Africa stands at the threshold of a renewable energy breakthrough, yet global investment patterns continue to overlook its vast potential. Despite accounting for only 1.7% of renewable capacity additions in 2024. The continent holds the greatest opportunity for scalable, resilient energy growth.

With rising energy demand, youthful markets, and abundant solar and wind resources, Africa could become the world's next renewable powerhouse, only if financing and infrastructure align.

Africa's Renewable Frontier – Opportunity Rising

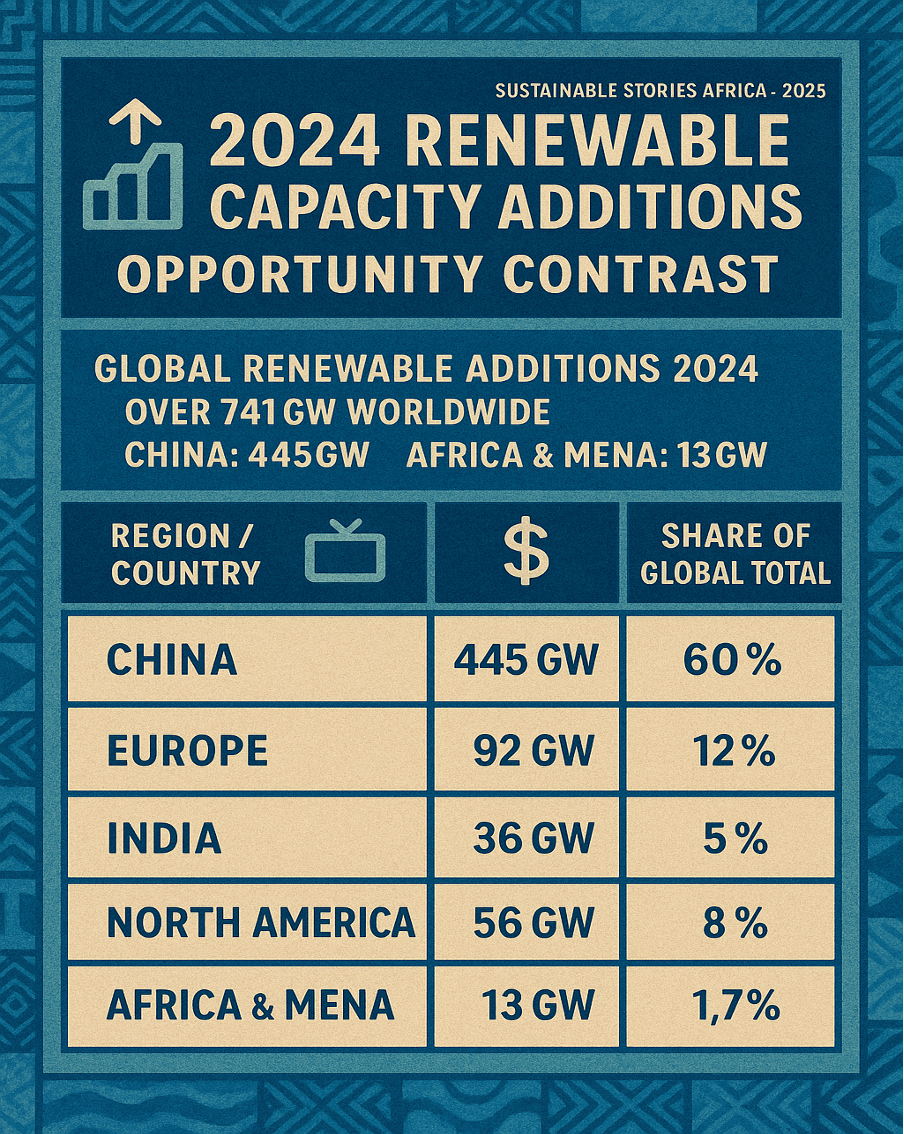

Africa's renewable energy moment has arrived. The latest Renewables 2025 Global Status Report reveals a global system shifting toward clean energy at record scale, with 741 GW of new renewable capacity added worldwide in 2024

However, Africa captured only a fraction of this growth, contributing 13 GW, the smallest regional share. At first glance, this appears to reinforce the familiar narrative of lagging progress. But a deeper reading of the data points to a different, more powerful story: Africa represents the world's most compelling opportunity frontier.

