Over the past decade, Sustainability Reporting in Nigeria has rapidly evolved, shifting from a compliance exercise to a driver of corporate credibility and long-term financial value.

Companies such as Airtel, Aradel, Dangote Cement, IHS Towers, Julius Berger, MTN Nigeria, Sahara Group, Seplat, Stanbic IBTC, and Unilever have set a new pace by producing consecutive annual sustainability reports from 2022 to 2024.

Their disclosures, which encompass both global standards and local regulations, offer consistency, contrasting with efforts found elsewhere in the private sector.

These ten companies’ reports come at a critical time. In 2024, sustainable finance topped $5.8 trillion globally, with markets and investors now demanding rigorous, verified disclosures.

For Nigeria, this marks the beginning of a dynamic “reporting imperative.” These leading companies demonstrate that robust transparency on environmental, social, and governance (ESG) risks is not just good practice, but an integral part of gaining market trust, social license to operate, community value, and regulatory alignment.

As Nigeria faces mounting challenges from climate shocks, social inequality, and global market volatility, the companies featured in this spotlight show how bold, quantifiable action is possible. Through cleaner energy, resilient infrastructure, inclusive stakeholder engagement, and deep local alliances, they are demonstrating that reporting isn’t just a matter of compliance; it is an engine for meaningful, measurable progress.

Airtel Africa

| Year | SDGs Reported | Materiality & Strategy | Sustainable Spend | Partnerships & Collaborations | Reach / Impact | Major Projects & Initiatives | Future Commitments | Other Key Notes |

|---|---|---|---|---|---|---|---|---|

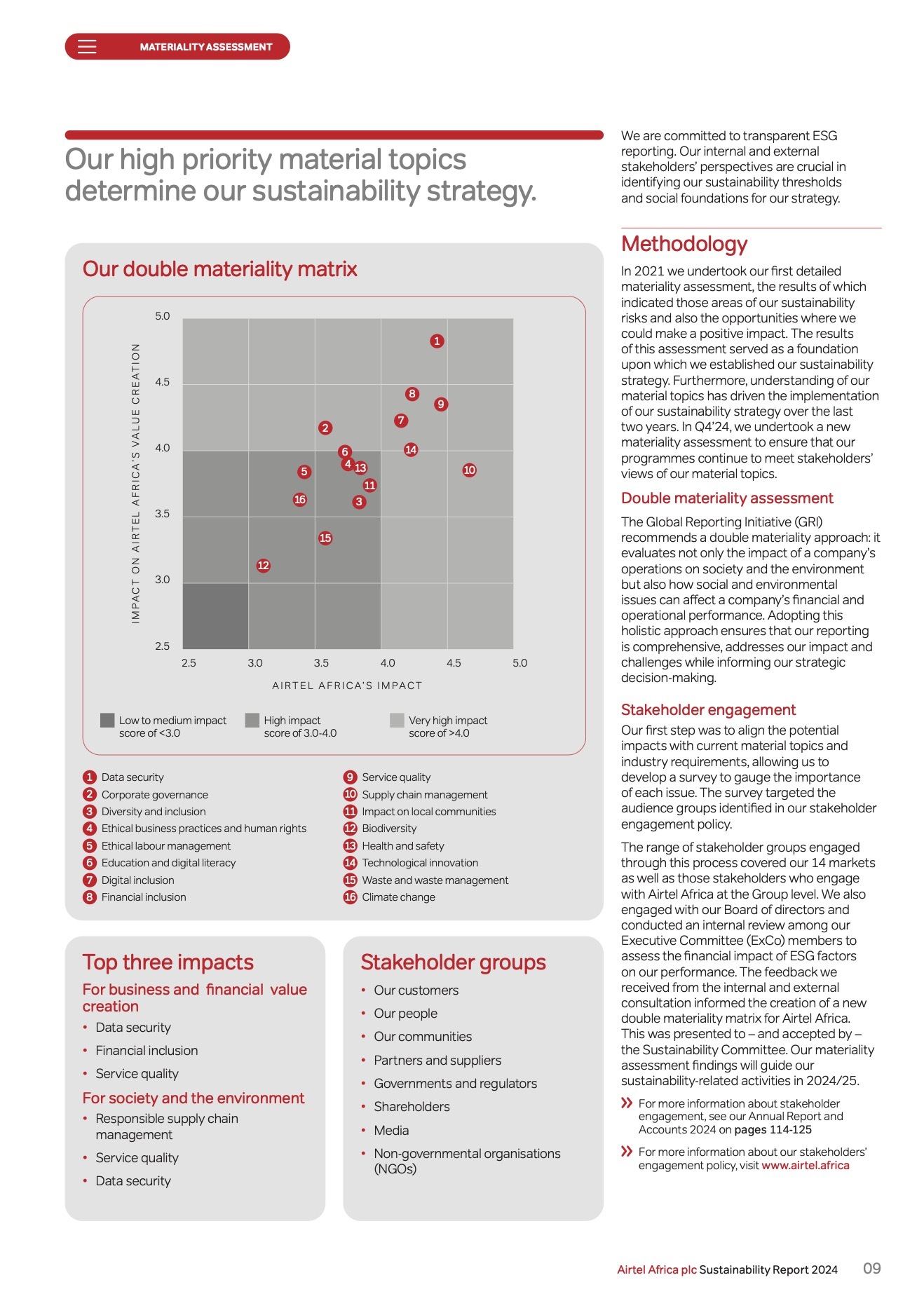

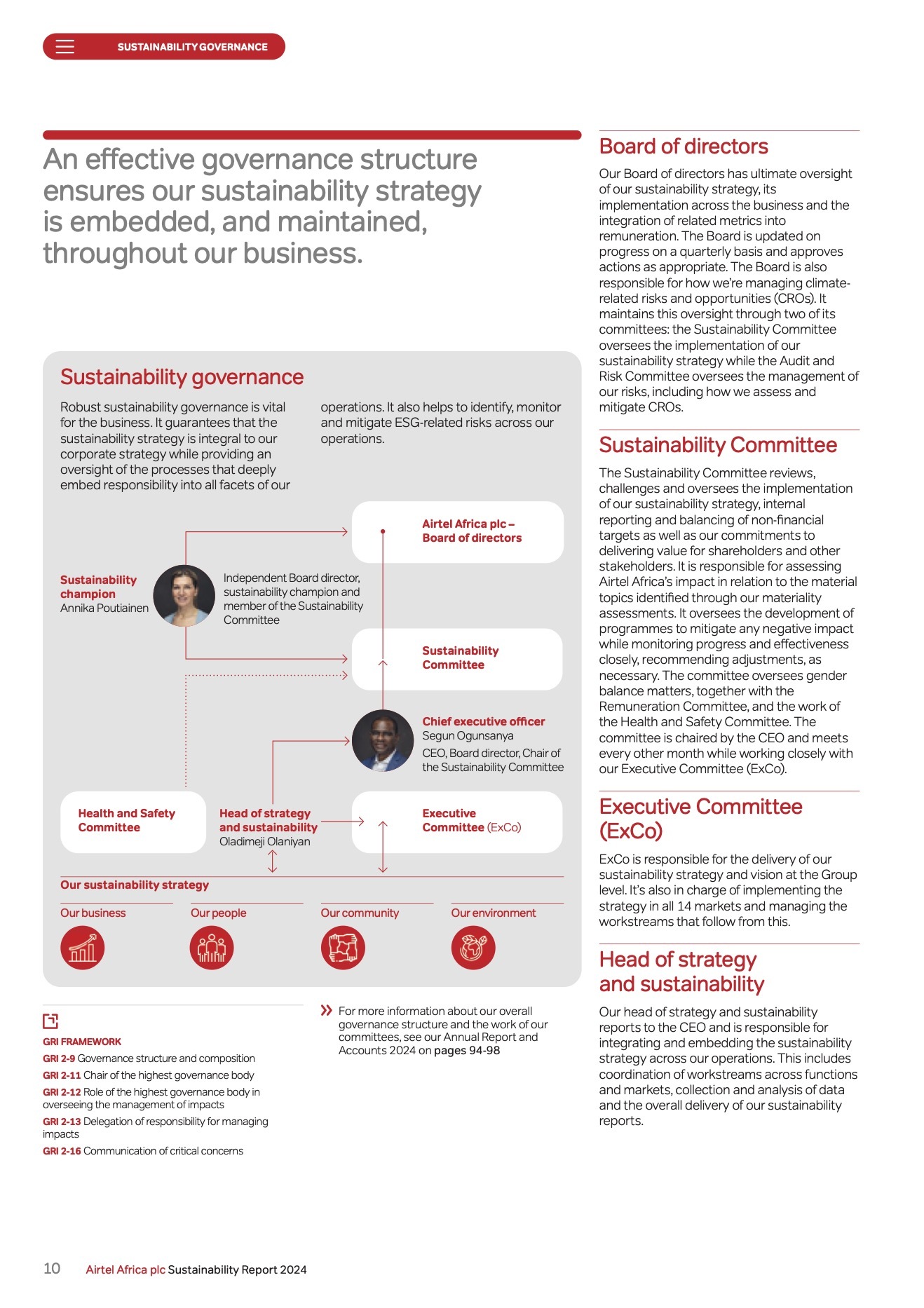

| 2022 | SDG 4, 5, 8, 9, 10, 12 | Single materiality assessment: 24 topics, 18 high-priority; 4-pillar strategy | Not fully disclosed; UNICEF 5-yr $57m partnership | UNICEF (school connectivity), UNGC, GSMA, JAC, American Tower | 14 countries, 134.7m customers; 48.6m data users; 29.7m Airtel Money users; 50.6% rural, 598m footprint | ISO 27001/22301 cert; VoLTE, rural expansion, water projects, digital centre Kibera | Net zero 2050, lithium battery by 2040, 40% fibre by 2030 | Scope 1+2: 115,719 tCO2e; 30,149 sites; Board Sustainability Committee |

| 2023 | “ | Double materiality; top: data security, inclusion, quality, supply chain | $2.3m+; ongoing UNICEF partnership | UNICEF (1,200 schools), ATC, Stockholm Inst., JAC, COP28 | 144m+ customers, expanded digital & financial inclusion, 921 rural sites | VoLTE commercialization, SmartCash, PCI DSS/ISO recert, Nxtra, lithium battery rollout | Net zero 2050, Scope 1+2 intensity reduction, ISO 14001 | Scope 1+2: 114,842 tCO2e, 34,500 infra sites, 22.3% on fibre |

| 2024 | “ | GSMA/GRI/TCFD-aligned, board risk/oversight, external assurance | $1.95m (infra/services), $1.4m to UNICEF; 1,200 schools, 1.7m kids | UNICEF, ATC, Stockholm Inst., JAC, COP28 | 152.7m customers (+13.4%), 64.4m data (+17.8%), 38m Airtel Money (+20.7%) | 5G RAN PoC, Nxtra launch, PCI DSS/ISO, lithium install, 99.3% hazardous recycling | Net zero 2050, Scope 1+2 –62% by 2032, GSMA ESG, procurement | Scope 1+2: 128,503 tCO2e, Board/Audit Risk governs |

Key Notes: Education access scaled up (1,200 schools/1.7million children in 2024); gender/diversity improvements; region-leading circularity; energy upgrades and strong board ESG integration.

Aradel Holdings

| Year | SDGs Reported | Materiality & Governance | Sustainability Spend | Key Partnerships | People/Communities Reached | Major Projects | Future Commitments | Additional Notes |

|---|---|---|---|---|---|---|---|---|

| 2022 | SDGs 1, 3, 4, 6, 7, 8, 9, 11, 14, 15 | Four pillars: economic, social, governance, environment; Board/CEO oversight | ₦313.3m (bursaries, PHC, health, infra, flood) | MURALI Trust, sectoral, academic orgs | 100 bursaries, infra/water/health projects, all host communities | 8+ infra projects, town halls, roads, water | Continue ISO 14001, zero spills, reduce impact | 99% local sourcing, 16.4m HSE man-hours zero fatality |

| 2023 | SDGs 1, 3, 4, 6, 7, 8, 9, 11, 14, 15 | Formalising, Board of governance, ISO 14001, systems | Not itemised; 3% OPEX to MURALI, water, infra | MURALI Trust, gov, renewables | 6+ host communities, 60+ youth elderly, infra | PHC upgrades, skills, security | Scale renewables, deeper digitisation | 734k HSE hours, 241 staff, 99.24% local contracts |

| 2024 | SDGs 1, 3, 4, 7, 8, 9, 11, 14 | Subsidiary boards, KPIs, AI-based; ISO 14001/9001 | Not consolidated; ongoing health/conservation | World Bank GGR Partnership, local orgs | 120 trained youth, 500+ stakeholders, all host | Solar mini-grids, roads, and conservation | Flaring out by Q4 2025, ISO 27001/IFRS S1/S2 | AI cut energy 22%, 96.44% local sourcing, low attrition |

Key Notes: Zero fatalities (2022–24); AI reduced refinery energy 22%; flaring phase-out (2025); aggressive digitisation; HSE best practice; strong community inclusion.

Dangote Cement

| Year | SDGs Reported | Materiality & ESG Focus | Sustainability Spend | Partnerships | Impact/Reach | Key Projects/KPIs | Future Commitments | Notes |

