Africa’s first privately financed electricity transmission project has officially moved into the construction phase, marking a structural shift in how power infrastructure is funded on the continent.

The milestone signals growing investor confidence in transmission as an investable asset class, not just generation.

Analysts say the project could redefine grid expansion models across emerging African power markets, unlocking billions in future infrastructure capital.

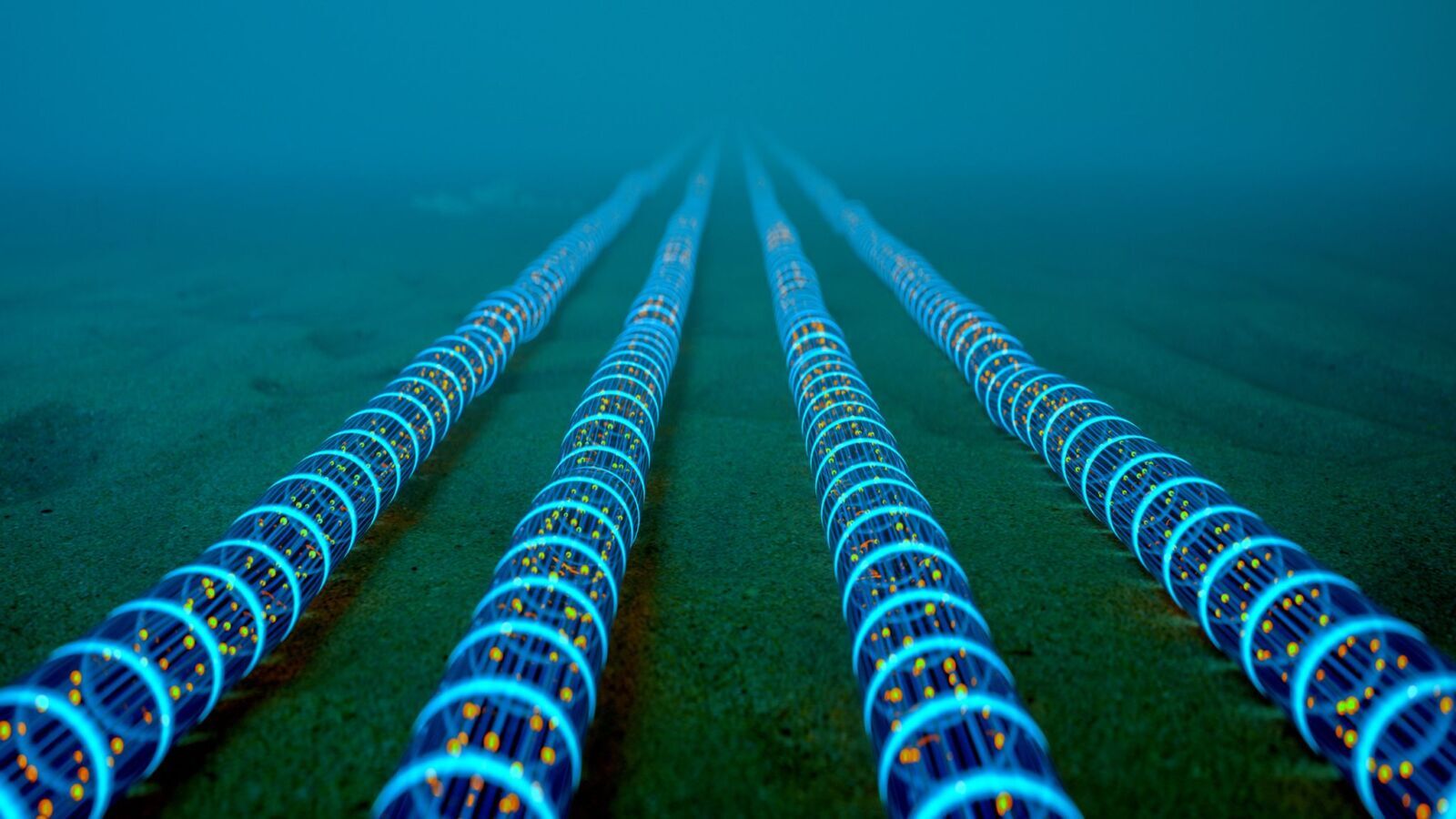

Private Capital Powers Africa’s Grid Shift

Construction has commenced on Africa’s first privately developed electricity transmission project, a landmark moment for a sector historically dominated by state utilities and public balance sheets.

The project introduces a new financing model for transmission infrastructure, traditionally viewed as a sovereign function, opening the door for private capital participation in grid expansion. Energy experts say the move addresses one of Africa’s most persistent energy bottlenecks: insufficient transmission capacity limiting power delivery.

With electricity demand rising and renewable energy investments accelerating, modernising grid infrastructure has become urgent.

Private Capital Enters Africa’s Grid Infrastructure Space

Transmission networks form the backbone of electricity systems. However, across Africa, underinvestment has constrained reliable power distribution.

By moving into construction, this private transmission initiative signals investor appetite for assets once considered too politically and financially complex.

It also reflects reforms aimed at improving regulatory frameworks and risk allocation.

Industry observers describe the development as a proof-of-concept for privately financed grid infrastructure in frontier markets.

