Africa's sustainable finance journey is accelerating, but global standards are tightening faster. The latest International Platform on Sustainable Finance (IPSF) Annual Report reveals emerging trends, such as taxonomy interoperability, transition finance, biodiversity integration, and strict disclosure regimes, that directly influence African markets.

This exclusive analysis examines how Nigeria and Africa must align with these global shifts to mobilise climate finance, upgrade regulation, and strengthen competitiveness by 2030.

Global Standards, African Finance at Crossroads

Across global climate negotiations, finance ministries and regulators now agree on one thing: the transition to a sustainable, low-carbon global economy is fundamentally a financial transformation.

The International Platform on Sustainable Finance (IPSF) Annual Report 2025 underscores this reality, setting out how jurisdictions from China to the EU, India, Singapore, and Morocco are redefining sustainable finance frameworks at unprecedented speed.

For Africa, these developments hit at a time of rising debt pressure, climate vulnerability, growing investor scrutiny, and the acceleration of green capital flows elsewhere.

Nigeria, Kenya, Morocco, Senegal, South Africa, and Ghana must now navigate a world where sustainability taxonomies, disclosure rules, and transition finance structures are no longer optional, but are the basis for market access, investment attraction, and financial stability.

This SSA exclusive piece breaks down the IPSF's most important updates, translates them for African realities, and analyses how the continent can leverage global momentum to drive its own sustainable finance leadership. For policymakers, regulators, banks, and corporates, the stakes have never been higher: adapt to global rules or be left behind.

Africa Confronts Global Sustainable Finance Shifts Redefining Markets

The IPSF 2025 report signals the arrival of a new global financial order. One anchored in climate objectives, biodiversity integrity, transition finance, and interoperable taxonomies.

It highlights the growing need for countries to standardise sustainable investment definitions, strengthen disclosure systems, and embed Do No Significant Harm (DNSH) safeguards across finance flows.

This global shift directly affects Africa's regulatory trajectory. Fossil-fuel-dependent economies like Nigeria, Angola, and Algeria, along with emerging green-transition leaders like Morocco, Kenya, and South Africa, must now align with global expectations or risk reduced capital access.

The IPSF frames sustainable finance as a geopolitical and macroeconomic priority, no longer just an environmental one.

The IPSF's Core Pillars and What They Mean for Africa

The IPSF Annual Report outlines major developments in taxonomy interoperability, transition finance, biodiversity integration, and international disclosure alignment.

These are reshaping global capital flows, and Africa must understand how they influence investment in energy, agriculture, mining, transport, and industry.

Taxonomy Interoperability: A New Investment Language

Taxonomy alignment is at the heart of global sustainable finance reform. The IPSF Multi-Jurisdiction Common Ground Taxonomy (M-CGT), linking the EU, China, and Singapore, is becoming a reference point for cross-border green capital allocation.

SSA Infographic — Why Taxonomies Matter for Africa

African nations developing taxonomies, such as Nigeria, Kenya, Morocco, and South Africa, must align with the M-CGT trend to remain globally competitive.

Transition Finance: Supporting Hard-to-Abate Sectors

The IPSF launched a dedicated workstream on strategic sectors and critical raw materials essential for the green transition—metals, manufacturing, energy, mining, and transport.

This is particularly relevant for Africa, whose economies rely heavily on:

- oil & gas (Nigeria, Angola)

- critical minerals (DRC cobalt, Zimbabwe lithium, South African PGMs)

- transport & logistics (East African ports, West African corridors)

A credible African transition finance framework can unlock large-scale blended finance for these sectors.

Biodiversity Integration Becomes Non-Negotiable

The IPSF's new Transition Finance Plus principles integrate nature and biodiversity into sustainable finance. This is vital for Africa, where 25% of the world's biodiversity underpins agriculture, tourism, forestry, and coastal economies.

The Working Group's focus on target-setting, supply chain proportionality, and alignment with TNFD and GBF targets is highly relevant for:

