Nigeria's oil producers are accelerating gas-flare reduction efforts after signing new commercial agreements to capture and monetise flared gas, aligning emissions control with energy supply goals. The deals reflect mounting regulatory pressure and rising climate scrutiny on Africa's largest oil producer.

If implemented at scale, the agreements could reshape Nigeria's emissions profile while unlocking domestic gas-to-power value.

Nigerian Oil Firms Move on Gas Flaring

Nigeria's oil producers have signed a series of commercial flare-gas agreements aimed at cutting emissions while converting previously wasted gas into usable energy, marking a pragmatic shift in how the country addresses one of its most persistent environmental challenges.

The deals, reported by Reuters, come as regulators intensify enforcement under Nigeria's gas-flaring framework and investors increasingly scrutinise emissions performance in hydrocarbon portfolios. For Africa's largest oil producer, the move signals a growing convergence between climate obligations and commercial energy strategy.

Gas Flaring Remains a Structural Problem

Despite decades of policy interventions, Nigeria remains among the world's top gas-flaring countries. Large volumes of associated gas are still burned off during oil production, contributing to greenhouse-gas emissions, local air pollution, and lost economic value.

Recent reforms, which include stricter penalties and incentives under Nigeria's flare-gas commercialisation programme, have begun to shift behaviour. The latest agreements involve partnerships with third-party gas processors that capture flared gas for power generation, industrial use, or compressed natural gas (CNG) distribution.

