Climate shocks are exposing insurance as Africa’s overlooked ESG frontline defence mechanism.

As floods, industrial accidents, and environmental liabilities increase, insurers are shifting from passive risk bearers to active sustainability enforcers.

Experts warn that firms ignoring ESG risks face higher premiums, reduced coverage, and growing financial vulnerability in Nigeria’s evolving regulatory landscape.

Insurance Becomes ESG Compliance Enforcer

Nigeria’s insurance sector is rapidly emerging as a critical enforcement mechanism for environmental, social, and governance (ESG) standards, as climate risks, industrial liabilities, and regulatory expectations intensify across key sectors.

Traditionally viewed as financial shock absorbers, insurers are increasingly shaping corporate behaviour by pricing ESG risks into underwriting decisions.

Companies with weak environmental safeguards, inadequate governance structures, or high exposure to climate-related disruptions now face higher premiums, restricted coverage, or outright exclusion.

This shift reflects a broader transformation in global insurance markets, where ESG integration is redefining how risk is assessed, priced, and transferred.

For Nigeria’s economy, where environmental exposure from oil, gas, agriculture, and urbanisation remains high, the implications are profound.

Insurance is no longer simply reacting to risk; it is actively influencing corporate transition pathways.

Rising Climate Losses Reshape Insurance Economics

Environmental and climate-related events are increasing the frequency and severity of insurance claims globally and within Nigeria.

Flooding, infrastructure damage, pollution liabilities, and operational disruptions are exposing insurers to escalating financial losses.

This trend is forcing insurers to adopt forward-looking ESG risk assessment frameworks.

ESG Risk Factor | Insurance Implication | Corporate Consequence |

|---|---|---|

Climate exposure | Higher claims frequency | Increased insurance premiums |

Environmental liabilities | Legal and remediation costs | Coverage restrictions |

Poor governance practices | Elevated operational risks | Reduced underwriting capacity |

Weak risk disclosure | Limited transparency | Higher risk pricing |

Insurers now require more detailed ESG disclosures, environmental safeguards, and operational resilience strategies before providing coverage. This is accelerating ESG adoption among corporates seeking to maintain insurability and investor confidence.

Globally, insurance markets are already restricting coverage for high-carbon and environmentally risky projects, signalling the direction of future underwriting in Nigeria.

ESG Integration Strengthens Financial Resilience

Integrating ESG into insurance underwriting creates strong incentives for businesses to improve sustainability performance.

Companies that adopt climate-resilient infrastructure, strong governance frameworks, and environmental safeguards benefit from lower premiums, broader coverage, and enhanced financial stability.