- Nigeria's mangroves and coastal fisheries

- Kenya's conservation landscapes

- Congo Basin forests

- West Africa's agro-ecosystems

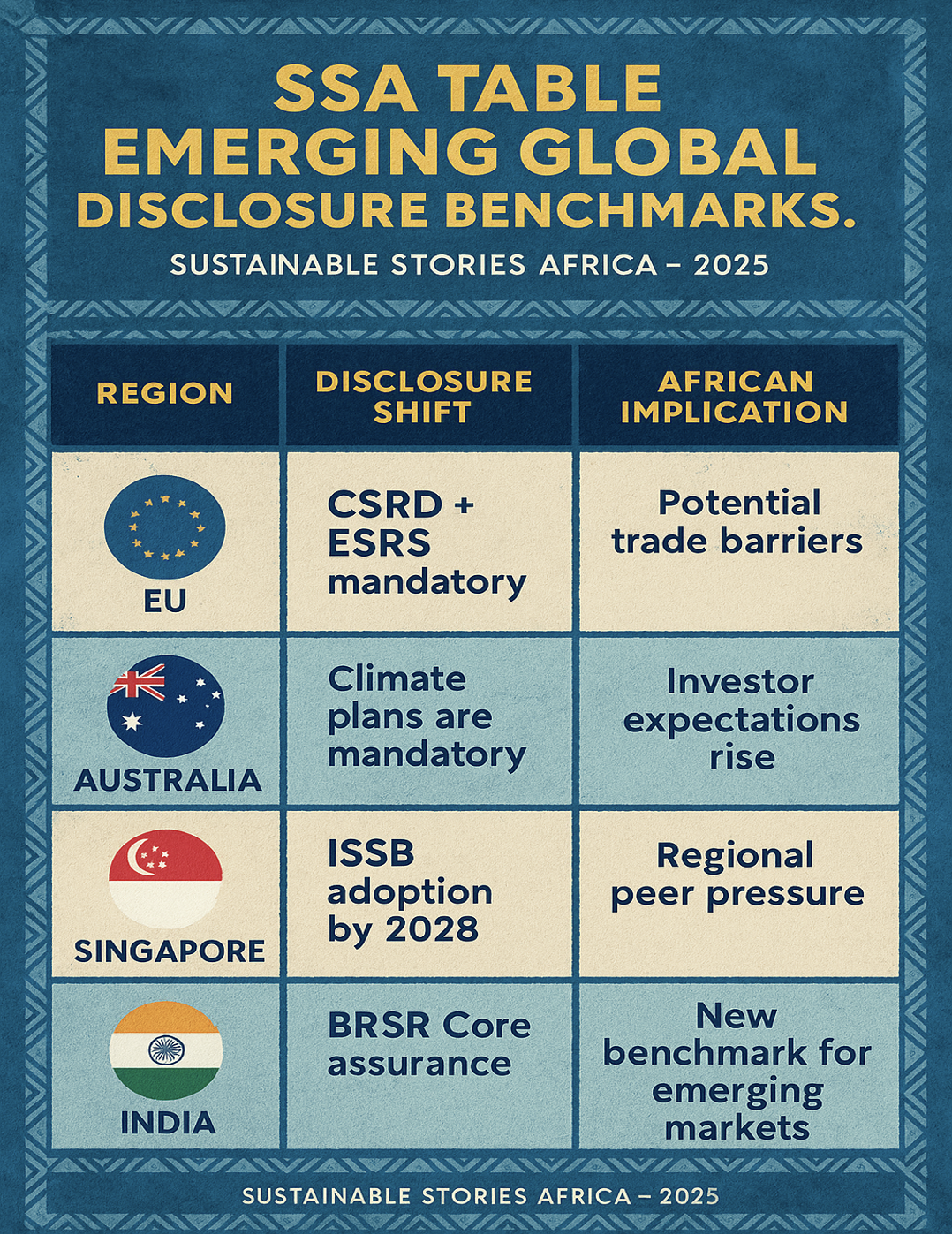

Disclosure Alignment & Global Reporting Rules

Countries across the IPSF, Australia, EU, Hong Kong, Japan, India, Singapore, are adopting ISSB-aligned sustainability disclosure systems, some mandatory by 2025–2028.

African regulators must accelerate adoption of ISSB-aligned standards to maintain financial system credibility.

Country Updates Showcase Global Momentum

The IPSF report contains detailed updates across over 25 jurisdictions. For African readers, the most relevant lessons include:

Benin

- VCMI partnership for carbon markets

- €200m guarantee unlocking €500m private finance

- National climate finance platform

Morocco

- National Climate Finance Strategy

- Green taxonomy development

- Sovereign Green Bond Framework

Senegal

- Green taxonomy (six sectors)

- DNSH and social safeguards

- Public consultations + implementation roadmap

Kenya

- No specific update submitted

- But strong alignment potential given existing green bonds, climate acts, and disclosure work

These cases reveal strong momentum across West and North Africa, leading indicators for Nigeria and other emerging green finance hubs.

Why African Policymakers Must Act on These Insights Now

The IPSF's key takeaway is clear: global sustainable finance is converging toward shared norms, and markets that fail to align will face capital exclusion, higher borrowing costs, and reduced investor confidence.

Three critical decisions for Africa

- Align national taxonomies with international norms – Nigeria's ongoing taxonomy development must align with M-CGT, ASEAN, and EU criteria to ensure interoperability.

- Develop credible transition finance frameworks – Africa must define clear transition pathways for:

- fossil-fuel dependent sectors

- mining value chains

- heavy industries

- transport corridors

- Strengthen disclosure and anti-greenwashing supervision – Without strong disclosure systems, greenwashing risk rises, and investors retreat.

How Africa Can Leverage IPSF Momentum for Sustainable Capital Growth

- Build African Interoperability Through Regional Blocks – ECOWAS, SADC, and EAC can align taxonomies and disclosure rules to attract large cross-border investment.

- Mobilise Transition Finance for Hard-to-Abate Sectors – Africa must tap blended finance, guarantees, and sustainability-linked instruments for gas-to-power, steel, cement, mining, and transport transitions.

- Localise Biodiversity Finance Tools – Adopt TNFD frameworks; develop biodiversity credits; integrate nature-positive financing across agriculture and forestry.

- Strengthen Supervisory Regimes – Regulators must supervise climate risks, enforce DNSH, and monitor greenwashing, just as ASIC, MAS, ESMA, and OSFI are doing globally.

- Position Africa as a hub for sustainable commodities finance – Critical minerals, regenerative agriculture, and renewable energy supply chains can position Africa as a competitive sustainability engine globally.

PATH FORWARD – Africa Aligns Finance With Global Momentum

Africa must accelerate its taxonomy development, climate disclosure adoption, blended finance structures, and transition pathways to remain competitive in global markets.

These reforms will enable more credible green bonds, sustainable loans, and climate investment inflows.

Driving Integrity, Innovation, and Interoperability for Growth

With strong regulatory coordination, nature-positive financing, regional harmonisation, and investor-focused governance, Africa can shape a sustainable finance architecture that strengthens resilience, attracts capital, and advances long-term economic transformation.