Nigeria's solar industry has received a regulatory boost as the new Nigerian Tax Act (NTA) preserves key tax exemptions for renewable energy equipment in 2026.

Despite a higher national VAT rate, solar panels, inverters, and batteries remain zero-rated, protecting affordability and investor confidence.

In an exclusive interview, tax expert Samuel Attah explains how VAT rules, input credits, and the new Economic Development Tax Incentive framework will shape Nigeria's clean-energy market.

Solar Tax Relief Holds Firm

Nigeria's renewable energy sector received a critical boost in 2026 as solar equipment retained its tax-exempt status under the Nigerian Tax Act (NTA), despite the introduction of a higher national VAT regime.

According to Samuel Attah, Finance Officer at Ceesolar, solar panels, inverters, batteries, and charge controllers remain zero-rated for VAT and exempt from import duties under Section 144 of the NTA and Nigeria Customs Circular T&T/2024/18.

"This protects affordability for households and investors while reinforcing government support for clean energy," Attah said.

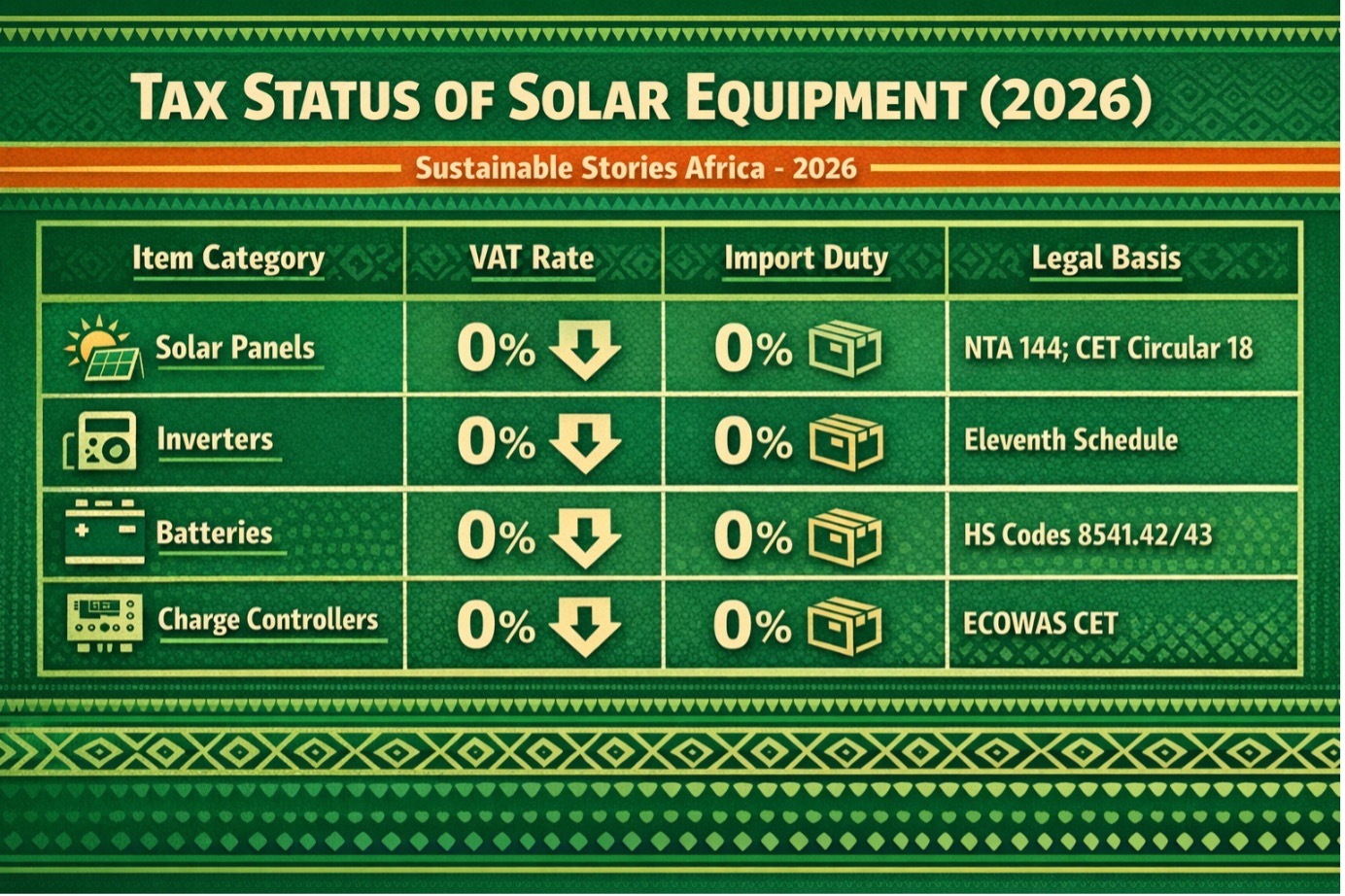

Tax Status of Solar Equipment (2026)

| Item Category | VAT Rate | Import Duty | Legal Basis |

|---|---|---|---|

| Solar panels | 0% | 0% | NTA 144; CET Circular 18 |

| Inverters | 0% | 0% | Eleventh Schedule |

| Batteries | 0% | 0% | HS Codes 8541.42/43 |

| Charge controllers | 0% | 0% | ECOWAS CET |

Local Installations Remain VAT-Free

While Nigeria's standard VAT rate rose to 10%, Attah clarified that solar system sales and installations remain exempt unless the Minister of Finance issues a formal commencement order.

"Section 185(2) of the NTA makes VAT activation conditional on a ministerial directive,"

he explained.

