A new wave of billion-dollar capital is flowing into African climate technology.

Investors are no longer testing the waters; they are scaling commitments.

From clean energy platforms to carbon infrastructure and climate-smart agriculture, global and regional funds are positioning Africa as the next frontier for climate innovation.

The opportunity is significant, but so are execution risks.

Billion-Dollar Capital Surge Targets Africa's Climate Tech Ecosystem – Climate Capital Finds African Momentum

Africa's climate technology sector is attracting a fresh wave of billion-dollar capital commitments, signalling renewed investor confidence in the continent's clean energy and sustainability innovation landscape.

New funds and blended-finance vehicles are increasingly targeting renewable energy, carbon markets, electric mobility and climate-resilient agriculture.

The shift reflects growing recognition that Africa is central to global decarbonisation pathways and that climate solutions here can deliver both environmental impact and competitive returns.

Investors see structural drivers including rapid urbanisation, energy deficits, abundant renewable resources and expanding digital infrastructure.

Capital Commitments Accelerate Across Sectors

Recent announcements indicate that multiple climate-focused funds and investment platforms are mobilising significant capital pools aimed at scaling African startups and infrastructure platforms.

Priority sectors include:

- Utility-scale solar and distributed renewable systems

- Electric mobility ecosystems

- Carbon credit generation and nature-based solutions

- Climate-smart agriculture and water resilience technologies

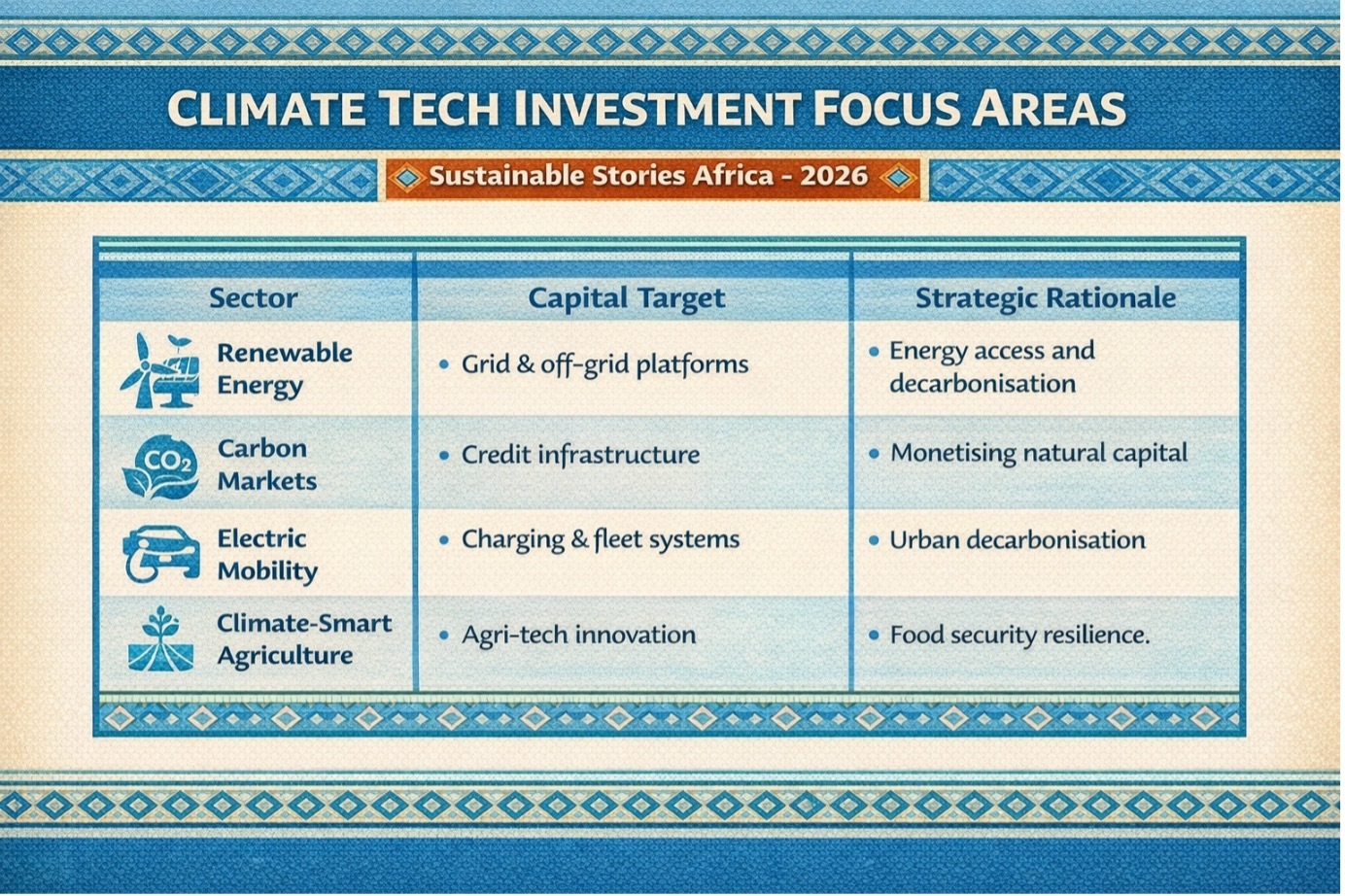

Climate Tech Investment Focus Areas

| Sector | Capital Target | Strategic Rationale |

|---|---|---|

| Renewable Energy | Grid & off-grid platforms | Energy access and decarbonisation |

| Carbon Markets | Credit infrastructure | Monetising natural capital |

| Electric Mobility | Charging & fleet systems | Urban decarbonisation |

| Climate-Smart Agriculture | Agri-tech innovation | Food security resilience |

Investors are increasingly structuring deals through blended finance, combining development finance institutions (DFIs), private equity and venture capital to de-risk early-stage climate ventures.

