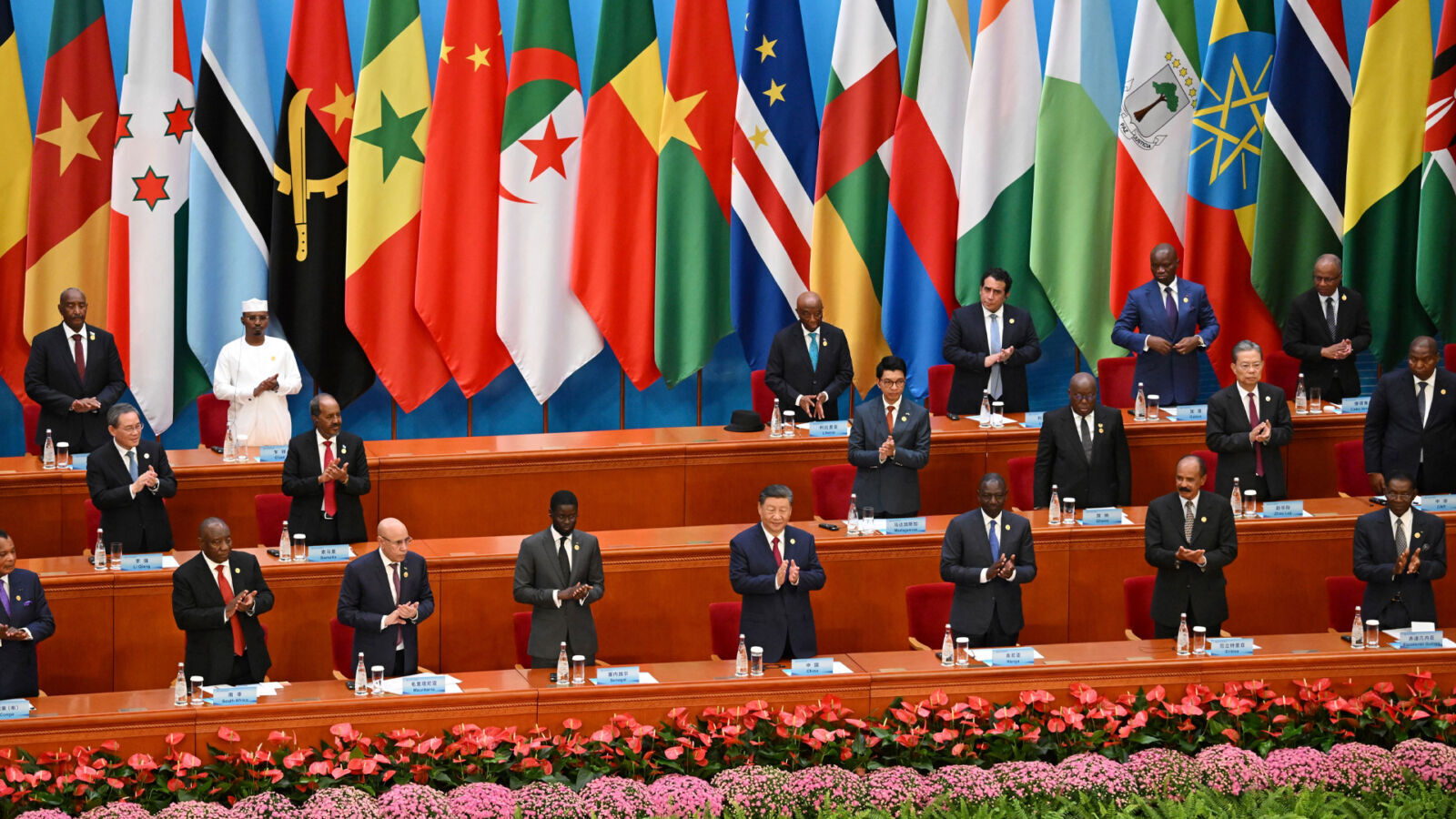

Africa’s policy voice is gaining institutional weight through new trilateral cooperation frameworks.

A strategic agreement linking African, Chinese and Canadian policy institutions reflects growing demand for coordinated ESG governance.

