Nigeria's competition law regime is entering a decisive phase as enforcement shifts from regulatory design to market culture.

With the Federal Competition and Consumer Protection Commission (FCCPC) expanding investigations, compliance expectations are rising across banking, telecoms, and consumer goods sectors.

Experts say sustained enforcement, corporate governance reforms, and judicial consistency will determine whether competition law becomes a lived business norm or remains a regulatory formality.

From Statute to Street Impact

The Federal Competition and Consumer Protection Act (FCCPA) empower the FCCPC to regulate mergers, investigate cartels, and protect consumers. However, experts say the real challenge is embedding competition principles into daily business culture.

"Law alone is not enough. Market behaviour must change," policy analysts note.

Enforcement Shapes Business Behaviour

Since the FCCPA's enactment, the FCCPC has expanded investigations into pricing abuses, market dominance, and unfair consumer practices.

Telecommunications, fast-moving consumer goods, banking, and digital services remain priority sectors.

Businesses now face stricter merger controls, information requests, and sanctions for non-compliance.

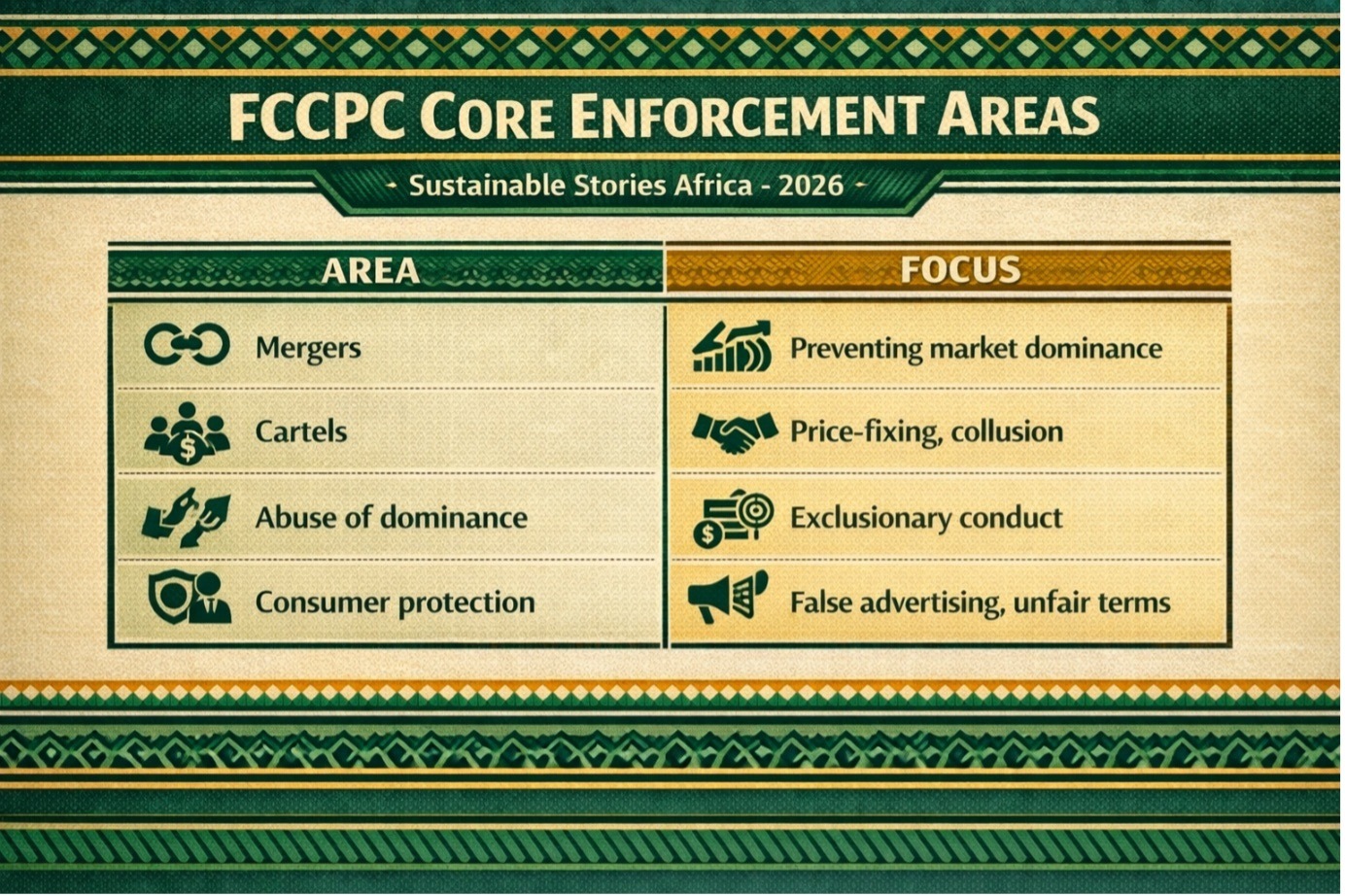

FCCPC Core Enforcement Areas

| Area | Focus |

|---|---|

| Mergers | Preventing market dominance |

| Cartels | Price-fixing, collusion |

| Abuse of dominance | Exclusionary conduct |

| Consumer protection | False advertising, unfair terms |

Regulatory clarity has improved, but judicial interpretation remains crucial to establishing rules and regulations.

Courts are playing a growing role in shaping enforcement consistency, especially in merger disputes and sanction appeals.

Compliance Becomes Corporate Strategy

Competition compliance is increasingly viewed as a governance priority, not just a legal obligation.

Companies are strengthening internal controls, competition audits, and staff training to reduce regulatory exposure.

Boards now factor competition risks into enterprise risk management frameworks.

Corporate Compliance Shifts

| Area | Change |

|---|---|

| Board oversight | Competition risk reporting |

| Legal teams | Proactive advisory roles |

| Training | Market conduct awareness |

| M&A strategy | Early FCCPC engagement |

Experts argue that competition law works best when firms internalise fair-market principles, rather than merely reacting to enforcement threats.

Culture Must Match Regulation

For competition law to succeed, regulators, courts, and corporations must align.

Regulators need transparent enforcement processes. Businesses must invest in ethical market conduct. Courts must ensure consistent interpretation of competition rules.

Public awareness is also essential. Consumers who understand their rights strengthen enforcement through complaints and accountability.

PATH FORWARD – Building Fair Markets, Not Fear

Nigeria's competition regime is shifting from rulemaking to culture-building. Stronger enforcement, judicial clarity, and corporate compliance systems will determine its success.

The goal is not regulatory fear, but fair competition, where innovation thrives, consumers are protected, and markets remain open to new entrants.

Culled From: Competition Law in Action: From Regulatory Framework to Market Culture in Nigeria – SSKOHN – Streamsowers & Kohn