Africa’s green hydrogen pipeline is expanding on paper, but contracts remain scarce.

Despite multibillion-dollar project announcements across Namibia, Egypt and Mauritania, developers are finding it difficult to secure binding off-take agreements from European and Asian buyers.

Without long-term purchase commitments, financiers are hesitant to release capital, raising questions about whether Africa’s hydrogen ambitions can transition from memorandum to mega-project.

Big Announcements, Few Buyers

Africa has positioned itself as a future powerhouse in green hydrogen production, supported by vast solar and wind resources. Governments have signed cooperation agreements with European Union states, Gulf investors and multilateral lenders.

Yet industry data indicate a structural bottleneck: off-take agreements — the long-term contracts guaranteeing purchase volumes — remain limited relative to announced capacity.

Project developers estimate that fewer than 20% of proposed African hydrogen projects have secured firm binding off-take contracts. Without guaranteed buyers, projects struggle to reach Final Investment Decision (FID).

Hydrogen may be abundant in resource potential. It is scarce in contractual certainty.

Why Off-Take Remains Elusive

Green hydrogen economics remain fragile. Production costs in Africa are competitive due to renewable resource quality, but delivered costs to Europe or Asia depend on shipping, ammonia conversion and port infrastructure.

Buyers face their own constraints:

- Price Sensitivity: European industrial buyers remain cautious amid uncertain carbon pricing trajectories.

- Policy Clarity: Subsidy frameworks such as the EU Hydrogen Bank are still evolving.

- Technology Risk: Electrolyser scale-up and logistics chains remain early-stage.

- Credit Risk Perception: African sovereign risk premiums raise financing costs.

