Emerging markets stand at a decisive moment as global sustainability reporting converges toward unified disclosure rules. A new IFC benchmarking analysis reveals that the International Finance Corporation's Disclosure & Transparency (D&T) Framework aligns strongly with ISSB, ESRS, and GRI, positioning emerging-market companies to integrate seamlessly into global capital markets. Yet capacity gaps, data scarcity, and fragmented regulations persist, raising pressing questions about readiness, equity, and the future of ESG integrity across the Global South.

Global Standards, Local Realities, Emerging Tensions

The global sustainability landscape is undergoing its most consequential transformation in decades. New mandatory rules, such as ISSB's IFRS S1 and S2, the EU's ESRS, and strengthened GRI standards, are reshaping how companies disclose climate, governance, and social performance. But in emerging markets, where regulatory pathways and institutional capacity vary widely, the shift carries more complex implications.

A landmark benchmarking report by the International Finance Corporation (IFC) finds that its D&T Framework already exhibits strong alignment with ISSB, ESRS, and GRI across governance, risk management, and strategic disclosure pillars. This alignment gives emerging-market entities, from banks to manufacturers to stock exchanges, a credible foundation for global compliance.

However, the study's stakeholder interviews paint a nuanced picture: harmonisation challenges, data shortages, and materiality conflicts remain significant barriers. 81% of interviewees cite "multiple and varying reporting requirements" as a top challenge; 75% call for better interoperability across standards; 63% struggle with data availability; and a majority emphasise governance as the top priority for reporting maturity.

This article interprets these findings through Sustainable Stories Africa's lens, showing not only where alignment exists, but what it means for Africa and the wider emerging-market community navigating the new ESG order.

A New Reporting Race Emerges for Global South Corporations

A global sustainability baseline is forming fast. More than 20 jurisdictions have already committed to adopting ISSB standards in law or regulation, creating a disclosure regime that will define capital flows, corporate credibility, and market access over the next decade.

For emerging markets, the speed of this transition introduces both opportunity and pressure. The IFC's benchmarking report reveals a rare affirmative finding: entities using the D&T Framework are already well positioned to comply with this new architecture, as its components – Performance Standards, Corporate Governance Methodology, and the D&T Toolkit – map closely to ISSB requirements and intersect significantly with ESRS and GRI criteria.

But alignment does not equal readiness. The expanded scope of double materiality, prescriptive disclosures, climate-risk quantification, and governance transparency could widen gaps between markets that have strong institutional scaffolding and those that do not.

Inside the Benchmark: Where Standards Converge and Where They Don't

The report outlines three layers of comparison: strategic purpose, general requirements, and detailed content mapping. The results present a textured, data-rich view of global convergence.

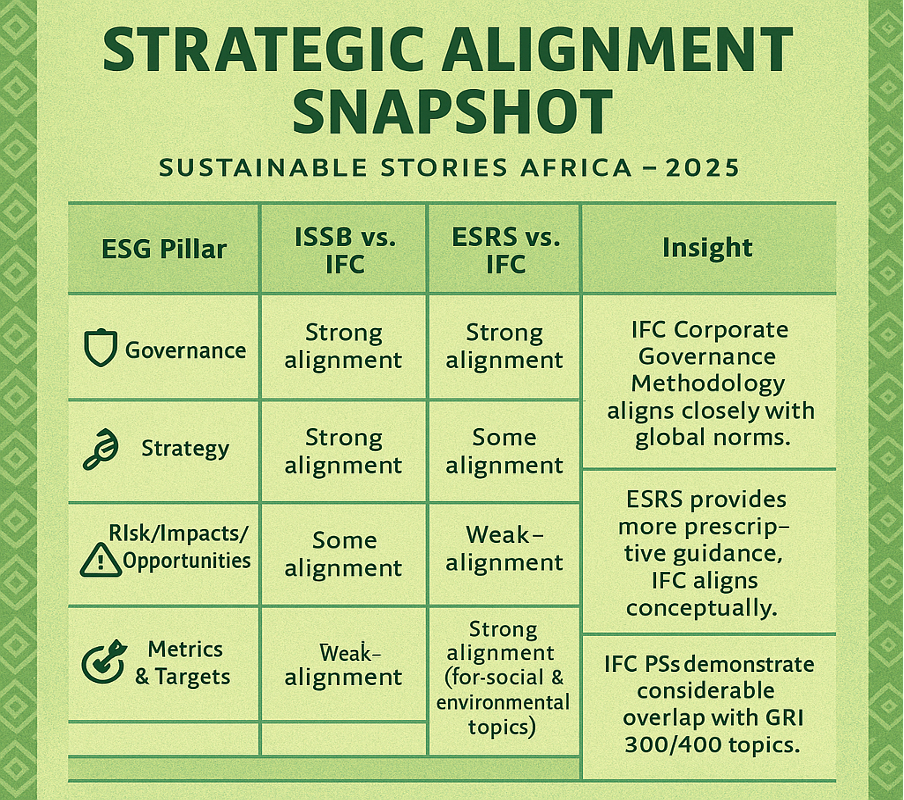

Strategic Alignment Snapshot

| ESG Pillar | ISSB vs. IFC | ESRS vs. IFC | GRI vs. IFC | Insight |

|---|---|---|---|---|

| Governance | Strong alignment | Strong alignment | Strong alignment | IFC Corporate Governance Methodology aligns closely with global norms. |

| Strategy | Strong alignment | Some alignment | Some alignment | ESRS provides more prescriptive guidance; IFC aligns conceptually. |

| Risk / Impacts / Opportunities | Some alignment | Some alignment | Strong alignment (for social & environmental topics) | IFC PSs demonstrate considerable overlap with GRI 300/400 topics. |

| Metrics & Targets | Some alignment | Weak–Some alignment | Weak alignment | Emerging markets require the capacity to quantify climate and impact metrics. |