However, companies that only provide installation services, without selling equipment, must still charge VAT on service fees.

This distinction ensures continued affordability for consumers while maintaining tax compliance for service providers.

Input VAT Credits Still Claimable

Solar companies selling zero-rated equipment can still recover VAT paid on business expenses such as vehicles, office equipment, and operational supplies.

Under Section 155 of the NTA, input VAT can be deducted where costs relate to taxable business activities, subject to apportionment rules and a five-year claim window.

"If your output VAT is zero but your inputs were taxed, you can claim refunds or carry credits forward," Attah noted.

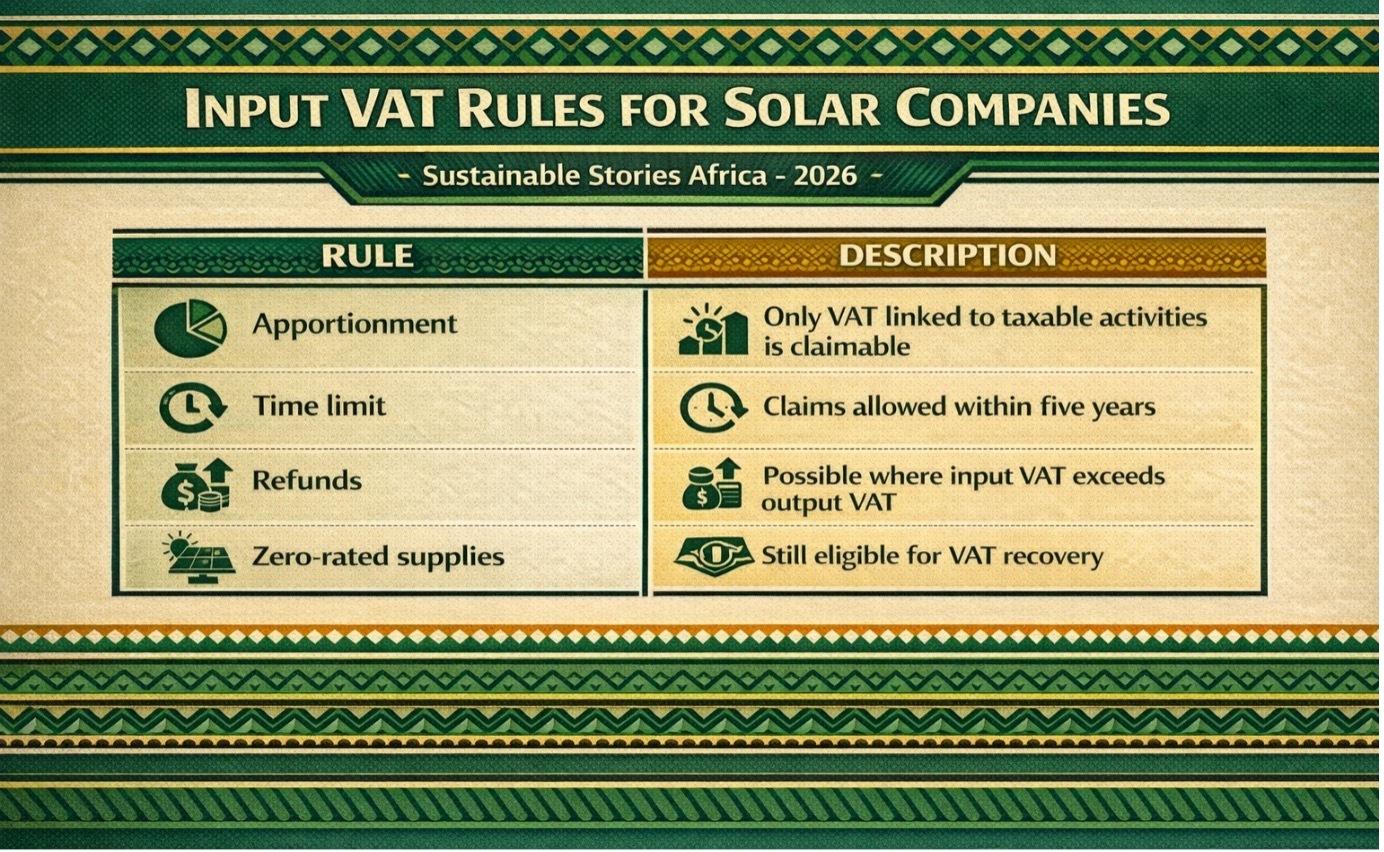

Input VAT Rules for Solar Companies

| Rule | Description |

|---|---|

| Apportionment | Only VAT linked to taxable activities is claimable |

| Time limit | Claims allowed within five years |

| Refunds | Possible where input VAT exceeds output VAT |

| Zero-rated supplies | Still eligible for VAT recovery |

Pioneer Status Replaced by Credits

From January 2026, Nigeria formally replaced the Pioneer Status Incentive with the Economic Development Tax Incentive (EDTI) framework.

Rather than granting tax holidays, EDTI offers a 5% annual tax credit on qualifying capital expenditure in priority sectors, including renewable energy.

"This shifts support from exemptions to performance-based investment credits," Attah said.

For solar firms, this means better alignment between capital investment and long-term tax planning.

PATH FORWARD – Clarity Drives Solar Investment Growth

Attah advised solar businesses to maintain strong VAT registration, detailed financial records, and proactive tax planning to maximize benefits under the new framework.

"The policy direction is supportive, but the rules are technical," he said. "Companies that understand them will gain a competitive edge."

With Nigeria's energy transition accelerating, stable tax incentives could play a decisive role in expanding solar adoption nationwide.

Culled From Omono Okonkwo's LinkedIn Page