However, funding remains uneven. Early-stage startups continue to face scale-up bottlenecks, including currency volatility, policy uncertainty and fragmented regulatory regimes.

Climate Innovation as Economic Catalyst

Beyond environmental impact, climate technology is emerging as an economic multiplier.

The expansion addresses Africa's persistent electricity access gap while supporting industrial productivity.

Carbon market platforms create new revenue streams for forestry and land-use projects. Climate-smart agriculture will improve food systems in the face of increasing temperature variability.

Economic Impact Potential

| Impact Channel | Long-Term Benefit |

|---|---|

| Energy Access Expansion | Increased industrial output |

| Carbon Credit Revenues | Foreign exchange inflows |

| Green Jobs Creation | Youth employment growth |

| Infrastructure Investment | Regional value-chain development |

For global investors, Africa represents both necessity and opportunity. The continent's renewable energy resources are among the world's richest, and climate mitigation would offer high marginal impact relative to capital deployed.

However, realising this promise requires stable policy frameworks and robust governance.

Strengthen Policy, Unlock Scale

Experts emphasise three priorities to sustain capital momentum:

- Policy Certainty – Clear renewable tariffs, carbon credit frameworks and electric mobility regulations.

- Local Currency Solutions – Mitigating forex risks through innovative financing structures.

- Capacity Building – Strengthening technical and managerial capabilities within climate startups.

Regional governments are encouraged to streamline licensing regimes and harmonise carbon market standards to avoid fragmentation.

For founders, transparency, governance discipline and measurable impact metrics will be critical to attracting institutional capital.

Investors are ready. The next test lies in execution.

Path Forward – Scale Capital, Stabilise Policy Frameworks

Sustaining Africa's climate tech capital surge will require predictable regulation, blended finance and stronger local capacity.

Governments and investors must align to reduce currency risk and accelerate market integration.

If policy stability matches investor appetite, climate innovation could become a defining pillar of Africa's economic transformation.

Culled From: https://launchbaseafrica.com/2026/01/20/a-new-billion-dollar-wave-of-capital-targets-african-climate-tech/