Africa installs more solar each year; however, it manufactures almost none of it.

New trade and import data reveal a widening gap between the continent’s renewable ambitions and its industrial base. Billions of dollars flow outward annually to purchase modules, inverters and battery components.

Policymakers now argue that without local manufacturing, Africa risks becoming a permanent consumer of clean energy rather than a value-chain participant, forfeiting jobs, technology transfer and fiscal resilience.

Solar Boom, Industrial Blind Spot

Africa’s energy transition is accelerating. Utility-scale solar projects are expanding from North Africa to Southern Africa, while distributed systems proliferate across West and East Africa.

However, import data show a structural imbalance: most photovoltaic modules, inverters and lithium battery systems are sourced from Asia and Europe.

In several markets, solar equipment is one of the fastest-growing categories of solar-energy imports. Industry analysts estimate that more than 80–90% of solar modules installed across sub-Saharan Africa are imported, representing billions in annual outflows.

The paradox is stark: Africa requires some of the world’s highest solar irradiation levels but captures only a fraction of the manufacturing value chain.

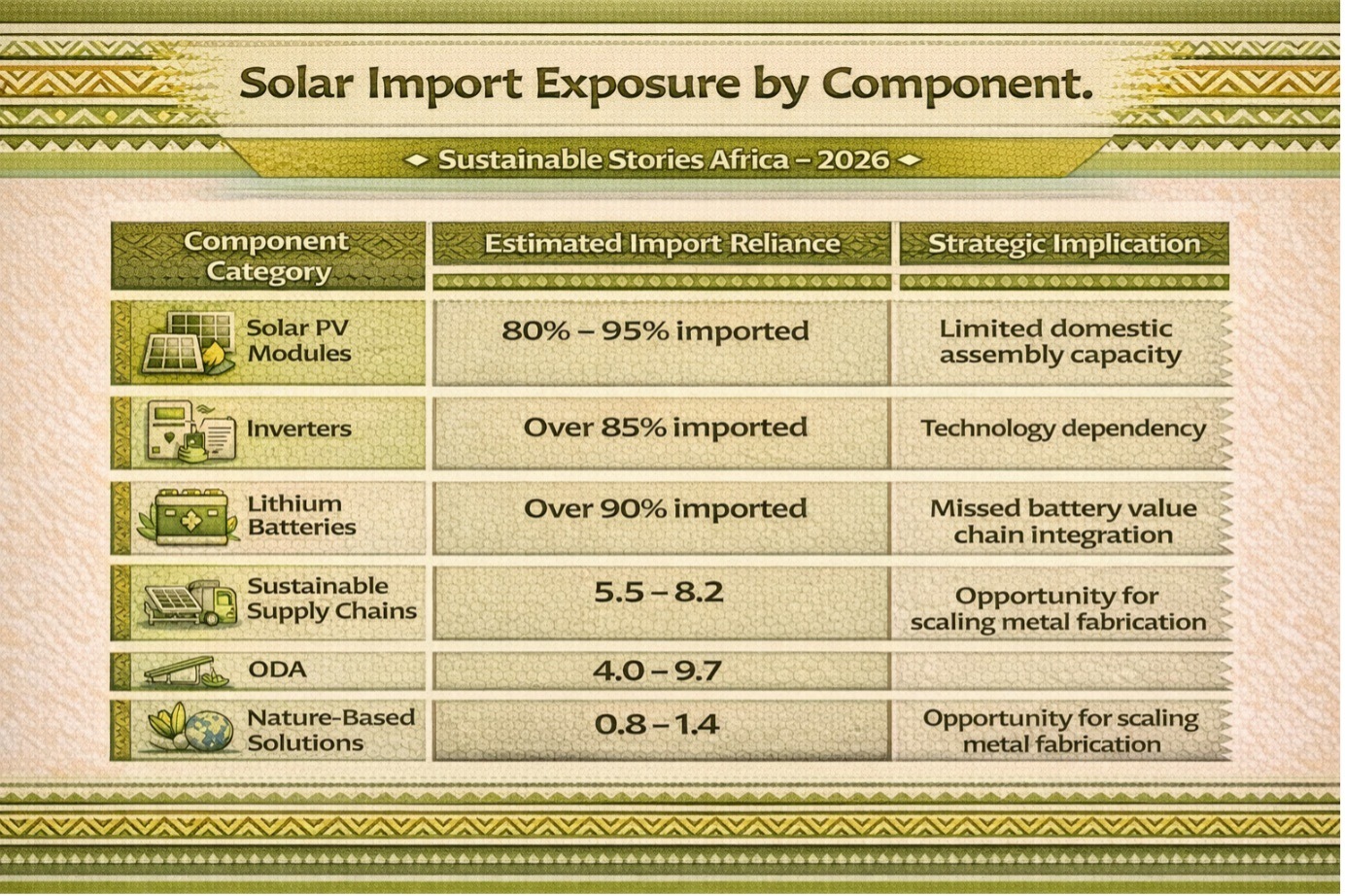

Import Dependency by Component Category

Trade disclosures and customs data illustrate where the dependency is most concentrated.

Solar Import Exposure by Component

Component Category | Estimated Import Reliance | Strategic Implication |

|---|---|---|

Solar PV Modules | 80% – 95% imported | Limited domestic assembly capacity |

Inverters | Over 85% imported | Technology dependency |

Lithium Batteries | Over 90% imported | Missed battery value chain integration |

Mounting Systems | Partial local fabrication | Opportunity for scaling metal fabrication |

While some countries have initiated assembly plants, upstream manufacturing, including wafer, cell, and advanced battery chemistry, remains minimal.

Industrial economists argue that the issue is not simply trade imbalance. It is industrial sequencing. Without policy support, such as tariff structuring, tax incentives, local content frameworks, concessional finance and procurement guarantees, solar deployment does not automatically translate into manufacturing growth.

Governments, including those of Nigeria, Egypt, South Africa and Morocco, have started policy discussions on domestic assembly and incentives. However, execution varies significantly.

