Nigeria's sustainable finance challenge is not just about capital mobilisation. It is about who understands the tools meant to deploy it.

New empirical evidence reveals that most professionals rate their knowledge of sustainability finance as merely "average," with deep regional and structural gaps.

The findings challenge assumptions about expertise, showing that geography matters more than job titles and that without targeted capacity building, Nigeria's green finance ambitions risk stalling at the knowledge frontier.

The Knowledge Layer Behind Sustainable Finance

Nigeria has built a growing architecture for sustainable finance. From the Central Bank's Sustainable Banking Principles to impending mandatory climate disclosures, the policy scaffolding is increasingly clear.

However, implementation remains uneven, and the flow of green capital lags ambition. Beneath this gap lies a quieter constraint: the level of sustainability finance knowledge among the professionals expected to operationalise these frameworks.

A peer-reviewed study published in 2025 provides one of the clearest empirical snapshots yet of that constraint. Surveying 204 finance and non-finance professionals across Nigeria, the research measures self-rated familiarity with core sustainability finance concepts, including green bonds, ESG integration, climate-risk reporting, and sustainable investment products.

The conclusion is both sobering and instructive. Knowledge is clustered around the middle, expertise is scarce, and location, not professional designation, is the strongest predictor of high sustainability finance literacy.

For a country racing to align regulation with practice, the findings raise urgent questions about readiness, equity, and institutional capacity.

