Nigeria's Securities and Exchange Commission (SEC) has unveiled sweeping reforms aimed at repositioning the country's capital market as a transparent, investor-friendly, and globally competitive platform.

The measures target regulatory efficiency, market integrity, digital innovation, and investor protection at a time when Nigeria seeks to deepen domestic capital formation.

The reforms signal a decisive shift toward credibility-driven growth and long-term market confidence.

SEC Unveils Capital Market Reset

Nigeria's Securities and Exchange Commission (SEC) has announced a broad package of regulatory reforms designed to reposition the country's capital market as a credible, efficient, and resilient financing platform.

The reforms, unveiled in Abuja, respond to long-standing concerns around market confidence, regulatory fragmentation, weak investor participation, and limited depth in Nigeria's non-bank financial markets.

According to the SEC, the reform agenda seeks to modernise capital-market operations, strengthen investor protection, and align Nigeria's market architecture with global best practices, particularly as emerging markets compete for increasingly selective capital flows.

Fixing Structural Gaps in Nigeria's Markets

Nigeria's capital market has struggled to fulfil its full economic role. Despite being Africa's largest economy by population, market capitalisation remains modest relative to GDP, while domestic institutional participation is still limited. Analysts have long pointed to regulatory complexity, weak enforcement, and slow innovation as barriers to scale.

The SEC's reform package focuses on:

- Streamlining regulatory processes

- Strengthening enforcement and compliance

- Expanding market products

- Accelerating digitalisation across market infrastructure

Nigeria Capital Market Context

| Indicator | Snapshot |

|---|---|

| Market capitalisation (equities) | N56 trillion |

| Market depth vs GDP | Low-to-moderate |

| Retail investor participation | Limited |

| Institutional investor dominance | High |

| Product diversity | Narrow |

Nigeria Capital Market Context

By addressing these gaps, the SEC aims to reposition the market as a credible alternative funding channel for government and private-sector growth.

What the Reforms Actually Change

At the core of the reforms is a push to restore trust and predictability. The SEC is strengthening its supervisory framework, tightening disclosure requirements, and enhancing enforcement against market infractions.

Key reform pillars include:

- Improved investor protection rules, particularly for retail participants

- Faster approval timelines for market instruments

- Technology-enabled surveillance to curb manipulation and insider trading

- Expanded product innovation, including commodities, derivatives, and sustainable finance instruments

These measures reflect a strategic shift from reactive regulation to risk-based, forward-looking oversight, aligning Nigeria more closely with international regulatory standards.

Unlocking Capital for the Real Economy

The reforms are expected to support Nigeria's broader economic objectives, particularly infrastructure financing, private-sector expansion, and long-term savings mobilisation.

By improving transparency and reducing friction, the SEC hopes to attract both domestic and foreign investors back into the market.