While mature markets struggle with grid saturation, rising costs, and slowing deployment, African economies possess the rare combination of expanding demand, abundant resources, and structural headroom for leapfrogging. The report notes that China alone accounted for 60% of global additions, driven by saturated deployment and industrial capacity

In contrast, Africa's low baseline offers a clear runway for rapid scaling, mirroring Uruguay's transformation to nearly 100% renewable electricity, which delivered jobs, stability, and resilience.

This opinion-based article argues that Africa's perceived lag is not a weakness but an advantage. With the right investment structures, institutional support, and policy clarity, the continent can shape the next chapter of global renewable growth and redefine how energy transitions deliver economic value.

Africa Holds the Untapped Renewable Advantage

The global renewable transition is accelerating, but Africa remains the most undervalued arena in the energy landscape. While the world added a record 741GW of renewable capacity in 2024, Africa captured only 1.7% of that growth, reflecting just 13GW of new installations. At face value, this seems negligible.

This imbalance highlights a striking truth: no other region combines vast renewable potential with rising demand, minimal legacy infrastructure, and urgent energy needs.

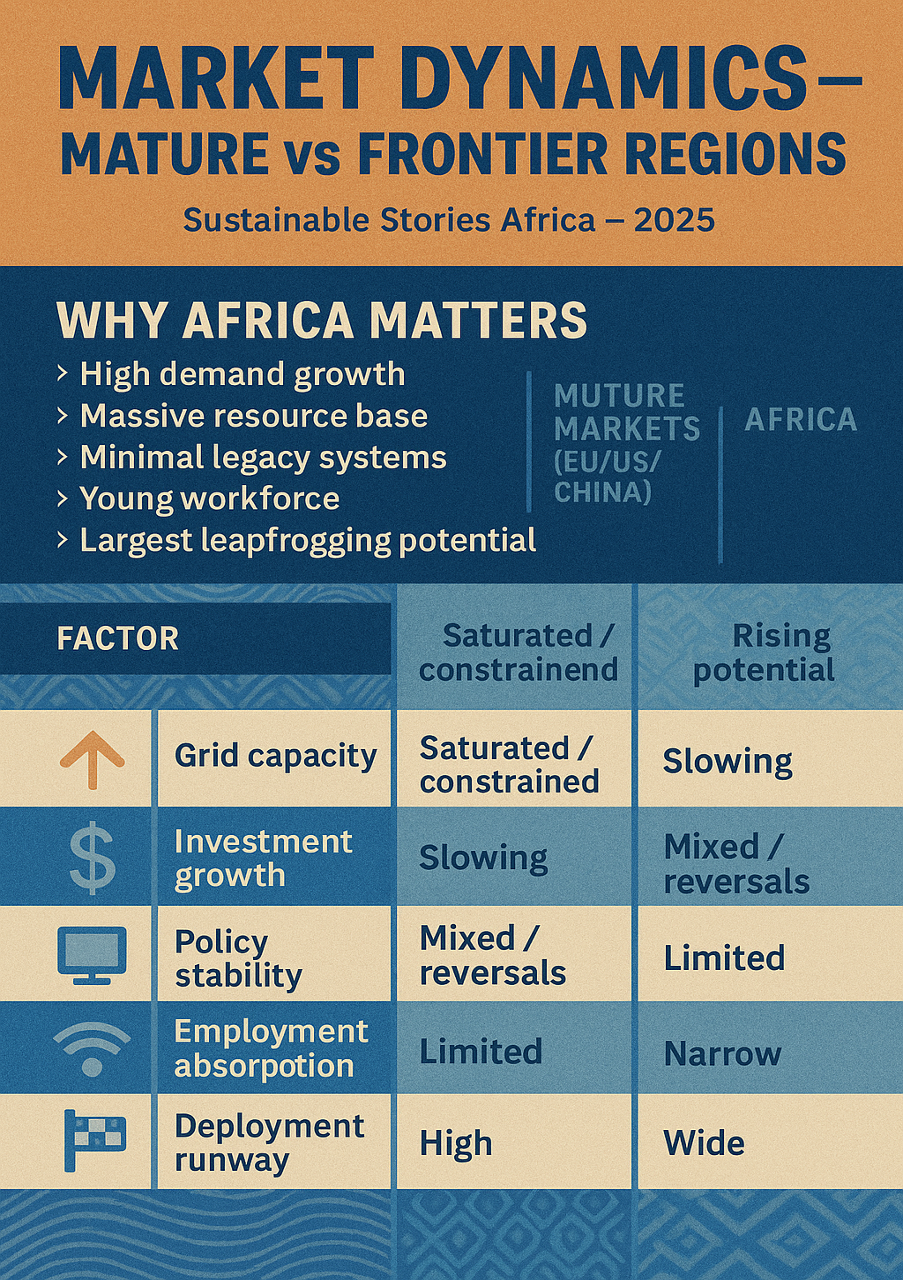

Unlike Europe and the United States, where grid constraints, political reversals, and financing fatigue are slowing deployment, Africa's fundamentals point toward exponential growth.

The report shows that China alone contributed 445GW, driven by mature industrial capacity and saturated demand, leaving limited room for continued expansion. Africa, by contrast, has the lowest deployment base and the highest marginal returns per dollar invested. This is where transformative growth can occur.

Investors, policymakers, and development actors are beginning to recognise this asymmetry: Africa is not behind, it is the last major frontier where renewable energy can scale rapidly and reshape entire economies.

2024 Renewable Capacity Additions – Opportunity Contrast

