Sustainable finance has never been more colossal and contested. Global sustainable bond issuance reached $1 trillion in 2024 (as we await the 2025 review year report), and the combined market for sustainable bonds and funds increased to $8.2 trillion.

However, green fund inflows stalled, and carbon markets struggled with integrity and pricing doubts.

Behind the headlines, a quieter battle is unfolding over who sets the rules, carries the disclosure burden, and when climate‑aligned capital will genuinely flow to developing economies or continue to circle endlessly in the Global North.

Capital Surges, Confidence Stumbles In Sustainable Finance

Sustainable finance is entering a paradoxical phase: markets are expanding quickly; however, trust is lagging.

The World Investment Report shows sustainable bond issuance reached a record $1.052 trillion in 2024, while sustainable assets in public funds climbed to $3.2 trillion, despite a reduction in the launch of new funds. In 2024, fund inflows fell to their lowest level since 2015, and ESG backlash and resistance increased in key markets, as we await details for 2025.

Taken together, sustainable bonds, funds and carbon markets now represent over $8.2 trillion in value, a 17% increase from 2023 figures.

However, concerns over greenwashing, fragmented standards, weak carbon prices and the marginal role of developing economies in sustainable funds are forcing a rethink of what "sustainable finance" really delivers for the climate and for equity.

Record Issuance, Rising Scepticism – When More Green Labels Mean More Questions

The numbers are impressive. Sustainable bond issuance has expanded by 19% annually since 2019, surpassing $5 trillion and contributing 11% of the global bond market in 2024.

Green bond issuance led with 64% of issuance, targeted at projects in energy, transport, and buildings, while sustainability bonds surged 89%, driven largely by development banks and supranationals.

However, credibility concerns are mounting. There was an over 40% reduction of net inflows to sustainable funds to $37 billion, returns fell behind traditional funds, and anti-ESG sentiment in the United States triggered fund closures, rebranding, and $20 billion in outflows.

Inside The New Green Capital Architecture – Who Issues, Who Invests, Who Gets Left Out

Beneath the headline growth sits a sharp imbalance in power and participation. Europe remains the centre of sustainable finance, with €2.7 trillion, roughly 84% of global sustainable fund assets, and is responsible for the majority of 2024's modest inflows.

Developing economies together host just 3% of funds by value, despite accounting for nearly a third of the broader market.

On the bond side, public issuers gained ground: government-linked entities raised $250 billion (up 43%), development banks more than doubled their issuance, and sovereigns expanded green and sustainability bonds.

However, corporates still drove market depth with $444 billion. Carbon markets lagged, with only $1.4 billion in value, and 40% of all credits advanced remain outstanding since 2002, and questions surrounding integrity remain alive.