|---|---|---|---|---|---|---|---|---|

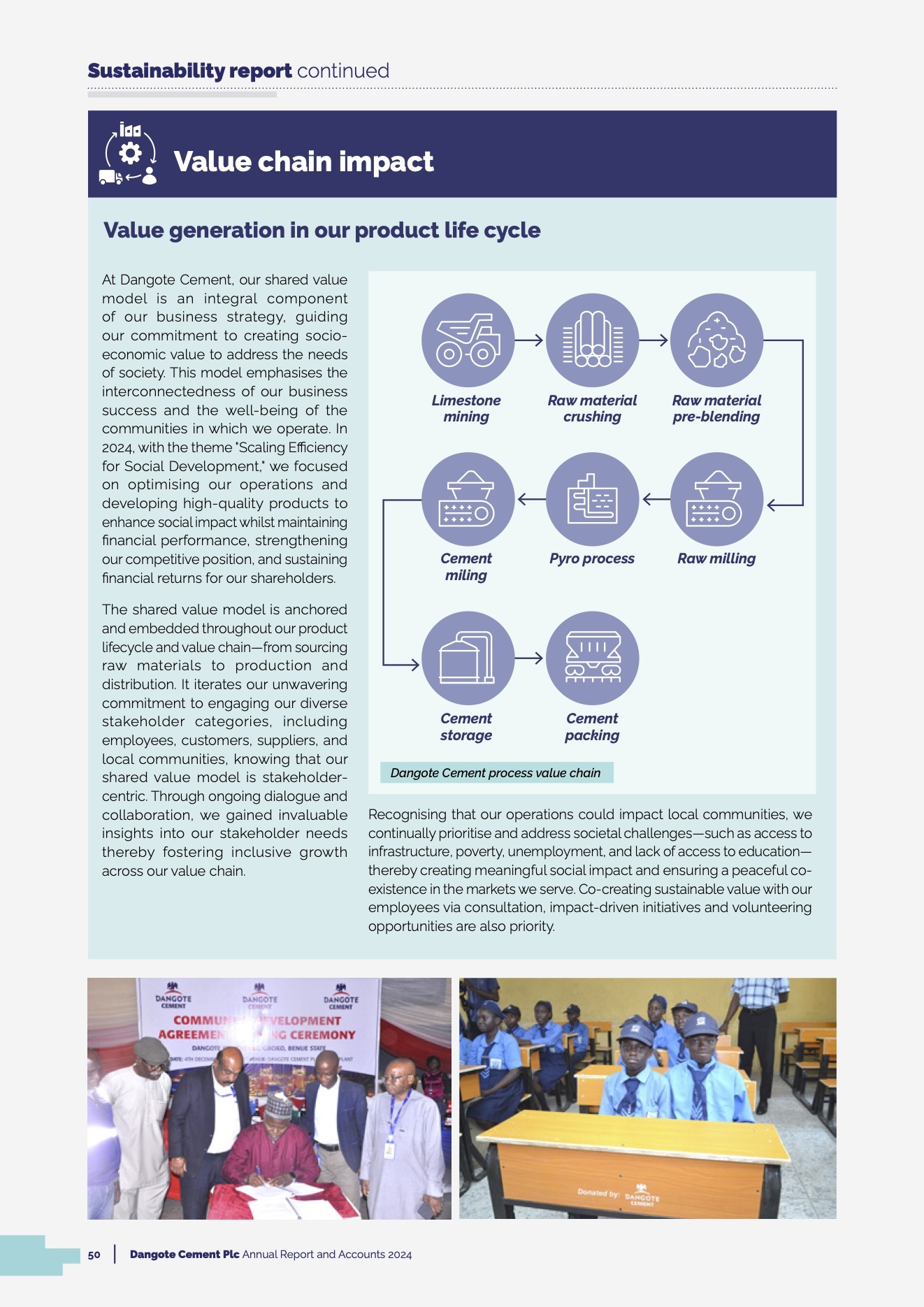

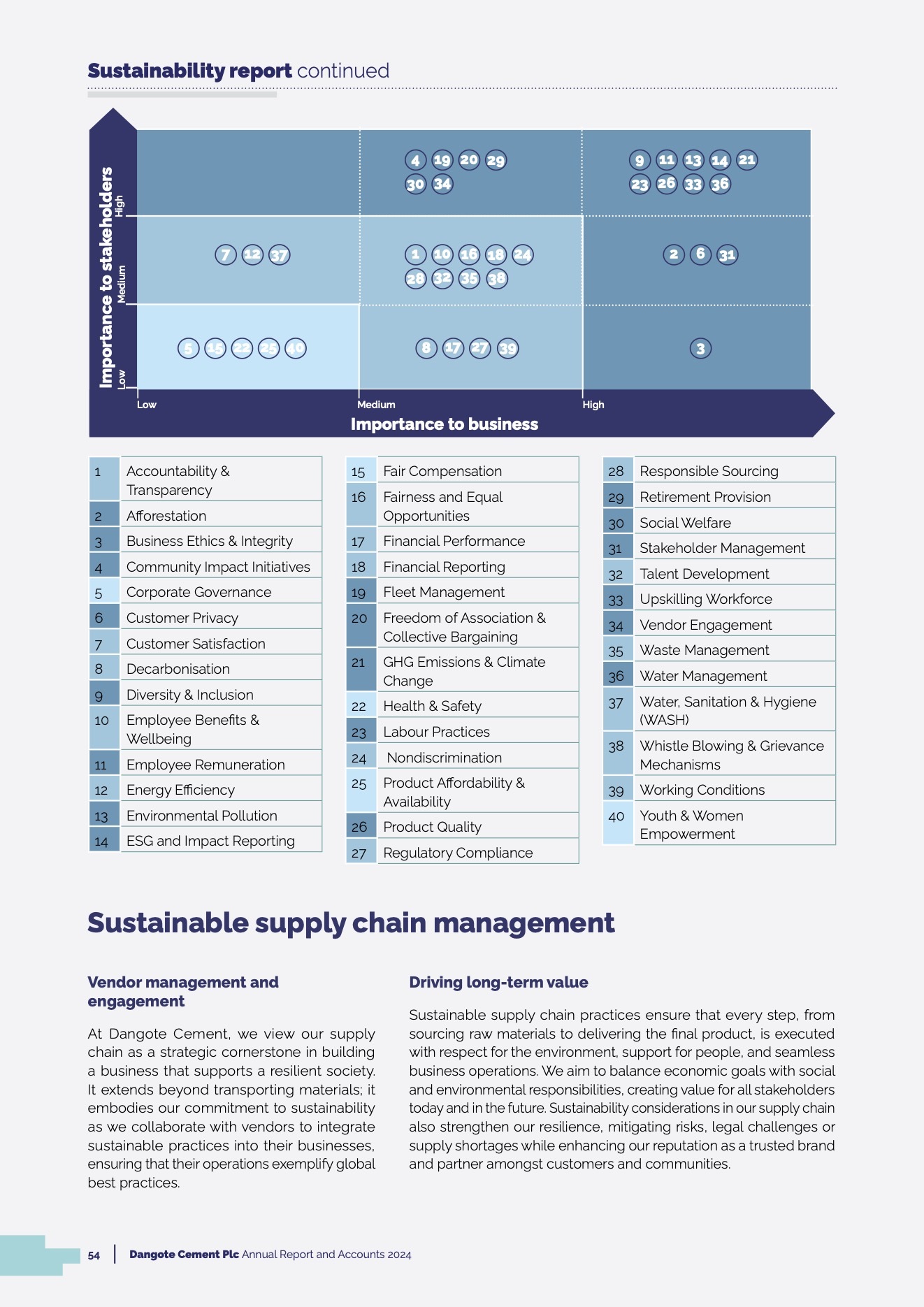

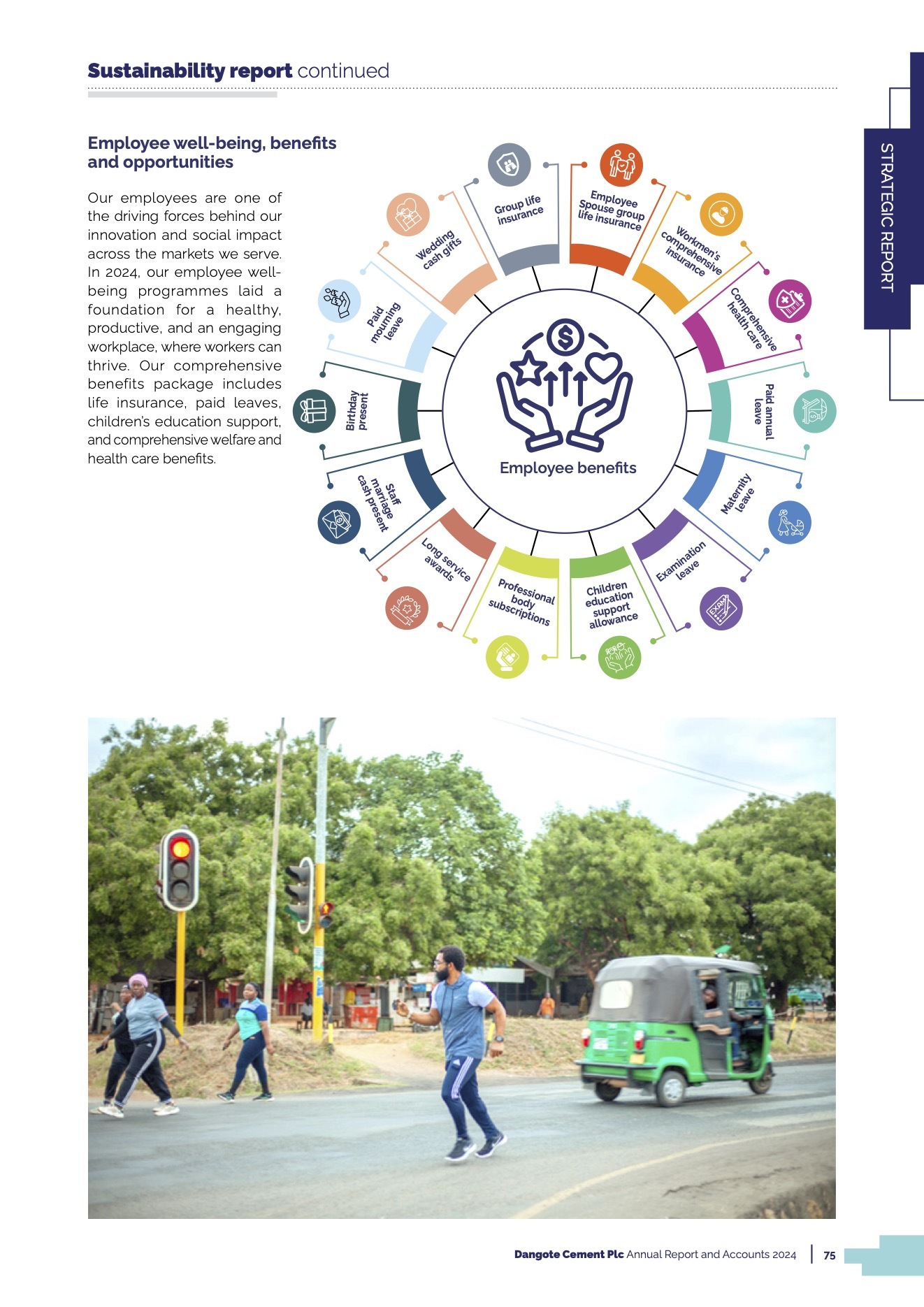

| 2022 | All SDGs focus on the 7-pillar path | Stakeholder review: climate, safety, gov., GHG, waste priority | ₦1.648bn social (+1.65bn total); ₦496bn Procurement | UNGC, GCCA, KPMG, government | 27,450 trainees, 763 engagements, 169 grievances, >100k green jobs | 71 comm. projects; AF system | 25% TSR by 2025, sustain embed across pillars | Scope 1: 17.7m tCO2, 15% women in senior mgmt |

| 2023 | UN SDGs, climate/circularity, diversity, health | Mat. review: decarb, HSE, inclusion | +social spend YoY, more procurement | Community MoUs, sector partners | Up workforce/diversity, pan-African projects | Tree planting, 70+ projects, inclusive policies | AF, CNG, digitalisation, net zero, inclusion | Lower CO2, higher diversion, best EBITDA |

| 2024 | UN SDGs, climate/circular at core | Digital ESG checks, diversity, and inclusion | ₦12.4bn social investment (+427%) | MAN, World Bank, CDP, diversity groups | 12,155 employees, 55,030t waste, 101% GT intake | CNG, volunteer, KPIs | 649kg/t CO2, zero fatality, record ESG awards | Waste diversion +36%; new disability policy |

Key Notes: Social investment quadrupled; waste diversion soared; sectoral governance, innovation, and safety earned top industry recognition.