| Region / Country | New Capacity 2024 | Share of Global Total |

|---|---|---|

| China | 445 GW | 60% |

| Europe | 92 GW | 12% |

| India | 36 GW | 5% |

| North America | 56 GW | 8% |

| Africa & MENA | 13 GW | 1.7% |

GLOBAL RENEWABLE ADDITIONS 2024

Over 741GW worldwide

China: 445GW

Africa & MENA: 13GW

Opportunity Gap: Massive runway for growth

Why Africa Is the World's Renewable Investment Frontier

The GSR data reveal a compelling investment paradox: while global renewable finance reached $728 billion in 2024, growth slowed due to market saturation, rising costs, and policy reversals in mature economies.

Wind investment declined sharply, driven by permitting delays and supply chain pressures. These dynamics signal shrinking returns in traditional markets. Africa, however, sits on the opposite curve.

With rapidly rising energy demand, expanding urbanisation, and the world's youngest population, the continent offers a rare combination of scale and necessity.

Unlike Europe and the United States, where grid bottlenecks and policy rollbacks have begun to stall progress, African markets remain structurally open for deployment. The report highlights that renewables are increasingly recognised as essential infrastructure, supporting economic resilience, energy security, and public health.

The continent also benefits from having fewer legacy assets. Without entrenched fossil fuel infrastructure, Africa can leapfrog outdated energy systems, adopting decentralised solar, wind, and storage technologies that are cheaper and more flexible. This mirrors the pattern seen in mobile telecommunications, where Africa bypassed landline dependency to become a global leader in mobile adoption.

Beyond infrastructure, the employment potential is transformative. The report notes that renewable industries generated millions of jobs globally, with solar and wind leading employment growth. Africa's labour demographics position it to capture a significant share of future clean energy employment if investment flows align.

This convergence of demand, demographics, and deployment readiness is rare. For investors seeking long-term returns and impact, Africa offers what saturated markets cannot: scalable growth.

