Nigeria's oil and gas sector is undergoing a quiet but consequential shift: sustainability reporting is no longer a branding exercise; it is shaping investor confidence, governance expectations, and community legitimacy. Evidence now links improved transparency to stronger institutional trust and long-term financial resilience.

However, disclosures remain uneven, environmentally shallow, and largely reactive, leaving firms vulnerable to regulatory pressure and market scepticism despite their economic weight.

Sustainability Reporting: Nigeria's Shifting Power Balance

Nigeria's oil and gas industry stands at a critical inflexion point. Investors, regulators, and host communities are demanding clearer accountability from companies whose operations have historically imposed environmental and social burdens while generating national revenue. Sustainability reporting, once a voluntary communication tool, is emerging as a defining marker of corporate integrity and competitiveness.

Recent research demonstrates that corporate governance disclosures significantly enhance financial performance, while poorly aligned social spending can negatively affect return on equity (ROE). Environmental reporting remains limited in both scope and financial influence, revealing underinvestment in meaningful environmental action despite increasing public pressure.

This evolving landscape presents both risk and opportunity. For Nigeria's leading oil and gas firms, sustainability reporting is no longer just about compliance; it has become central to reputation, investment, and the social licence to operate.

Why Sustainability Reporting Matters

Nigeria's petroleum sector continues to wrestle with a credibility deficit. Decades of pollution, displacement, and unfulfilled community development promises have eroded trust and intensified activism.

Simultaneously, global investors are prioritising companies with transparent ESG practices, reshaping access to capital and international partnerships.

Sustainability reporting provides a structured mechanism for companies to disclose environmental, social, and governance performance, enhancing accountability and stakeholder engagement.