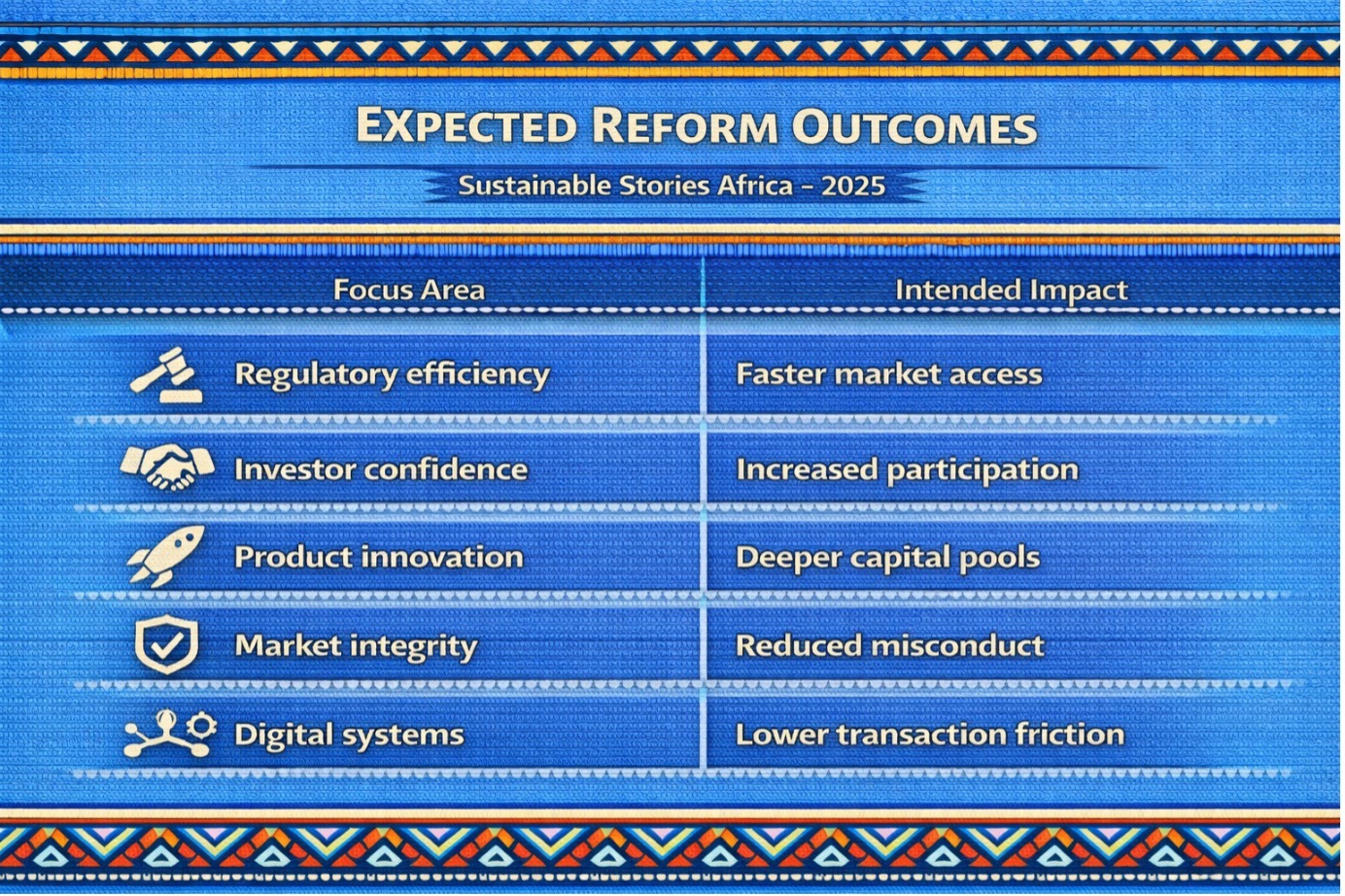

Expected Reform Outcomes

| Focus Area | Intended Impact |

|---|---|

| Regulatory efficiency | Faster market access |

| Investor confidence | Increased participation |

| Product innovation | Deeper capital pools |

| Market integrity | Reduced misconduct |

| Digital systems | Lower transaction friction |

Market operators have welcomed the reforms, noting that predictable regulation and credible enforcement are essential for unlocking patient capital and supporting Nigeria's economic diversification agenda.

Path Forward: Rebuilding Trust, Mobilising Long-Term Capital

Rebuilding Trust to Unlock Sustainable Capital

The SEC's reform agenda, which we term "Rebuilding Trust to Unlock Sustainable Capital," marks a decisive attempt to rebuild credibility in Nigeria's capital market by strengthening governance, enforcement, and innovation.

By prioritising investor protection and regulatory clarity, the commission is laying the groundwork for deeper, more resilient capital formation.

Ultimately, the success of the reforms will depend on consistent implementation, stakeholder collaboration, and the ability to translate regulatory intent into measurable market confidence, liquidity growth, and real-economy impact.

Culled From: https://independent.ng/sec-unveils-sweeping-reforms-to-reposition-nigerias-capital-market/