More than 200 million migrant workers send money home annually, creating one of the most powerful but under-appreciated financial flows in global development.

In 2023, global remittances reached $656 billion, outstripping official foreign aid and acting as a stable economic lifeline for developing communities.

Despite rising costs and policy shifts, these flows sustain households, spur investment, and underpin economic resilience from Lagos to Lahore.

Global Flows Surge as Development Lifelines

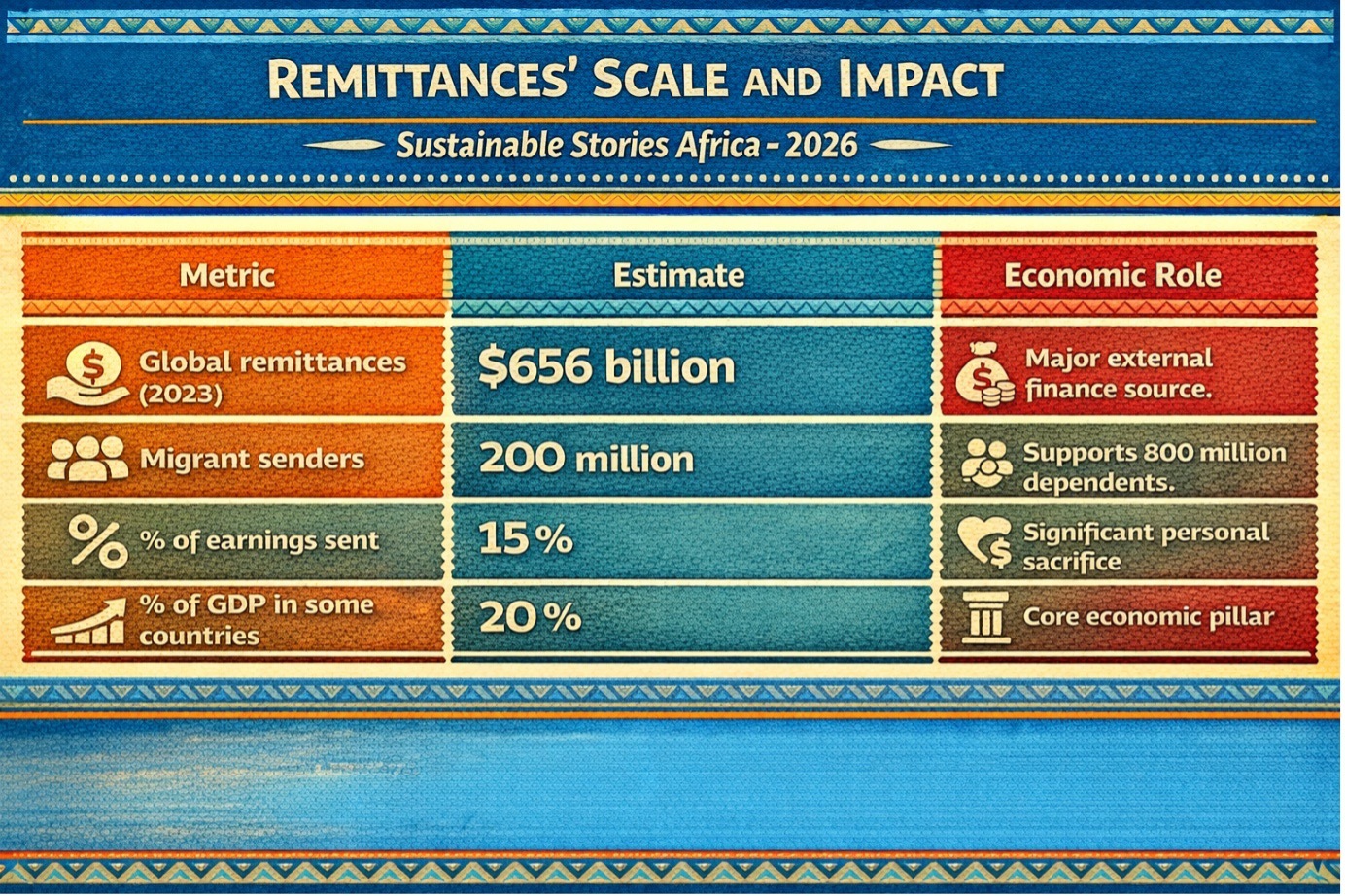

International remittances, money migrant workers send back home, reached approximately $656 billion in 2023, a historic high and nearly equivalent to the GDP of countries like Belgium.

These flows, often small in individual size but vast in aggregate, have become the largest source of external financial support for many low- and middle-income countries, significantly surpassing official development assistance.

United Nations research highlights that migrants typically send almost 15 % of their earnings back to their communities of origin, underscoring both the magnitude and personal sacrifice behind these funds.

Who Sends, Who Benefits, and What It Means

Remittances are more than cash transfers; they act as economic anchors for families and communities.

Globally, around 200 million migrants send money home, supporting over 800 million relatives and dependents across developing regions.

In many countries, including Nepal, where remittances contribute over 20 % of GDP, these flows rival or exceed foreign direct investment and trade earnings.

Remittances’ Scale and Impact

Metric | Estimate | Economic Role |

|---|---|---|

Global remittances (2023) | $656 billion | Major external finance source. |

Migrant senders | 200 million | Supports 800 million dependents. |

% of earnings sent | 15 % | Significant personal sacrifice. |

Remittances also exhibit stability in the face of shocks, maintaining flows even in downturns, making them a vital buffer against economic crises for many households.

Experts describe them as counter-cyclical finance, rising when economies falter and formal risk capital retreats.