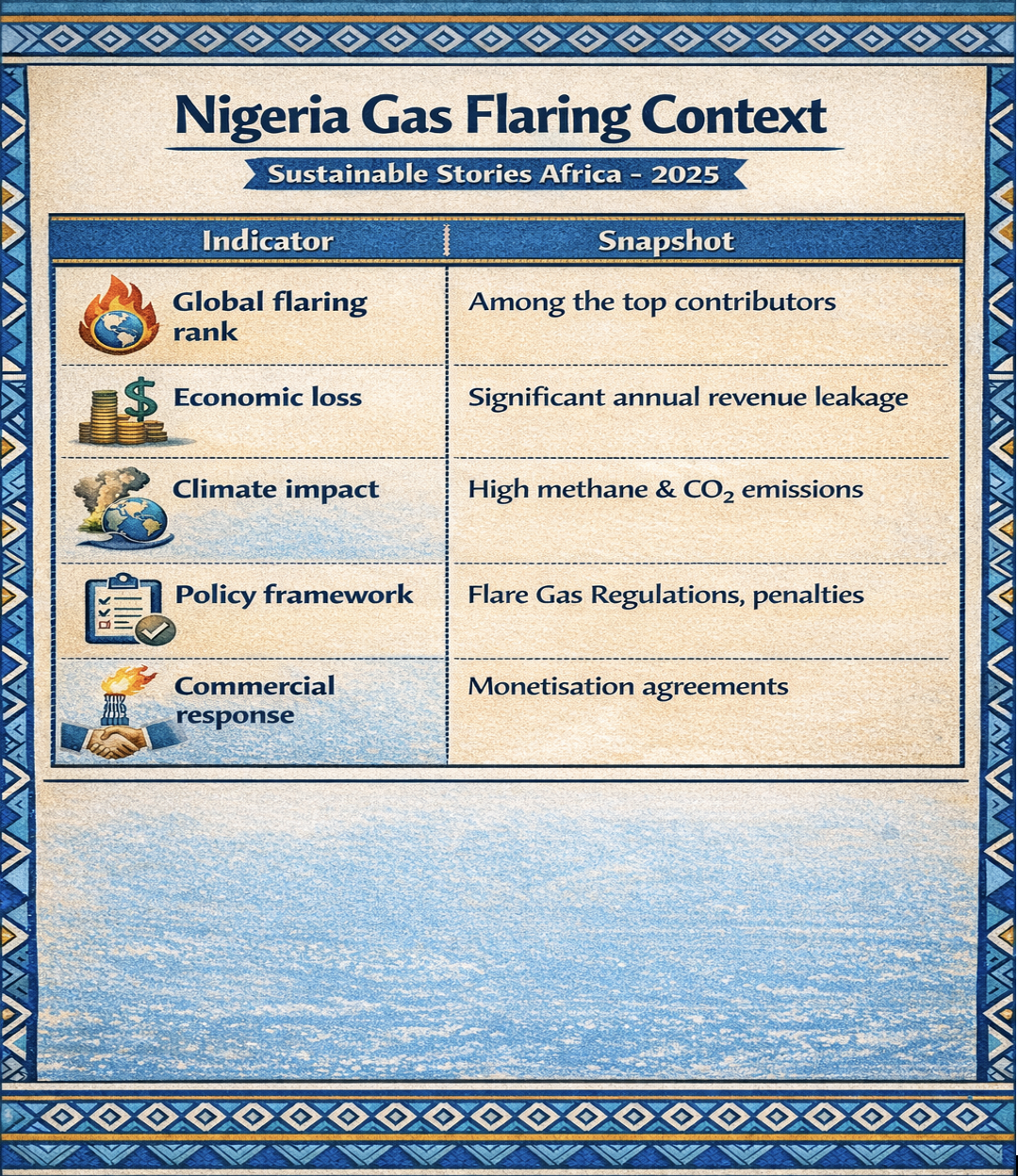

Nigeria Gas Flaring Context

| Indicator | Snapshot |

|---|---|

| Global flaring rank | Among the top contributors |

| Economic loss | Significant annual revenue leakage |

| Climate impact | High methane & CO₂ emissions |

| Policy framework | Flare Gas Regulations, penalties |

| Commercial response | Monetisation agreements |

Analysts note that monetising flare gas improves energy supply while reducing environmental and social costs in oil-producing communities.

Why the Deals Matter Now

The timing of the agreements reflects multiple pressures which converge on Nigeria's oil sector. International financiers are tightening emissions standards, while domestic energy shortages persist despite abundant gas reserves.

For operators, flare-gas deals offer a lower-cost emissions-reduction pathway compared with large-scale carbon capture investments, while still delivering measurable climate and energy benefits.

Key drivers behind the shift include:

- Regulatory enforcement and fines for flaring

- Investor ESG expectations

- Demand for gas-to-power solutions

- Nigeria's broader gas-led transition strategy

By converting flare gas into power or industrial fuel, producers can move to improve operational efficiency while demonstrating tangible ESG progress.

Linking Emissions Reduction With Energy Access

If fully executed, the agreements could channel flare gas into small-scale power plants, manufacturing clusters, and transport fuel networks, particularly in regions where energy access remains unreliable.

Potential Impact of Flare-Gas Monetisation

| Impact Area | Expected Outcome |

|---|---|

| Emissions | Lower CO₂ and methane release |

| Energy supply | Increased domestic gas availability |

| Communities | Reduced pollution exposure |

| Operators | Improved ESG performance |

| Economy | New gas-based revenue streams |

However, industry experts caution that success will depend on the rate of infrastructure rollout, pricing clarity, and sustained regulatory consistency, areas where Nigeria has historically faced implementation challenges.

Path Forward – Turning Emissions Into Energy Value

Nigeria's flare-gas agreements represent a pragmatic step toward Turning Flare Gas Into Energy Assets, which aligns climate goals with commercial energy realities. By prioritising gas capture and utilisation, oil producers can reduce emissions while supporting power generation and industrial growth.

Sustained impact will require transparent regulation, investment in gas infrastructure, and enforcement discipline to ensure flare reduction commitments translate into measurable environmental and economic gains.

