Nigeria and emerging economies are intensifying calls for structural reforms to the global financial system to address inequality and climate financing gaps.

At the G-24 summit, policymakers warned that current frameworks disproportionately disadvantage developing economies through high borrowing costs and limited access to capital.

Leaders argue that reforming global finance is essential to unlocking sustainable development, climate resilience, and long-term economic stability.

Developing Economies Demand Financial System Reform

Nigeria and other developing economies have intensified calls for urgent reforms to the global financial architecture, arguing that existing frameworks limit their ability to finance development, manage debt, and respond to climate risks.

At the G-24 summit, finance ministers and policymakers highlighted structural inequalities in global finance, including high borrowing costs, limited access to concessional funding, and inadequate representation in key international financial institutions.

These constraints are increasingly affecting economic stability, infrastructure development, and climate transition efforts across emerging markets.

Leaders emphasised that reform is essential to enable sustainable growth and reduce vulnerability to external economic shocks.

For countries like Nigeria, fairer access to finance could unlock critical investment in infrastructure, energy transition, and climate resilience.

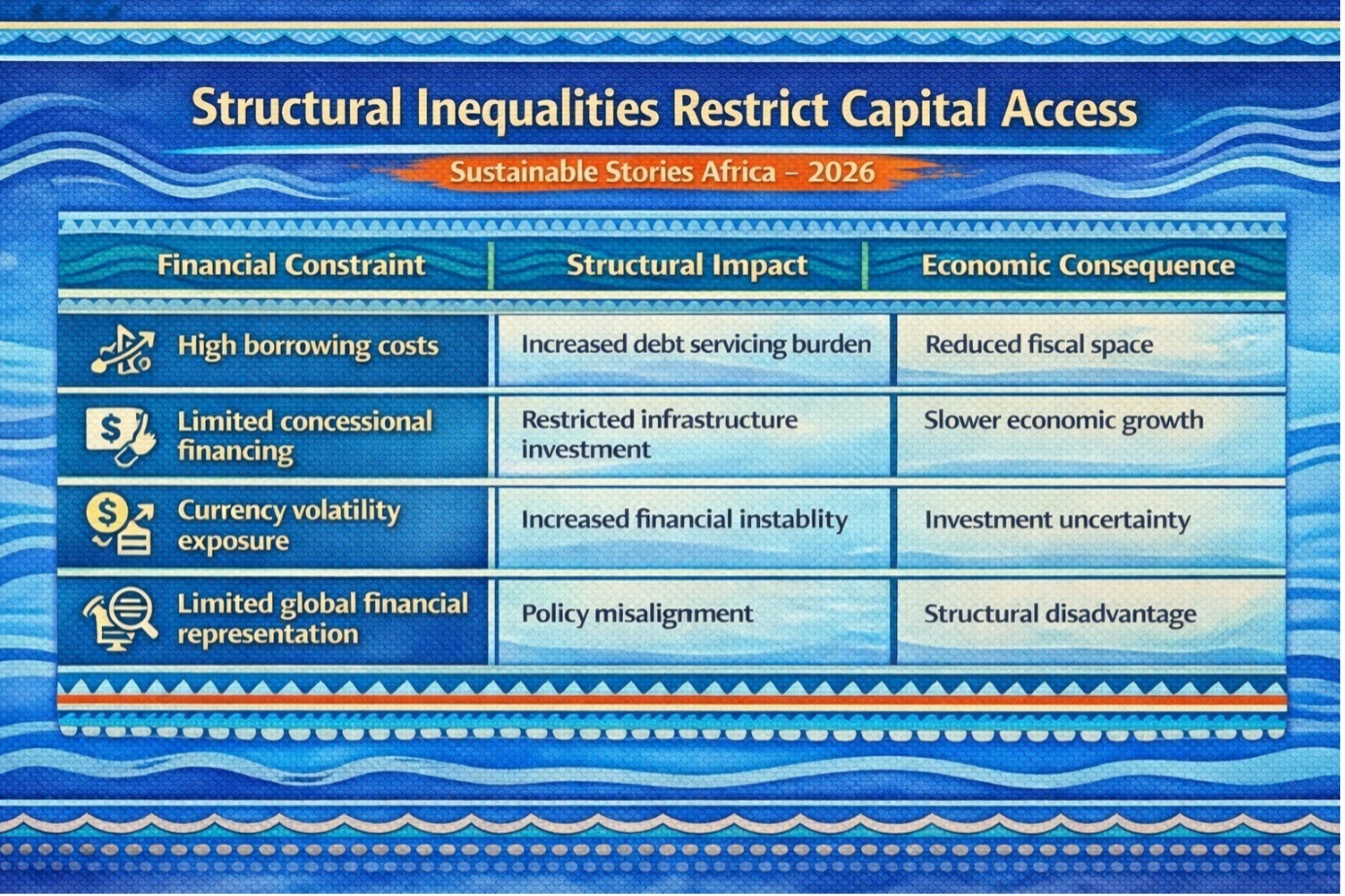

Structural Inequalities Restrict Capital Access

Developing economies face systemic barriers that increase financing costs and limit capital availability. Global financial rules often expose emerging markets to higher risk premiums, restricting their ability to access affordable funding.

This disparity creates a structural financing gap that slows economic development.

Financial Constraint | Structural Impact | Economic Consequence |

|---|---|---|

High borrowing costs | Increased debt servicing burden | Reduced fiscal space |

Limited concessional financing | Restricted infrastructure investment | Slower economic growth |

Currency volatility exposure | Increased financial instability | Investment uncertainty |

Limited global financial representation | Policy misalignment | Structural disadvantage |

These constraints are particularly significant for climate finance, where developing economies require substantial investment to support energy transition and resilience projects.