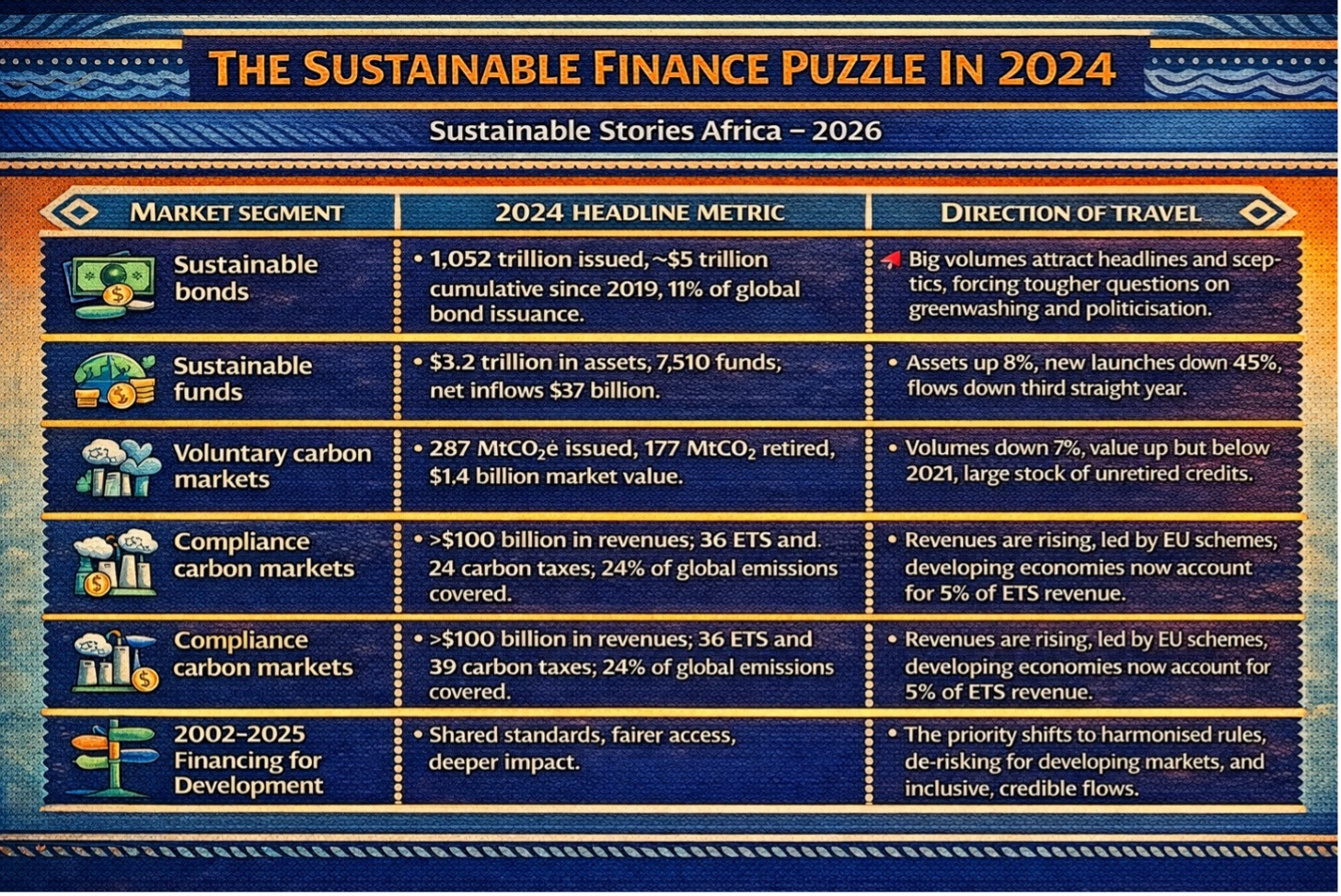

The Sustainable Finance Puzzle In 2024

| Market segment | 2024 headline metric | Direction of travel | Equity and credibility signal |

|---|---|---|---|

| Sustainable bonds | 1.052 trillion issued; >$5 trillion cumulative since 2019; 11% of global bond issuance. | Up 11% year‑on‑year; strong growth in green and sustainability bonds. | Clear demand, but standards and "greenium" fading, raising questions about differentiation. |

| Sustainable funds | $3.2 trillion in assets; 7,510 funds; net inflows $37 billion. | Assets up 8%; new launches down 45%; flows down third straight year. | ESG fatigue, performance doubts, and regulatory uncertainty are eroding momentum. |

| Voluntary carbon markets | 287 MtCO₂e issued; 177 MtCO₂e retired; $1.4 billion market value. | Volumes down 7%; value up but below 2021; large stock of unretired credits. | Integrity questions and low prices limit mitigation impact and corporate confidence. |

| Compliance carbon markets | >$100 billion in revenues; 36 ETS and 39 carbon taxes; 24% of global emissions covered. | Revenues are rising, led by EU schemes; developing economies now account for 5% of ETS revenue. | Potentially powerful fiscal tool, but prices are mostly below levels needed for 2°C alignment. |

Desire From Label Games To Real‑Economy Impact

For developing regions, progress is uneven. In 2024, Africa doubled its sustainable bond issuance, driven by the AfDB's $6 billion issuance. However, markets still rely on multilateral organisations. Meanwhile, developing Asia, led by China and Singapore, is gaining ground in global ESG investing.

From Label Games To Real‑Economy Impact – Rewiring Incentives, Not Just Renaming Funds

The report signals a shift in sustainable finance from multiplying products to proving real outcomes. In Europe, the once distinct "greenium" on sustainable bonds has narrowed to just 1 basis point, suggesting investors are no longer paying extra for a label as supply grows.

Among leading global asset owners, momentum is steady but uneven. Over 90% now target renewable and green investments, and 75% aim for net-zero portfolios by 2050.

However, only about 1 ha ve explicit fossil fuel divestment goals, and 43 of the top 100 funds still withhold sustainability reports, largely in regions facing weaker regulation and political resistance.