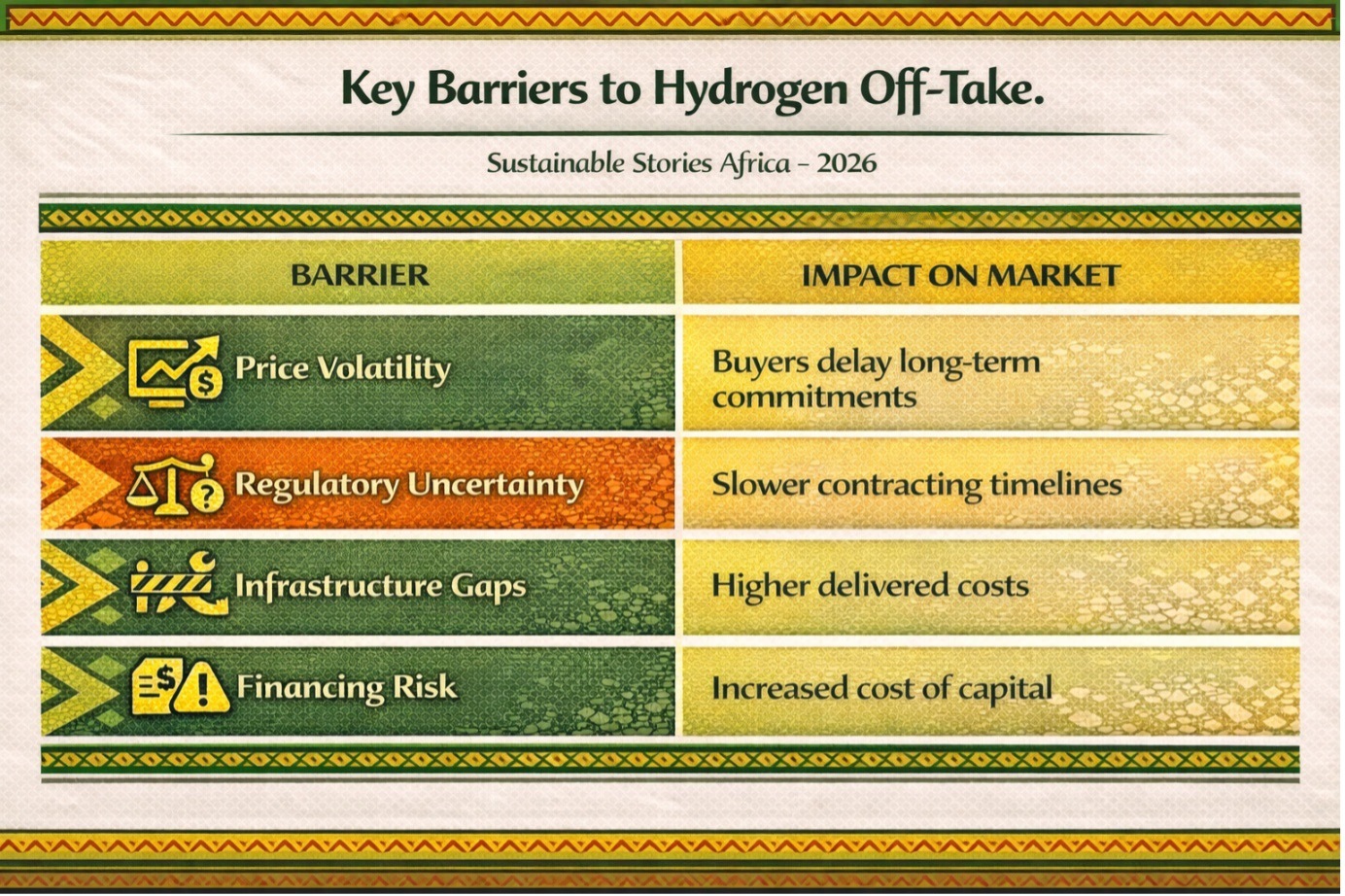

Key Barriers to Hydrogen Off-Take

Barrier | Impact on Market |

|---|---|

Price Volatility | Buyers delay long-term commitments |

Regulatory Uncertainty | Slower contracting timelines |

Infrastructure Gaps | Higher delivered costs |

Financing Risk | Increased cost of capital |

Export-oriented projects require between 15 and 20 years of purchase agreements to unlock financing. In their absence, projects remain at the feasibility stage.

European utilities and industrial groups have signed memoranda of understanding (MoUs), but many are non-binding. Investors differentiate sharply between political announcements and bankable contracts.

What Secured Off-Take Could Unlock

If off-take barriers are addressed, the economic potential is significant.

Hydrogen development could:

- Catalyse large-scale renewable deployment.

- Create port and logistics infrastructure.

- Enable fertiliser and green ammonia industries.

- Generate export revenues comparable to traditional extractives in certain markets.