Most Professionals Are Only Partly Prepared

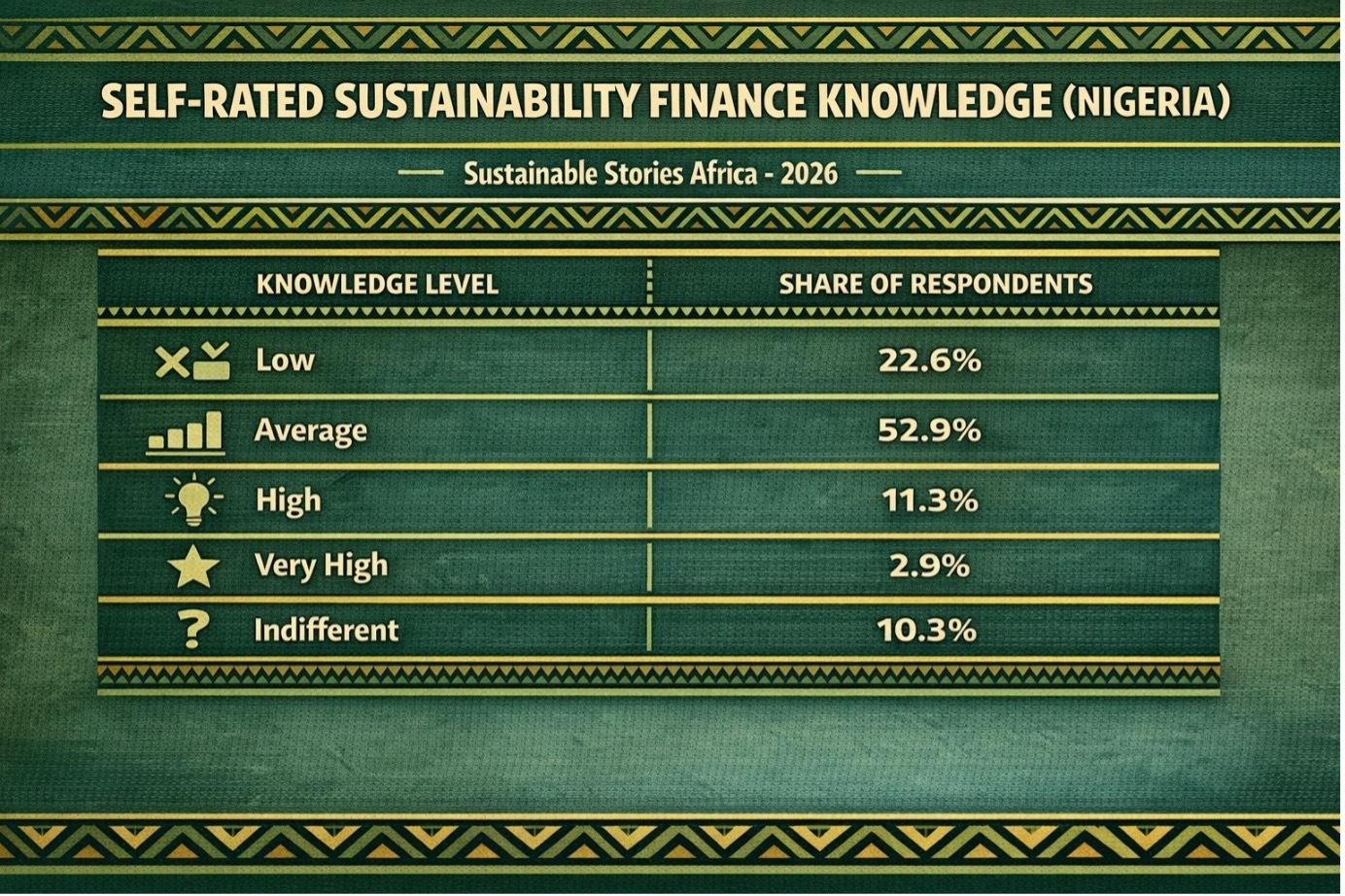

At the headline level, the data are stark. Just over half of surveyed professionals – 52.9%, rated their sustainability finance knowledge as "Average." A further 22.6% reported "Low" knowledge. Only 11.3% described their understanding as "High," and fewer than 3% claimed "Very High" familiarity.

In other words, fewer than one in seven professionals believe they possess strong expertise in sustainability finance.

This matters because these respondents include accountants, auditors, bankers, tax specialists, procurement officers, and project managers. These are roles central to capital allocation, reporting, and governance.

As Nigeria prepares for stricter ESG disclosure requirements and deeper integration of climate risk into financial decision-making, this distribution suggests a fragile human-capital base. Policies may be advancing faster than the people expected to implement them.

