Kenya has launched a national carbon registry to enhance transparency, credibility, and investment confidence in climate finance markets.

The platform will track carbon credit issuance, ownership, and retirement, addressing integrity concerns that have slowed Africa’s carbon market growth.

Officials say the registry positions Kenya as a regional leader in carbon markets while unlocking new climate financing opportunities.

Kenya Strengthens Carbon Market Integrity Framework

Kenya has launched a national carbon registry to enhance transparency, accountability, and credibility within its carbon markets, marking a major milestone in Africa’s climate finance evolution.

The registry provides a centralised platform to track carbon credit issuance, ownership, transfers, and retirement.

This addresses longstanding concerns around double-counting, lack of transparency, and market fragmentation that have undermined investor confidence in voluntary carbon markets globally.

By strengthening governance and oversight, Kenya aims to position itself as a trusted originator of carbon credits, capable of attracting international climate finance and supporting national climate objectives.

The move reflects growing recognition that credible carbon markets are essential for mobilising private capital to support climate mitigation and adaptation efforts.

Carbon Registries Improve Market Transparency and Governance

Carbon registries play a critical role in ensuring environmental integrity, transparency, and accountability in carbon markets.

They provide verified records of carbon credit transactions, enabling buyers, investors, and regulators to track climate impact.

This strengthens confidence among investors seeking credible climate finance opportunities.

Registry Function | Market Impact | Strategic Benefit |

|---|---|---|

Credit issuance tracking | Prevents double counting | Improved market credibility |

Ownership records | Ensures transparency | Increased investor confidence |

Credit retirement verification | Confirms emissions reductions | Strengthened environmental integrity |

Centralised data management | Improved oversight | Regulatory efficiency |

Transparent registries are essential for enabling carbon markets to function efficiently and attract global capital flows.

Without credible systems, carbon markets risk losing investor trust and failing to deliver climate impact.

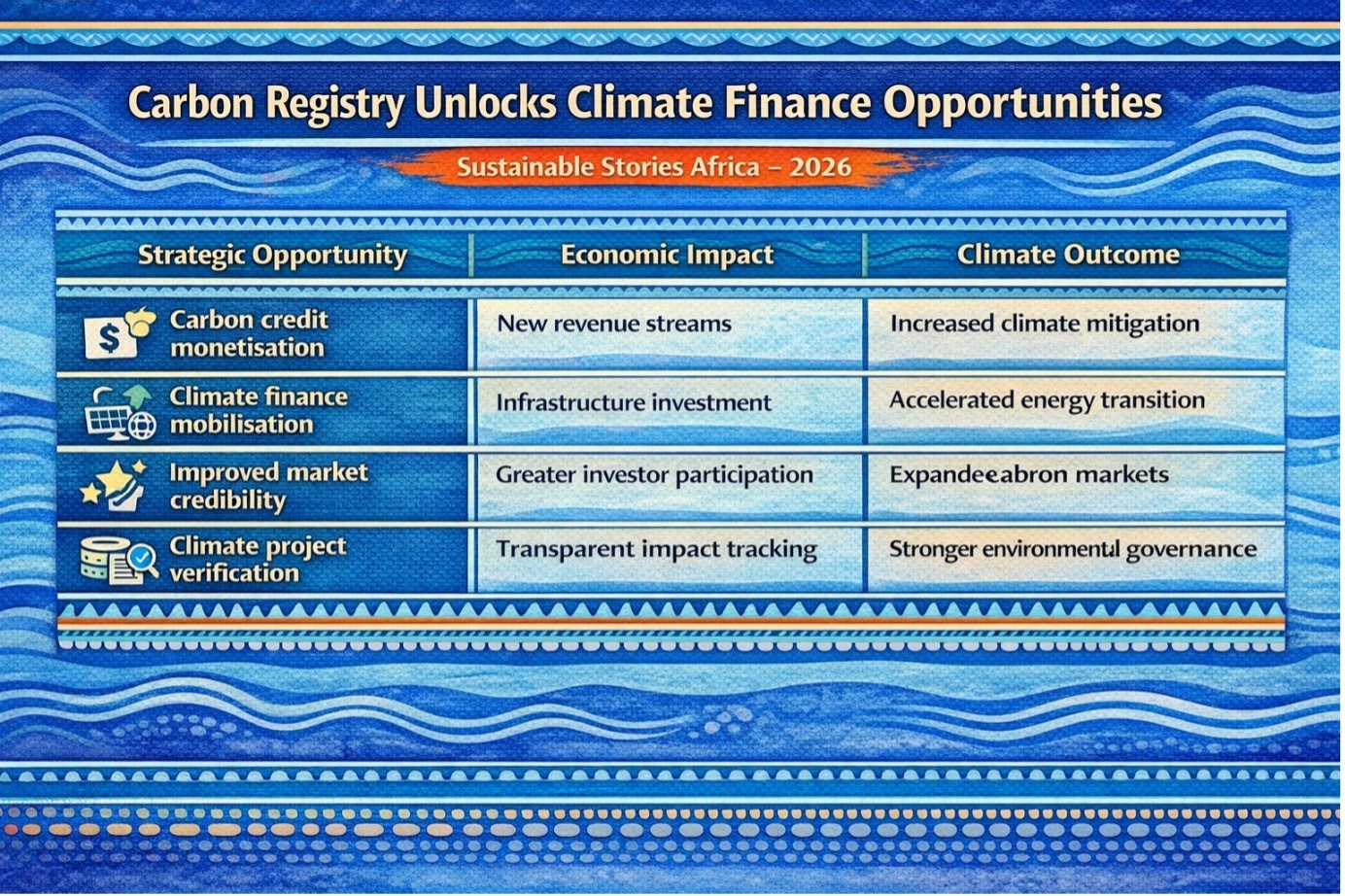

Carbon Registry Unlocks Climate Finance Opportunities

Kenya’s carbon registry positions the country to attract increased climate investment and participate more actively in global carbon markets.

Carbon markets offer significant opportunities for developing economies to monetise climate mitigation efforts, including forest conservation, renewable energy, and sustainable land management.

Strategic Opportunity | Economic Impact | Climate Outcome |

|---|---|---|

Carbon credit monetisation | New revenue streams | Increased climate mitigation |

Climate finance mobilisation | Infrastructure investment | Accelerated energy transition |

Improved market credibility | Greater investor participation | Expanded carbon markets |

Climate project verification | Transparent impact tracking | Stronger environmental governance |

For Kenya, the registry enhances its ability to develop carbon projects, attract international buyers, and support sustainable economic growth.

Africa is increasingly recognised as a major potential supplier of high-quality carbon credits.

Strong Governance Essential for Market Success

To fully realise these benefits, Kenya must ensure strong governance, robust verification systems, and regulatory enforcement to maintain market integrity.

Government agencies, project developers, and private sector stakeholders must collaborate to develop credible carbon projects aligned with international standards.

Expanding carbon market participation requires clear regulations, transparent systems, and investor confidence.

Kenya’s registry represents a critical step toward building a credible and scalable carbon market ecosystem.

If successfully implemented, it could serve as a model for other African economies seeking to mobilise climate finance through carbon markets.

Path Forward – Registry Enables Trusted Climate Finance Markets

Kenya must ensure strong governance, transparent systems, and credible verification to sustain the growth of its carbon market.

Robust carbon markets can unlock climate finance, support mitigation efforts, and strengthen economic resilience.

Culled From: Kenya Launches National Carbon Registry to Strengthen Climate Finance Credibility