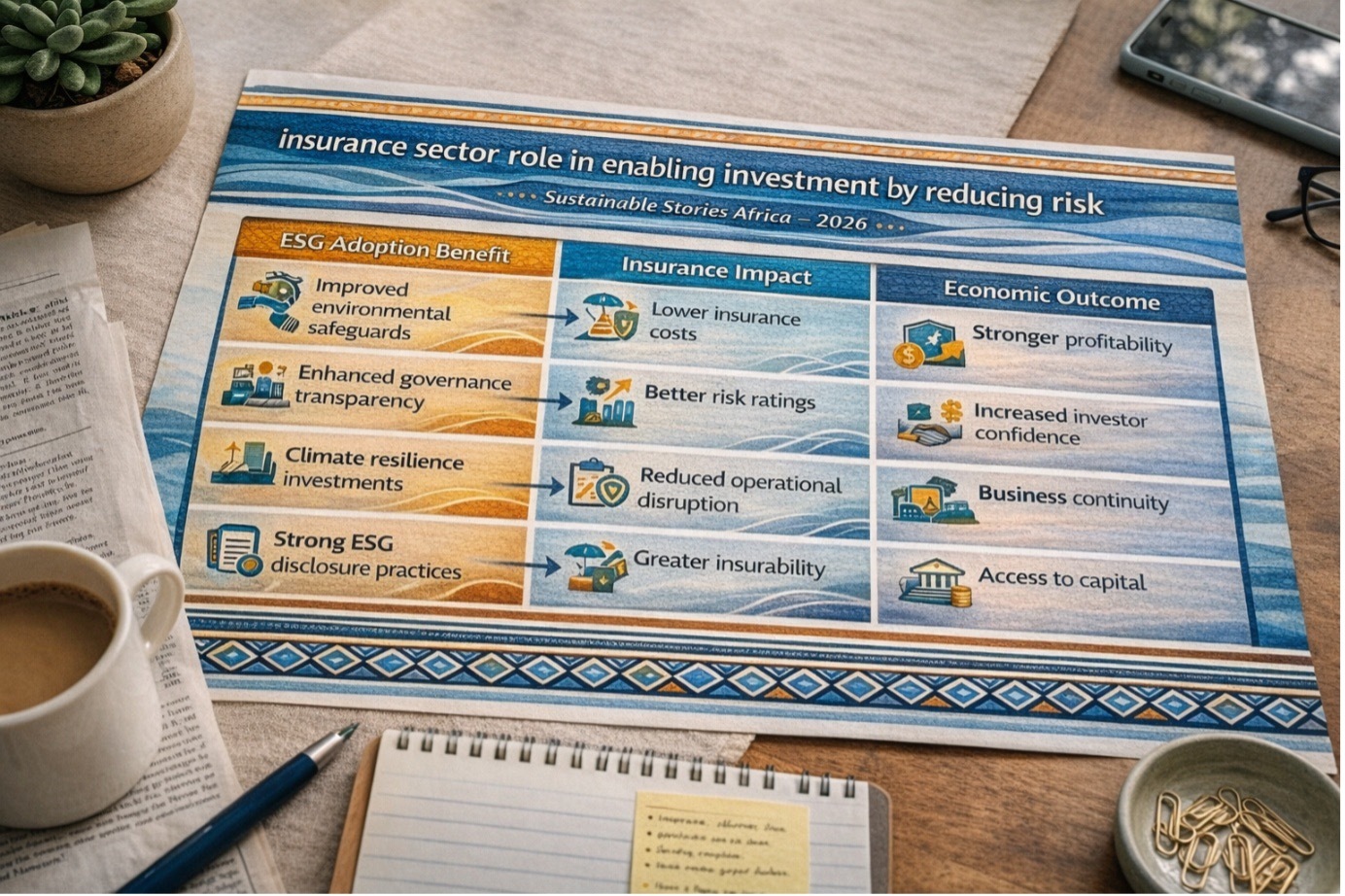

The insurance sector also plays a vital role in enabling investment by reducing risk exposure for lenders and investors.

ESG Adoption Benefit | Insurance Impact | Economic Outcome |

|---|---|---|

Improved environmental safeguards | Lower insurance costs | Stronger profitability |

Enhanced governance transparency | Better risk ratings | Increased investor confidence |

Climate resilience investments | Reduced operational disruption | Business continuity |

Strong ESG disclosure practices | Greater insurability | Access to capital |

By embedding ESG criteria into underwriting, insurers are helping align Nigeria’s corporate ecosystem with global sustainability standards while strengthening long-term economic resilience.

This creates a virtuous cycle where ESG compliance enhances insurability, investment attractiveness, and financial performance.

Nigerian Insurers Must Accelerate ESG Alignment

To fully realise these benefits, Nigeria’s insurance sector must deepen ESG integration across underwriting, risk assessment, and capital allocation. Regulatory support, improved data systems, and enhanced disclosure standards will be critical in enabling this transition.

Insurers must also develop innovative products—such as climate risk insurance, environmental liability coverage, and resilience-linked policies—to support businesses navigating the transition.

For corporates, ESG is no longer optional. Failure to align with sustainability standards could increase operational risks, reduce insurability, and weaken competitiveness.

Insurance is rapidly becoming one of the most powerful drivers of ESG adoption across Nigeria’s economy.

Path Forward: Insurance Must Lead ESG Transition

Insurers must integrate ESG risk models, strengthen disclosure requirements, and support climate resilience investments across Nigeria’s economy.

Businesses adopting sustainability practices will benefit from lower risk costs, stronger investor confidence, and long-term financial stability in evolving global markets.

Culled From: https://businessday.ng/opinion/article/insurance-and-esg-managing-environmental-risk-smarter/