expanded lending could accelerate Africa's green transition, infrastructure build-out, and resilience efforts, inviting investors and enabling inclusive growth.

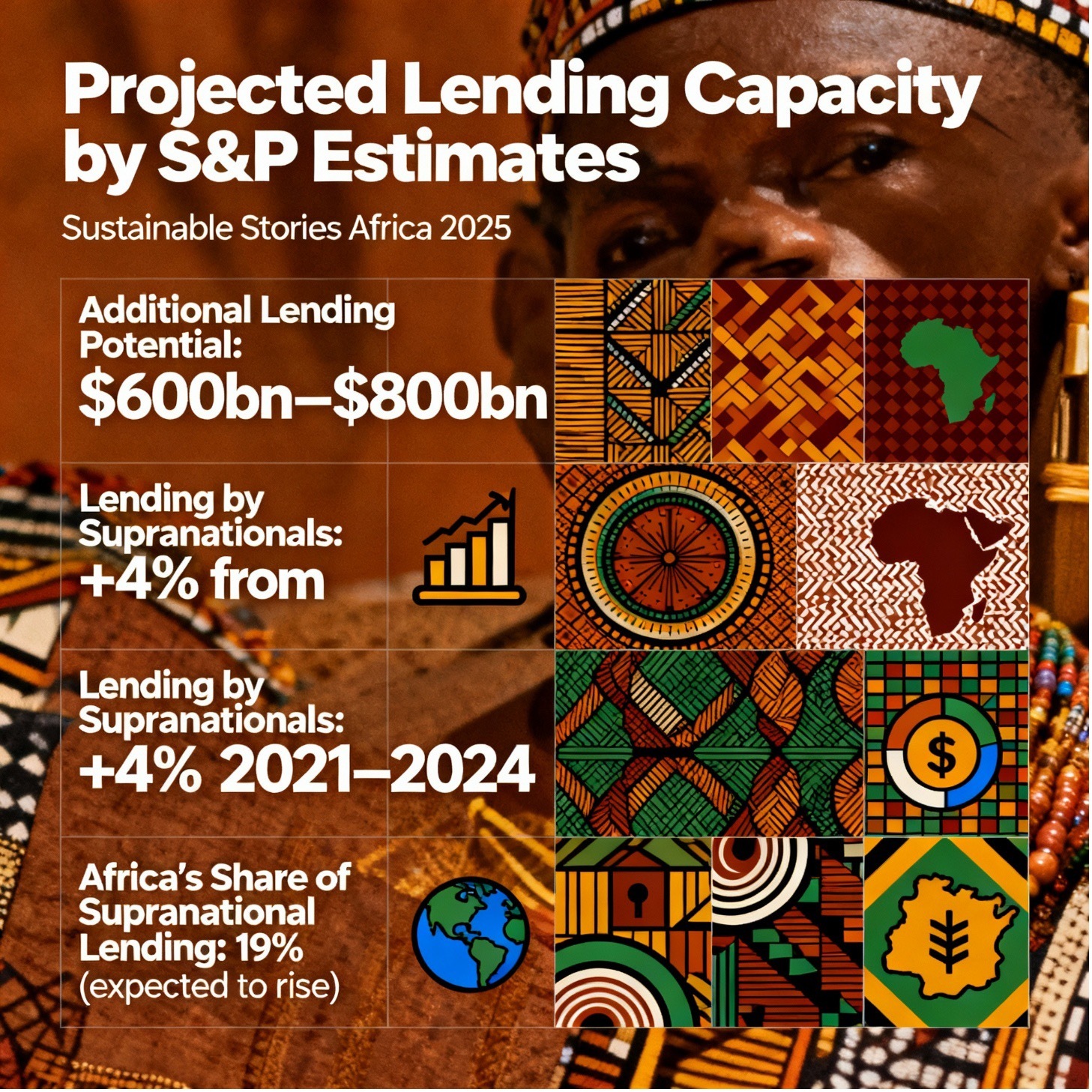

Infographic: Projected Lending Capacity by S&P Estimates

- Additional Lending Potential: $600bn–$800bn

- Lending by Supranationals: +4% from 2021–2024

- Africa's Share of Supranational Lending: 19% (expected to rise further)

Next Steps – Mobilising Resources for Sustainable Change

S&P urges ongoing innovation, such as hybrid instruments, capital swaps, and mobilising private finance, amid fiscal pressures.

As global credit tightens, African banks are central to bridging investment gaps for climate, manufacturing, and digital economies; now, stakeholders must prioritise impact-led lending and resilient fiscal policies.

Path Forward – Priorities for Impactful Growth

African development banks will drive regional recovery by growing lending with robust capital frameworks, focusing on climate, trade, and technology sectors.

Strengthened buffers and innovative risk tools are central to sustaining long-term, inclusive development.