Without reform, financing gaps could widen, slowing progress towards attaining the Sustainable Development Goals.

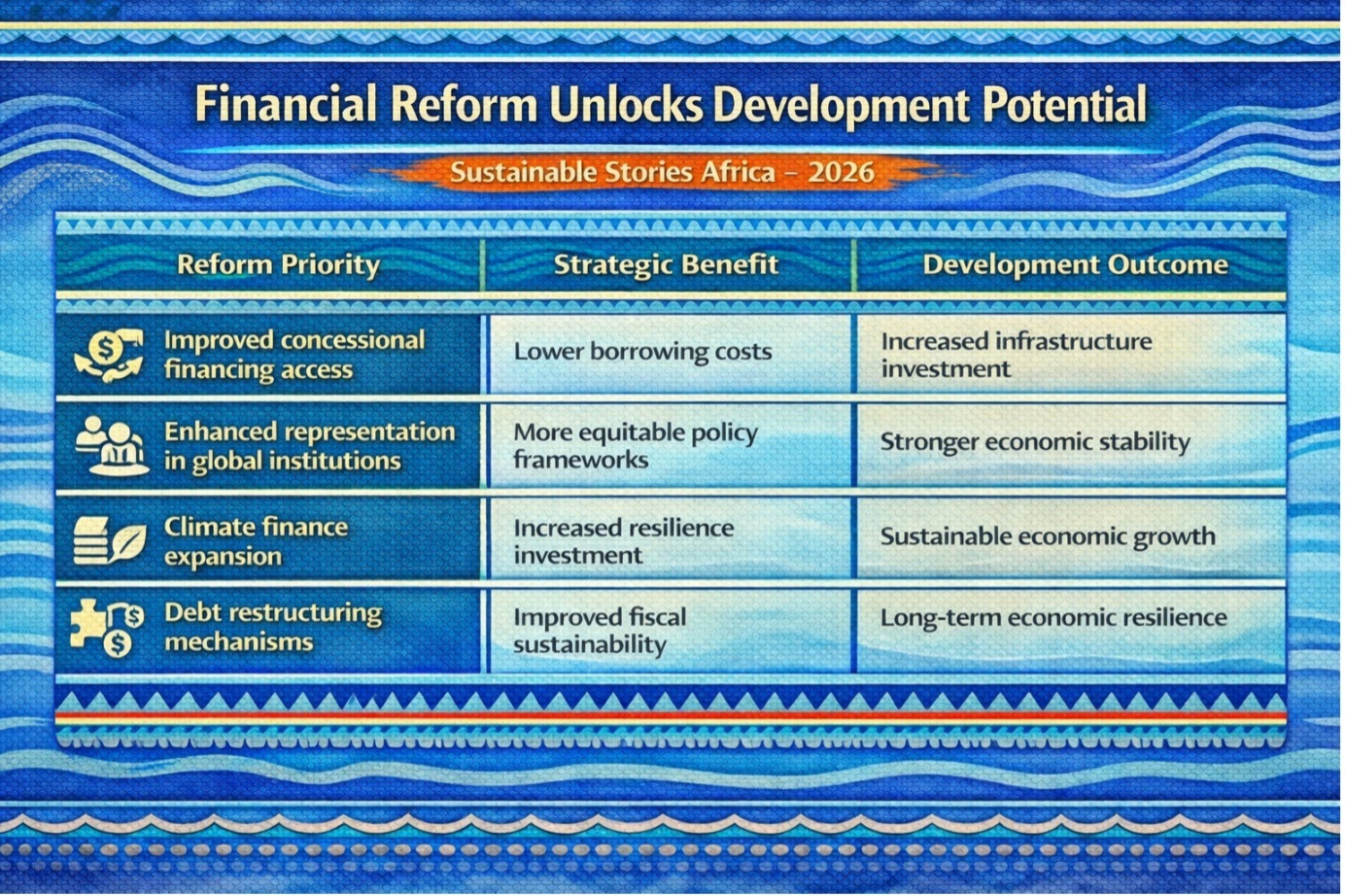

Financial Reform Unlocks Development Potential

Reforming the global financial system could unlock significant economic and climate investment opportunities across developing economies.

Improved access to affordable financing would enable countries to invest in infrastructure, energy systems, and climate resilience, strengthening economic competitiveness.

Reform Priority | Strategic Benefit | Development Outcome |

|---|---|---|

Improved concessional financing access | Lower borrowing costs | Increased infrastructure investment |

Enhanced representation in global institutions | More equitable policy frameworks | Stronger economic stability |

Climate finance expansion | Increased resilience investment | Sustainable economic growth |

Debt restructuring mechanisms | Improved fiscal sustainability | Long-term economic resilience |

For Nigeria and its peers, fairer financial access could accelerate industrialisation, reduce economic vulnerability, and strengthen global competitiveness.

Financial reform is increasingly viewed as a prerequisite for achieving global climate and development goals.

Global Coordination Required for Financial Reform

Achieving meaningful reform will require coordinated action among international financial institutions, developed economies, and emerging markets.

Leaders at the summit emphasised the importance of restructuring debt frameworks, expanding concessional financing, and improving the representation of developing economies in global financial governance.

Financial institutions must adapt to reflect changing global economic realities and support sustainable development objectives.

Without reform, developing economies risk prolonged financing constraints and slower economic progress.

The G-24 summit signals growing momentum toward reshaping global financial systems to support equitable development.

Path Forward – Financial System Reform Critical for Equity

Global financial institutions must expand concessional financing, enhance representation, and strengthen access to climate finance for developing economies.

Fairer financial systems can unlock investment, strengthen resilience, and accelerate sustainable development globally.

Culled From: https://guardian.ng/business-services/nigeria-others-push-for-fairer-global-financial-system-at-g-24-summit/