Africa is witnessing a record surge in sustainable debt, nearly $13 billion in 2024, yet the flow remains a drop in the ocean compared with its development and infrastructure needs.

While green and social bonds are gaining traction, critical sectors such as climate-adaptation, water security and biodiversity still receive only piecemeal funding, underscoring the continent's financing deficit.

Growing momentum, glaring shortfall

According to the recent report S&P Global's Look Forward: Unlocking Africa, the continent's sustainable finance market has expanded: sustainable debt issuance reached almost $13 billion in 2024, marking one of the few regions globally where growth persists despite increased scrutiny.

Yet even this growth remains modest: it constitutes less than 1 per cent of global sustainable bond issuance and is far from sufficient to meet Africa's development and infrastructure gaps.

The report flags key structural drivers such as renewable energy, blended finance, capital-market development, and infrastructure investment as central to unlocking Africa's potential.

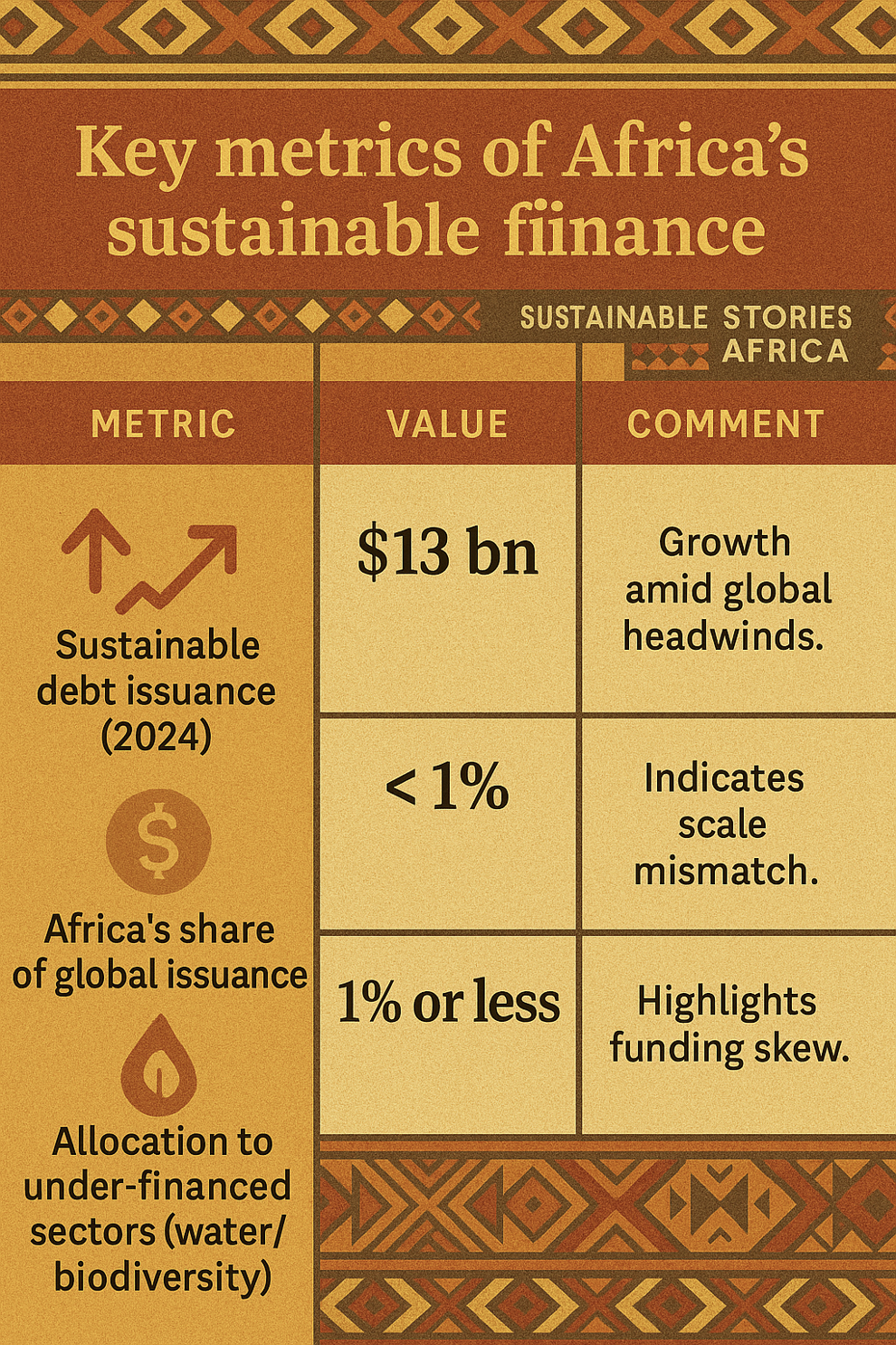

Key metrics of Africa's sustainable finance

| Metric | Value | Comment |

|---|---|---|

| Sustainable debt issuance (2024) | $13 bn | Growth amid global headwinds. |

| Africa's share of global issuance | < 1% | Indicates scale mismatch. |

| Allocation to under-financed sectors (water/biodiversity) | 1% or less | Highlights funding skew. |

Why this matters now

Africa's young population, extensive natural resources (including critical minerals) and rising middle class position the continent to play a meaningful role in global sustainable growth. But that potential is contingent on financing flows aligning with the scale of the challenge.

Energy access remains uneven, social infrastructure lags, and climate-adaptation needs escalate. For example, one study notes that by 2040, there is a 90 per cent likelihood that the global average temperature will exceed 1.5 °C, heightening urgency for adaptation investment in Africa.

The report emphasises that while green and social instruments add transparency and attract thematic investors, they alone cannot bridge the continent's large financing gap.

What stakeholders want: alignment and scale

Stakeholders across public and private sectors are seeking:

- Deepened capital markets to channel and mobilise domestic and international investment into sustainable assets.

- Blended-finance solutions that bring together concessional funds and private capital to de-risk investments in Africa. According to the report, in 2024, blended finance flows ranged between $6 billion and $15 billion, still far below the continent's needs.

- Governance and institutional frameworks to support project readiness, transparency, and impact reporting, especially in underfunded areas like water security, biodiversity, and adaptation.