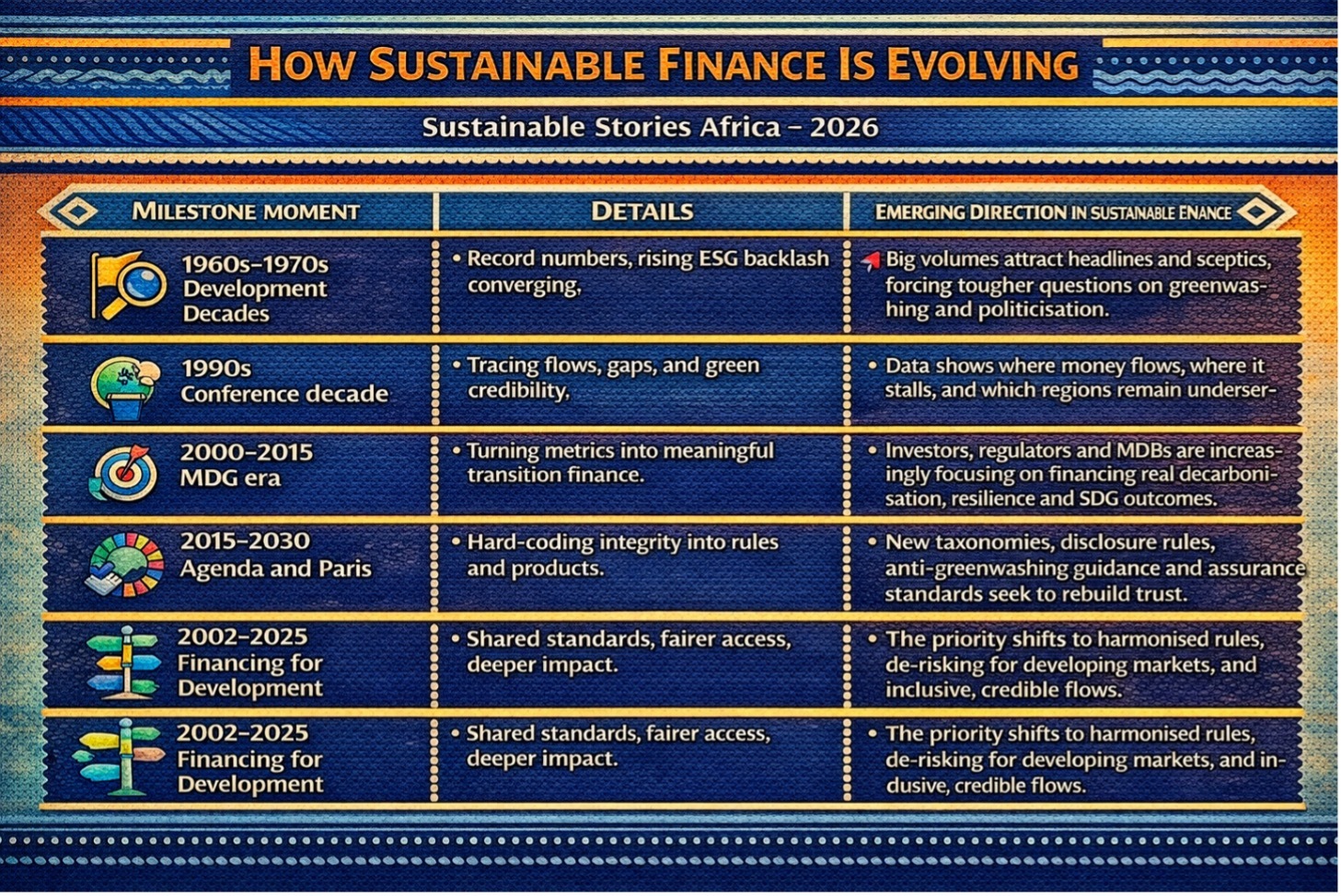

How Sustainable Finance Is Evolving

Global rules for sustainable finance are taking shape. Over 30 jurisdictions are adopting new IFRS standards, the EU is tightening ESG oversight, and emerging taxonomies across ASEAN signal a move from voluntary disclosure to credible, investable policy frameworks.

What Needs To Happen Next – From Fragmented Markets To Coherent Transition Pathways

Three fault lines now shape the global sustainable finance debate.

- The first is credibility: carbon prices remain far below the $62 – $127 per tonne range consistent with a 2°C pathway, while many sustainability-linked bonds and offsets still fail basic additionality tests.

- The second is fragmentation, as competing standards, taxonomies, and political pushback fracture markets and complicate cross-border investment.

- The third is inclusion: developing economies host most voluntary carbon credits and new policy measures but attract little sustainable capital and face rising disclosure burdens for SMEs.

Closing these gaps will require coordinated reforms, which include aligning carbon prices and scaling blended finance to embed credible transition plans in future climate commitments.

Regulators must also strike a delicate balance: tough enough on greenwashing to build trust, yet flexible enough so that emerging market issuers are not priced out of sustainable finance by compliance costs.

Path Forward – Sharing Risks, Standards and Opportunities

The report concludes that sustainable finance stands at an inflexion point. Progress is visible, but trust remains uneven between the Global North and South.

Its future hinges on aligning standards, directing concessional capital to developing markets, and matching disclosure with real support.

With the conclusion of the Fourth Financing for Development Conference and COP30, the task remains to create a system that prices carbon fairly, rewards real impact and gives developing economies a genuine voice in shaping a more resilient global finance architecture.