Nigeria's distributed renewable energy market has gained new momentum as InfraCredit issued a credit guarantee for CEESOLAR's ₦9 billion mini-grid rollout in Cross River State. The deal strengthens investor confidence in locally financed clean-energy projects.

With four mini-grids expected to electrify 3,600 homes and businesses, the transaction showcases how blended finance can unlock scalable, climate-aligned infrastructure across underserved communities.

Solar Financing Surge Signals New Chapter for Nigeria

InfraCredit has guaranteed CEESOLAR Energy's ₦9 billion local-currency debt, marking the fifth deal under the UK-funded Climate Finance Blending Facility (CFBF). The project will deliver 760 kWp of isolated solar hybrid mini-grids to underserved Cross River communities—electrifying 3,600 households and MSMEs, creating 561 jobs and avoiding 737 tonnes of CO₂ annually.

Blended Capital Unlocks Long-Term Clean Energy Infrastructure

The CFBF blends concessional capital from FCDO (£10m), BII (US$10m), and a US$20m counter-guarantee, enabling domestic pension and insurance funds to invest confidently.

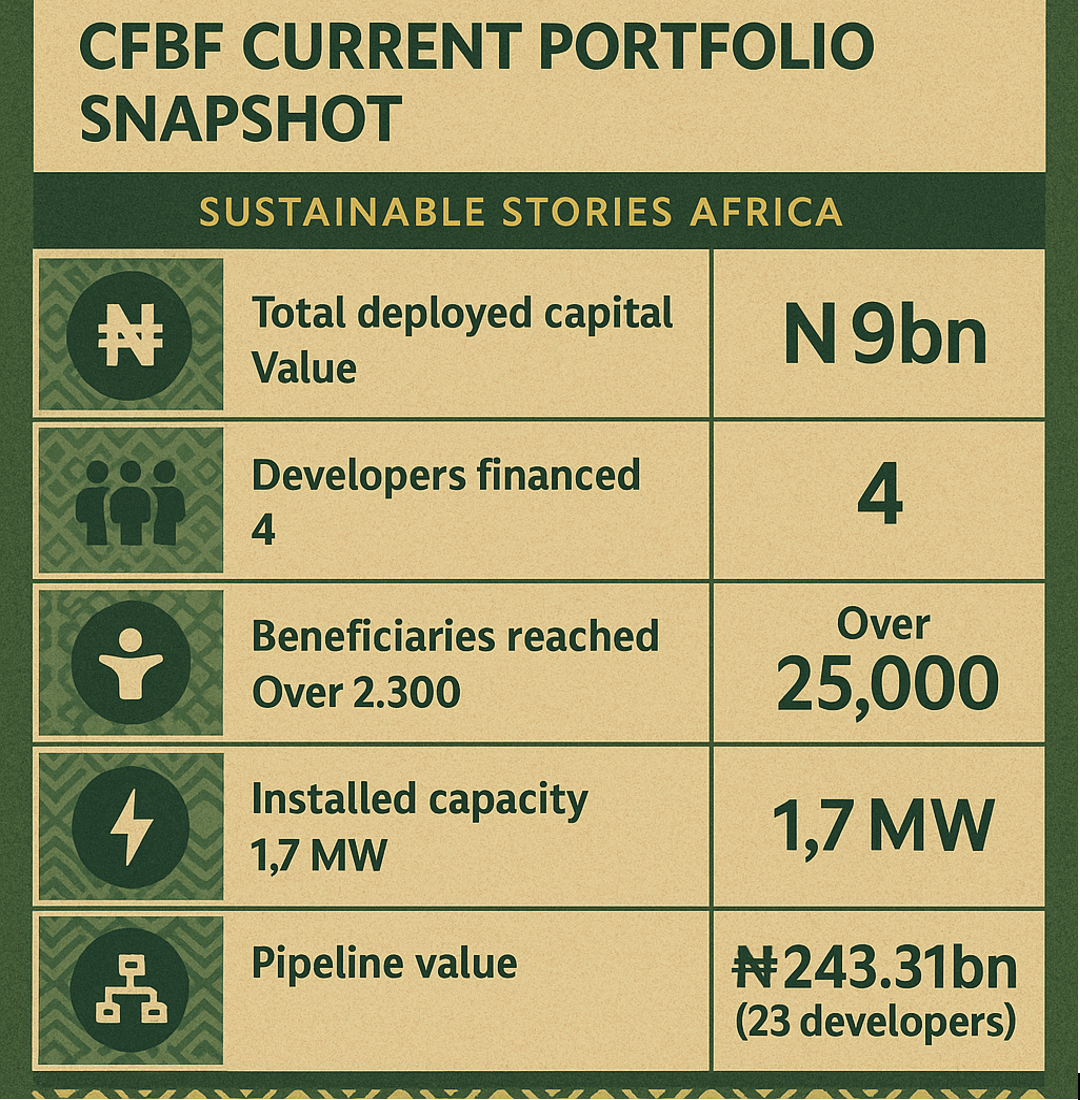

CFBF Current Portfolio Snapshot

| Metric | Value |

|---|---|

| Total deployed capital | ₦9bn |

| Developers financed | 4 |

| Beneficiaries reached | Over 25,000 |

| Jobs created | Over 2,300 |

| Installed capacity | 1.7 MW |

| Pipeline value | ₦243.31bn (23 developers) |

Stakeholders, including the REA, AMDA, FSD Africa, NSIA and the World Bank's DARES facility, support the transaction through due diligence, grants and construction liquidity.

