Africa's energy future is entering a decisive phase. New gas hubs, rising electricity demand, and persistent financing gaps are reshaping the continent's power landscape ahead of 2026.

Africa's Power Crunch Meets Gas Expansion

Africa's energy landscape is shifting in 2026, driven by new natural-gas hubs, growth in electricity demand, and widening funding gaps for power infrastructure.

From Mozambique's LNG projects to Senegal's offshore gas fields and Nigeria's gas-to-power ambitions, governments are increasingly turning to gas as a "transition fuel" to stabilise electricity supply and support industrial growth.

However, more than 600 million Africans still lack access to reliable electricity, raising questions about whether large-scale energy investments will translate into widespread access to energy.

Why Gas Is Back on the Agenda

Gas is emerging as a central pillar of Africa's short to medium-term energy strategy.

Rising urbanisation, industrial expansion, and population growth are pushing electricity demand higher than renewable deployment can currently match.

Gas offers a relatively fast way to scale generation, support grid stability, and reduce reliance on diesel and coal.

Key gas-driven energy developments include:

- Mozambique's LNG export projects

- Senegal and Mauritania's offshore gas fields

- Nigeria's gas-to-power expansion

- Tanzania's planned LNG investments

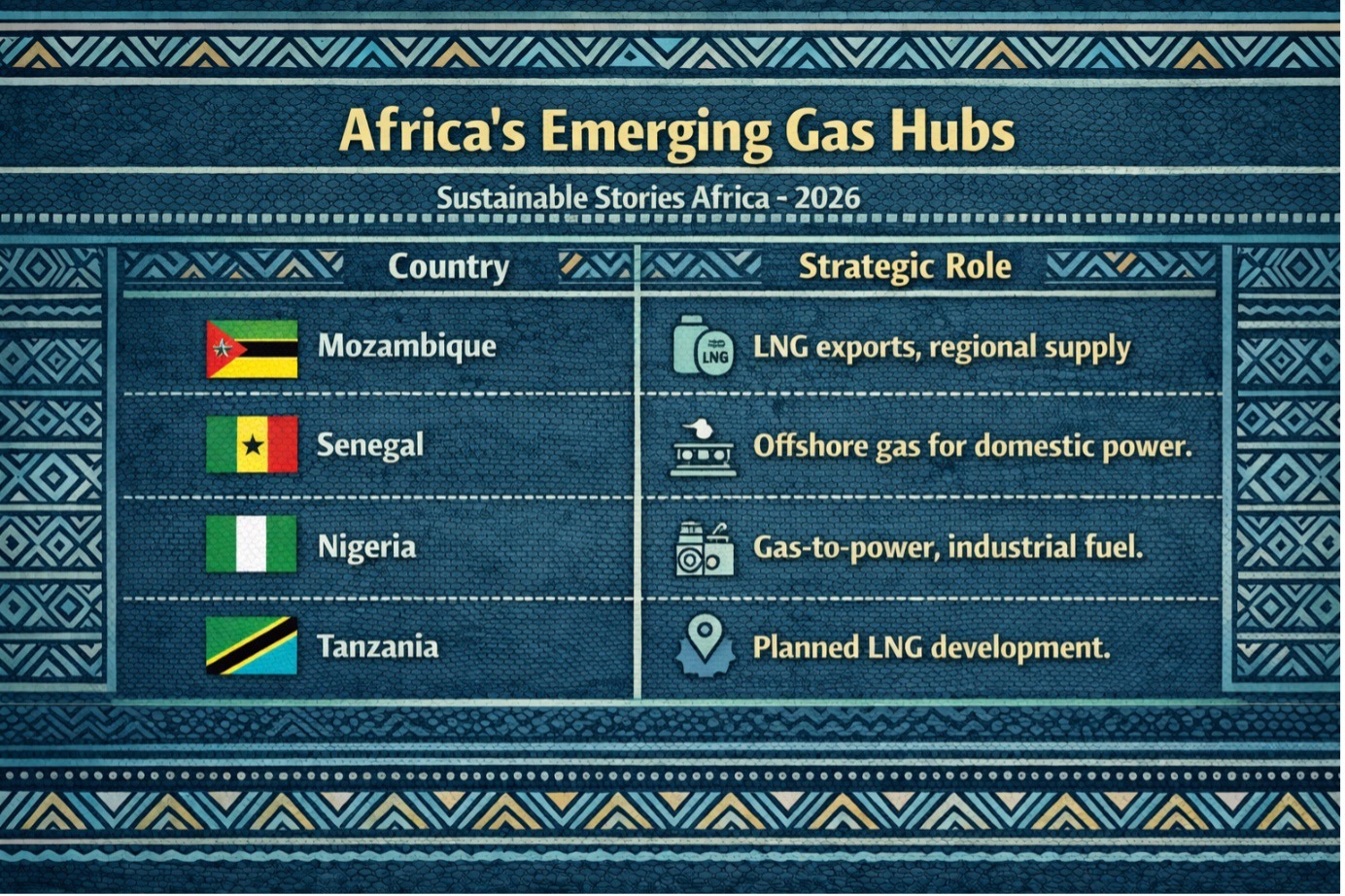

Africa's Emerging Gas Hubs

| Country | Strategic Role |

|---|---|

| Mozambique | LNG exports, regional supply |

| Senegal | Offshore gas for domestic power |

| Nigeria | Gas-to-power, industrial fuel |

| Tanzania | Planned LNG development |

Supporters argue that gas can improve energy security while renewables scale up. Critics warn it could lock countries into fossil-fuel dependency if clean-energy investment lags.

Funding Gaps Threaten Energy Access

Despite major energy announcements, financing remains Africa's biggest bottleneck.

Power infrastructure, including transmission lines, distribution networks, and mini-grids, requires billions in long-term investment. Yet many utilities struggle with weak revenue collection, currency risks, and political interference.

Renewables, while expanding, still face:

- Limited grid capacity

- High project-preparation costs

- Slow permitting processes

- Investor risk concerns

Barriers to Power Access

| Challenge | Impact |

|---|---|

| Weak utilities | Poor service reliability |

| Grid constraints | Limits renewable expansion |

| Financing gaps | Delays projects |

| Policy uncertainty | Raises investor risk |

As a result, large gas and renewable projects often move faster than local distribution systems, leaving rural and low-income communities behind.

Who Gets the Power?

Africa's energy debate is no longer just about generation capacity. It is about who actually gets electricity.

Urban centres and industrial zones are benefiting most from new investments, while rural communities rely on mini-grids, solar home systems, or remain unserved.

To close the access gap, energy experts are calling for:

- More funding for distribution networks

- Stronger support for mini grids

- Clearer renewable-energy policies

- Better utility governance

Without these reforms, Africa risks developing energy systems that will serve exports and industry while households remain in the dark.

PATH FORWARD – Balancing Gas, Renewables, and Access

Africa's 2026 energy outlook will depend on its ability to balance the expansion of gas infrastructure with faster deployment of renewable energy options and stronger grid investment.

Gas may stabilise supply in the short term, but long-term energy security requires clean, affordable, and accessible power.

If policymakers prioritise distribution, financing reform, and decentralised solutions, Africa can turn energy growth into inclusive development rather than uneven progress.