For every $1 invested in protecting nature, $30 flows into activities that degrade it.

That is the stark imbalance at the heart of the State of Finance for Nature 2026 report, prompting a fresh UN call for sweeping financial reform.

With $7.3 trillion directed toward nature-negative sectors in 2023, compared to $220 billion for nature-based solutions, the message is clear: markets are financing environmental decline on a large scale.

Nature's Price Tag in a Distorted Global Market

The world is spending billions to protect nature, but trillions to undermine it.

That contradiction sits at the centre of the State of Finance for Nature 2026 report, as the United Nations renewed calls for systemic financial reform to realign markets with planetary boundaries.

The report finds that for every dollar invested in nature-positive solutions, $30 are channelled into activities that harm ecosystems.

UNEP Executive Director Inger Andersen framed the challenge bluntly: "If you follow the money, you see the size of the challenge ahead of us... We can either invest in nature's destruction or power its recovery; there is no middle ground."

Thirty Dollars Against Every One

The imbalance is not marginal; it is structural.

In 2023 alone, $7.3 trillion flowed into nature-negative activities across utilities, industrials, energy and basic materials. These include sectors that benefit from environmentally harmful subsidies, notably fossil fuels, agriculture, water, transport and construction.

By contrast, only $220 billion was allocated to nature-based solutions, with the majority in the form of public finance.

Global Nature Finance Flows (2023)

| Category | Amount (USD) | Insight |

|---|---|---|

| Nature-negative activities | $7.3 trillion | Driven by fossil fuels, industrials, and subsidies |

| Nature-based solutions | $220 billion | Predominantly public finance |

| Ratio | 30:1 | Destruction outpaces protection |

The numbers reveal not a funding gap, but a funding distortion.

Damage Concentrated in Core Sectors

The report identifies the sharpest environmental damage in utilities, industrial production, energy and basic materials sectors, deeply embedded in global supply chains.

Subsidies remain a key accelerant. Fossil fuels, intensive agriculture and transport continue to receive public support that tilts investment away from biodiversity protection and climate resilience.