High-Level Observations

The IFC D&T Framework aligns strongly with:

- ISSB's four-pillar system – Governance, Strategy, Risks & Opportunities, Metrics & Targets—building confidence that IFC users can adapt to IFRS S1/S2 with minimal restructuring.

- ESRS General Requirements, though ESRS demands more explicit detail on lobbying, payment practices, and corruption, areas where IFC provides less prescriptive guidance.

- GRI Environmental & Social Standards, with gaps mainly in economic performance topics (GRI 200 series) that emerging markets will need to strengthen.

Stakeholder Perspectives: What Users Actually Need

The qualitative insights deepen the narrative.

Interviews revealed:

- A strong preference for harmonised templates

- Concern over double vs. single materiality conflicts

- A call for collaboration between standard setters

- A recognition that data systems, not intent, are the primary bottleneck

These insights connect the technical to the human, showing reporting teams overwhelmed by the volume, pace, and complexity of new expectations.

The capacity gaps identified, data, materiality assessment, and risk quantification are not isolated challenges. They represent systemic hurdles that could:

- Restrict access to sustainable finance

- Increase compliance costs for SMEs

- Deter foreign investors seeking "assurance-ready" disclosures

- Expose markets to greenwashing risks due to poor data integrity

However, IFC users gain a competitive advantage by leveraging tools already aligned with global norms, which becomes more valuable as regulatory expectations accelerate.

Seizing the Moment: Turning Alignment into Advantage

The report presents a constructive, forward-looking vision. If emerging markets act now, they can convert today's alignment into tomorrow's competitive edge.

Strong Alignment = Lower Transition Costs

Because IFC frameworks map closely to ISSB and ESRS structures, companies in Africa, Latin America, South Asia, and Southeast Asia can:

- Transition with fewer governance disruptions

- Build climate-risk systems without starting from zero

- Embed social safeguards aligned with IFC Performance Standards

- Reduce investor scepticism through globally recognisable disclosures

Better Reporting = Stronger Capital Flows

Global investors increasingly demand standardised, comparable data. As emerging-market firms adopt globally aligned ESG systems, they can:

- Access green and sustainability-linked finance

- Strengthen valuations

- Improve supply-chain attractiveness

- Demonstrate resilience

Collaboration = Reduced Complexity

Since 81% of stakeholders want harmonisation, this is an opportunity for:

- Stock exchanges to co-develop templates

- Regulators to issue interoperable guidelines

- Companies to join capacity-building platforms

- Investors to support scalable disclosure frameworks

Emerging markets have long been consumers, not designers, of global standards. This moment offers a shift toward co-creation and representation.

Closing the Gaps: A Blueprint for Emerging-Market Readiness

Based on the report findings, four priority actions emerge:

- Build Data Systems That Match Global Expectations – Data shortages are the Achilles' heel of ESG reporting. Governments, exchanges, and companies must invest in:

- Digital data-capture systems

- Climate-risk modelling tools

- Social safeguards monitoring

- Governance transparency dashboards

Without this, alignment remains theoretical.

- Strengthen Double-Materiality Understanding – ISSB focuses on financial materiality; ESRS integrates impact materiality. Emerging markets must:

- Train boards and audit committees

- Integrate stakeholder impact mapping

- Update risk registers to include climate and social impacts

Materiality maturity is critical for credibility.

- Simplify Reporting Through Templates and Shared Infrastructure – Stakeholders explicitly call for reporting templates. IFC, regulators, and exchanges can jointly design sector-specific materiality templates, climate transition-planning primers, and governance disclosure checklists.

This lowers compliance barriers.

- Expand Collaboration Between Standard Setters – With 75% of interviewees citing harmonisation needs, emerging markets benefit from:

- Joint ISSB–ESRS–GRI guidance notes

- Regional capacity-building ecosystems

- Public-private ESG knowledge hubs

The objective is not just compliance, but capability.

PATH FORWARD – Aligned Foundations, Empowered Markets, Shared Future

Emerging markets now possess a rare head start: IFC's frameworks already align with major global standards. But alignment alone is insufficient. To fully participate in the evolving ESG landscape, companies must strengthen data infrastructures, deepen materiality assessments, and build governance capacities that match global expectations.

The momentum for harmonisation, collaboration, and market-level support is clear. With deliberate action, emerging markets can transform compliance pressure into a sustainable competitive advantage, anchoring integrity, resilience, and inclusive growth in a new global reporting era.