Market Dynamics – Mature vs Frontier Regions

| Factor | Mature Markets (EU/US/China) | Africa |

|---|---|---|

| Grid capacity | Saturated / constrained | Underdeveloped, scalable |

| Investment growth | Slowing | Rising potential |

| Policy stability | Mixed / reversals | Emerging frameworks |

| Employment absorption | Limited | High |

| Deployment runway | Narrow | Wide |

WHY AFRICA MATTERS

- High demand growth

- Massive resource base

- Minimal legacy systems

- Young workforce

- Largest leapfrogging potential

What Africa Gains by Leading the Transition

The strongest argument for Africa's renewable surge is not merely environmental; it is economic transformation. The GSR report demonstrates that countries achieving high renewable penetration experience lower energy costs, greater resilience, and employment expansion, as seen in Uruguay's transition to nearly 100% renewable electricity, which created 50,000 new jobs and protected the economy from price volatility. Africa stands to unlock even greater returns.

With 80% of those lacking electricity access residing in Sub-Saharan Africa, the deployment of decentralised renewable systems presents an unprecedented opportunity to electrify communities while stimulating local industries. Schools, health centres, agro-processing hubs, and digital services depend on reliable power. Renewable energy can enable this infrastructure without the burden of fuel imports or central grid dependence.

Economic sovereignty is another powerful incentive. Fossil fuel volatility has repeatedly destabilised African economies, driving inflation and fiscal strain. The report identifies renewables as a pathway to energy security and economic resilience, reducing exposure to global fuel shocks and trade disruptions.

By investing in solar, wind, and storage, African nations can retain capital, develop local value chains, and foster technology ecosystems. The potential extends beyond domestic benefits.

As global markets impose carbon border adjustments and green manufacturing standards, countries with renewable-powered industrial bases will be better positioned to compete. Africa's abundant critical minerals and growing manufacturing ambitions can leverage clean energy to build export-ready, low-carbon industries.

Economic Payoffs of Renewable Leadership

| Benefit Category | Impact Potential |

|---|---|

| Job creation | Millions of new roles |

| Energy security | Reduced import dependency |

| Industrial competitiveness | Green manufacturing edge |

| Fiscal resilience | Lower price volatility |

| Social development | Electrified services |

Mobilising Capital and Capacity Now

To unlock Africa's renewable opportunity, intention must become investment. The GSR report highlights a critical barrier: despite global ambition, current plans will deliver only half of the renewable expansion needed to meet international targets by 2030. This shortfall translates into a projected 3,800GW gap, reinforcing the need for accelerated deployment in emerging markets. Africa cannot afford to wait for global capital to adjust.

The continent requires deliberate financing structures that de-risk investment and support large-scale implementation. Blended finance models, combining concessional funding with private capital, are essential to bridge the financing gap.

The report shows that energy transition progress stalls where policy clarity and institutional capacity are weak, underscoring the need for robust governance frameworks.

Institutional strengthening is equally crucial. Clear regulatory pathways, transparent procurement, and streamlined permitting processes will determine whether projects move from planning to construction. Uruguay's experience illustrates how strong policy alignment can transform a national energy system within a decade, delivering resilience and economic benefits.

African governments, investors, and development agencies must therefore act decisively: scale proven solutions, invest in grids and storage, and prioritise distributed renewable systems that directly power industries, communities, and services. The window of opportunity is open, but for how long?

Key Actions to Unlock Africa's Renewable Growth

| Priority Area | Required Action |

|---|---|

| Financing | Blended investment mobilisation |

| Policy | Clear, stable frameworks |

| Infrastructure | Grid & storage deployment |

| Institutions | Procurement & permitting reform |

| Local value chains | Manufacturing & skills development |

WHAT MUST HAPPEN NOW:

- Mobilise finance

- Strengthen institutions

- Build grids and storage

- Deploy distributed systems

- Scale local industries

PATH FORWARD – Systems, Capital, Markets: Africa's Next Leap

Africa's renewable future depends on coordinated action: scaling blended finance, strengthening institutions, and accelerating grid and storage development. With clear policy frameworks and targeted investment, the continent can unlock industrial growth, electrify communities, and build resilient economies.

The opportunity is immediate. By mobilising capital and aligning governance, Africa can leapfrog legacy systems, drive job creation, and position itself as a global renewable manufacturing and energy hub.