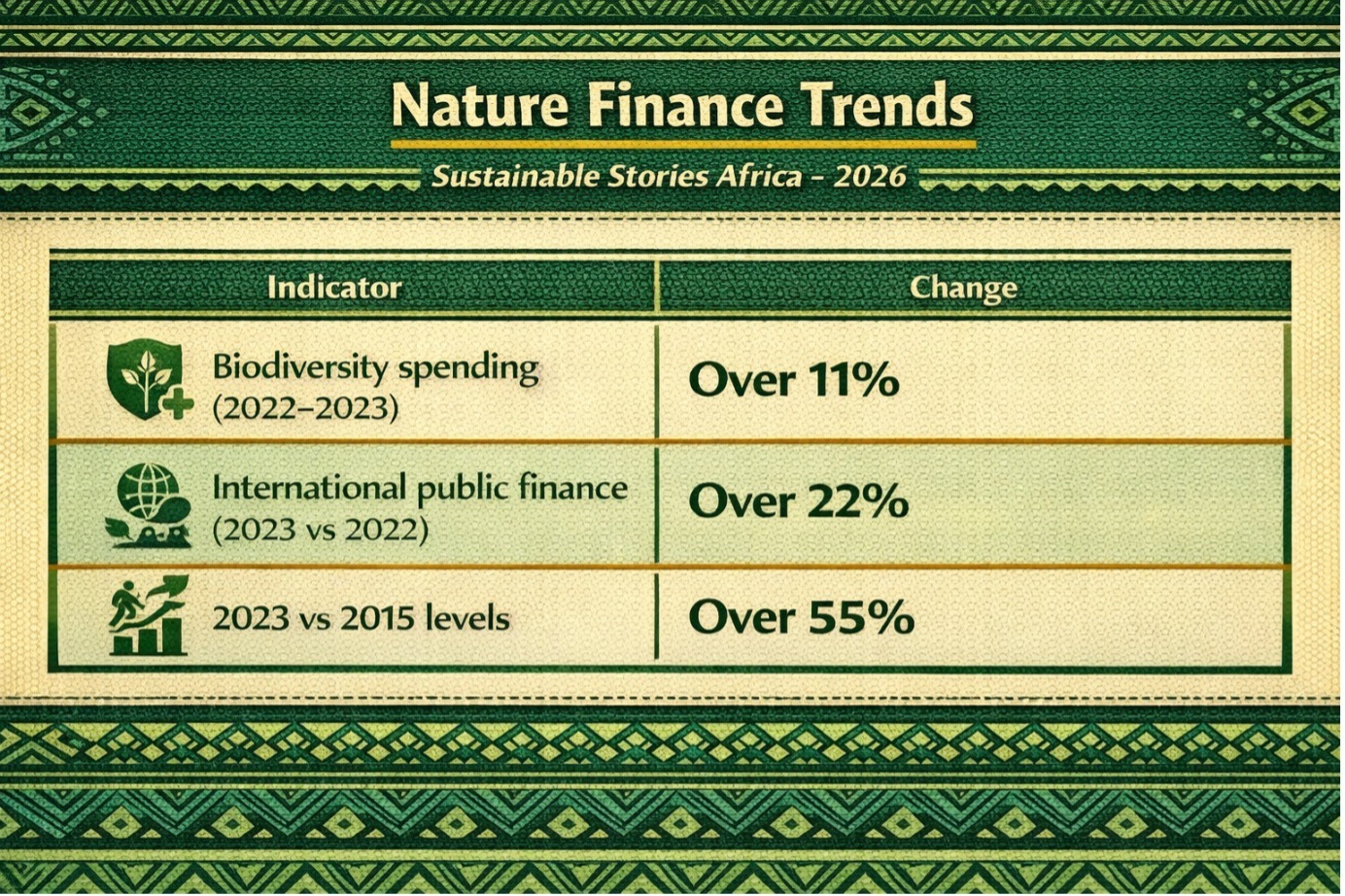

Yet there are early signs of movement. Spending on biodiversity and landscape protection rose 11% between 2022 and 2023. International public finance for nature-based solutions increased 22% year-on-year in 2023 and now stands 55% above 2015 levels.

Nature Finance Trends

| Indicator | Change |

|---|---|

| Biodiversity spending (2022–2023) | Over 11% |

| International public finance (2023 vs 2022) | Over 22% |

| 2023 vs 2015 levels | Over 55% |

The trajectory is positive, but nowhere near sufficient to close a multi-trillion-dollar gap.

A Blueprint for a 'Big Nature Turnaround'

The report also diagnoses the imbalance; it outlines scalable, economically viable solutions.

Among them:

- Greening cities to counter heat-island effects and improve urban liveability.

- Embedding nature-based design into road and energy infrastructure.

- Producing emissions-negative building materials.

These interventions are not philanthropic add-ons. They are productivity-enhancing investments that reduce climate risk, protect supply chains and support long-term economic resilience.

The study also charts a phased withdrawal of harmful subsidies, alongside scaling up "nature-positive" production systems. Redirecting even a fraction of destructive capital flows could fundamentally shift market incentives.

The opportunity is not merely environmental; it is economic.

Financial Reform as Systemic Lever

The UN's message is unequivocal: financial reform is the most powerful lever for change.

This includes:

- Repricing environmental risk in capital markets.

- Phasing out environmentally harmful subsidies.

- Scaling blended finance mechanisms.

- Embedding nature metrics into corporate and sovereign reporting.

Without structural reform, nature-based solutions will remain undercapitalised relative to the scale of degradation.

Markets move where incentives point. Today, incentives still favour extraction over restoration.

The report argues that redirecting capital, not merely adding new funds, is the fastest path to realigning growth with planetary stability.

Path Forward – Redirect Capital, Redesign Incentives

Governments and financial institutions must phase out harmful subsidies, integrate nature risk into financial regulation, and scale investment in viable nature-based solutions. Redirecting even a modest share of destructive capital flows could unlock systemic change.

The choice is binary: entrench environmental decline or engineer a nature-positive transition. Aligning finance with ecological recovery is no longer optional; it is foundational to economic stability.

Culled From: https://news.un.org/en/story/2026/01/1166809