Egypt has signed renewable energy agreements worth $1.8 billion, accelerating its efforts to reach a 42% clean power target by 2030.

The deals, spanning wind and solar projects, underscore Cairo's abilities to reposition itself as a regional green energy hub amid mounting fiscal and climate pressures.

For Africa's most populous Arab nation, the message is clear: energy security and decarbonisation are no longer competing goals; they are converging strategies.

Egypt's $1.8bn Bet on Clean Power Acceleration – Scaling Renewables Amid Fiscal Pressures

Egypt has signed a $1.8 billion in renewable energy agreements as part of a sweeping drive to expand clean electricity generation and reduce its dependence on imported fossil fuels.

The new deals, announced by the government and reported by ESG News, reinforce Cairo's ambition to source 42% of its electricity from renewables by 2030.

The agreements span large-scale wind and solar projects, adding critical capacity to a grid under pressure from rising demand, currency volatility and high external debt servicing costs.

For policymakers, the stakes are high: deliver reliable power, attract foreign capital investments, and cement Egypt's position as North Africa's renewable energy anchor state.

A High-Stakes Energy Pivot

Egypt's $1.8 billion clean energy package signals more than project financing; it marks a structural pivot in the country's energy strategy.

Under the agreements, new renewable projects are expected to expand solar and wind generation capacity significantly, reinforcing Egypt's 2030 clean electricity target. The country has already positioned itself as a renewable frontrunner in the region, with landmark projects such as the Benban Solar Park and large-scale wind farms along the Gulf of Suez.

But the urgency has intensified. Electricity demand continues to climb, industrial expansion requires a stable supply, and foreign exchange constraints have sharpened the need to reduce fossil fuel import exposure.

Deals That Reshape Energy Economics

The $1.8 billion agreements are primarily for utility-scale renewable generation. While detailed project allocations vary, the strategy aligns with Egypt's Integrated Sustainable Energy Strategy and its nationally determined contributions under the Paris Agreement.

Key Deal Snapshot

| Category | Details |

|---|---|

| Total Value | $1.8 billion |

| Focus Areas | Wind and Solar Power |

| National Target | 42% electricity from renewables by 2030 |

| Strategic Aim | Energy security, emissions reduction, and investment attraction |

The renewable expansion is also designed to unlock export opportunities. Egypt has signalled ambitions to export green electricity and potentially green hydrogen to Europe and neighbouring markets, leveraging its geographic advantage and grid interconnections.

However, challenges remain. Grid stability, transmission upgrades, and financing costs are central risk variables. Egypt's broader macroeconomic landscape, including inflation and currency pressures, adds complexity to long-term infrastructure commitments.

Still, renewable energy remains one of the few sectors consistently attracting international capital, particularly from Gulf sovereign funds and European development finance institutions.

Energy Security Meets Climate Ambition

If executed effectively, the $1.8 billion renewable pipeline could deliver tangible dividends.

First, it strengthens energy independence. By expanding domestic clean power generation, Egypt reduces its exposure to volatile global fuel markets.

Second, it supports fiscal resilience. Renewable projects often come with long-term power purchase agreements that create predictable revenue streams and attract concessional financing.

Third, it reinforces Egypt's geopolitical positioning. As Europe accelerates decarbonisation, proximity to Mediterranean markets gives Egypt leverage in emerging cross-border energy trade.