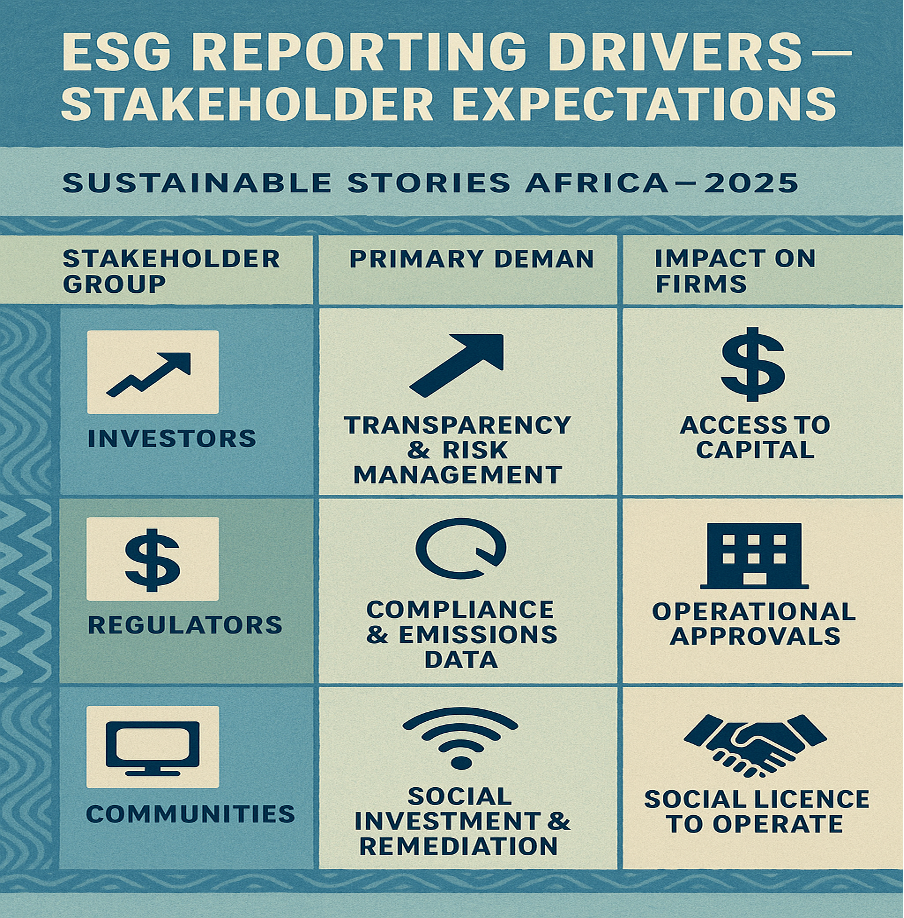

ESG Reporting Drivers – Stakeholder Expectations

| Stakeholder Group | Primary Demand | Impact on Firms |

|---|---|---|

| Investors | Transparency & risk management | Access to capital |

| Regulators | Compliance & emissions data | Operational approvals |

| Communities | Social investment & remediation | Social licence to operate |

The Financial Reality Behind ESG Claims

Contrary to perceptions that sustainability is merely philanthropy, data show a strong link between governance disclosures and financial performance. Larger and more diverse boards tend to make better strategic decisions, improving investor confidence and ROE.

However, fragmented CSR spending, especially when driven by crisis response or political pressure, erodes profitability.

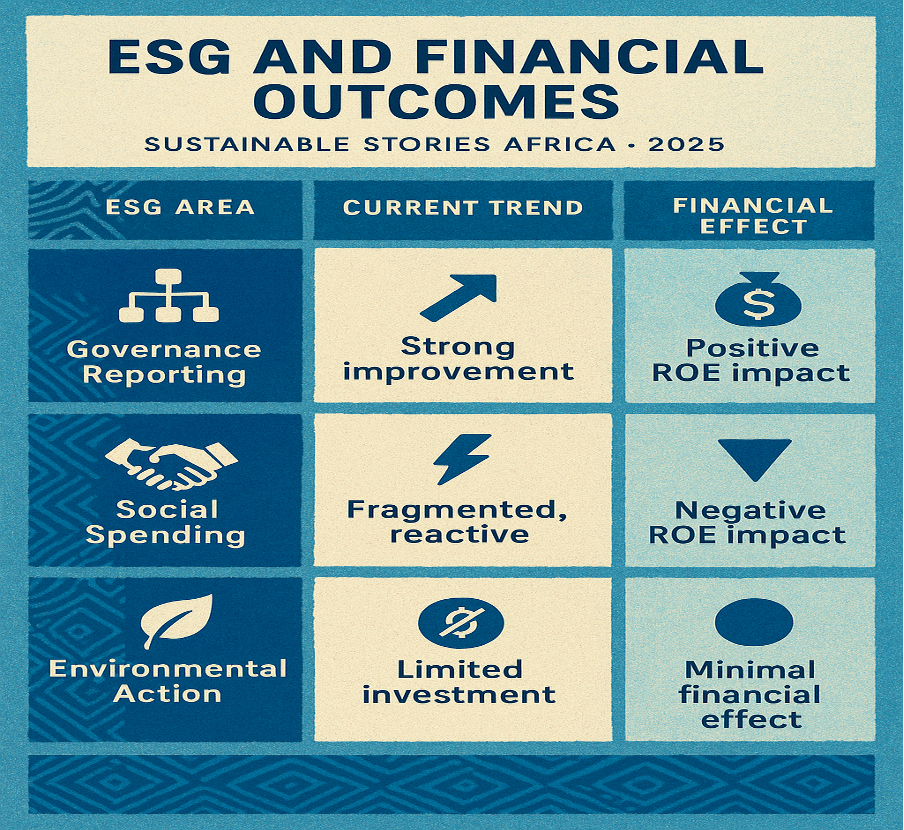

ESG and Financial Outcomes

| ESG Area | Current Trend | Financial Effect |

|---|---|---|

| Governance Reporting | Strong improvement | Positive ROE impact |

| Social Spending | Fragmented, reactive | Negative ROE impact |

| Environmental Action | Limited investment | Minimal financial effect |

The Opportunity for Transformation

Sustainability reporting offers strategic benefits beyond compliance:

- stronger stakeholder trust

- improved corporate reputation

- access to sustainability-linked financing

- competitive positioning in global energy markets

International evidence underscores that firms with strong ESG performance attract diversified capital and maintain long-term profitability.

Nigeria's energy transition goals further elevate the need for credible environmental stewardship and community investment.

What Oil Firms Must Do Now

To realise ESG's full value, companies must:

- align social investments with measurable outcomes

- expand environmental reporting to include emissions, waste, and remediation spending

- improve governance transparency

- adopt internationally recognised reporting standards

Failure to act risks exclusion from emerging capital flows as global ESG standards tighten.

