Global ESG regulations are tightening, but African markets are asking a harder question: compliance to what end?

At a high-level panel session titled “Global Rules, Local Realities,” policymakers, investors, and corporate leaders debated how international sustainability standards can align with African economic priorities.

The conclusion was clear: ESG in Africa must move beyond box-ticking toward integrity, materiality, and long-term value creation.

Global Rules, Local Realities Test African ESG

As global sustainability standards, from IFRS S1 and S2 to EU supply-chain due diligence rules, reshape corporate reporting expectations, African companies face mounting compliance pressures.

However, many argue that rigid application of global rules risks overlooking local economic realities.

That tension framed discussions at the panel session “Global Rules, Local Realities: Rethinking ESG Compliance and Corporate Integrity in African Markets.” Speakers challenged businesses to rethink ESG not merely as regulatory obligation, but as a strategic governance tool tailored to African growth dynamics.

The event underscored a central dilemma: how can African markets comply with evolving global ESG standards while safeguarding competitiveness, capital access, and development priorities?

Global ESG Rules Collide With African Growth Realities

“Compliance without context becomes performative,”

one panellist remarked, setting the tone for the debate.

Speakers warned that blanket adoption of Western-designed ESG frameworks can strain African firms already grappling with infrastructure deficits, energy instability, and financing constraints.

With cross-border investors demanding climate disclosures and supply-chain transparency, the stakes are high.

Failure to align with global ESG norms risks capital exclusion. But over-compliance without localisation risks misallocation of scarce corporate resources.

Integrity, Materiality, and Context Drive ESG Recalibration

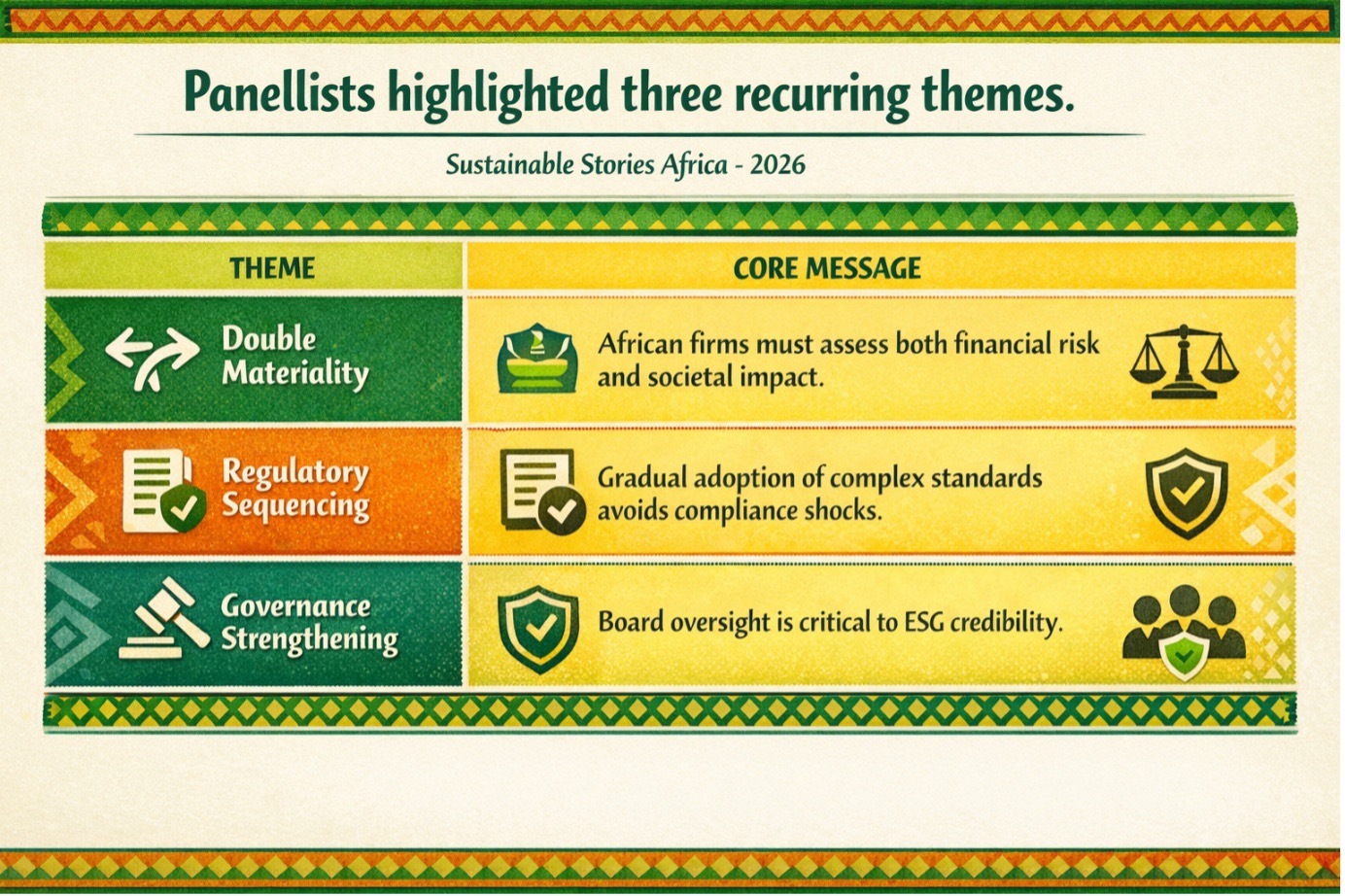

Panellists highlighted three recurring themes:

Theme | Core Message |

|---|---|

Double Materiality | African firms must assess both financial risk and societal impact |

Regulatory Sequencing | Gradual adoption of complex standards avoids compliance shocks |

Governance Strengthening | Board oversight is critical to ESG credibility |

Several speakers referenced IFRS sustainability standards and regional regulatory responses, noting that African regulators must sequence implementation in line with domestic readiness.

One governance expert noted:

“Integrity is not imported. It must be embedded in corporate culture and board accountability.”

The discussion also emphasised that ESG disclosure gaps in Africa often reflect capacity constraints rather than governance failure.

SMEs in particular struggle with data infrastructure needed for advanced climate reporting.

Contextual ESG Frameworks Unlock Investment And Credibility

The panel pivoted toward opportunity.

Aligned ESG systems can:

- Improve access to global capital markets

- Reduce sovereign and corporate risk premiums

- Strengthen stakeholder trust

- Enhance supply-chain competitiveness

A private equity representative argued that investors are not seeking perfection, but progress:

“Markets reward transparency and credible transition plans—even where emissions baselines are evolving.”

The consensus was that contextualisation does not mean dilution. Instead, it requires prioritising material risks, including energy transition exposure, labour standards, governance oversight, while building capacity for full compliance over time.

Without reform, African companies’ risk being locked out of supply chains governed by EU and global sustainability rules.

Boards Must Lead ESG Transformation Now

Speakers urged boards and regulators to act decisively:

- Establish ESG oversight committees

- Invest in emissions data systems

- Conduct double materiality assessments

- Engage regulators on phased compliance roadmaps

Corporate leaders were encouraged to move beyond reporting templates and embed ESG into strategy, risk management, and capital allocation decisions.

The message was urgent: delay increases transition costs.

Path Forward – Align Standards, Build Capacity, Protect Competitiveness

African regulators and corporate boards must prioritise phased ESG implementation aligned with economic realities.

Capacity-building, regulatory clarity, and materiality-driven reporting are essential.

By embedding integrity and contextual compliance, African markets can strengthen investor confidence while safeguarding growth and competitiveness in a tightening global regulatory landscape.