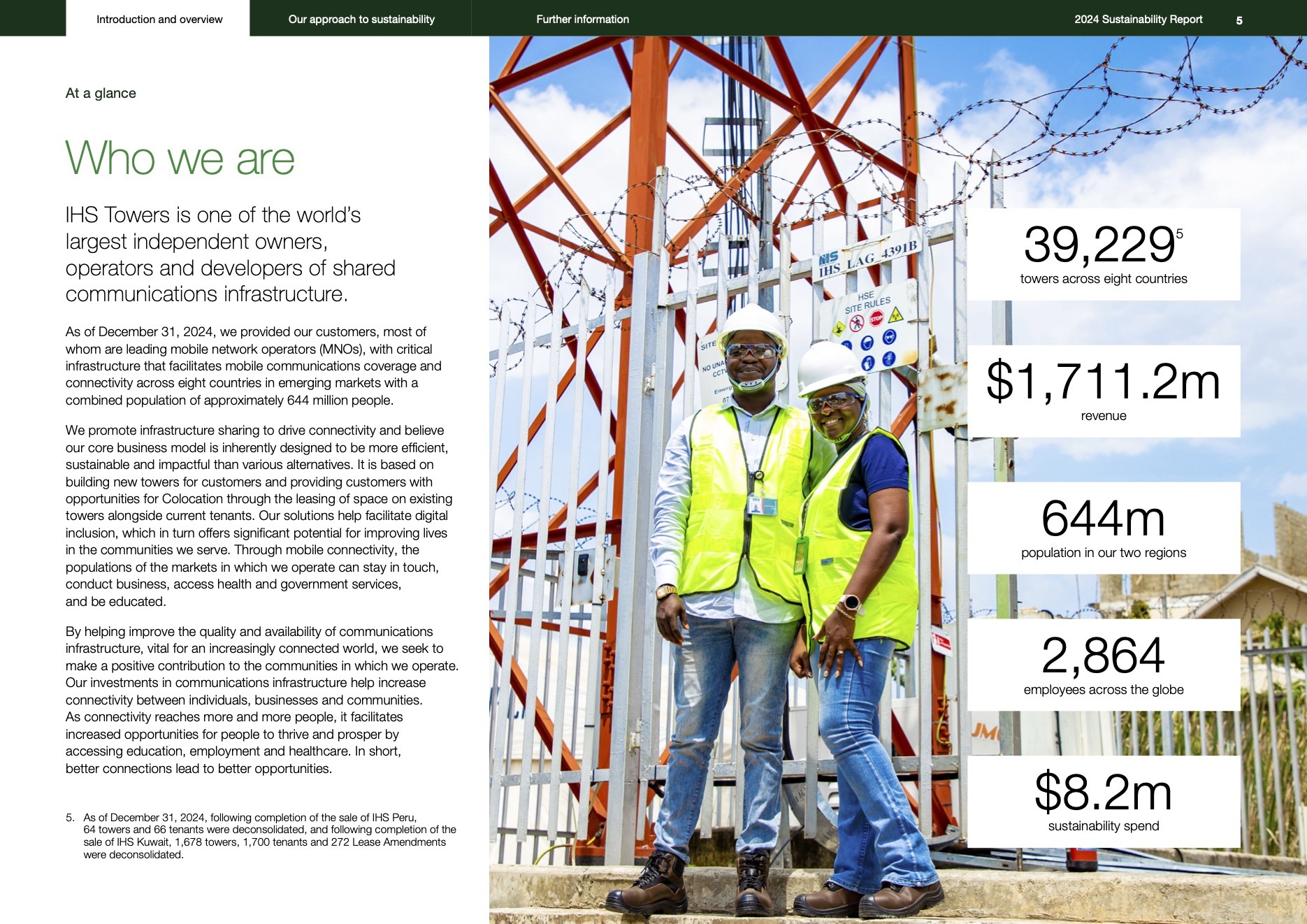

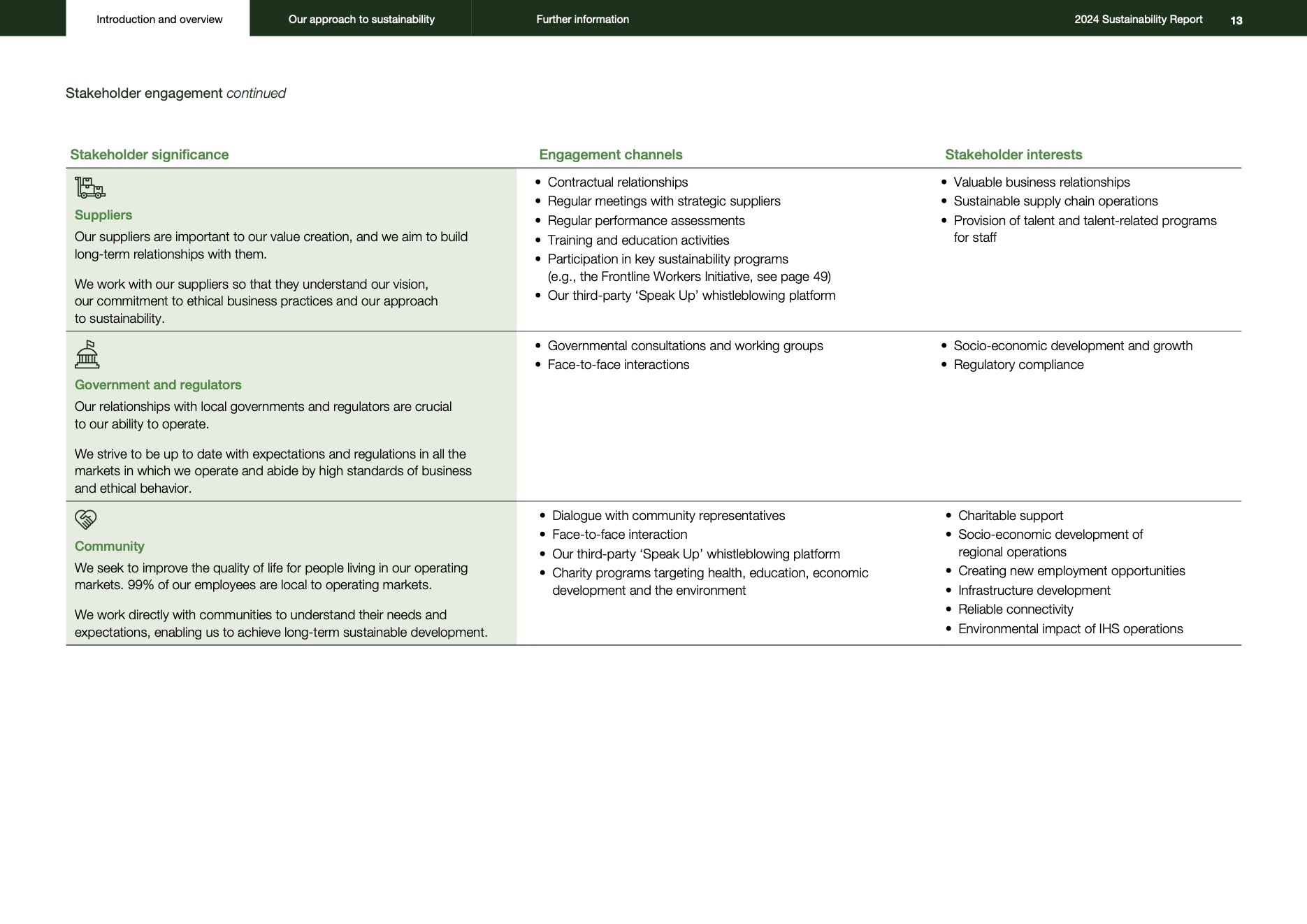

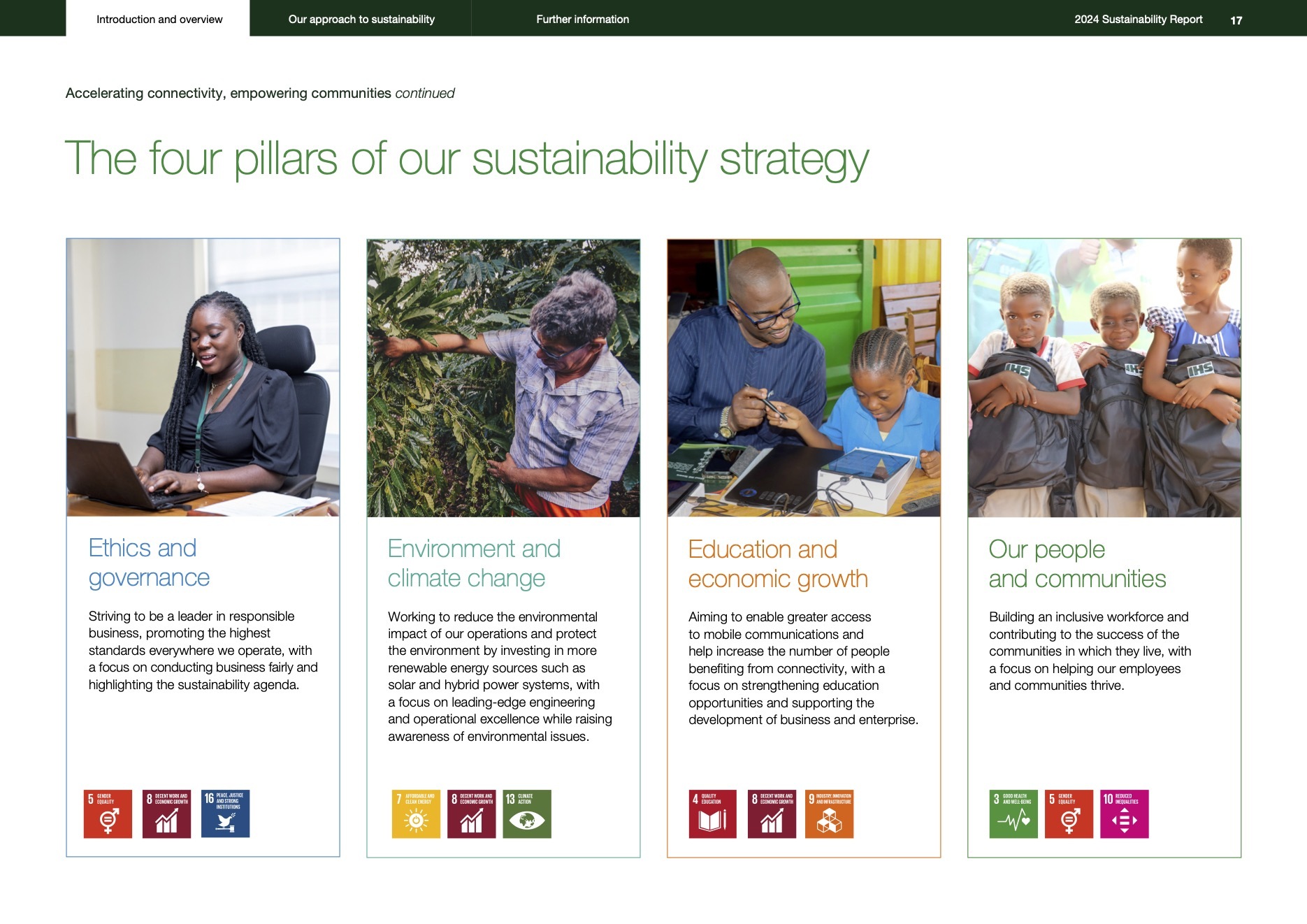

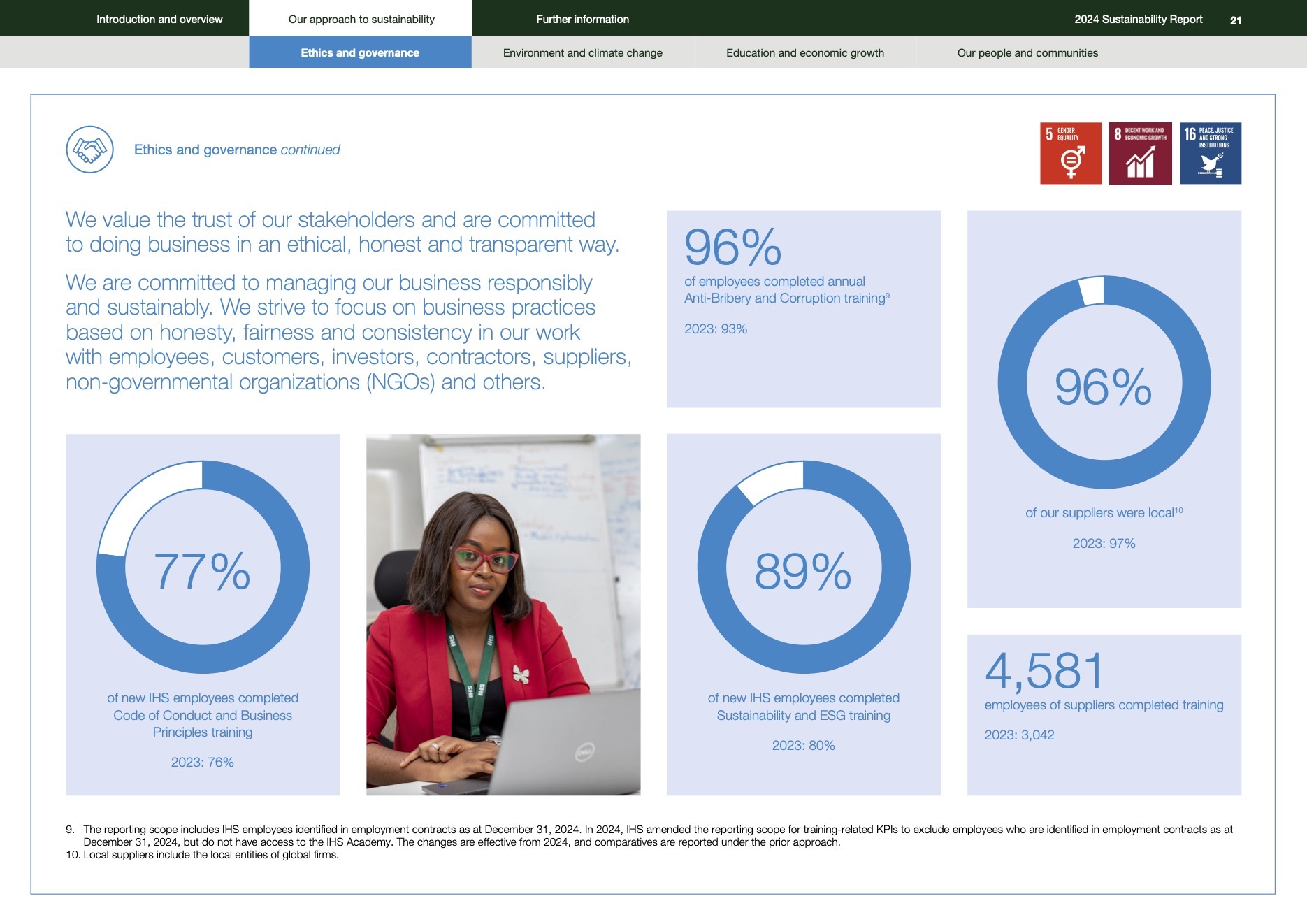

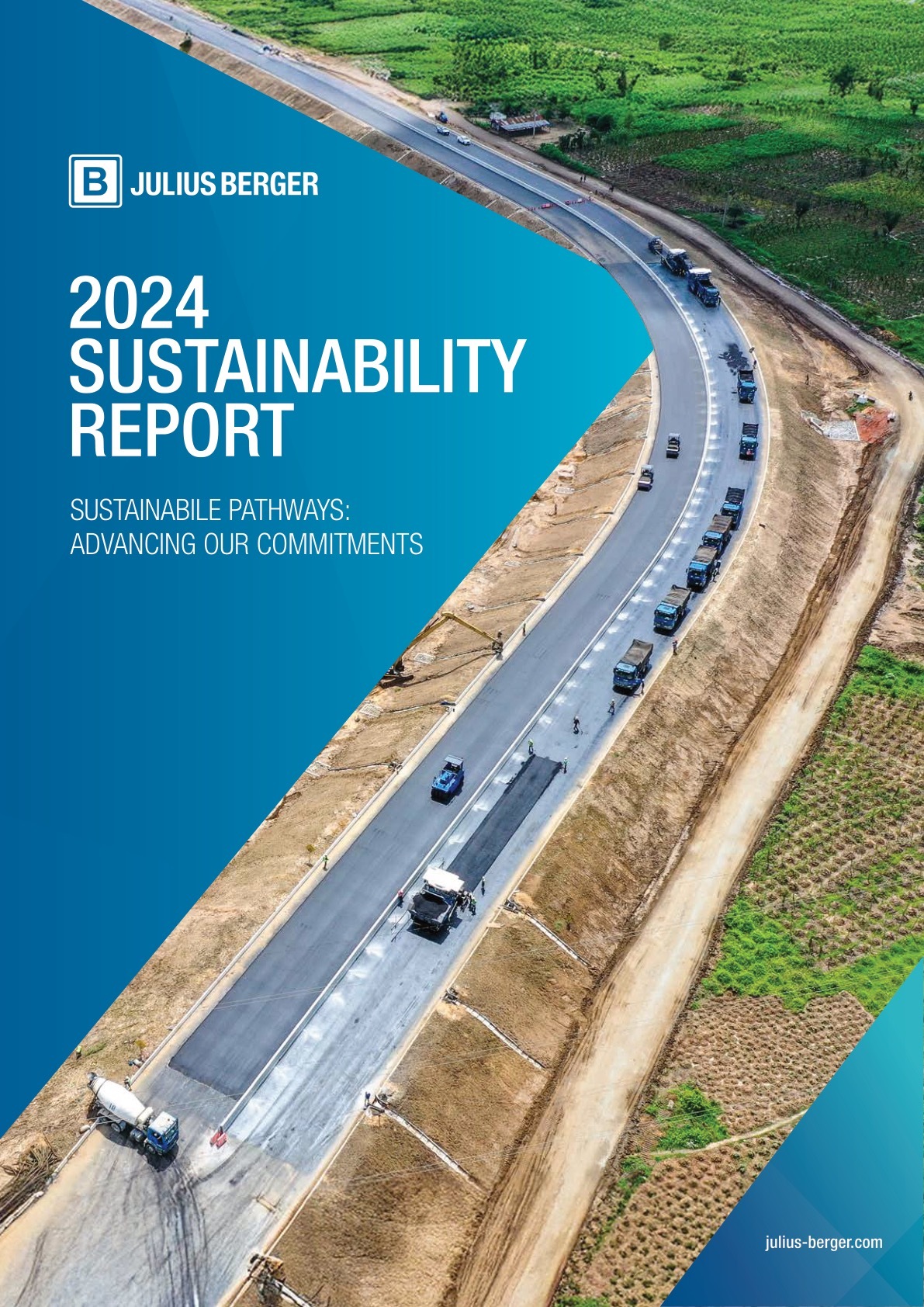

IHS Towers

| Year | SDGs Reported | Materiality & ESG Focus | Sustainability Spend (USD) | Partnerships | Reach | Projects Delivered | Future Commitments | Notes |

|---|---|---|---|---|---|---|---|---|

| 2022 | 9 core SDGs: 4,5,7,8,16 | 13-priority ESG topics, GRI/board | $7.5m (80% edu/community, +6%) | UNICEF Giga, UNGC | ~770m people, 485 solar sites | 196 (education, community, env) | 50% emission cut (2030), solar, stakeholder ESG | Zero fatality staff; Board-level ESG |

| 2023 | 9 SDGs (education, climate-focused) | 13 ESG topics, supplier ESG diligence | $7.0m (–7%), +$29m since ’17 | UNICEF, STEM, supplier ESG | 788m, 5,200 STEM, 601 solar | 186 projects | Project Green, STEM, renewable, supplier R&D | Zero fatality; $103m green invest |

| 2024 | 9 SDGs, more on water/sanitation | Inclusivity, emissions/energy, risk board | $8.2m (+17%), 93% to education | UNICEF, END Fund, NSSF, Cote d’Ivoire projects | 644m (exits trimmed), 623 solar, 109 women health | 194 projects (health, STEM, water, recycling) | AI, renewables, emissions, inclusion | Zero fatality, AI/ESG, 27% women, 33% directors |

Key Notes: $209m green investments; 600+ solar rural sites; education/employment amplification; global recognition for board ESG and risk.

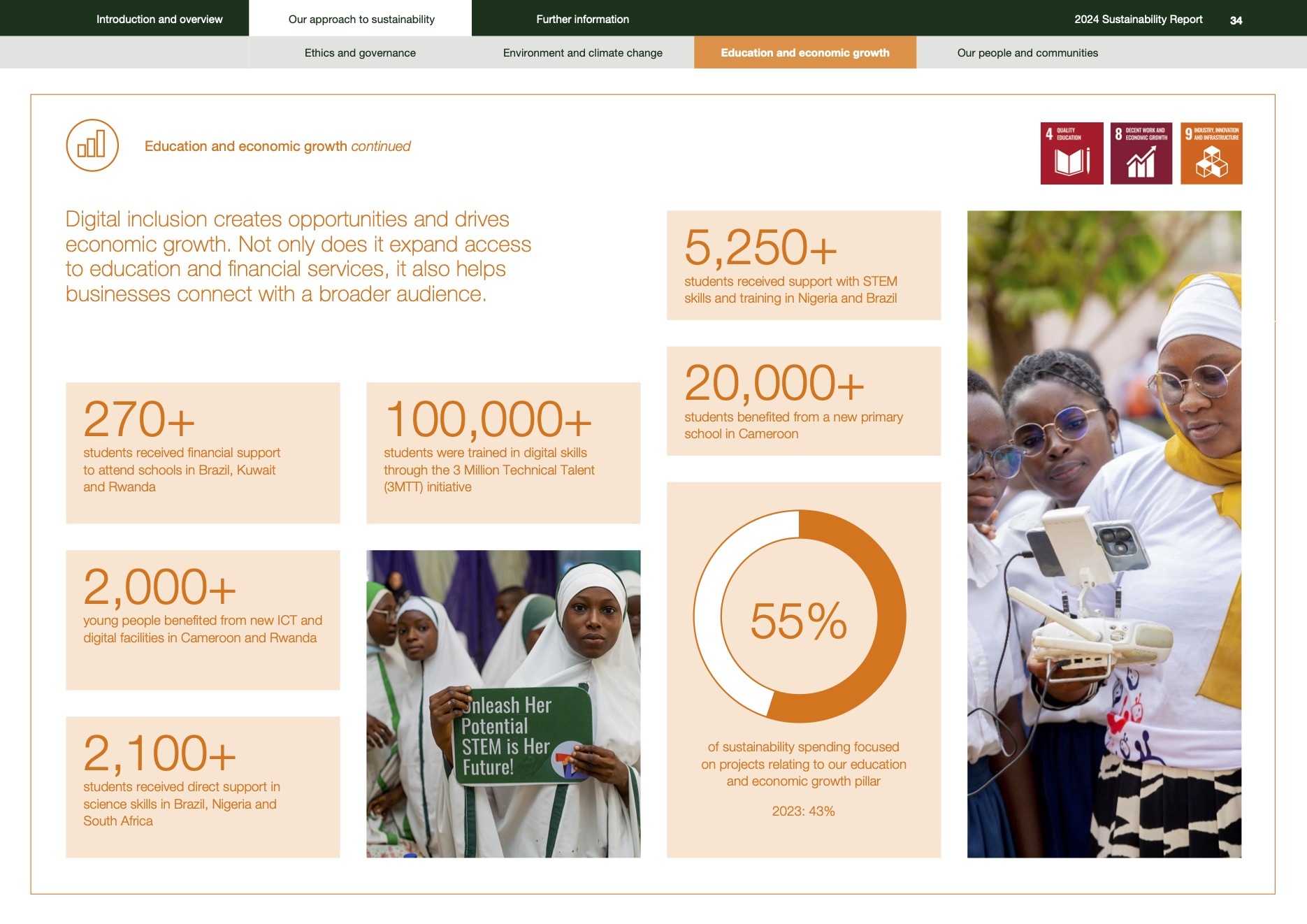

Julius Berger Nigeria

| Year | SDGs Reported | Materiality & ESG Structure | Sustainability Spend (₦) | Partnerships | People/Communities Reached | Major Projects | Future Commitments | Noteworthy Additions |

|---|---|---|---|---|---|---|---|---|

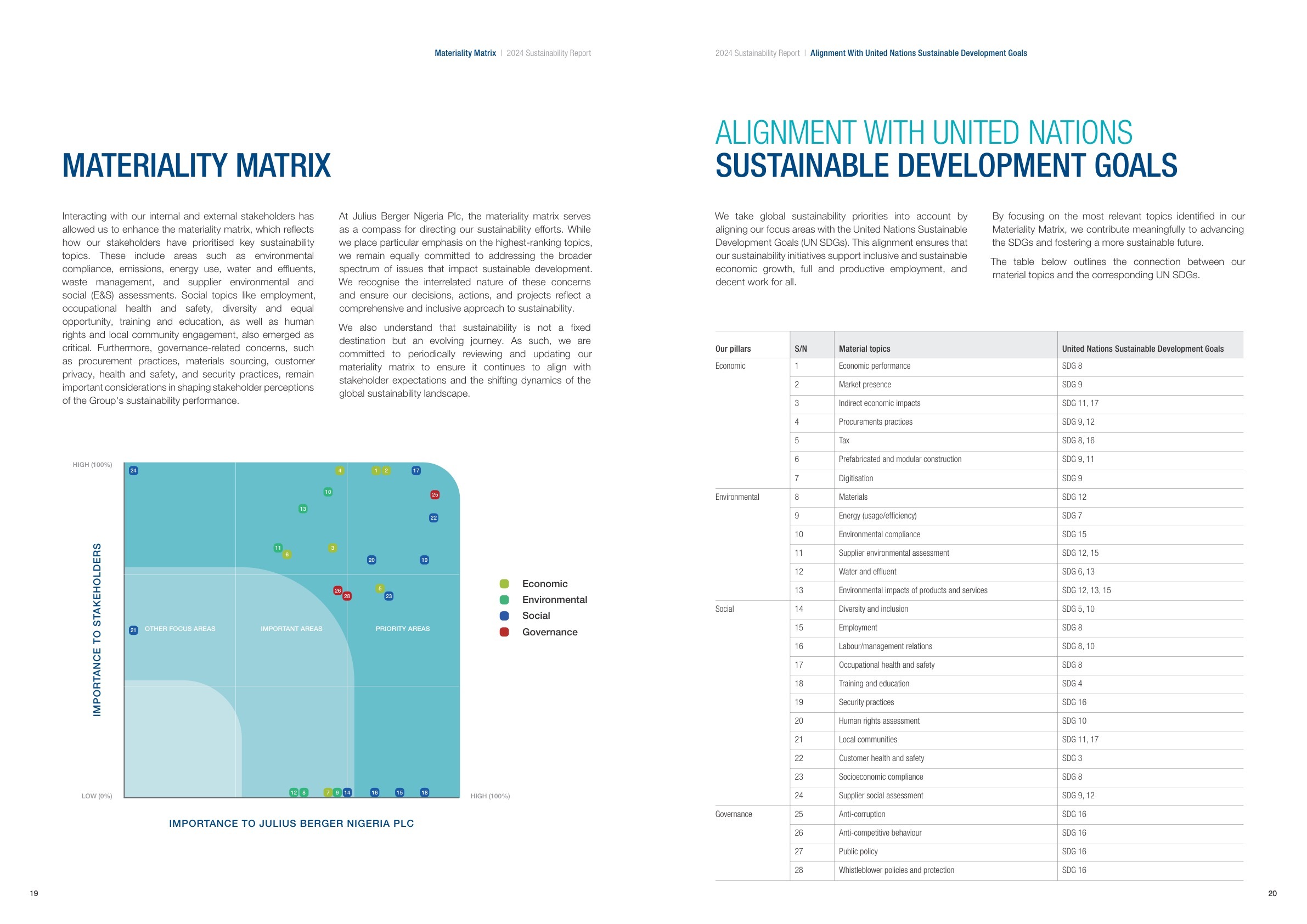

| 2022 | SDGs mapped to all pillars; emphasis on SDG 4, 5 (STEM scholarships) | Stakeholder-driven, 28 topics; governance at Board level | 507m (Education: 256.9m, Philanthropy: 142.1m, Community Dev: 98.4m) | UNGC, NLNG Bonny, FOCI-GIZ, HIV Trust Fund | 86 female engineering scholars, 330 cashew farmers, thousands via water/health/education | Second Niger Bridge, Lagos-Shagamu, cancer centre, hospitals, CSR infra | Smart/energy buildings, green concrete, circular economy, 5% workforce disability by 2025 | 150bn procurement (95% local), 97m staff dev, LTIFR 0.24, >10k staff |

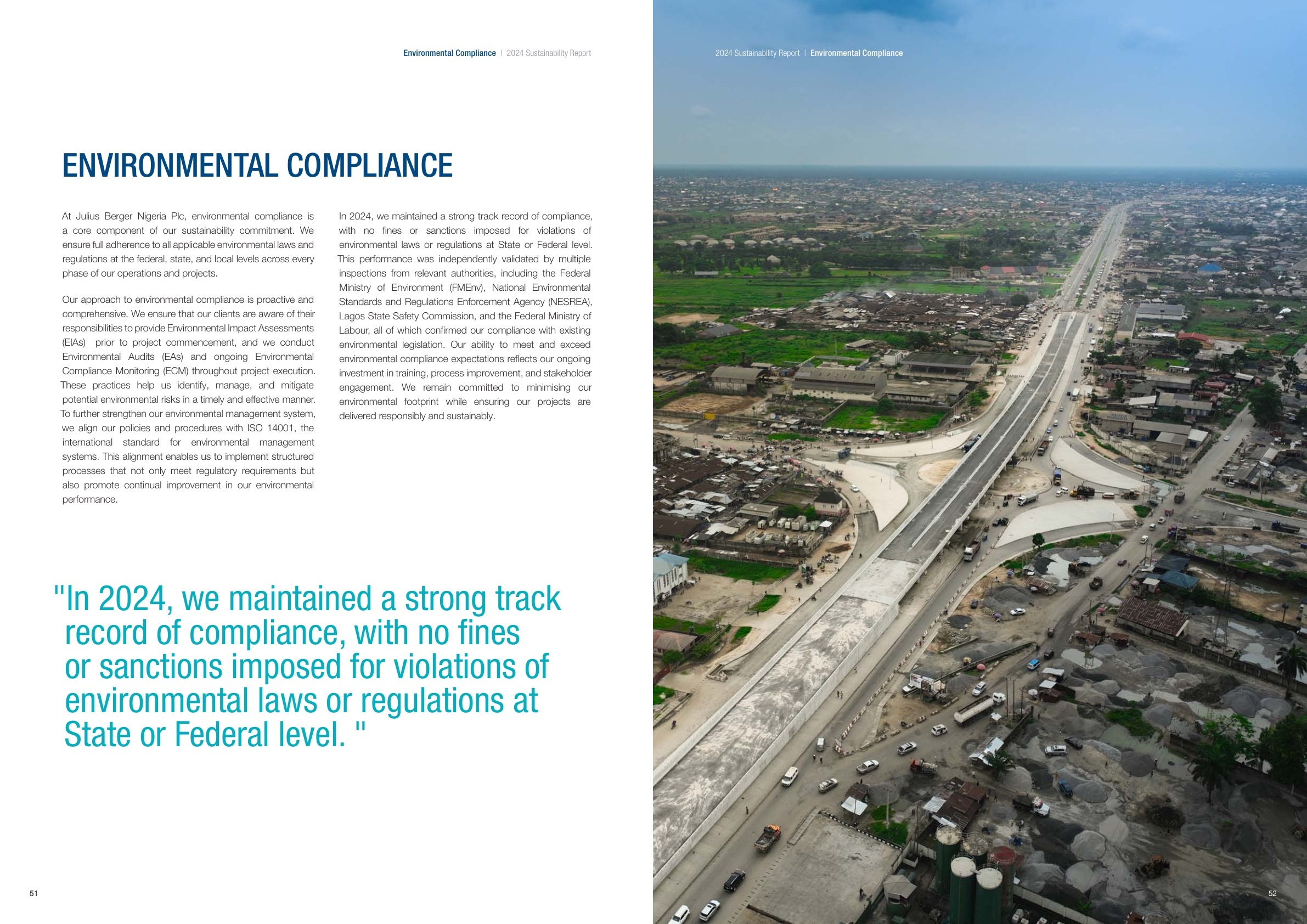

| 2023 | SDGs 3,5,6,7,8,9,10,11,12,13,15,16,17; materiality mapped & updated | Revalidated matrix, four ESG pillars, stakeholder engagement | 505m (education, community dev, health incl. 10 child surgeries) | Federal Medical Centre Jabi, ABU cold recycling, EcoVadis, UNGC | >10,000 employees (94% Nigerian), 202k+ training hours, 150 female STEM recipients | Bodo-Bonny, Opebi-Mende, NUPRC HQ green building, cold recycling | Solar scale-up, emission/resource data, circular economy, HR digitisation, female inclusion | 157bn local procurement (90%), LTIFR 0.11 (-54%), 84,199t CO2 baseline |