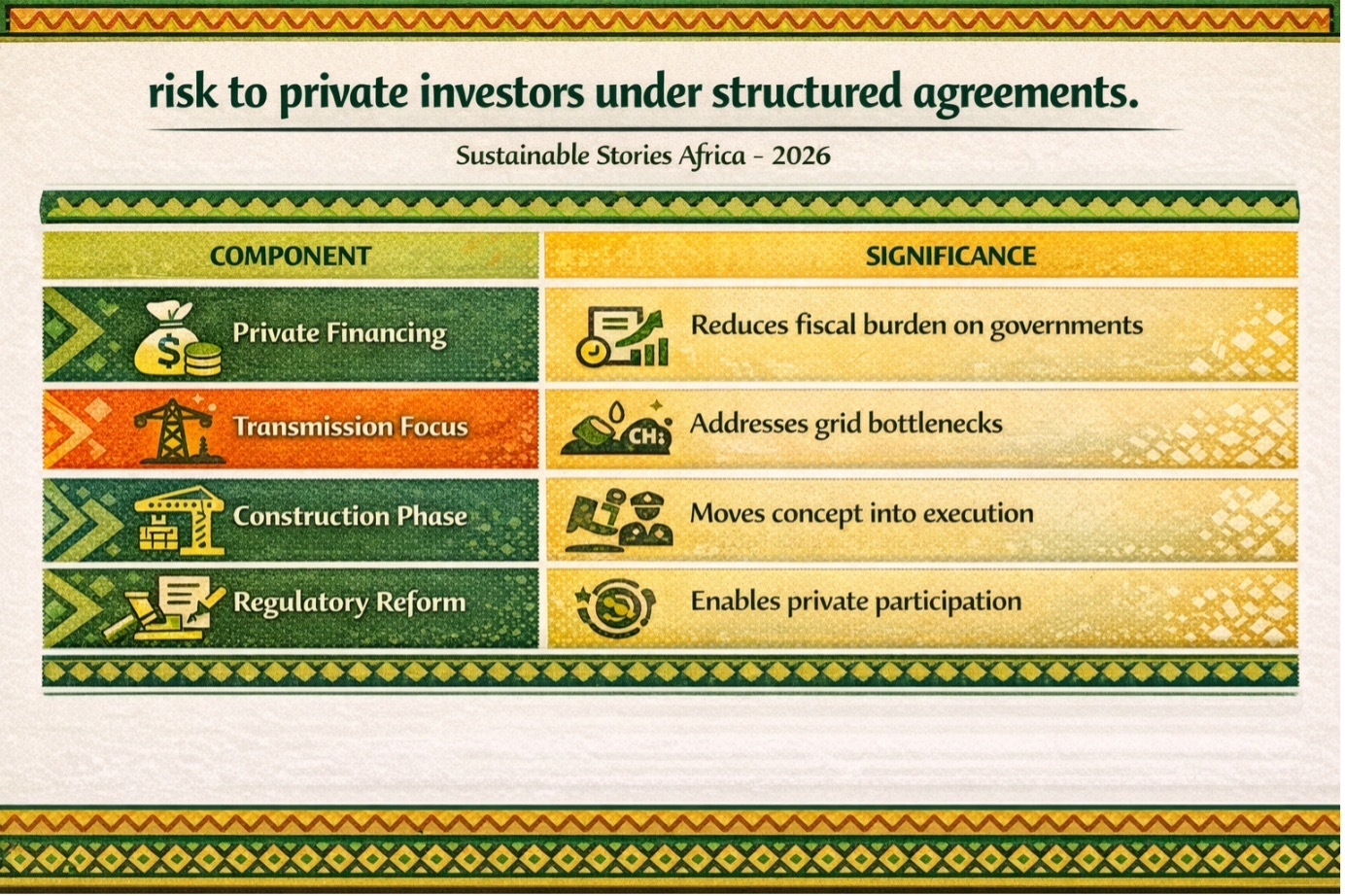

Blended Infrastructure Model Reshapes Power Sector Financing

Historically, African transmission infrastructure has relied on sovereign borrowing or development finance institutions.

The new model shifts some financing risk to private investors under structured agreements.

Component | Significance |

|---|---|

Private Financing | Reduces fiscal burden on governments |

Transmission Focus | Addresses grid bottlenecks |

Construction Phase | Moves concept into execution |

Regulatory Reform | Enables private participation |

Energy analysts note that generation capacity expansion—particularly renewables—often outpaces transmission upgrades, resulting in stranded power.

A senior sector executive commented:

“Generation without transmission is wasted capital. This project demonstrates that transmission can be bankable.”

The project could serve as a template for future grid investments across countries seeking to accelerate electrification and renewable integration.

Reliable Grids Unlock Economic Transformation

Improved transmission capacity can deliver:

- Reduced power outages

- Lower system losses

- Increased renewable integration

- Enhanced industrial productivity

Power reliability directly influences manufacturing output, SME growth, and foreign investment confidence. Weak grids raise operating costs and deter capital inflows.

Economists argue that transmission modernisation may offer higher system-wide returns than standalone generation projects, especially in markets where installed capacity exceeds dispatchable capacity due to grid limitations.

Scaling Private Transmission Requires Regulatory Certainty

For the model to replicate, experts stress the need for:

- Transparent tariff mechanisms

- Bankable concession agreements

- Sovereign support frameworks

- Independent regulatory oversight

Governments must provide predictable policy environments to sustain investor confidence. Without regulatory clarity, private transmission capital could stall.

Stakeholders are now watching closely to assess delivery timelines, cost discipline, and operational performance once construction concludes.

Path Forward – Replicate Model, Strengthen Grid Governance

The project sets a precedent for private participation in transmission infrastructure across Africa.

Scaling the model will require regulatory certainty, risk-sharing mechanisms, and robust oversight.

If successful, privately financed transmission could accelerate grid expansion, integrate renewables efficiently, and improve long-term power reliability across emerging African economies.

Culled From: Africa’s first private transmission project moves to construction