Local Capital, Local Developers, Local Impact

CEESOLAR CEO Chibueze Ekeh says each new grid "supports women, powers small businesses, improves healthcare, and gives children a better chance at education."

AMDA's leadership notes it "validates local capacity to scale," while InfraCredit CEO Chinua Azubike highlights "the power of partnership" in unlocking climate-resilient infrastructure.

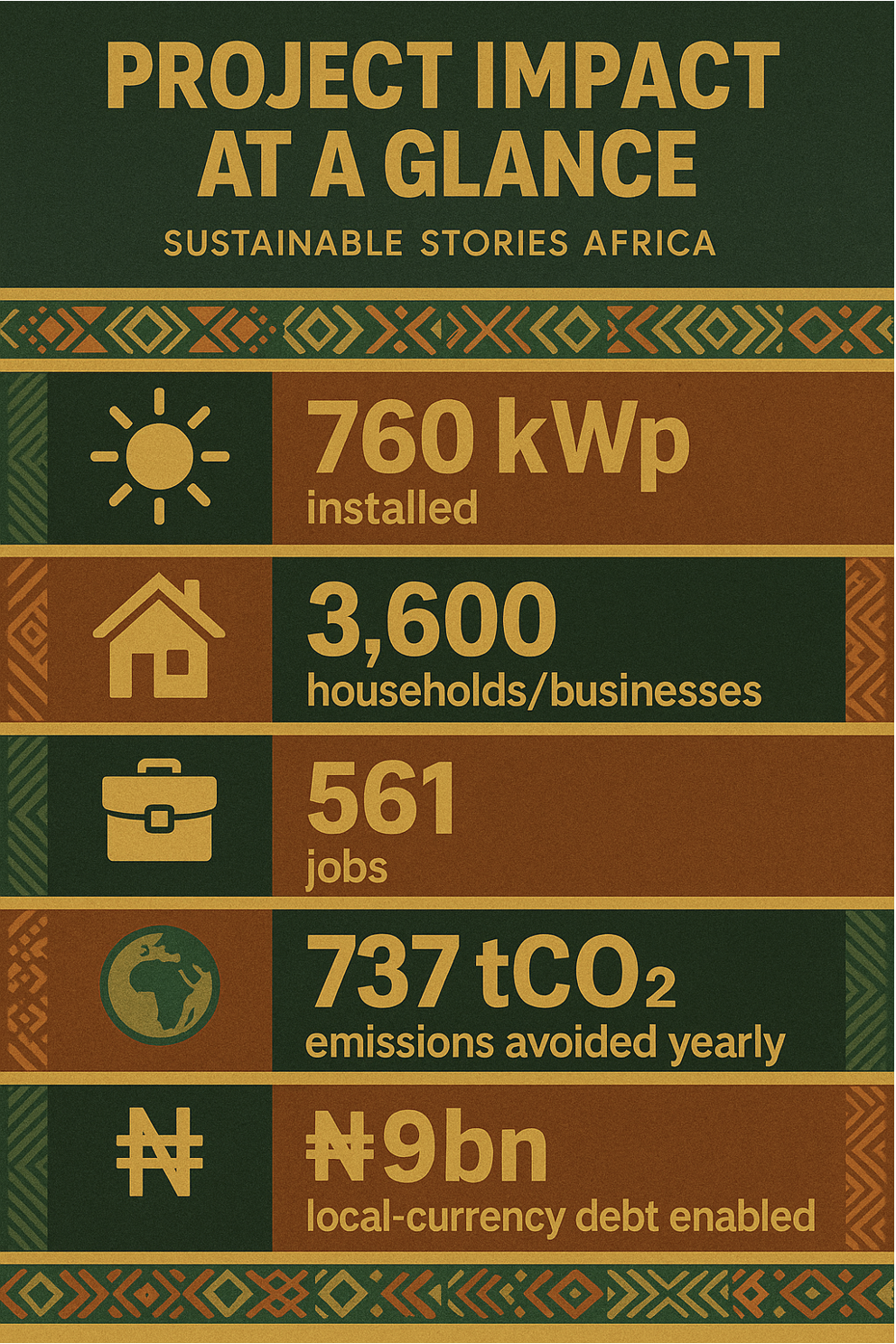

Project Impact at a Glance

🔆 760 kWp installed

🏘️ 3,600 households/businesses electrified

💼 561 jobs

🌍 737 tCO₂ emissions avoided yearly

💰 ₦9bn local-currency debt enabled

Scaling Distributed Solar for Universal Access

With rising investor confidence and a strong project pipeline, Nigeria's mini-grid sector shows clear potential for scale. InfraCredit's blended-finance model presents a replicable pathway for domestic capital mobilisation.

Path Forward – Scaling Solar With Local Capital

InfraCredit, CEESOLAR, and development partners plan to deepen blended-finance structures that derisk mini-grid investments and expand solar infrastructure in underserved areas. Strengthening the CFBF pipeline will accelerate universal electrification and climate-resilient growth.

A coordinated push from concessional capital to technical assistance aims to empower local developers, boost job creation and position Nigeria as the continent's leading distributed energy market.