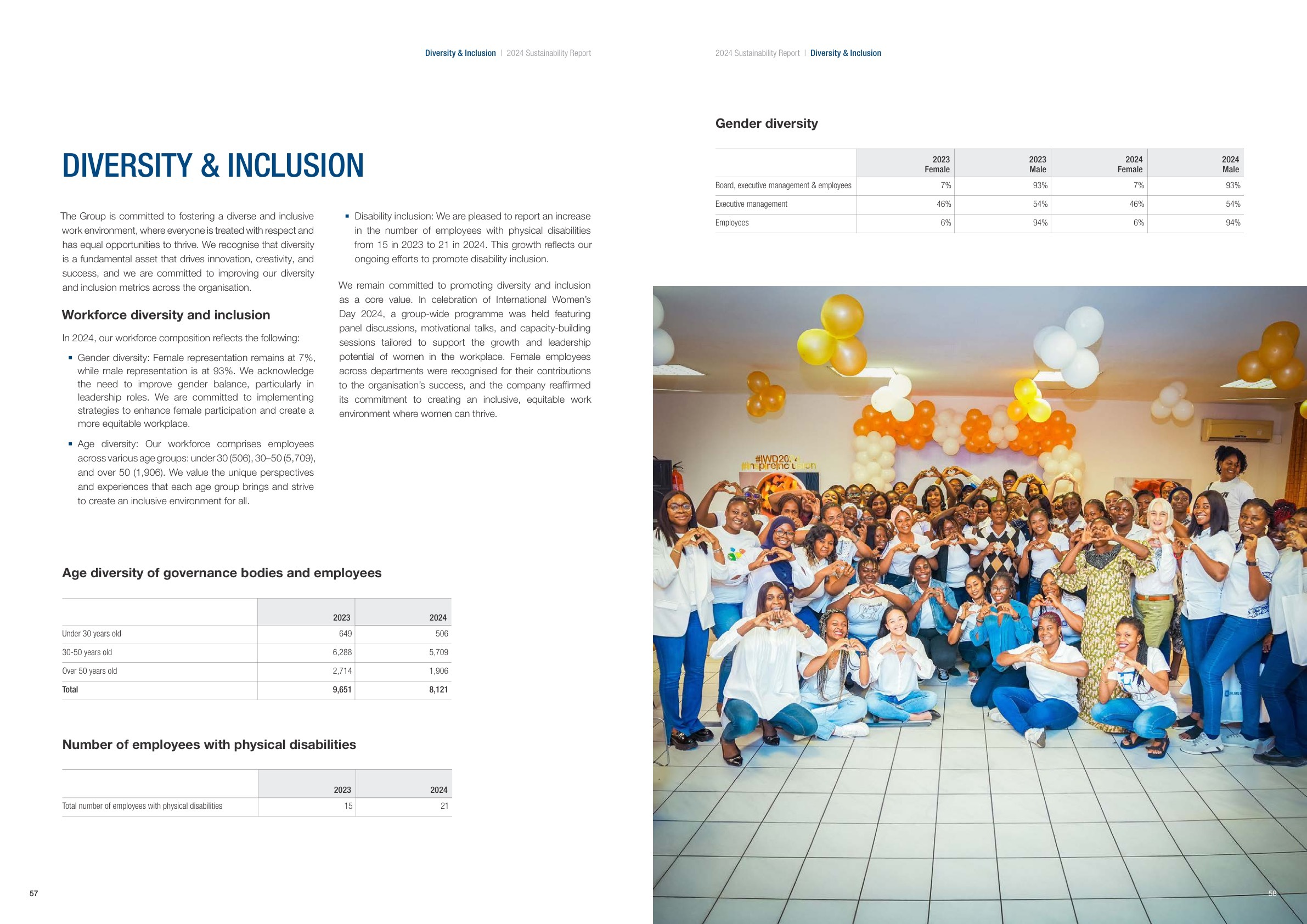

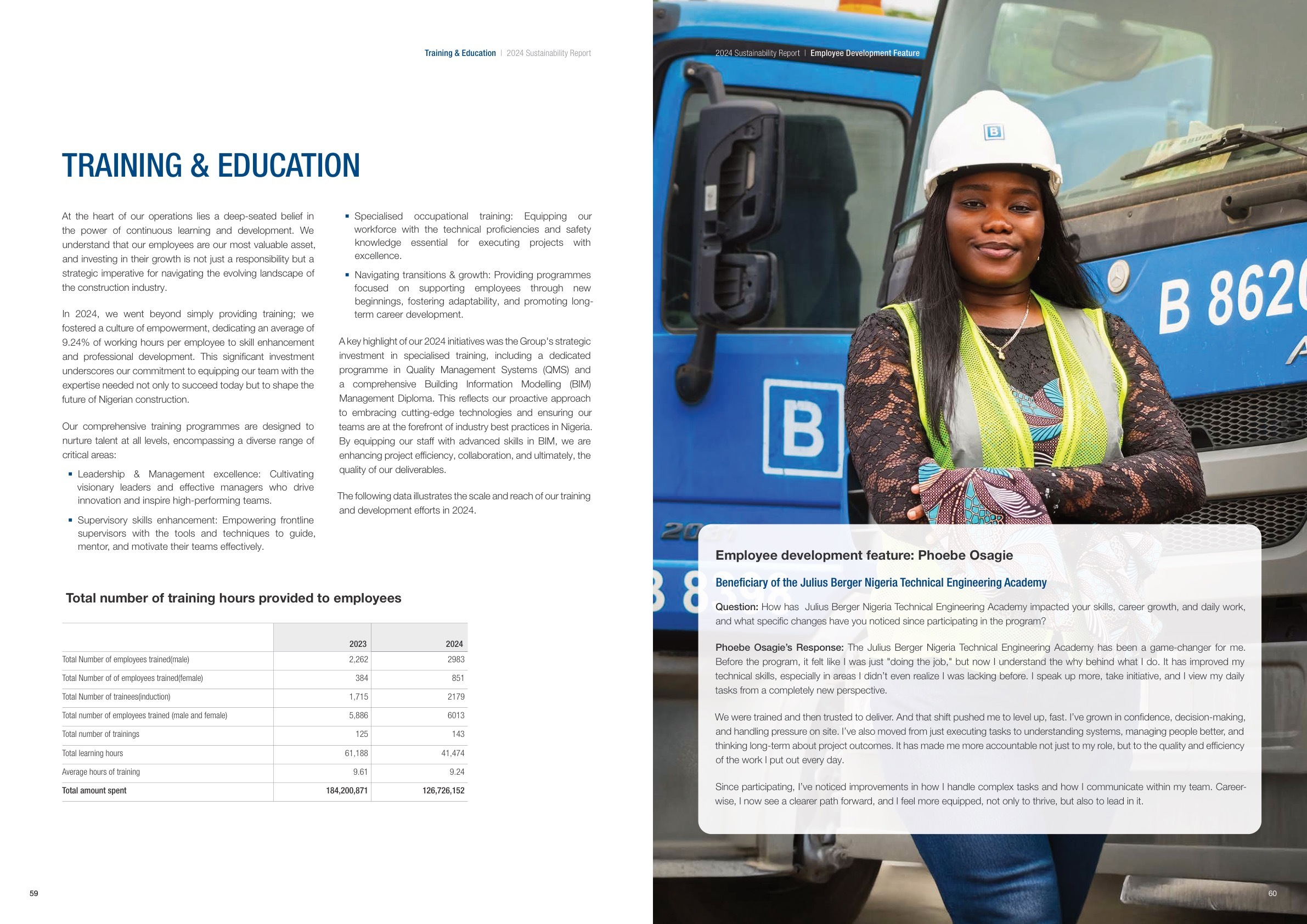

| 2024 | All business-linked SDGs; ISSB alignment, GRI/IFRS reporting preps | Stakeholder-driven matrix (16 issues), ESG supplier screenings (227 environmental, 204 social) | 555m (Education: 137m, Community Dev: 312m, Philanthropy: 102m) | IFC EDGE green building, NCF tree planting, Army housing, KNOSK School | 21 employees with disability, thousands via projects, 10 orphanages, 5,000 trees | Gbagada ICU, science labs, community roads, housing, sanitation, military camps | Formal Scope 1/2 targets, solar/renewable scale, recycling expansion, supplier ESG training | Revenue +25.6% (557bn), LTIFR <1 (14 yrs), 204bn (90%) local procurement |

Key Notes: Local procurement consistently above 90%; LTIFR improvement of 54% (2023); 14-year safety record; pioneering green building certifications; comprehensive supplier ESG screening.

MTN Nigeria

| Year | SDGs Reported | Materiality & ESG Structure | Sustainable Spend (NGN) | Partnerships & Collabs | People/Communities Reached | Major Initiatives/Projects | Future Commitments | Additional Notes |

