The climate adaptation crisis across Africa is not defined by a lack of funding reaching communities for their implementation, but rather by a lack of solutions.

Local adaptation initiatives, from drought-resistant agriculture to water conservation, are proving effective, yet remain critically underfunded.

This disconnect highlights a structural ESG financing failure, where capital flows bypass the frontline solutions that determine Africa’s climate resilience and long-term economic stability.

Local Climate Solutions Lack Critical Funding

Africa’s climate adaptation challenge is increasingly defined not by the absence of innovation, but by a persistent financing gap that prevents effective local solutions from scaling.

Communities across the continent are already deploying adaptation strategies, from climate-smart agriculture to ecosystem restoration; however, international climate finance continues to flow primarily through large-scale, centralised projects, limiting direct support to grassroots initiatives.

This mismatch is emerging as one of the most consequential ESG financing inefficiencies shaping Africa’s climate trajectory.

Adaptation Success Exists, but Capital is Misaligned

Local adaptation projects have demonstrated measurable resilience outcomes, improving food security, water management, and economic stability in climate-vulnerable regions.

However, structural barriers prevent capital from reaching these initiatives efficiently. International climate funds often prioritise large institutional programmes due to perceived governance, scalability, and risk considerations.

The resulting capital allocation gap creates a paradox: effective solutions exist but lack sufficient funding.

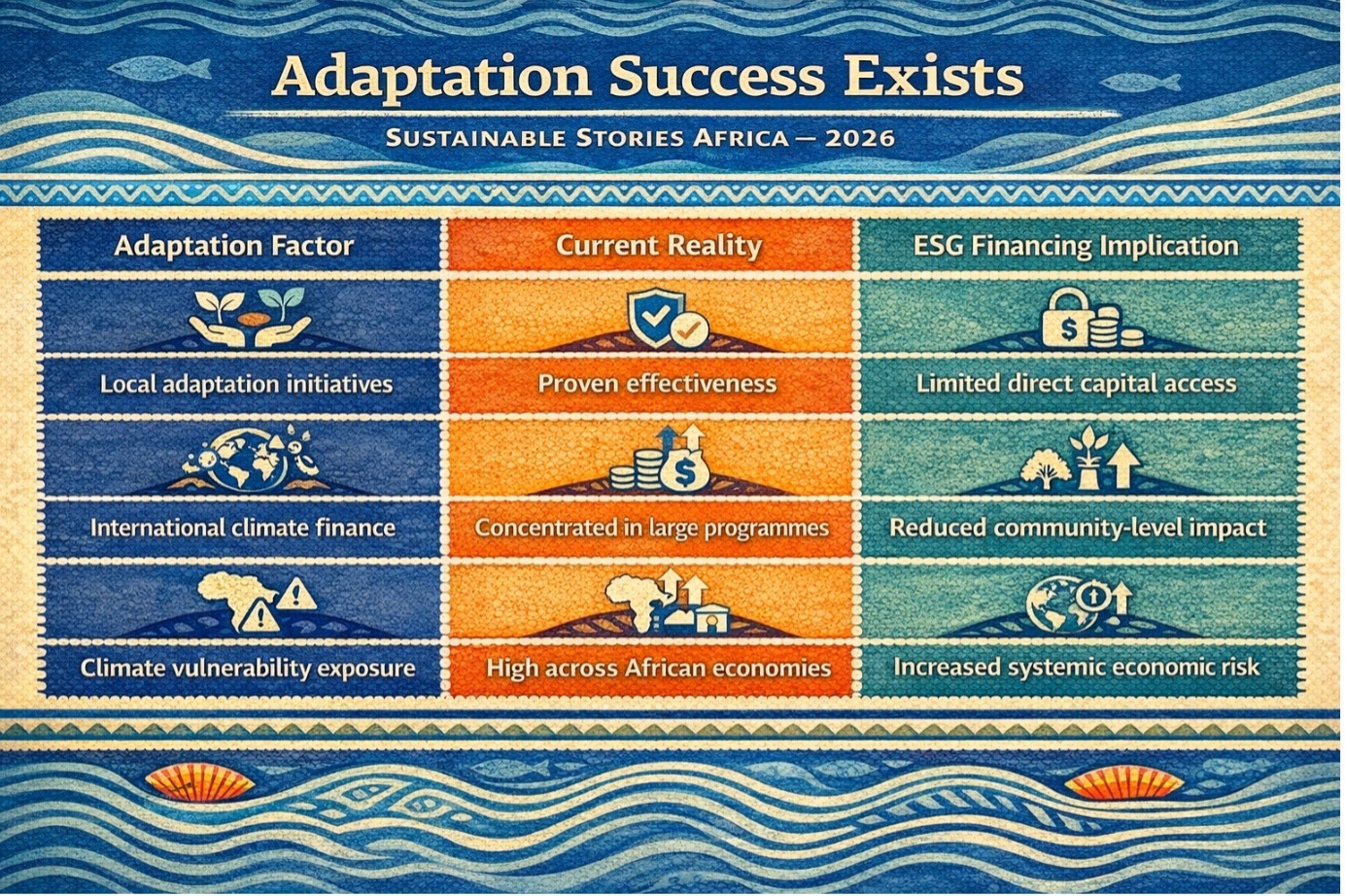

Adaptation Factor | Current Reality | ESG Financing Implication |

|---|---|---|

Local adaptation initiatives | Proven effectiveness | Limited direct capital access |

International climate finance | Concentrated in large programmes | Reduced community-level impact |

Climate vulnerability exposure | High across African economies | Increased systemic economic risk |

This financing structure limits the effectiveness and economic resilience of adaptation.

Community Investment Strengthens Climate Economic Stability

Direct investment in community-led adaptation offers significant economic and environmental returns. Strengthened agricultural resilience improves food security, reduces economic volatility, and enhances fiscal stability.

Adaptation finance also reduces long-term climate risks, lowering future disaster recovery costs and supporting sustainable development objectives.

Communities equipped with financial and technical resources can scale proven adaptation models, strengthening national climate resilience.

Strategic Adaptation Investment | Economic Benefit | Climate Outcome |

|---|---|---|

Climate-resilient agriculture | Stable food systems | Reduced climate vulnerability |

Water resource management | Improved productivity | Enhanced drought resilience |

Ecosystem restoration | Sustainable livelihoods | Increased carbon sequestration |

Such investments align climate resilience with economic development priorities.

Climate Finance Reform Needed For Impact

Closing Africa’s adaptation financing gap will require structural reforms in the delivery mechanisms for climate finance. Direct access funding models, improved governance frameworks, and decentralised finance channels can strengthen capital flow efficiency.

Development finance institutions, governments, and international climate funds must prioritise community-level investment pipelines to maximise the impact of adaptation.

Without these reforms, Africa risks remaining climate-vulnerable despite possessing effective adaptation solutions.

The future of Africa’s climate resilience depends not only on innovation but on accessibility to financing.

Path Forward – Direct Financing Enables Local Climate Resilience

Climate finance systems are shifting toward decentralised funding mechanisms that prioritise community-led adaptation solutions and strengthen resilience outcomes.

Improved governance, institutional capacity, and access to funding frameworks will ensure climate capital reaches frontline communities, enabling scalable adaptation and long-term economic stability.

Culled From: Africa’s Climate Adaptation Gap: Local Solutions Work, But Funding Misses Communities | Dawan Africa | Dawan Africa