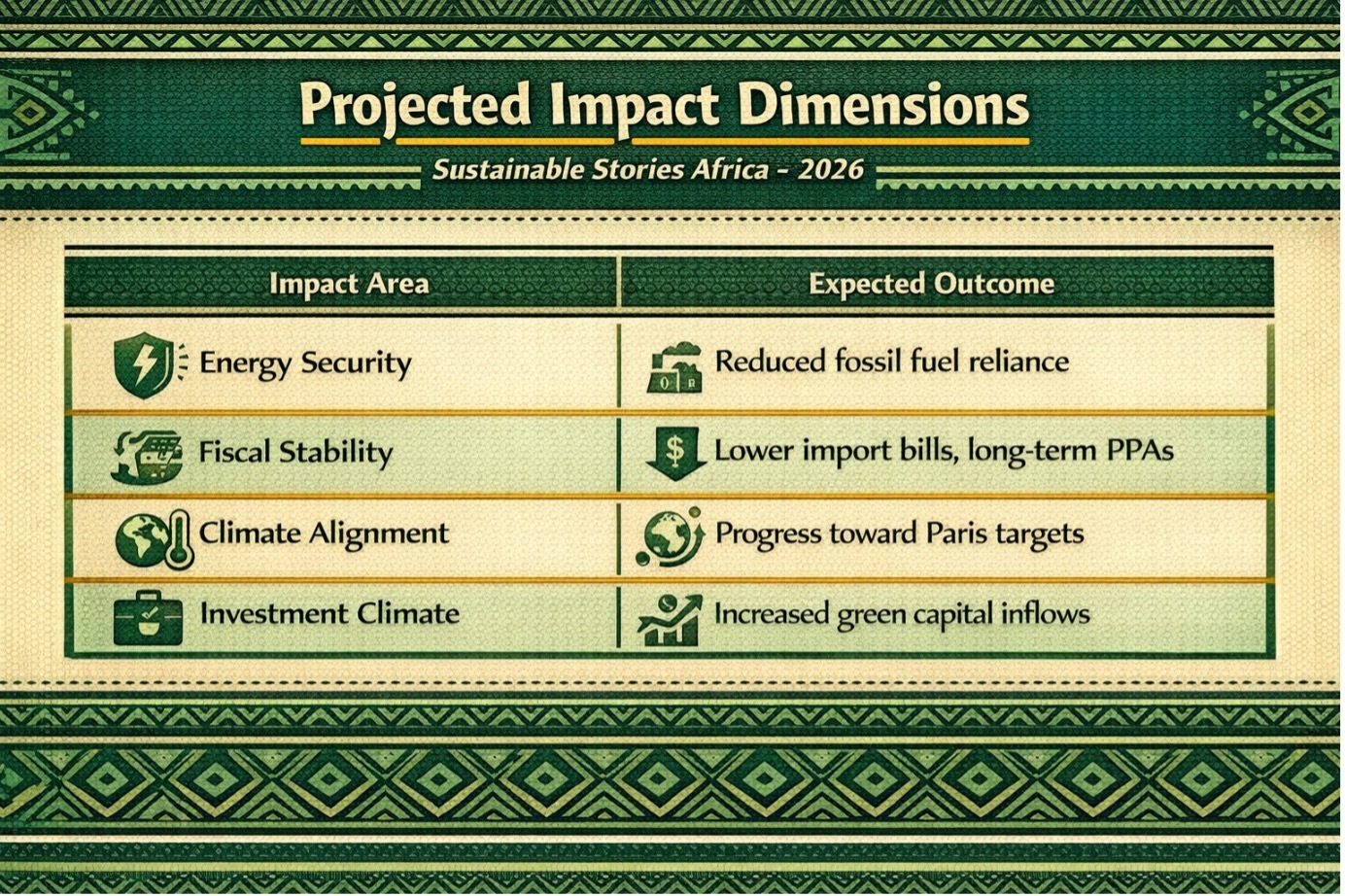

Projected Impact Dimensions

| Impact Area | Expected Outcome |

|---|---|

| Energy Security | Reduced fossil fuel reliance |

| Fiscal Stability | Lower import bills, long-term PPAs |

| Climate Alignment | Progress toward Paris targets |

| Investment Climate | Increased green capital inflows |

For Africa more broadly, Egypt's acceleration carries symbolic weight. It demonstrates that large emerging economies can pursue climate-aligned growth even in the light of fiscal constraints.

Turning Commitments into Capacity

Announcements are powerful; execution is decisive.

The government will need to prioritise grid modernisation, streamline permitting processes and maintain regulatory clarity to ensure projects move from memorandum to megawatt. Transparent procurement and bankable power purchase agreements will be critical to sustaining investor confidence.

Private developers, financiers and multilateral institutions also carry responsibility. Scaling blended finance models and de-risking mechanisms will determine whether Egypt's clean energy ambitions remain bankable under tightening global capital conditions.

The broader question is no longer whether Egypt should transition, but how quickly it can scale without destabilising its fiscal balance.

PATH FORWARD – Deliver Targets, De-Risk Investment, Strengthen Grid

Egypt's renewable expansion now hinges on disciplined execution. Grid upgrades, stable regulatory frameworks and credible financing structures must accompany headline investment figures to ensure delivery.

If policy consistency and investor confidence are maintained, the $1.8 billion agreements could catalyse broader regional clean energy momentum, positioning Egypt as both a continental leader and a strategic bridge between Africa and Europe's low-carbon future.

Culled From: https://esgnews.com/egypt-signs-1-8-billion-in-renewable-energy-deals-to-accelerate-2030-clean-power-target/