|---|---|---|---|---|---|---|---|---|

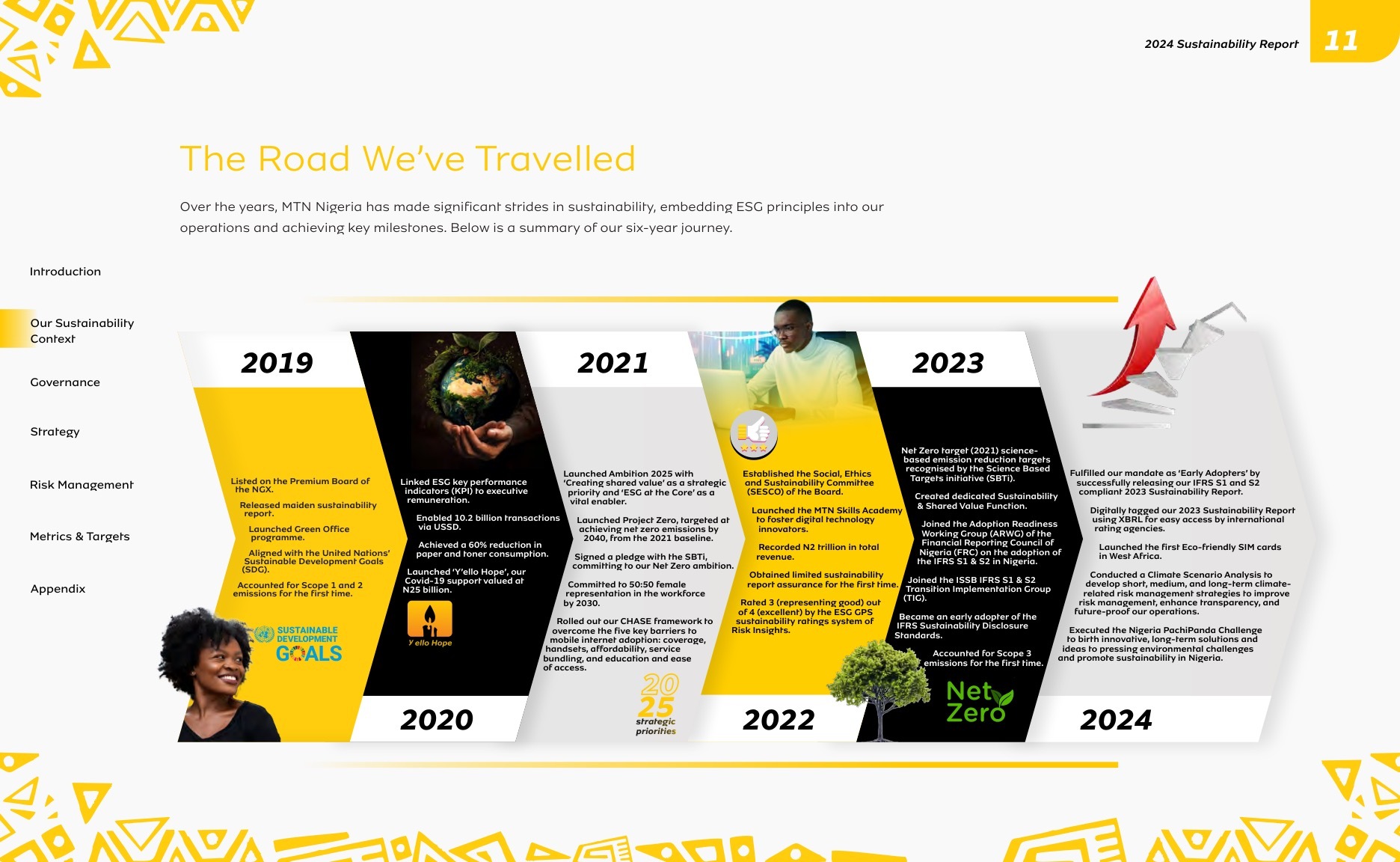

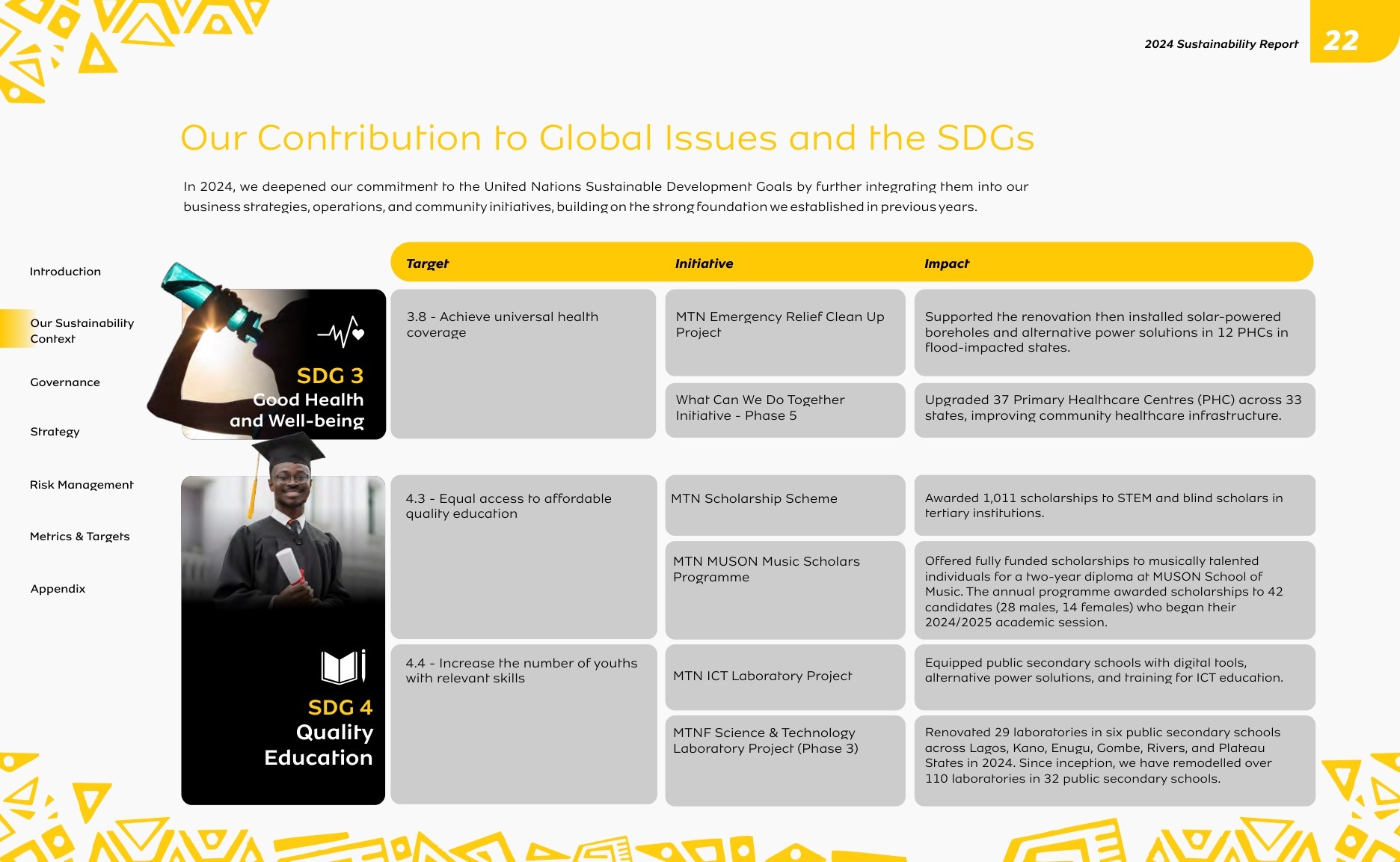

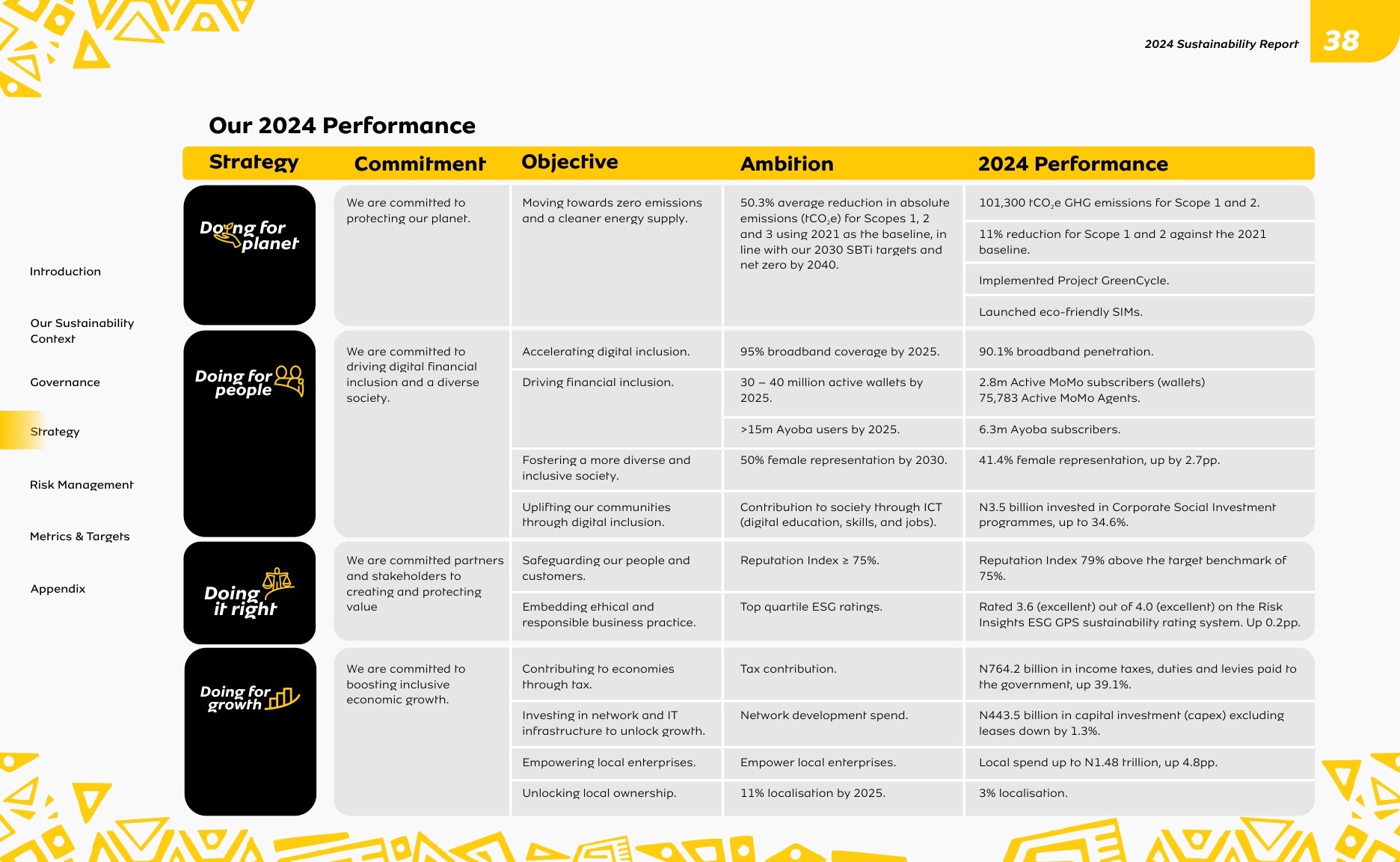

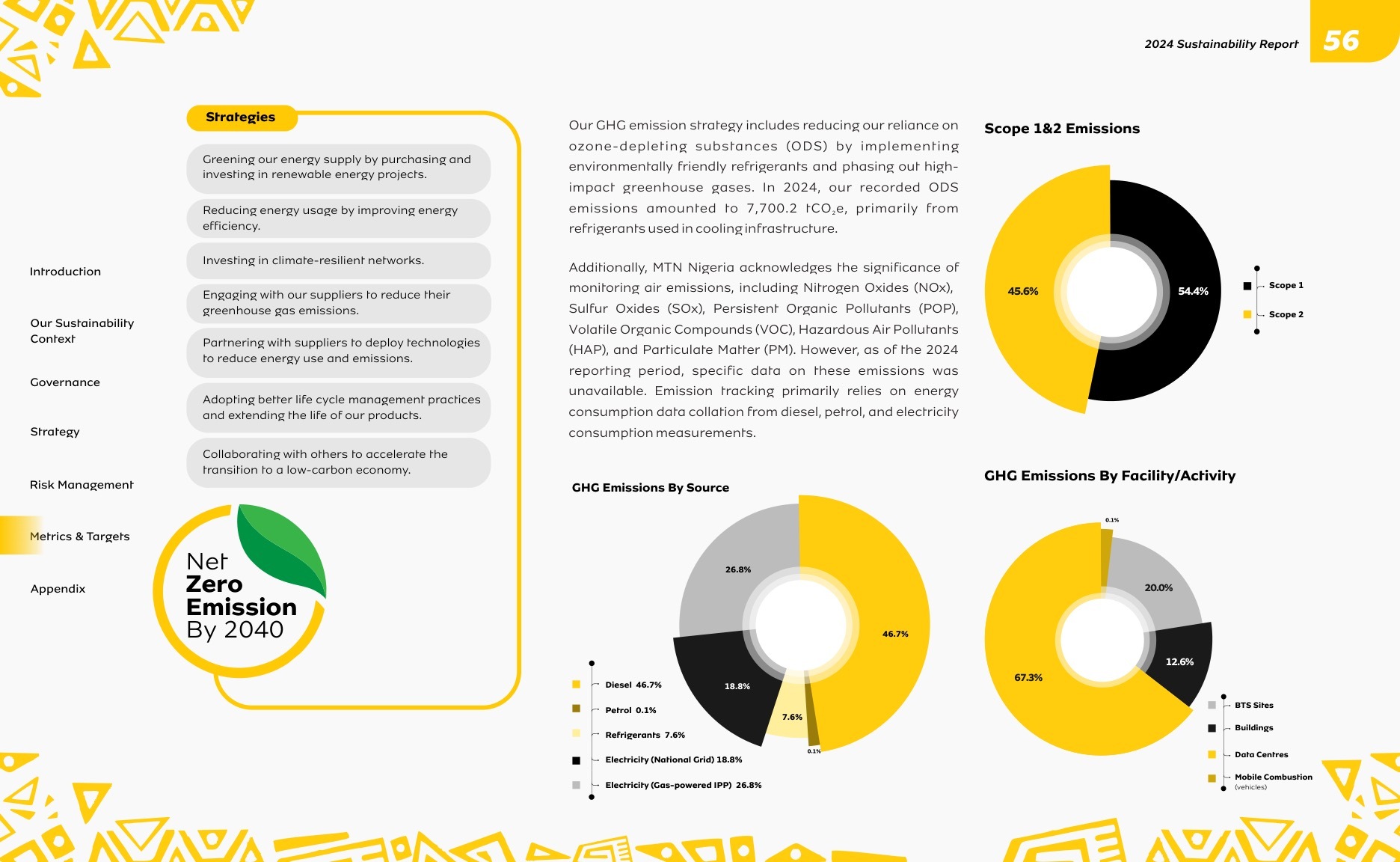

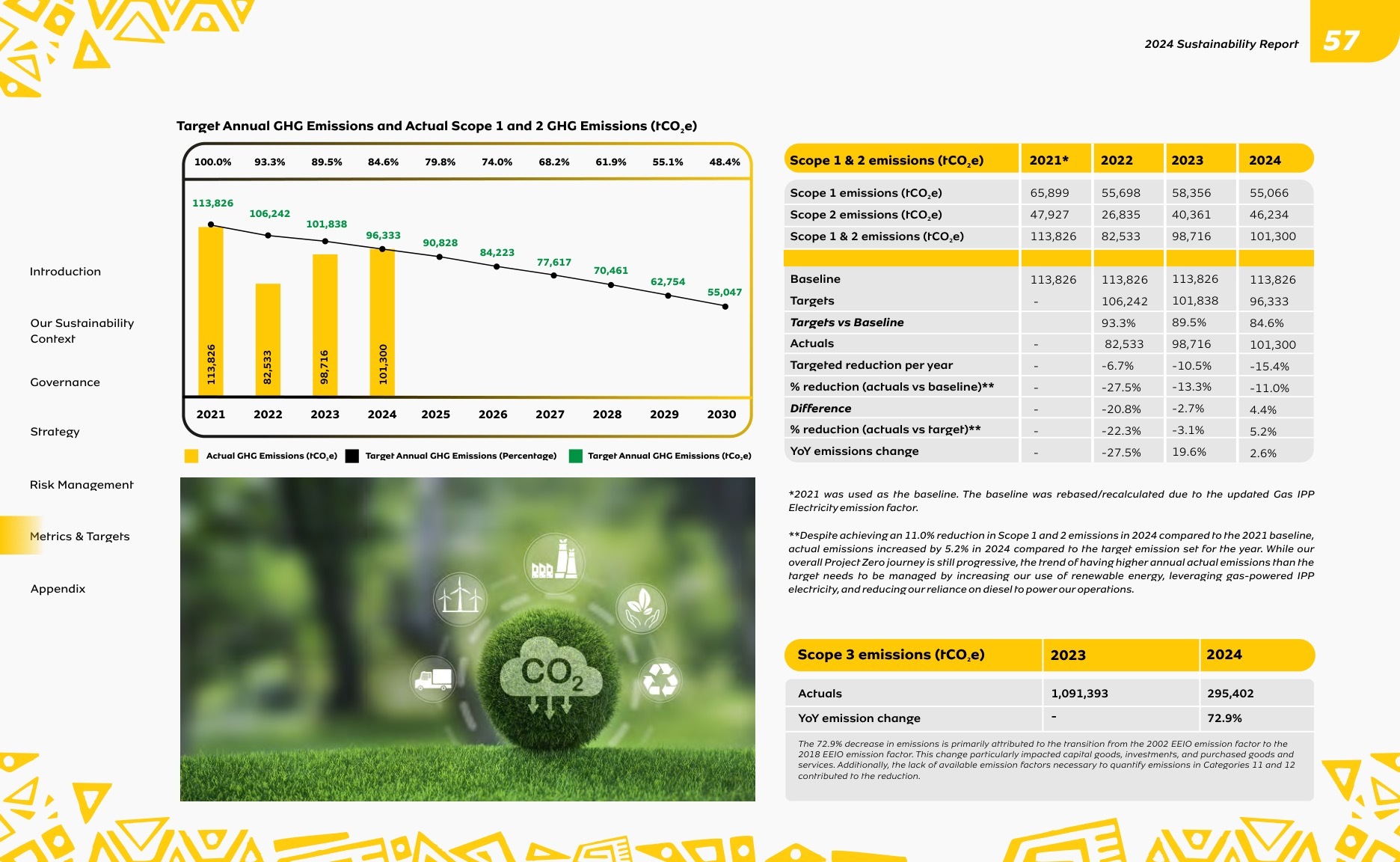

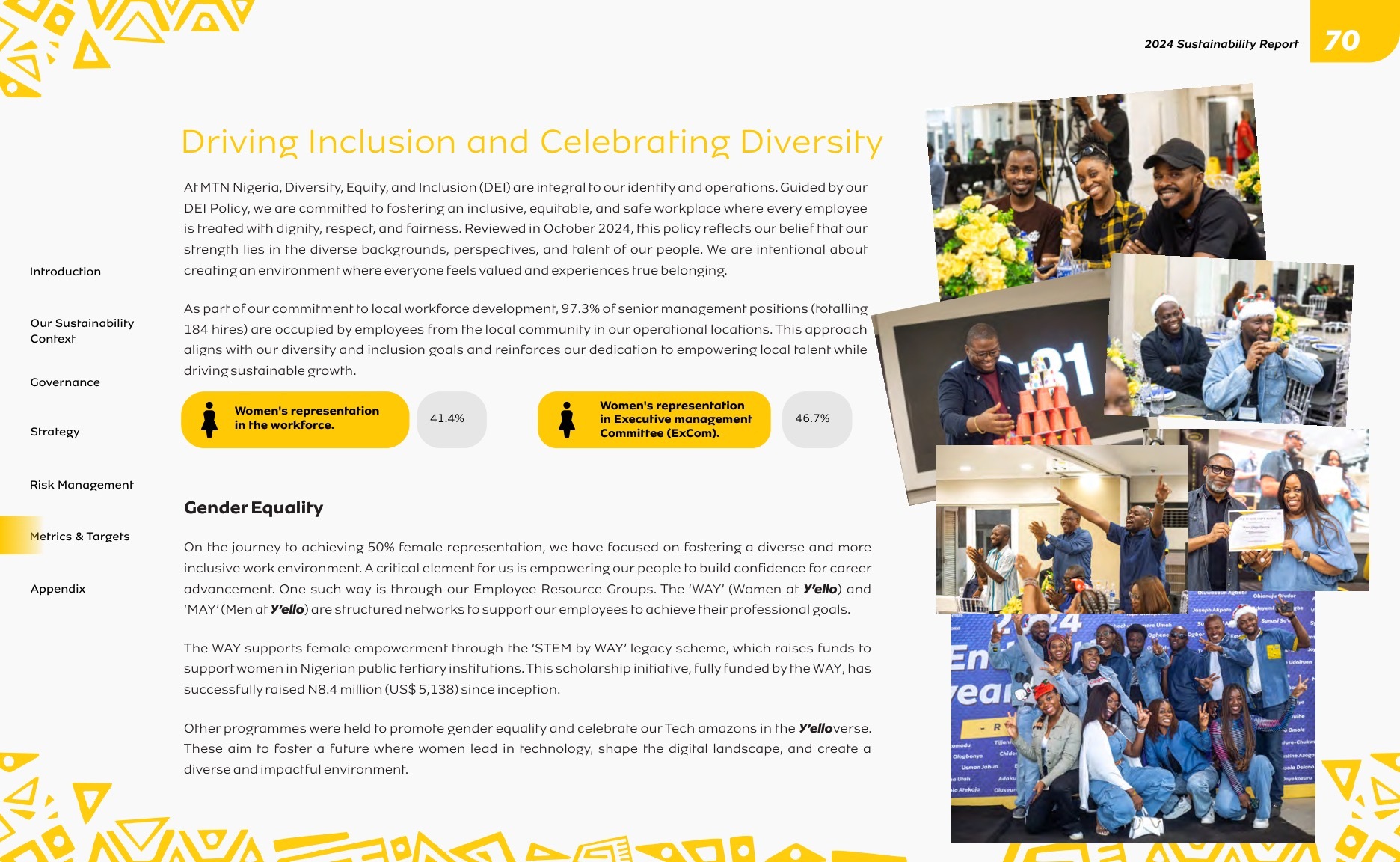

| 2022 | SDGs (digital inclusion, education, health, climate), Paris Agreement | Stakeholder-driven materiality, Seven-Pillars framework, GRI/SASB | 1.8bn (Foundation: 25.7bn cum.), capex: 504.3bn | UNGC, NGX, NCCG, MoMo PSB, broad ecosystem | 778 rural sites, 87.9% broadband, 15m MoMo users, >77m connected | 778 rural sites, 588 5G sites, Foundation CSI projects (edu, health, women) | Net zero 2040, 50/50 gender by 2030, ISSB transition | 25% Scope 1+2 CO₂ cut (2022), 36% women, 2.0tr revenue, 725.3bn taxes |

| 2023 | SDGs 2,3,4,5,6,7,8,9,10,11,12,13,16,17 | Updated matrix (third-party reviewed), Seven-Pillars, SESCO | 2.6bn CSI, expanding community impact | IFRS S1/S2 early adopters, FRC ARWG, ISSB TIG, Sightsavers | 90+ communities, 89.8% broadband, 912 solar rural sites, 5.3m MoMo | 912 solar rural sites, ICT labs, teacher fellowships, health programs | 95% broadband target 2025, 15m Ayoba, 30-40m wallets, net zero 2040 | Scope 1+2: 98,716 tCO2e (-10.3% vs '21); industry-best NPS |

| 2024 | SDGs full mapping, IFRS S1/S2, GRI, ISSB, NGX, SEC, SASB, UNGC | Refreshed assessment, Board review, Seven-Pillars matrix | 3.5bn CSI (cum. 31.9bn), increased strategic spend | WWF, NCF, MoMo, SESCO, PachiPanda Challenge | 6.2 million positively impacted; 31,828 in 1,500+ financial sessions | 194 new rural sites, PachiPanda climate challenge, Project GreenCycle (wastewater) | Project Zero net zero 2040, ISSA 5000 assurance, XBRL digital filing | Scope 1+2: 101,300 tCO2e (11% below '21), 90.1% broadband |

Key Insights: First Nigerian 5G operator; Project Zero delivering consistent emission reductions; PachiPanda climate entrepreneurship; top CDP/ESG scores; XBRL digital reporting pioneer.

Sahara Group

| Year | SDGs Reported | Materiality & ESG Structure | Sustainable Spend | Partnerships & Collaborations | People/Communities Reached | Major Projects/Initiatives | Future Commitments | Noteworthy Details |

|---|---|---|---|---|---|---|---|---|

| 2022 | SDGs (7, 8, 13, 17, all mapped via GRI) | Multi-stakeholder materiality; 4 pillars: Governance, Planet, People, Prosperity | >₦5bn committed to clean energy projects | UNDP Impact Fund, NCF, WEF, OECD, ARDA, Sahara Foundation | 30 Impact Fund fellows, access to energy programs, hundreds to thousands served | Access to Energy, school renos, Go-Recycling expansion, Ajoki 24hr power | Net zero 2060, no gas flaring at Asharami after 2025, deepen renewables | 5,000+ staff, 3m LTI-free hours, workforce diversity, circularity |

| 2023 | SDGs: WEF metrics, energy transition, circularity, biodiversity, health, education | Board-level ESG platform, "Collective Pathway for Inclusivity" matrix | Multi-billion spend on renewables, Go-Recycling, infra, education | Treedom reforestation, LSETF, Wecyclers, GE, UNILAG, COP28 | Power to Ajoki, >11,000 UNILAG students, 1mn households sector-wide | Go-Recycling hubs, solar, safety academy, reforestation, community upgrades | Net zero 2060, ISSB/GRI reporting, scale Go-Recycling, renewables | 3m LTI-free hrs, 2,000 trees/sequestration, ISO 14001/20400 |

| 2024 | SDGs across all pillars, GRI, ISSB, sector frameworks | Stakeholder-driven, peer benchmarking, 25 priority topics | ₦43.5m to waste collectors; ₦499m capex for environmental systems | Treedom (16,100 trees), Wecyclers/LSETF (12 recycling hubs), UNILAG | >3mn via health, 58,000 direct, 80,000+ indirect; 1,000+ waste collectors | 13 PCSR projects, 12 recycling hubs Lagos, solar for police stations | 30% emissions cut by 2030, net zero 2060, Ajoki expansion | 210tkg waste diverted, 16,100 trees planted, zero env. violations |

Key Notes: Massive reforestation (16,100 trees, 2024); Go-Recycling scaled to 12 Lagos hubs; net-zero pathway with 2030 milestones; 87.7% African workforce; 40% female new hires.