More than Survival – Growth, Investment, Stability

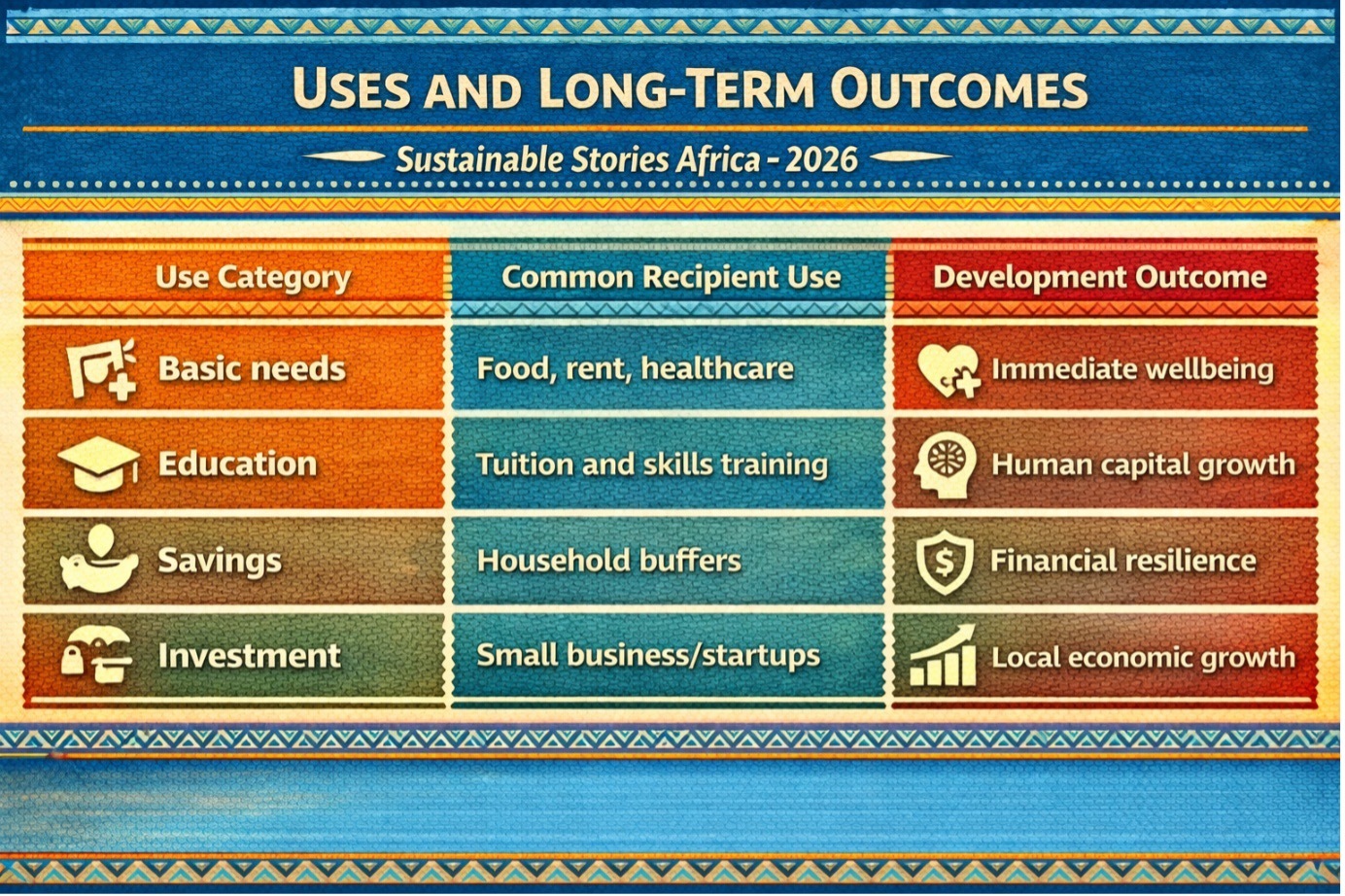

While remittances often meet basic needs, such as food, housing, and healthcare, a growing portion is channelled into education, savings, business, and entrepreneurship, expanding their developmental footprint.

Commitments by global institutions aim to reduce transaction costs, improve financial inclusion, and strengthen channels so more of this money reaches productive use rather than expensive intermediaries.

Uses and Long-Term Outcomes

Use Category | Common Recipient Use | Development Outcome |

|---|---|---|

Basic needs | Food, rent, healthcare | Immediate wellbeing |

Education | Tuition and skills training | Human capital growth |

Savings | Household buffers | Financial resilience |

Investment | Small business/startups | Local economic growth |

Despite rising costs and regulatory pressures in some sending countries, the role of remittances as a poverty reduction tool and economic stabiliser remains potent.

Lower Costs, Strengthen Systems, Scale Impact

Policymakers, financial institutions, and international agencies are pushing to make remittances cheaper, faster, and more transparent, because high costs disproportionately burden low-income households.

Greater digitalisation and mobile money integration have already expanded access in Africa and Asia, enabling quicker, more affordable transfers, which translates to increased financial inclusion.

Industry leaders urge expanding the formal remittance corridors and reducing reliance on informal cash networks to boost security and traceability.

Path Forward – Integrate Remittances, Build Inclusive Growth

Embed remittance flows into broader economic development plans: reduce transfer costs, support financial access, and align remittance-linked investment with education, healthcare, and enterprise growth.

By investing in formal channels and supportive policy frameworks, governments can turn remittances from safety nets into engines of resilient, inclusive economic development.

Culled From: Remittances matter: 8 facts you don’t know about the money migrants send back home | United Nations