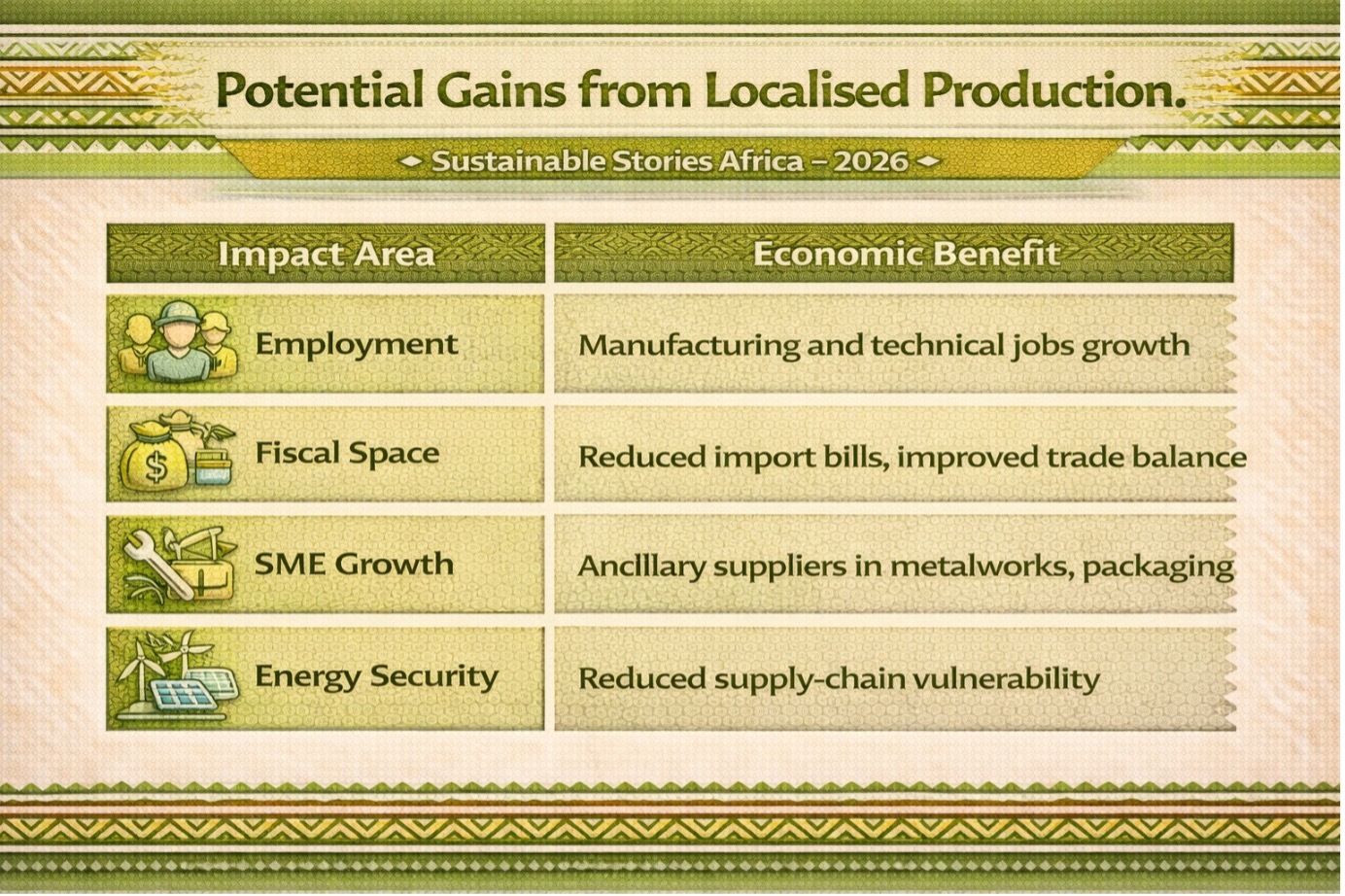

The Case for Local Solar Manufacturing

Local manufacturing offers measurable economic leverage:

- Job Creation – Solar assembly and component production can generate skilled and semi-skilled employment across engineering, fabrication and logistics.

- FX Stability – Reduced equipment imports ease pressure on foreign exchange reserves.

- Technology Transfer – Domestic facilities support workforce training and innovation ecosystems.

- Industrial Diversification – Solar manufacturing integrates with steel, glass, aluminium and electronics supply chains.

Potential Gains from Localised Production

Impact Area | Economic Benefit |

|---|---|

Employment | Manufacturing and technical jobs growth |

Fiscal Space | Reduced import bills, improved trade balance |

SME Growth | Ancillary suppliers in metalworks, packaging |

Energy Security | Reduced supply-chain vulnerability |

Global precedent suggests that early industrial movers capture disproportionate value. China’s solar dominance did not emerge organically; it was driven by its coordinated industrial policy, scale financing and export strategy.

African policymakers now face a strategic question: whether to deploy solar or manufacture it?

Policy Pathways for Industrial Alignment

Experts propose a phased framework:

- Short Term (1–3 years) – Incentivise module assembly plants through tax holidays, import duty waivers on intermediate inputs, and public procurement guarantees.

- Medium Term (3–7 years) – Develop regional value chains under AfCFTA to pool demand and achieve scale.

- Long Term – Invest in upstream manufacturing, including polysilicon processing and battery cell production, supported by blended finance.

Financial institutions and development banks are being encouraged to structure concessional financing windows tied specifically to local content thresholds.

Private sector players emphasise regulatory clarity, stable FX policy, and transparent incentive schemes as prerequisites.

The opportunity window is time-bound. As global clean-tech supply chains consolidate, late entrants risk marginalisation.

PATH FORWARD – Localise Production, Secure Energy Sovereignty

African governments are increasingly aligning solar deployment with industrial policy. The objective is clear: retain more value domestically while accelerating energy access.

Policy tools under discussion include targeted incentives, regional manufacturing hubs and concessional climate finance tied to local content.

If executed coherently, solar manufacturing could transform Africa from an energy importer to an industrial participant, strengthening economic resilience while advancing climate goals.

The next five years will determine whether the continent takes advantage of the opportunity or remains at the periphery of the clean-tech revolution.

Culled From: Import data points to local solar manufacturing