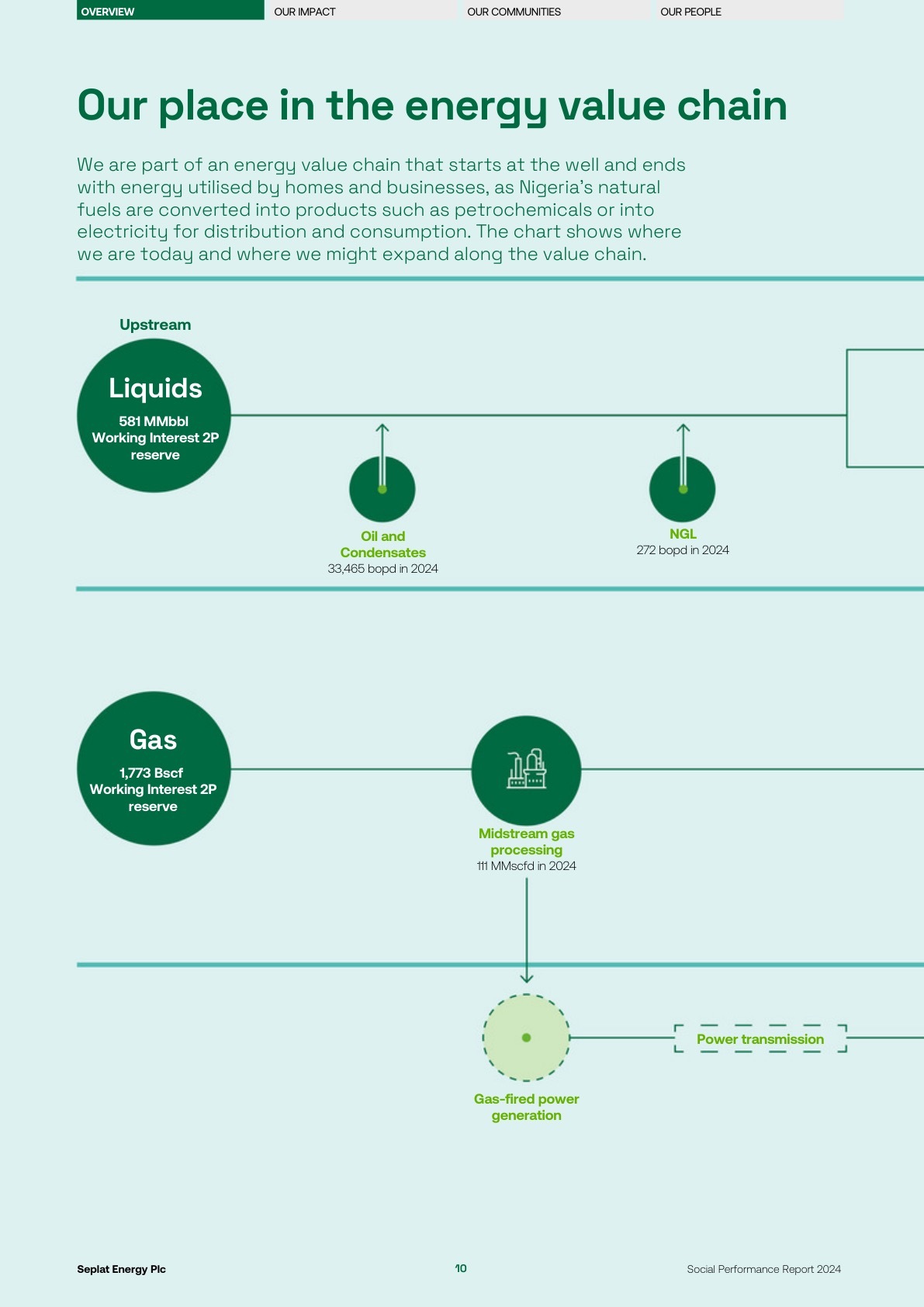

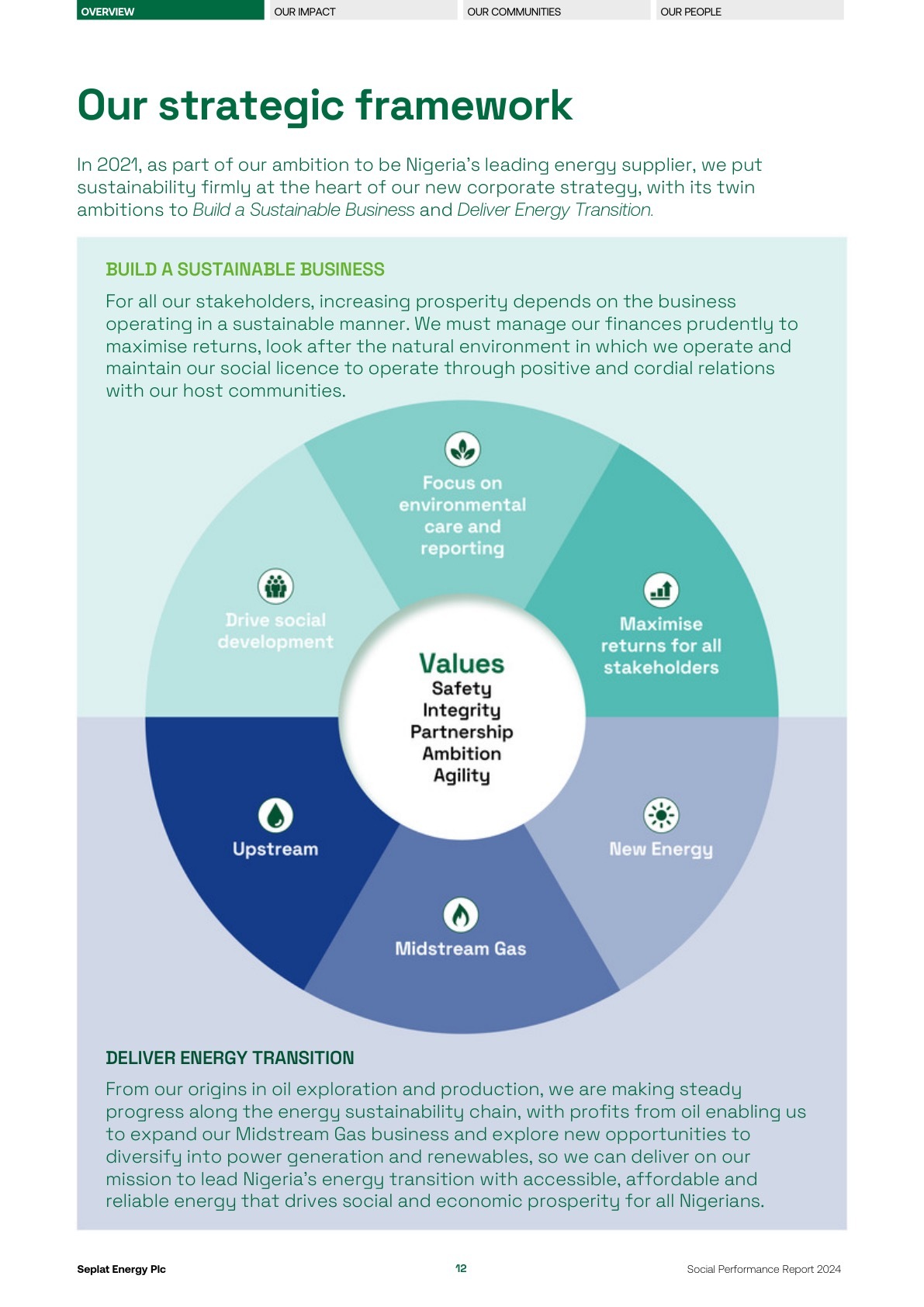

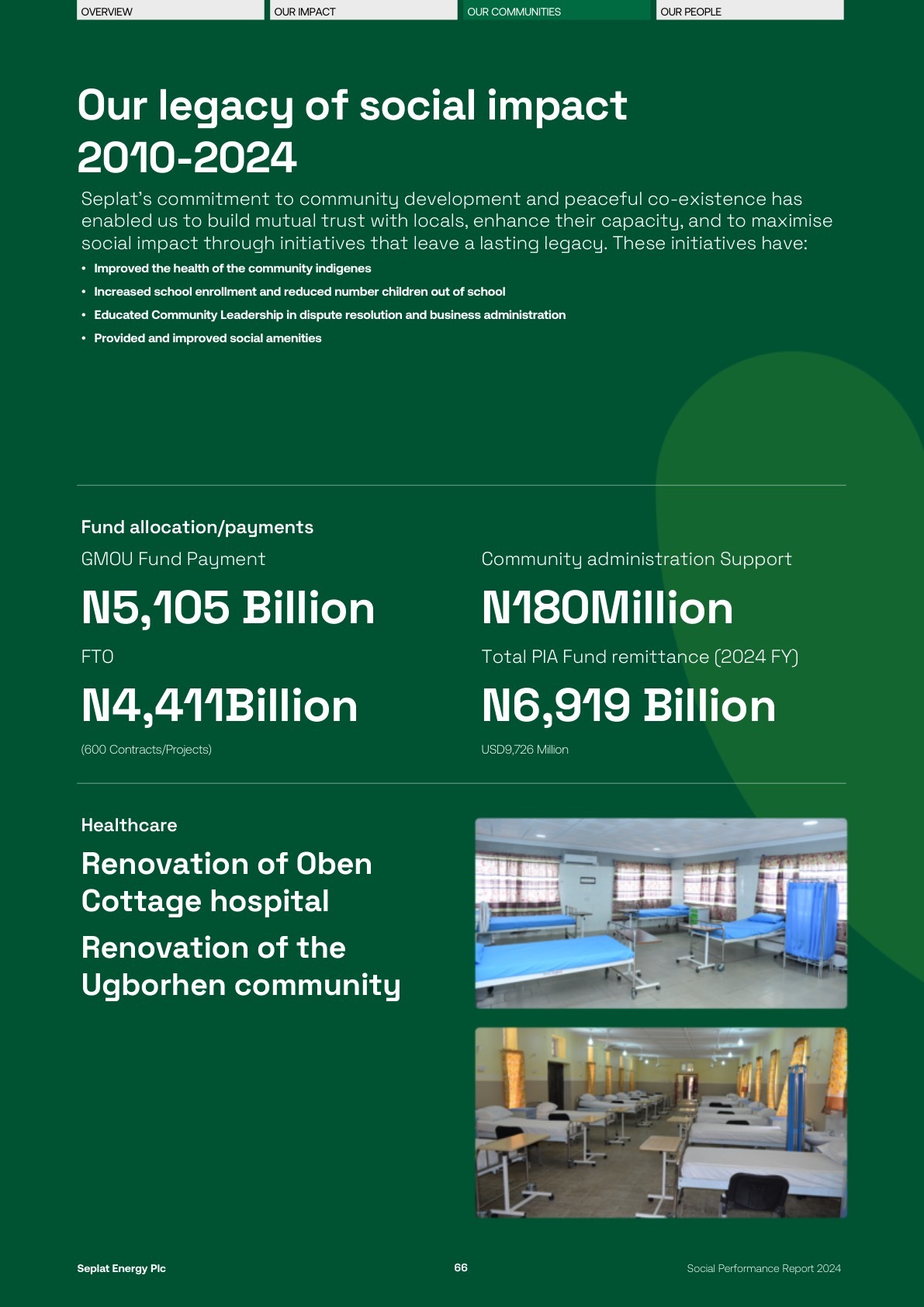

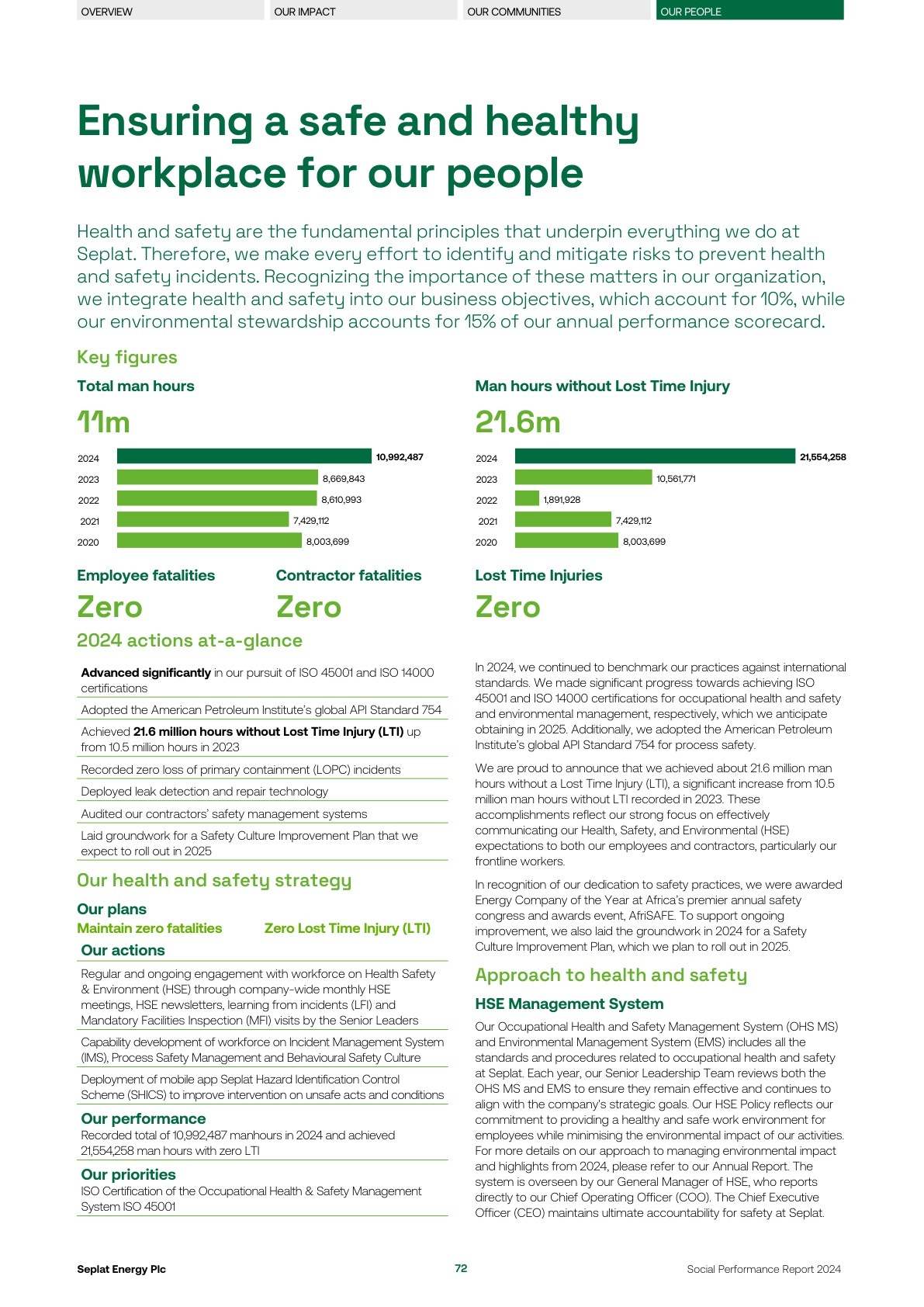

Seplat Energy

| Year | SDGs Reported | Materiality & ESG Structure | Sustainable Spend & Investment | Partnerships & Collaborations | People/Communities Reached | Major Initiatives & Projects | Future Commitments | Noteworthy Details |

|---|---|---|---|---|---|---|---|---|

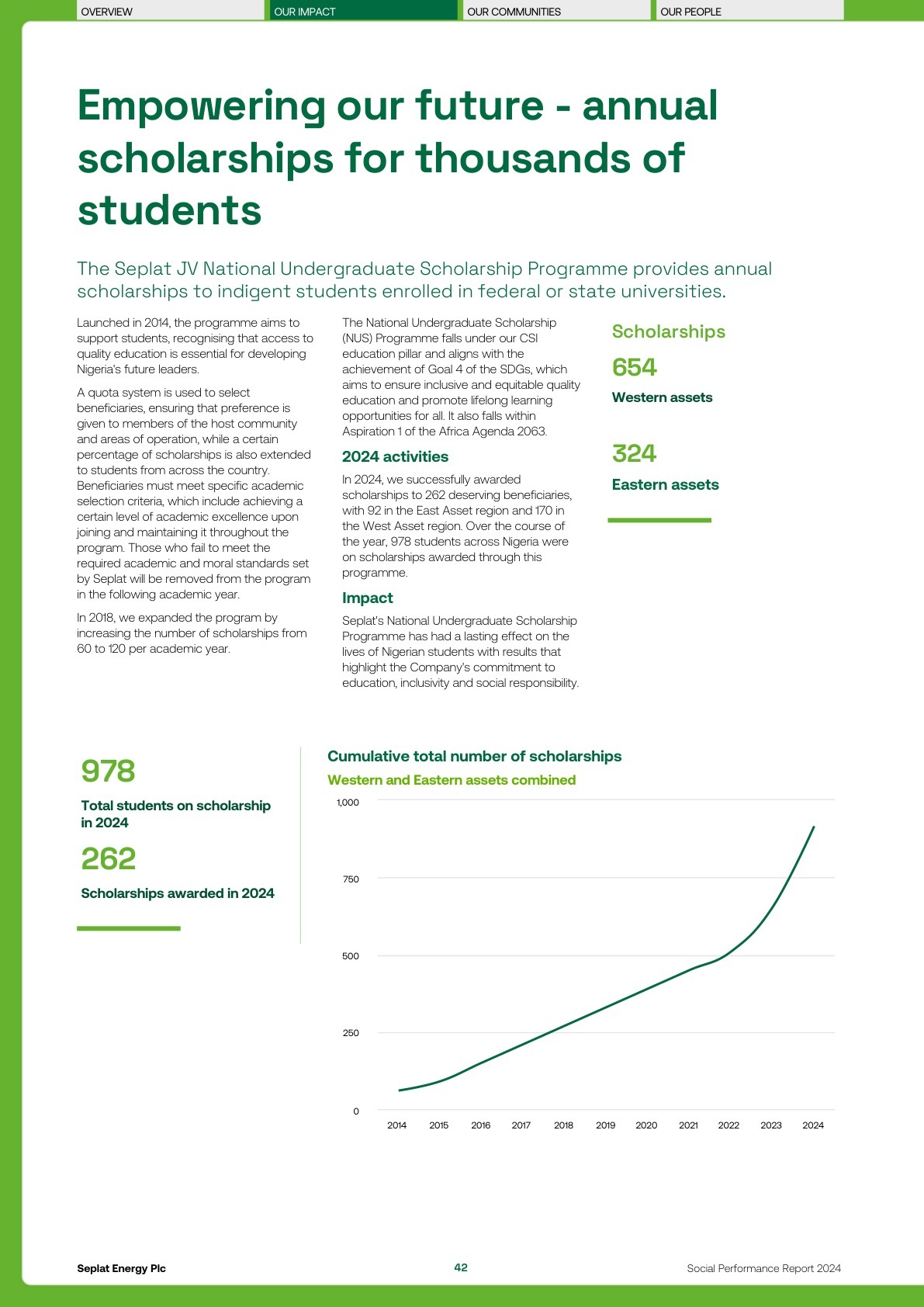

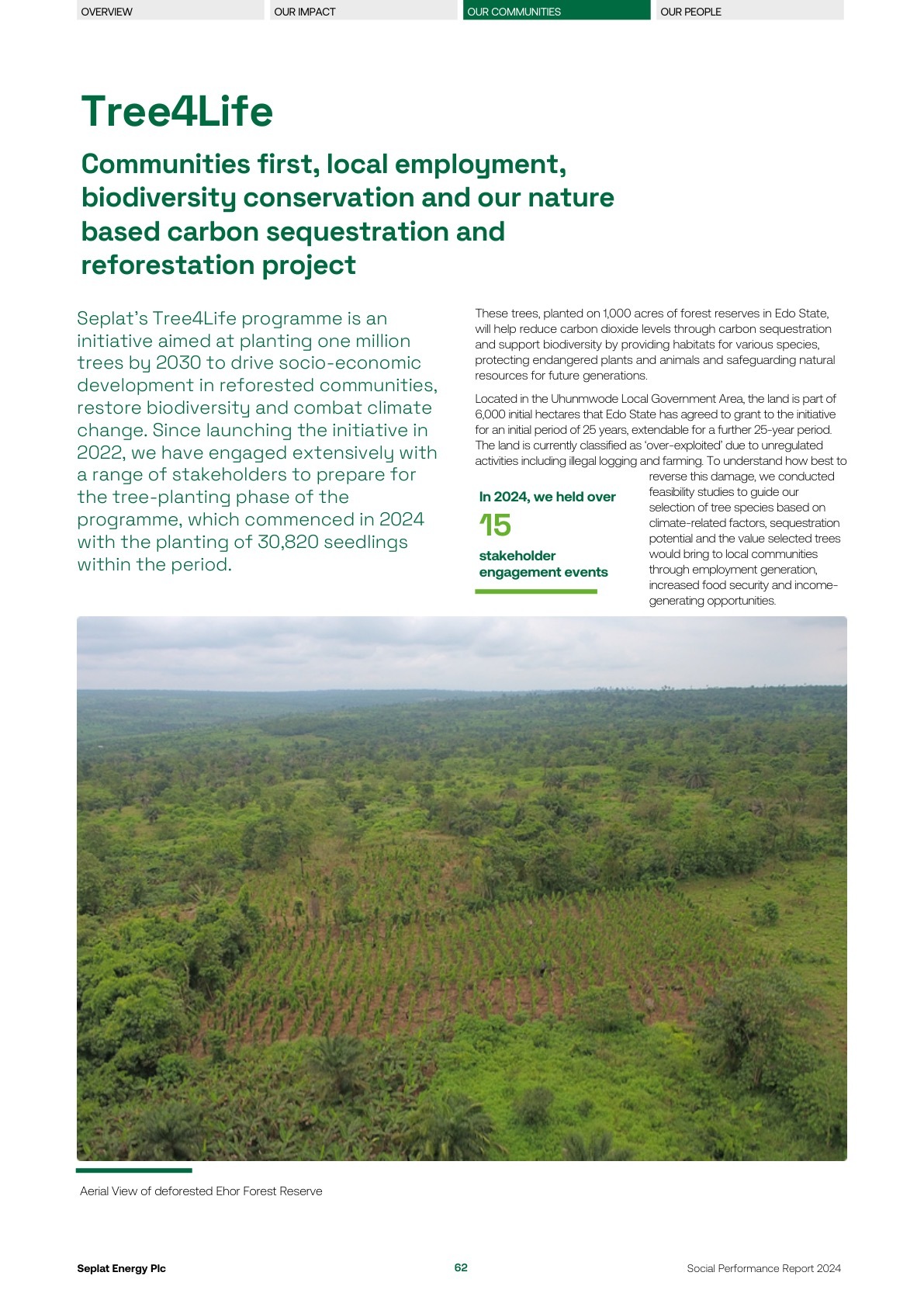

| 2022 | SDGs 3, 4, 7, 8, 13, 17; GRI, TCFD, UNGC Advanced | Formal GRI Oil & Gas assessment; climate, OHS, human rights, biodiversity core risks | No consolidated CSR; Host Communities Trust (3% OPEX) | UNGC Advanced, NGIC, ANOH Gas Processing JV | 271 teachers trained; 682 schools PEARLs; 378 scholarships; 461 surgeries, 10,185 treatments | PEARLs Quiz, STEP, Eye Can See, youth/teacher training, renewable pilots | End routine flaring 2024; ISO 14001 by 2024; scale renewables, Tree4Life | First African ISO 55001 cert; 30m LTI-free hours; 11% flared gas reduction |