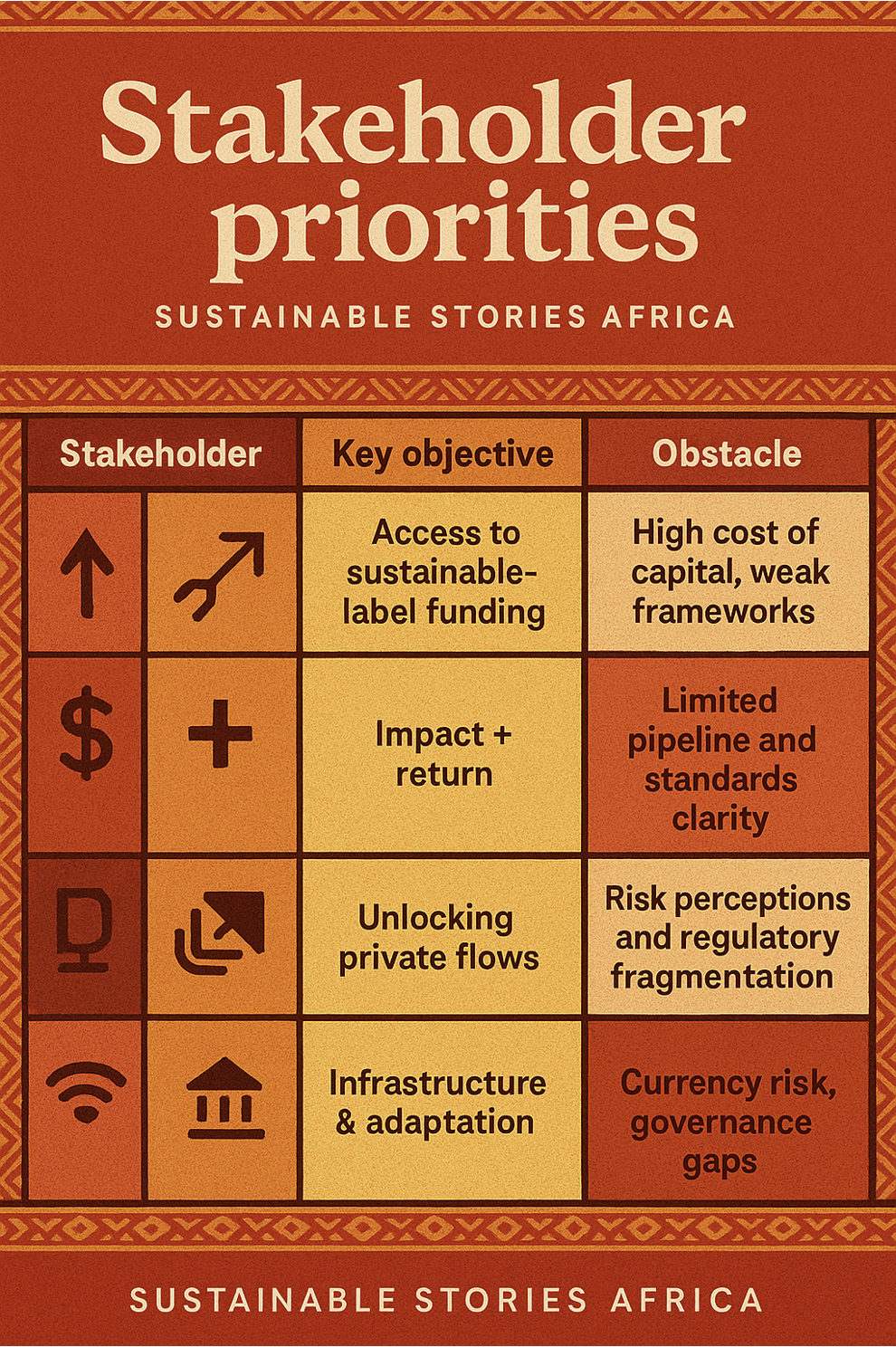

Stakeholder priorities

| Stakeholder | Key objective | Obstacle |

|---|---|---|

| Issuers (sovereigns/corporates) | Access to sustainable-label funding | High cost of capital, weak frameworks |

| Investors | Impact + return | Limited pipeline and standards clarity |

| Donors & DFIs | Unlocking private flows | Risk perceptions and regulatory fragmentation |

| Governments | Infrastructure & adaptation | Currency risk, governance gaps |

Steps to close the financing gap

- Strengthen frameworks for sustainable debt issuance (use-of-proceeds, allocation, impact reporting). The report notes that most second-party opinions in Africa cover mixed green/social frameworks.

- Scale blended-finance vehicles to attract larger pools of private capital by sharing risk and improving project bankability.

- Deepen domestic capital markets, including pension and sovereign-wealth funds, to re-invest domestically and reduce reliance on external borrowing.

- Prioritise under-financed sectors such as climate adaptation, water security and biodiversity – currently receiving minimal financing but critical for resilience.

Path Forward – Mobilising Africa's Finance for Green Growth

Looking ahead, Africa stands at a decisive juncture. The continent's sustainable-finance framework must evolve beyond modest issuance growth to embrace scale, impact and resilience.

The S&P Global report signals that while sustainable finance is part of the solution, it cannot, on its own, fill the vast development and infrastructure gaps. Issuers, investors and policymakers must collaborate to reduce financing costs, strengthen governance and structure investable projects.

Only then can Africa harness its natural-resource endowments, young population and evolving capital markets to drive green growth that is inclusive, resilient and sustainable.