Path Forward – Credible ESG Action Secures Competitiveness

Nigeria's oil and gas firms must prioritise credible environmental investment, strategic social programmes, and stronger governance disclosures to align with global expectations and rebuild stakeholder confidence. Integrating international reporting frameworks will strengthen transparency and financial resilience.

The sector's competitiveness depends on shifting from reactive CSR spending to measurable ESG impact. Firms committing to structured reporting and long-term environmental action will attract diversified capital and secure their social licence to operate, positioning themselves for a just and profitable energy transition.

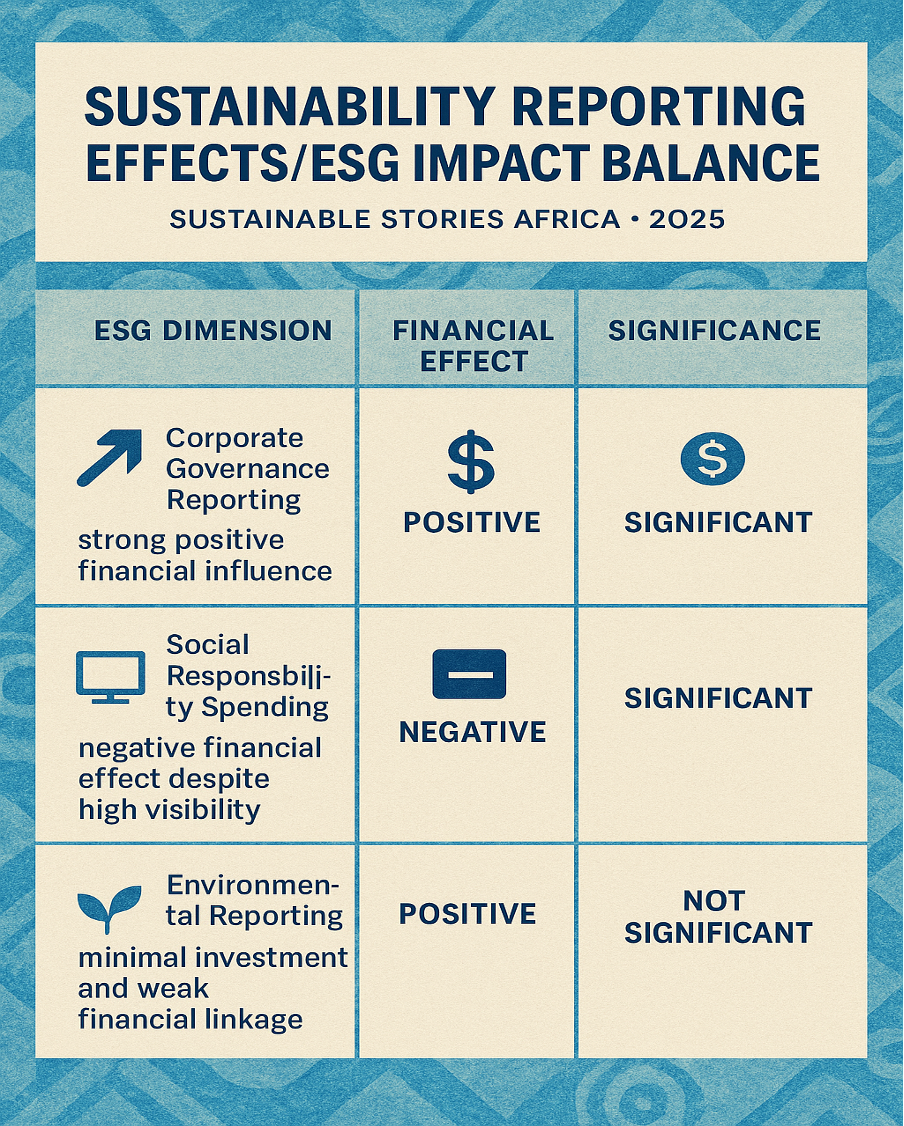

Sustainability Reporting Effects

| ESG Dimension | Financial Effect | Significance |

|---|---|---|

| Corporate Governance Reporting | Positive | Significant |

| Social Responsibility Spending | Negative | Significant |

| Environmental Reporting | Positive | Not Significant |

ESG Impact Balance

- Governance – strong positive financial influence

- Social – negative financial effect despite high visibility

- Environmental – minimal investment and weak financial linkage