| 2023 | SDGs 3, 4, 7, 8, 13, 17; GRI, SASB, IFRS S1/S2 adoption | 25 material topics: climate, ecology, water/waste, critical risk, OHS, human capital | ₦10m CSI, 41.5m decarbonisation, 5.7m flaring reduction | Four Host Community Development Trusts, UNGC, ANOH JV, Tree4Life | 429 surgeries, 6,482 glasses; 357 STEP teachers; 510 schools, 57,875 students | Eye Can See outreach, PEARLs/STEP expansion, youth seed funding, 8 institutions solarized | End routine flaring/methane by 2025; 70% Scope 1/2 cut; net zero 2050 | 10.6m LTI-free hours; revenue $1.061bn; 94% staff retention |

| 2024 | SDGs 3, 4, 7, 8, 13, 15, 16, 17; IFRS S1/S2, GRI G11, SASB | ISSB-aligned process, 11 material issues; ethics/transparency, OHS/security top priority | Program-level spend (74.4m staff benefits, 76% local procurement) | Edo State Tree4Life, DELTA Hospital, Sapele Eye Centre, women suppliers | 4,681 surgeries; 53,644 glasses; 703 schools, 61,390 students; 138 home/business minigrid | Sapele Eye Centre commissioning, four solar STEAM labs, youth energy apprenticeships | 100,000 trees 2025 toward 1m goal; scale minigrids; Mobil integration | $1.116bn revenue; 91.4m dividends; 280 investor meetings; 76% local procurement |

Key Notes: Tree4Life targets 1 million trees; Sapele Eye Centre (70 surgeries daily); mini-grid pilots; IFRS S1/S2 early adoption; 94% staff retention; top social impact awards.

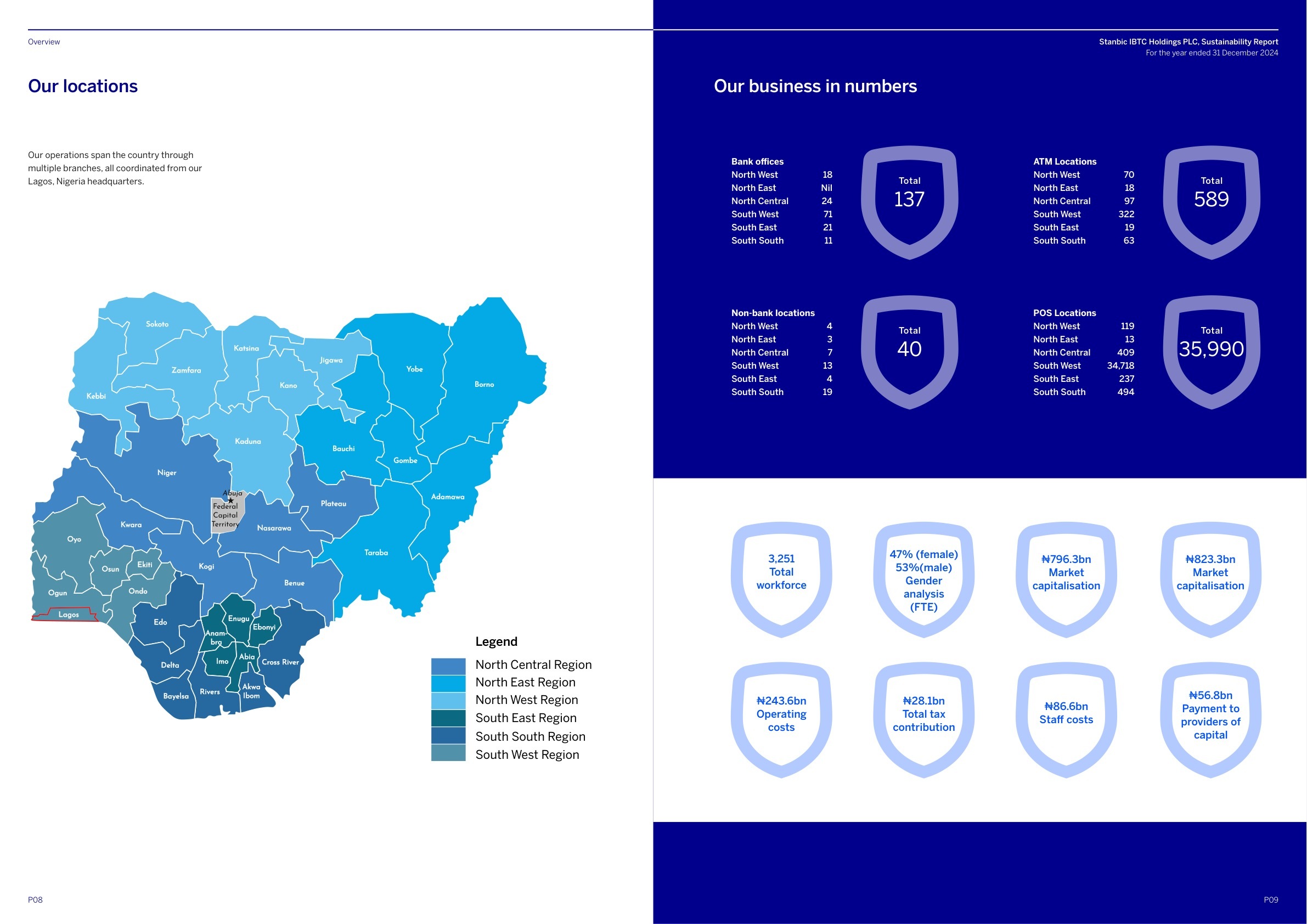

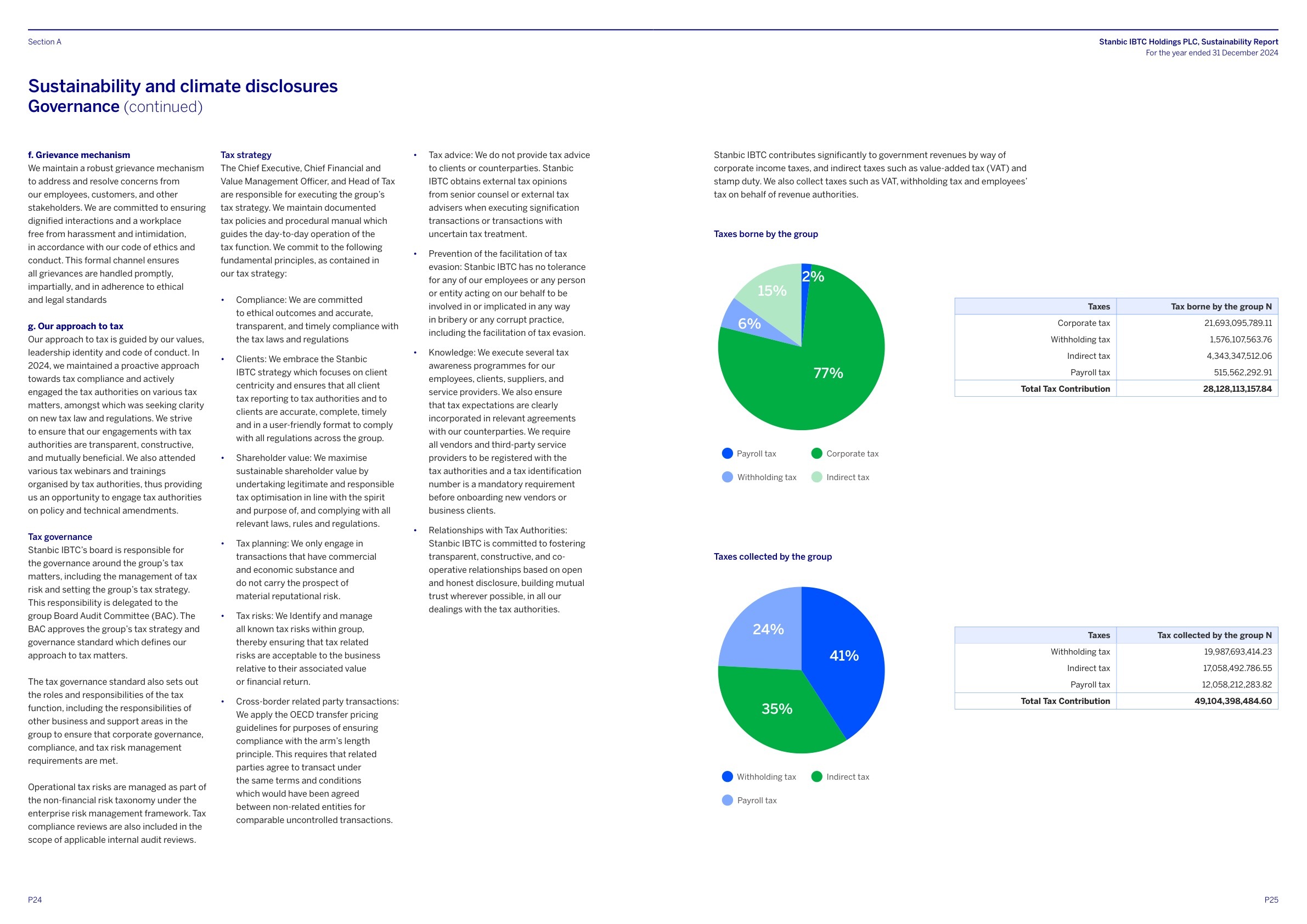

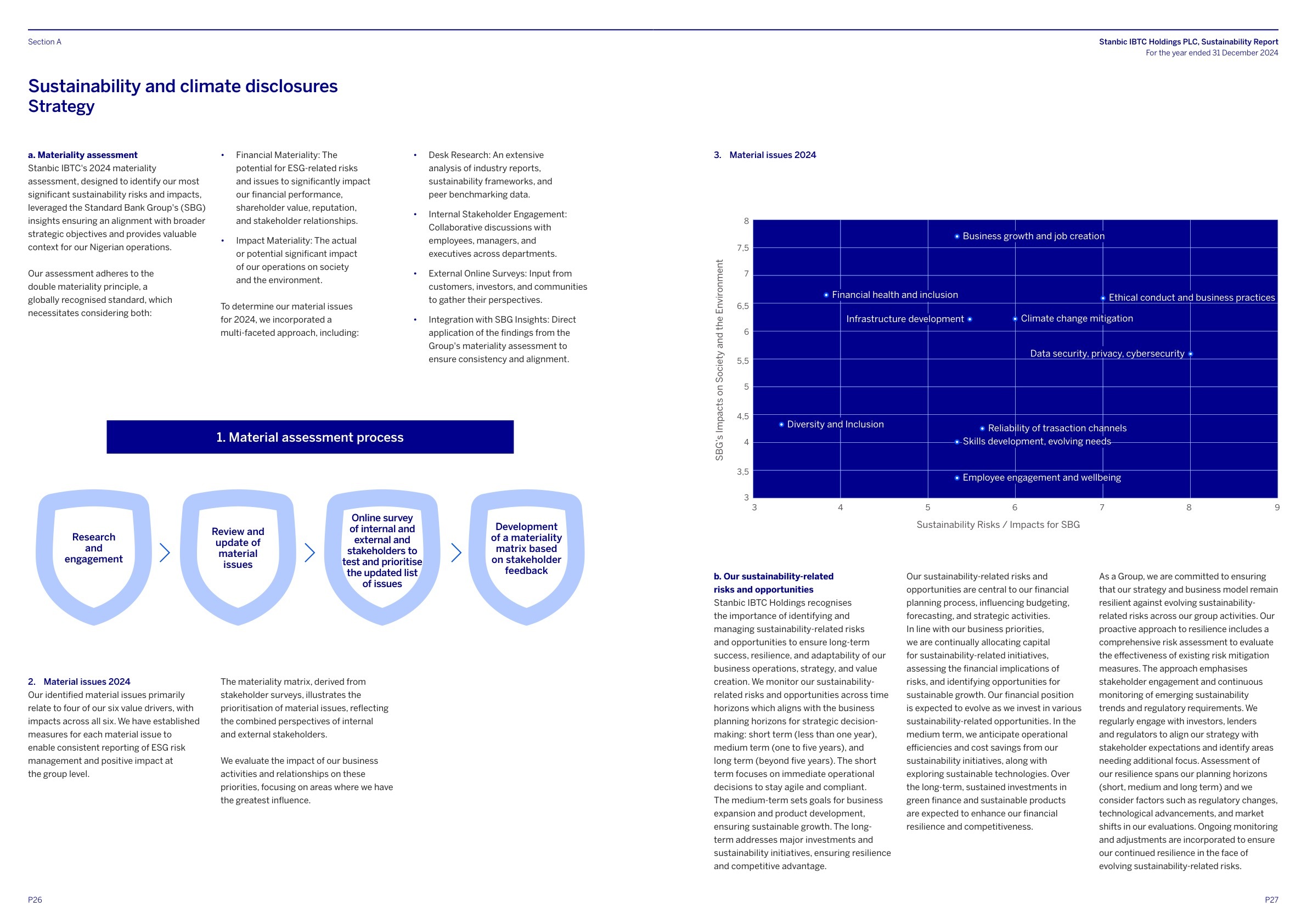

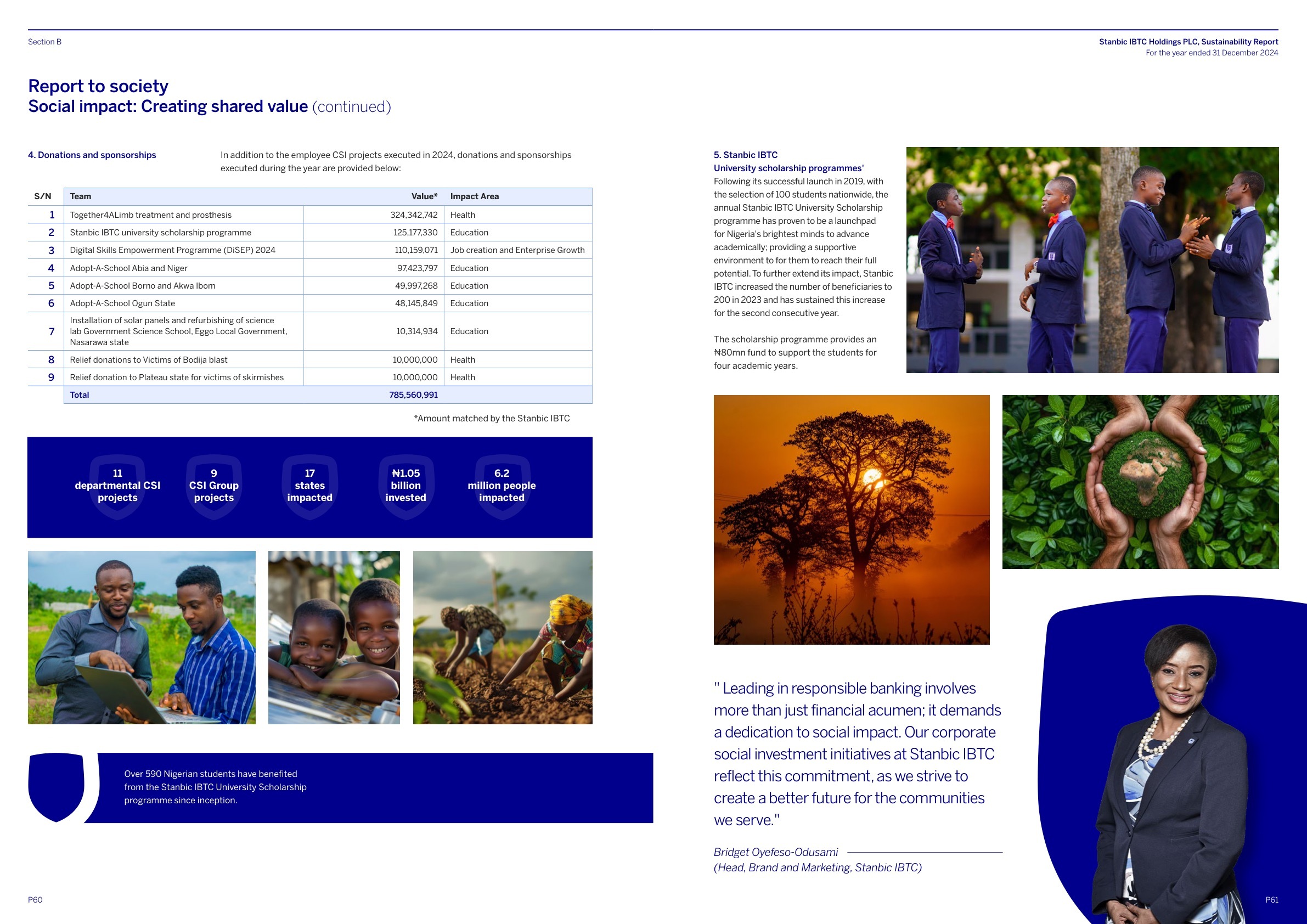

Stanbic IBTC

| Year | SDGs Reported | Materiality & ESG Structure | Sustainable Spend/Investment | Partnerships & Collabs | People/Communities Reached | Major Projects/Initiatives | Future Commitments | Additional Notes |

|---|---|---|---|---|---|---|---|---|

| 2022 | UN SDGs, Paris Agreement, AU Agenda 2063, PRB, Nigerian Principles | Stakeholder-driven, risk-integrated, 4-pillar materiality; SEE impact focus | ₦160m (employee CSI), ₦185.96m (donations); 48.08bn sustainable investments | PRB, Equator, NCF, AfDB, BII, Nigerian Football Federation | 929,176 Ease wallets; 9,285 agent banks; 7,000 SME training; >329,000 via CSI | 38 employee CSI projects; Together4ALimb (10 children), SME/health lending | Net zero: facilities 2030, operations 2040, portfolio 2050; expand solar branches | 13.95t waste recycled, 30 board/management gender parity, 20 solar branches |

| 2023 | All 17 SDGs, GRI, NSBP, NGX, SEC | Double materiality with climate, ecology, water/waste, HSS, DEI, supply chain | ₦826m CSI; 98.66bn bonds/notes, 10bn sustainable loans; 32,200 trees | NCF, Montane Forest, Impact Investors Foundation, COP28 | 10 million impacted by CSI; 100 Together4ALimb kids; 200 scholars; 1,000+ SMEs | Enterprise Academy, school upgrades, Blue Blossom women SMEs, community clinics | Net zero: facilities 2030, operations 2040, portfolio 2050; expand solar to 35 | AAA Fitch, 98bn bonds, 2.76bn women businesses; trending positive LTIFR |

| 2024 | SDGs/ISSB/IFRS S1/S2, NSBP, NGX, SEC; SDG-targeted finance/inclusiveness | Board-led, updated materiality, climate/social inclusion, regulatory innovation | ₦958m CSI; 57bn sustainable bonds; 173bn sustainable loans; 9.14bn women-owned | LBS Sustainable Summit, NCF, FinDev Canada, women/FinTech platforms | 6.2 million positively impacted; 31,828 in 1,500+ financial sessions; 200t waste recycled | ECSI volunteer/CSI, Together4ALimb, Blue Blossom (10,951 new women SME accounts) | SEC approval ISSB voluntary adoption 2025; scale loans/GSS, gender/SME finance | 62,180 trees (target met); 56 solar-hybrid sites (40% operations); ZERO breach |

Key Notes: Net-zero roadmap (facilities 2030/operations 2040/portfolio 2050); IFRS S1/S2 prep with FRC approval; 100k tree planting across Nigeria; millions reached annually via financial inclusion; Together4ALimb reached 100 children; strong, sustainable finance growth.