Geography Shapes Knowledge More Than Titles

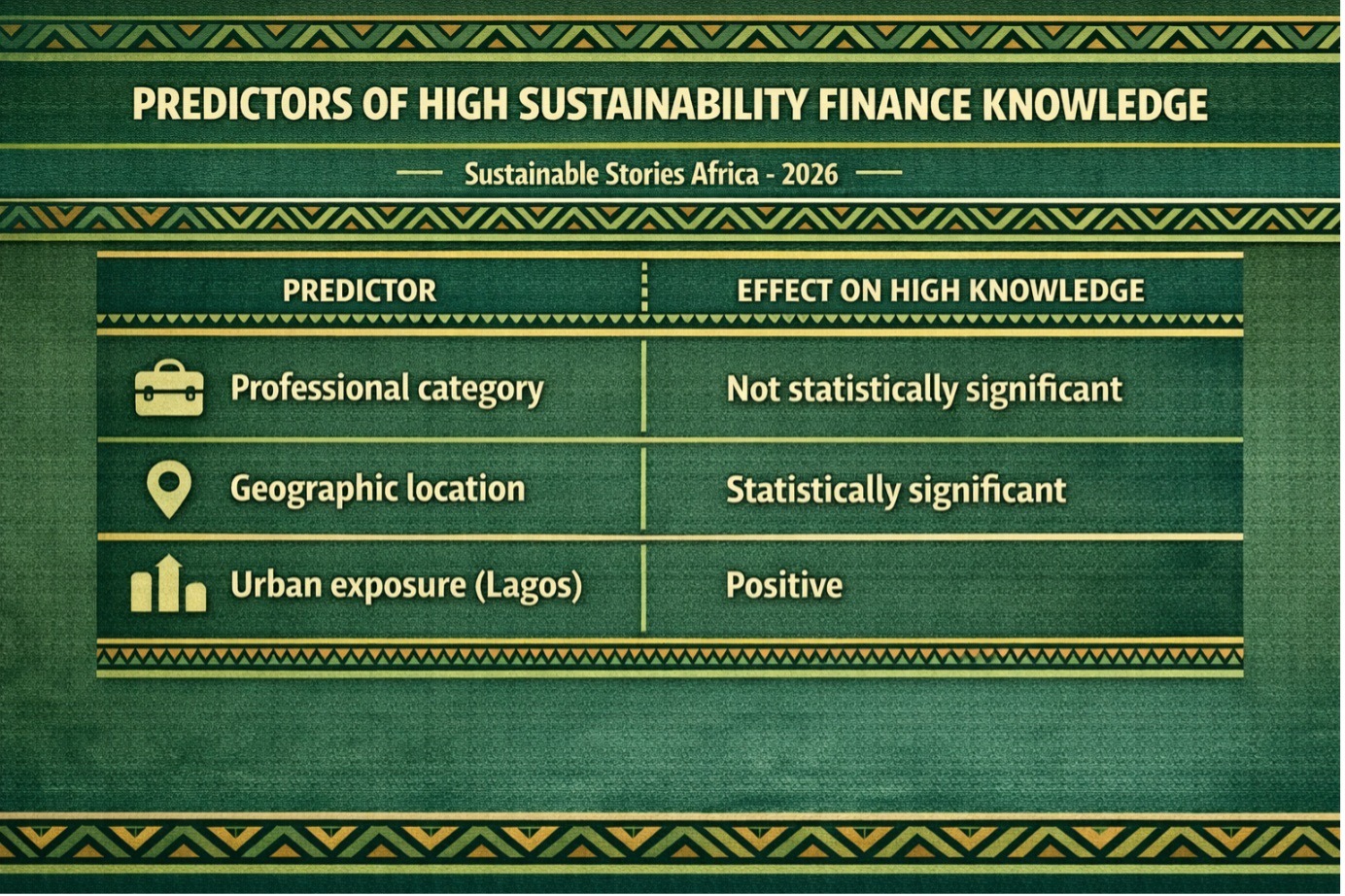

One of the study's most counterintuitive insights is that professional background does not automatically translate into stronger sustainable finance literacy.

An independent-samples t-test revealed a statistically significant gap between finance and non-finance professionals, but in the opposite direction to what was expected.

Finance professionals reported marginally lower average knowledge scores in comparison to their non-finance peers. The researchers suggest this may reflect more critical self-assessment among accountants and bankers, who better understand the technical bar, while non-finance respondents may overestimate their competence.

Geography, by contrast, exerts a clearer influence. A one-way ANOVA showed significant location-based differences, with Lagos respondents reporting the highest knowledge levels, followed by Abuja and then Kano. Logistic regression confirmed that location, and not profession, was a significant predictor of "High" or "Very High" self-reported knowledge.

The signal is structural. Access to training, ESG-focused institutions, conferences, and professional networks remains unevenly concentrated in Nigeria's leading commercial centres, reinforcing regional disparities in sustainable finance capabilities.

Self-Rated Sustainability Finance Knowledge (Nigeria)

| Knowledge Level | Share of Respondents |

|---|---|

| Low | 22.6% |

| Average | 52.9% |

| High | 11.3% |

| Very High | 2.9% |

| Indifferent | 10.3% |

Why Closing the Knowledge Gap Matters

This is not a debate about abstract skills. Sustainability finance literacy determines whether professionals can price climate risk, structure green instruments, audit ESG disclosures, and advise clients with credibility.

Where knowledge is thin, adoption slows, compliance erodes, and green finance risks are on the verge of sliding into box-ticking. In a system where sustainable finance underpins competitiveness and access to capital, knowledge becomes a strategic asset.

The findings also unsettle a familiar policy shortcut: assuming finance professionals will naturally carry sustainability expertise into organisations. Without targeted, context-specific training, neither finance nor non-finance staff develop deep competence by default.

Lagos's higher scores help to underscore the fact that exposure matters; workshops, networks, regulatory engagement, and peer learning help build literacy.

Replicating these ecosystems, rather than rolling out generic national programmes, could accelerate capability-building in secondary cities.

Predictors of High Sustainability Finance Knowledge

| Predictor | Effect on High Knowledge |

|---|---|

| Professional category | Not statistically significant |

| Geographic location | Statistically significant |

| Urban exposure (Lagos) | Positive |

Capacity Building Must Become Place-Based

The study points toward a clear policy response. Capacity-building strategies must be geographically targeted, not professionally assumed. Lagos-style training ecosystems – combining regulators, professional bodies, financial institutions, and academia - need to be extended to cities such as Kano, Kaduna, and beyond.

Professional associations must embed sustainability finance competencies into continuing professional development requirements, grounded in objective assessments rather than self-ratings alone.

At the same time, regulators and standard setters must acknowledge that imposing disclosure mandates without parallel investment in skills development risks widening, rather than closing, compliance gaps.

Regulation alone cannot scale Sustainable finance. It requires people who understand the instruments, the risks, and the trade-offs.

PATH FORWARD – Building Literacy Before Scaling Capital

Nigeria's sustainable finance challenge is as much cognitive as financial. Evidence shows that location, not job title, shapes who truly understands ESG and climate finance tools.

The priority now is targeted, place-based training, linking regulation, professional development, and local ecosystems, so that sustainable finance frameworks translate into practice, not just policy.