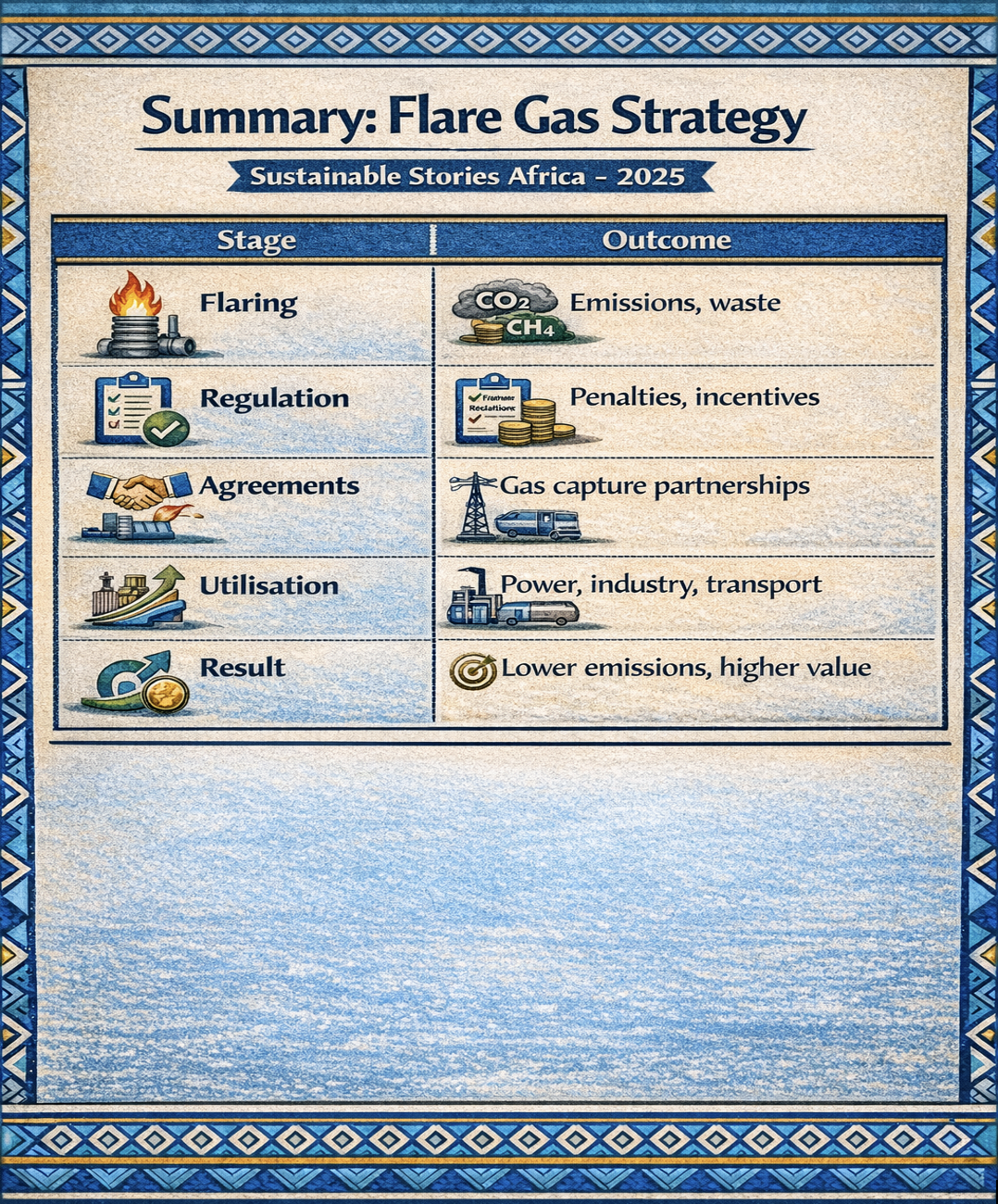

Summary: Flare Gas Strategy

| Stage | Outcome |

|---|---|

| Flaring | Emissions, waste |

| Regulation | Penalties, incentives |

| Agreements | Gas capture partnerships |

| Utilisation | Power, industry, transport |

| Result | Lower emissions, higher value |

Culled From: https://www.reuters.com/sustainability/boards-policy-regulation/nigerian-oil-firms-strike-flare-gas-deals-curb-emissions-boost-energy-2025-12-10/