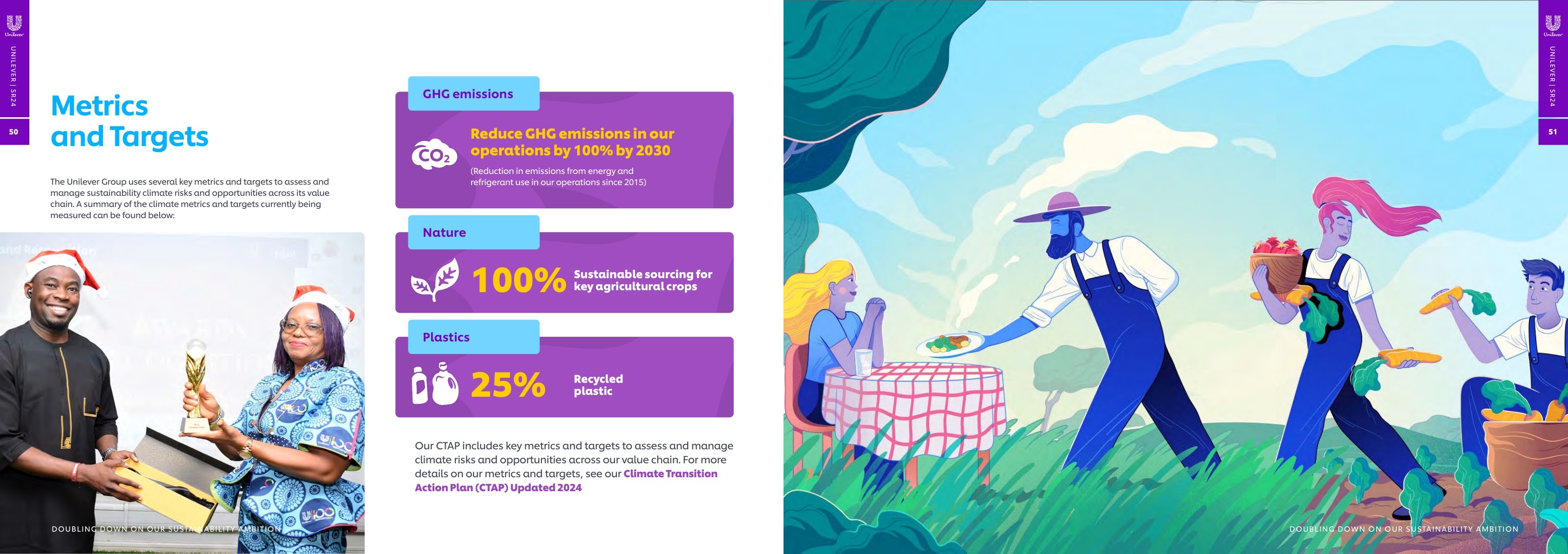

Unilever Nigeria

| Year | SDGs Reported | Materiality & ESG Structure | Sustainable Spend & Investment | Partnerships & Collaborations | People/Communities Reached | Major Initiatives/Projects | Future Commitments | Noteworthy Details |

|---|---|---|---|---|---|---|---|---|

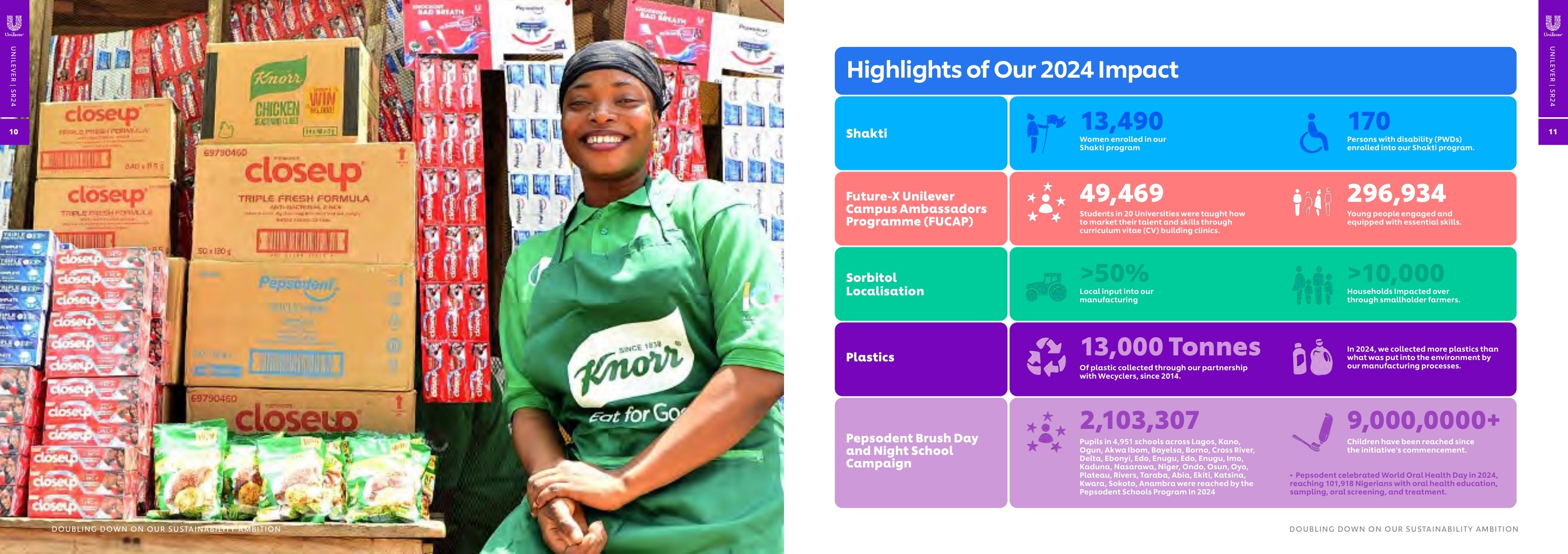

| 2022 | SDGs via UNGC, GRI, NSE, mapped to climate, waste, nutrition, health, inclusion | Annual stakeholder assessment, Compass Strategy, multi-level committee oversight | No single figure; includes social investment, R&D, local procurement, packaging innovation | Wecyclers (plastics), Unstereotype Alliance, UNICEF, local suppliers | Millions of households, >1,000 suppliers, thousands farmers, 1,240 employees | Oral health (Pepsodent), packaging innovation, inclusion/disability workshops, water/sanitation | Net zero pathway, 5% workforce disability inclusion by 2025, expanded local content | Strong ethics/governance, active Speak-Up hotline, responsible advertising |

| 2023 | SDGs via GRI, UNGC, NSE, SEC, Compass Strategy mapped to 7 SDGs | Stakeholder-driven annual reassessment, 16 topics, 10 high-impact | Notable: $2M grant to Wecyclers, significant skills/women's empowerment investment | Wecyclers, UNICEF Future-X/FUCAP, Shakti 13,000 women, micro-entrepreneur program | 700,000 youth empowered (planned); 500+ internships; 622 employees (45% management women) | Plastics circularity, Shakti women's program, FUCAP youth employability; major local sourcing | Scale Shakti/womens outreach, deeper youth engagement, ongoing plastics reclamation | Centenary milestone, zero discrimination, continuous feedback loop, strong gender ratio |

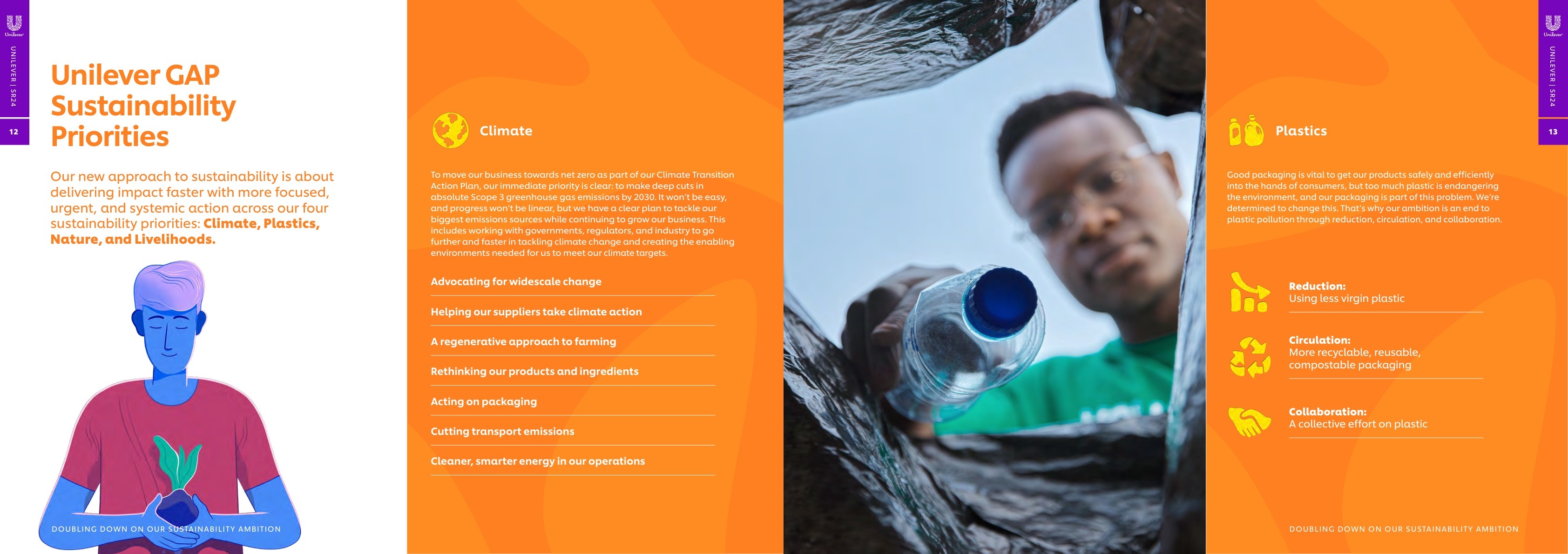

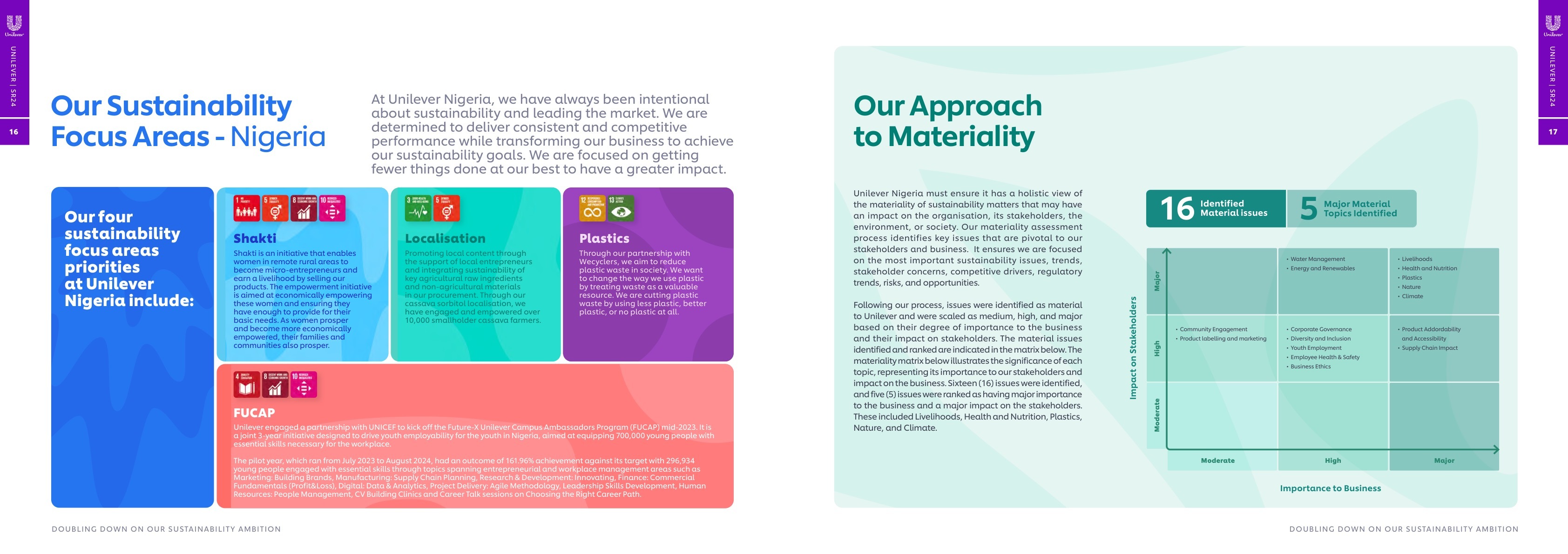

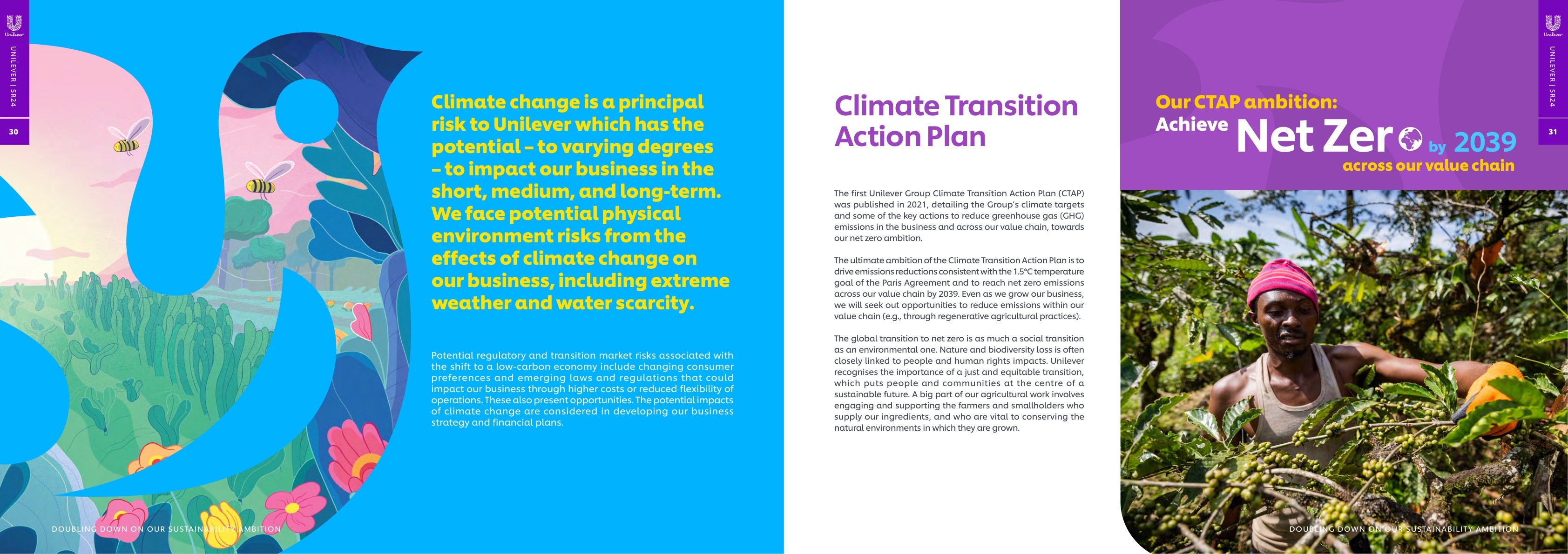

| 2024 | SDGs via IFRS S1/S2, SASB, GRI, UNGC; pillars: Climate, Plastics, Nature, Livelihoods | Robust annual matrix (16 issues), stakeholder engagement and risk oversight | Highlights: 13,490 women (Shakti), 296,934 youth skilled, 49,469 CV clinics | UNICEF Future-X, Wecyclers (13,000t plastic), circularity projects, local input >50% | 9M+ children (oral health), 10,000+ farmer families, 2.1M school pupils, 296,934 youth | Shakti micro-entrepreneurship, plastics collection, regenerative sourcing, product innovation | Net zero 2039, Scope 3 GHG cuts 2030, living wage, end plastic pollution | Renewable energy scale, IFRS/GRI/SASB/UNGC reporting, >50% local input |

Key Notes: $2M+ invested in Wecyclers, achieving 13,000+ tons of plastic recovery; Shakti program reached 13,490 women; 9M+ children via oral health campaigns; net-zero 2039 with Scope 3 cuts by 2030; leading local content (>50%).

Nigeria’s corporate sustainability landscape is being reshaped by ten pioneering companies, which are proving that transparent, year-on-year reporting builds both investor confidence and measurable progress. From Airtel’s rural connectivity drive to Dangote Cement’s circular waste innovations, Sahara Group’s reforestation efforts, and Unilever’s plastics recovery initiatives, their work showcases how embedding ESG at the core of business strategy drives impact across industries.

Their discipline demonstrates that sustainability reporting is more than a regulatory task; it is a lever for accountability, innovation, and competitiveness. By publishing three consecutive years of reports, these firms are not only complying with standards but also anticipating shifts in markets and global investor demands, positioning themselves ahead of policy requirements.

As Nigeria’s regulatory frameworks, guided by the Financial Reporting Council, move toward stricter timelines, these leaders provide a playbook for others. By aligning global best practices with local realities, they are building resilience, trust, and pathways for inclusive growth across Africa’s largest economy.

. It is important to note that none of the organisations listed have solicited their inclusion.

While this list aims to be comprehensive, it is by no means exhaustive; numerous other companies have published their two-year 2022 and 2023 reports, e.g., FirstHoldCo, but have yet to release their 2024 reports. Whilst some have published their 2023 and 2024 reports, we were unable to access their 2022 reports, e.g., Zenith Bank.

Once we get access to the other 2024 reports, we will update our story in line with standard best practices in the Media Industry.

This compilation is exclusive to SSA and could be updated periodically to reflect changes through the inclusion of new organisations. We will appreciate your feedback to help us improve our storytelling from an African Perspective.

Also, kindly note that this compilation is in no specific order of ranking in any way, form, and/or format.