The move signals a shift from fragmented engagement toward structured policy alignment, which shapes investment, sustainability and economic credibility.

Trilateral Agreement Reshapes Africa’s Policy Position

A new strategic memorandum of understanding between the Africa-China Centre for Policy and Advisory (ACCPA) and the China–Canada Association for Policy Advancement and Research (CCAAPR) marks a decisive step toward strengthening Africa’s institutional voice in global governance.

The agreement establishes a trilateral cooperation platform linking Africa, China and Canada across policy research, ESG governance and economic strategy.

The partnership reflects a broader shift in global economic diplomacy, where ESG compliance, regulatory integrity and policy credibility increasingly determine access to capital, trade partnerships and sustainable investment flows.

A structured policy alignment and institutional coordination are essential to strengthening market confidence and the resilience of governance.

Strategic Cooperation Aligns Policy Research Priorities Globally

The MoU formalises cooperation across policy research, institutional exchange, governance frameworks and advisory collaboration.

The objective is to bridge policy asymmetries between emerging and developed markets, ensuring that Africa’s regulatory priorities are reflected in evolving global ESG standards.

The agreement represents a structural gap: while Africa represents one of the fastest-growing regions for climate investment, infrastructure development and energy transition, its participation in shaping global regulatory frameworks has often lagged capital flows.

Strategic Cooperation Pillar | Policy Objective | Expected Impact |

|---|---|---|

Joint Policy Research | Develop shared ESG and governance frameworks | Improved regulatory coherence and investor confidence |

Institutional Exchange | Facilitate academic and advisory collaboration | Stronger policy capacity and technical expertise |

ESG Governance Alignment | Harmonise sustainability and integrity standards | Increased access to global capital markets |

Strategic Advisory Cooperation | Support investment and regulatory policy dialogue | Enhanced economic competitiveness and credibility |

This structured collaboration establishes an institutional bridge connecting Africa’s policy ecosystem to two major global economic actors, strengthening its influence in shaping governance and sustainability agendas.

ESG Alignment Unlocks Investment And Credibility Gains

For African economies, ESG governance is no longer a compliance exercise; it is an economic competitiveness strategy. Investors increasingly assess regulatory stability, transparency and institutional credibility before allocating capital, particularly in sectors such as energy transition, infrastructure and climate finance.

By participating directly in policy development networks, African institutions can help shape governance standards rather than react to externally imposed frameworks. This shift improves investment predictability and reduces perceived regulatory risk.

The MoU also positions Africa within a broader geopolitical transition, where economic alliances are increasingly defined by sustainability governance, technological collaboration and policy interoperability rather than traditional aid-based relationships.

The implications extend beyond regulatory alignment. Enhanced policy credibility strengthens Africa’s negotiating leverage, accelerates climate finance access and supports long-term industrial transformation.

Institutional Partnerships Strengthen Africa’s Policy Sovereignty

The agreement underscores a fundamental strategic objective: moving Africa from policy recipient to policy architect.

Through joint research initiatives, governance dialogue and institutional exchange, the partnership will help develop frameworks aligned with African economic realities while maintaining compatibility with global standards.

Policy institutions, regulators and investment stakeholders are expected to benefit from enhanced analytical capacity, technical expertise and coordinated governance approaches.

As ESG compliance becomes central to economic competitiveness, Africa’s ability to influence policy architecture will directly shape its investment trajectory, climate resilience and industrial development prospects.

This institutional cooperation model presents a scalable blueprint for strengthening Africa’s governance infrastructure while reinforcing its role within the global sustainability economy.

Path Forward – Strengthening Africa’s Institutional Policy Leadership

The partnership prioritises joint ESG research, governance alignment and institutional collaboration to strengthen Africa’s global policy influence.

These efforts aim to enhance regulatory credibility, attract sustainable investment and ensure African priorities are embedded within emerging global governance frameworks.

By institutionalising trilateral policy cooperation, the agreement positions Africa to shape ESG standards proactively, strengthening its economic sovereignty and long-term competitiveness in a sustainability-driven global economy.

Culled From: ACCPA and CCAAPR Sign Strategic MoU to Advance Africa–China–Canada Policy Cooperation - Africa-China Centre