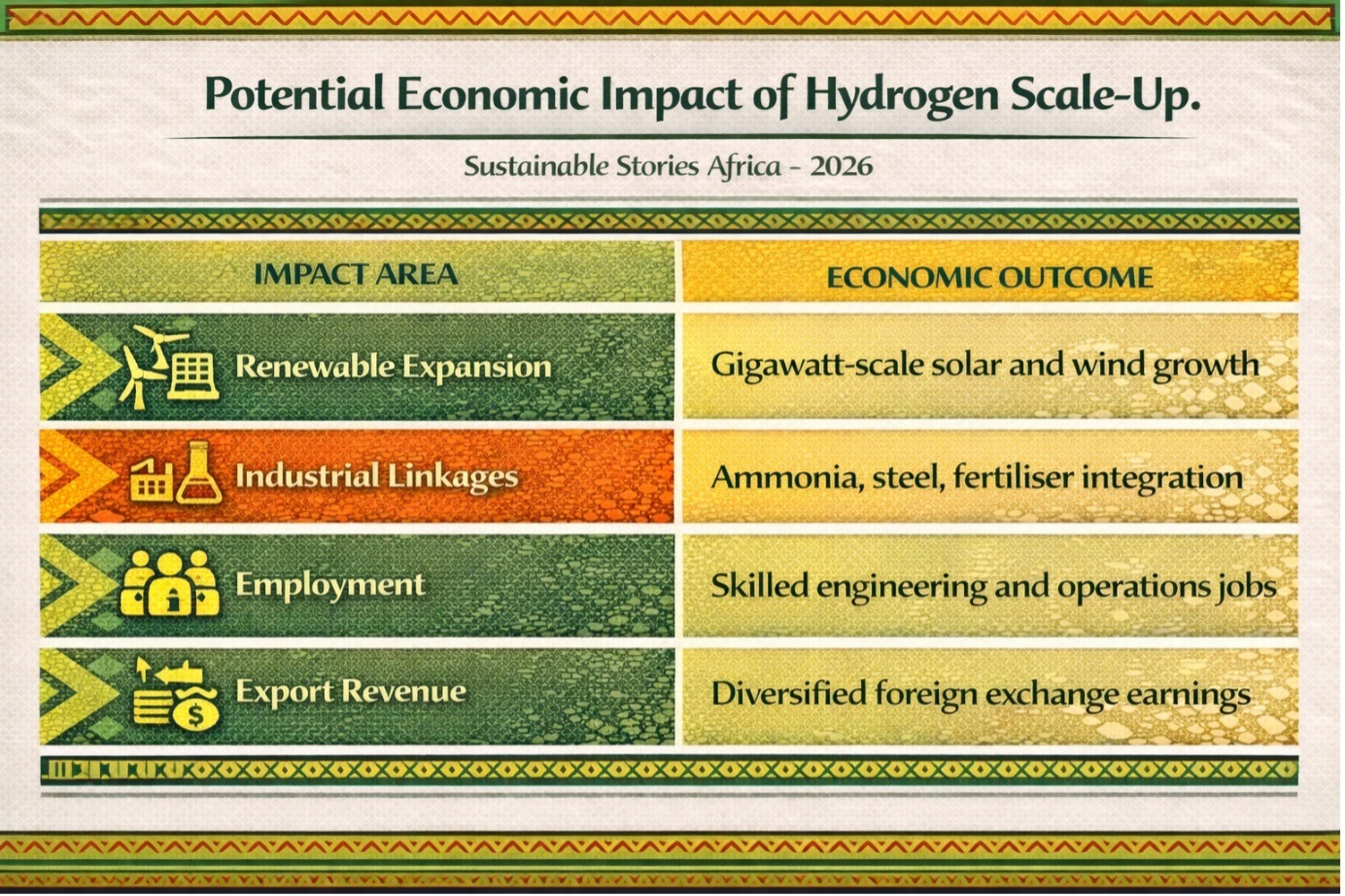

Potential Economic Impact of Hydrogen Scale-Up

Impact Area | Economic Outcome |

|---|---|

Renewable Expansion | Gigawatt-scale solar and wind growth |

Industrial Linkages | Ammonia, steel, fertiliser integration |

Employment | Skilled engineering and operations jobs |

Export Revenue | Diversified foreign exchange earnings |

Namibia, Egypt and Mauritania have emerged as leading candidates due to their land availability, renewable resources and port access.

However, developers emphasise that resource advantage alone does not close deals.

One project executive noted: “The technology works. The sun shines. The wind blows. But without contracts, capital does not move.”

The difference between ambition and execution is not sunlight; it is certainty.

Bridging the Contract Gap

Experts propose coordinated intervention:

- Blended Finance Guarantees: Multilateral institutions underwriting early off-take risk.

- Carbon Pricing Signals: Stronger, predictable EU carbon border mechanisms.

- Sovereign Risk Mitigation: Political risk insurance and credit enhancements.

- Demand-Side Incentives: Subsidies tied to industrial decarbonisation commitments.

Regional pooling under AfCFTA frameworks may also strengthen bargaining power and create intra-African demand, particularly for fertiliser and refining sectors.

Ultimately, hydrogen is not just an energy project; it is a trade architecture question.

Without a synchronised policy across production and demand markets, Africa risks developing feasibility studies rather than functioning export corridors.

PATH FORWARD – De-Risk Contracts, Unlock Capital Flows

Governments and financiers are increasingly focusing on credit guarantees, demand-side subsidies and structured price floors to close the off-take gap.

Multilateral institutions are being encouraged to transition from project support to contract support, reducing perceived risk for early buyers.

If executed swiftly, Africa could leverage its hydrogen resource advantage into durable export industries. Without binding purchase agreements, however, projects may remain aspirational, technologically viable, but financially stalled.

Culled From: Why African hydrogen struggles to secure off-take