The United Kingdom has introduced a landmark assurance standard for corporate sustainability disclosures, signalling a shift in how ESG data is treated within financial reporting regimes.

The move aims to enhance investor confidence by bringing rigorous audit-style scrutiny to non-financial information.

This standard positions sustainability data as a verifiable asset and aligns the UK with global efforts to standardise ESG assurance. The implications are far-reaching for companies, auditors and capital markets alike.

UK Implements New Assurance Standard

The UK's Financial Reporting Council (FRC) has officially issued the ISSA (UK) 5000 ("General Requirements for Sustainability Assurance Engagements"), providing a clear benchmark for sustainability-assurance engagements.

Effective for reporting periods beginning on or after 15 December 2026 (with early application permitted), the standard enables both "limited" and "reasonable" assurance levels on ESG disclosures under a single UK-aligned framework.

This initiative aligns the UK with the International Auditing and Assurance Standards Board's global assurance framework, ISSA 5000, thereby enhancing interoperability and investor-comparability of sustainability information.

Why the Standard Matters

For companies and capital markets, the standard transforms sustainability disclosures from marketing commentary to audited outputs. Investors long for credible, consistent data and the UK's move responds to that demand.

By establishing a voluntary but high-quality assurance regime, the UK is setting an implicit expectation of future mandatory disclosure regimes and boosting the credibility of ESG-aligned reporting.

The consultation on assurance oversight indicates that registration regimes for assurance firms may follow.

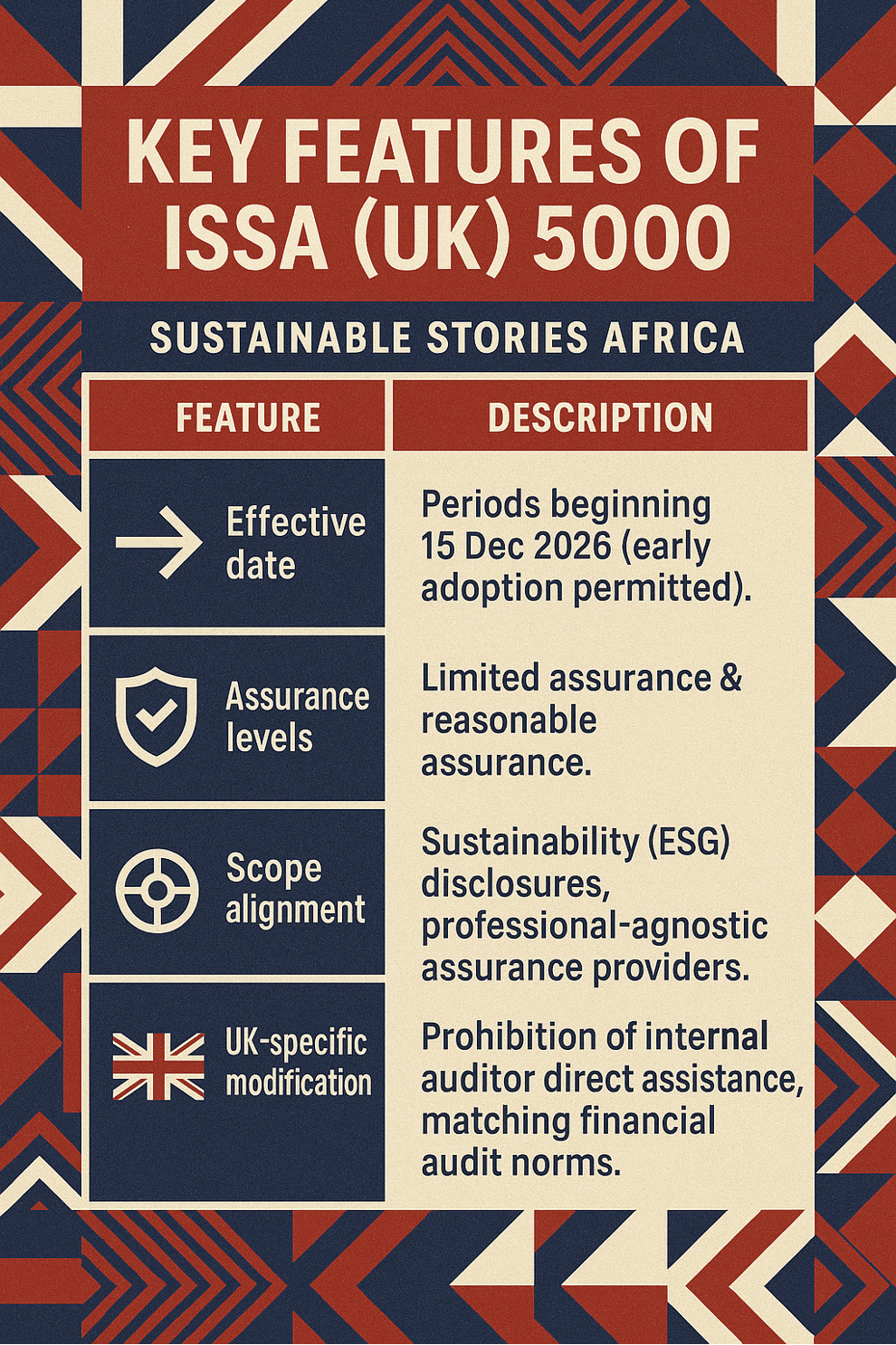

Key Features of ISSA (UK) 5000

| Feature | Description |

|---|---|

| Effective date | Periods beginning 15 Dec 2026 (early adoption permitted). |

| Assurance levels | Limited assurance & reasonable assurance. |

| Scope | Sustainability (ESG) disclosures, professional-agnostic assurance providers. |

| Alignment | Fully aligned with the international ISSA 5000 framework. |

| UK-specific modification | Prohibition of internal auditor direct assistance, matching financial audit norms. |

Implications for Stakeholders

- For companies: Boards, audit committees, and sustainability functions must now treat ESG disclosures with the same rigour as financial statements; internal controls and assurance planning are no longer optional.

- For assurance providers: New skill sets and audit frameworks must be developed; firms offering assurance will need to align with the standard and possibly future registration regimes.

- For investors and capital markets: The new regime reduces green-washing risk, improves confidence in ESG disclosures, and supports more efficient capital allocation to sustainable business models.

What Comes Next

- Companies should begin gap-analysing their sustainability data, control environment, assurance readiness and vendor/assurance-partner selection.

- Assurance firms should master the standard's technical requirements and build capacity for reasonable assurance engagements.

- The UK regulator is expected to consult further on oversight of assurance providers (registration regime) and link assurance requirements with disclosure mandates.

- Market participants should monitor whether the standard becomes mandatory or remains voluntary; early adopters will likely gain a competitive advantage and regulatory credence.

Stronger Assurance Harnesses Sustainable Reporting

Looking ahead, the UK's adoption of ISSA (UK) 5000 sets a strategic template for maturity in sustainability transparency.

The industry must now scale assurance capability, integrate ESG into financial governance and align with broader global frameworks (such as the International Sustainability Standards Board's IFRS S1/S2).

This standard may catalyse a global shift where sustainability disclosures are no longer soft commentary but audited metrics embedded in enterprise risk and governance systems.

Culled From: UK Releases Sustainability Reporting Assurance Standard - ESG Today