Nigeria’s development finance institutions (DFIs) are emerging as critical engines of climate capital mobilisation, reshaping how sustainable investment reaches infrastructure, agriculture, and industry.

As global ESG capital tightens and private investors prioritise risk-adjusted returns, DFIs are increasingly bridging financing gaps and anchoring long-term climate resilience.

Their evolving sustainability positioning signals a structural shift, where public-backed capital is becoming the foundation for Nigeria’s climate and economic transformation.

Development Finance Institutions Reshape Climate Capital Flows

Nigeria’s development finance institutions are rapidly emerging as central pillars of the country’s climate finance ecosystem, positioning themselves to mobilise sustainable capital into infrastructure, agriculture, and industrial decarbonisation.

As global climate finance increasingly prioritises scalable, credible investment pipelines, Nigeria’s DFIs, including development banks and intervention funds, are playing a catalytic role in bridging the financing gap between public climate ambition and private sector investment readiness.

Their strategic positioning reflects a broader shift in ESG capital allocation toward institutions that are capable of risk absorption, enabling long-term economic transformation.

Public Capital Now Enables Private Climate Investment

Development finance institutions serve a unique function: de-risking investments, enabling private sector participation, and accelerating climate-aligned development projects that might otherwise remain unfunded.

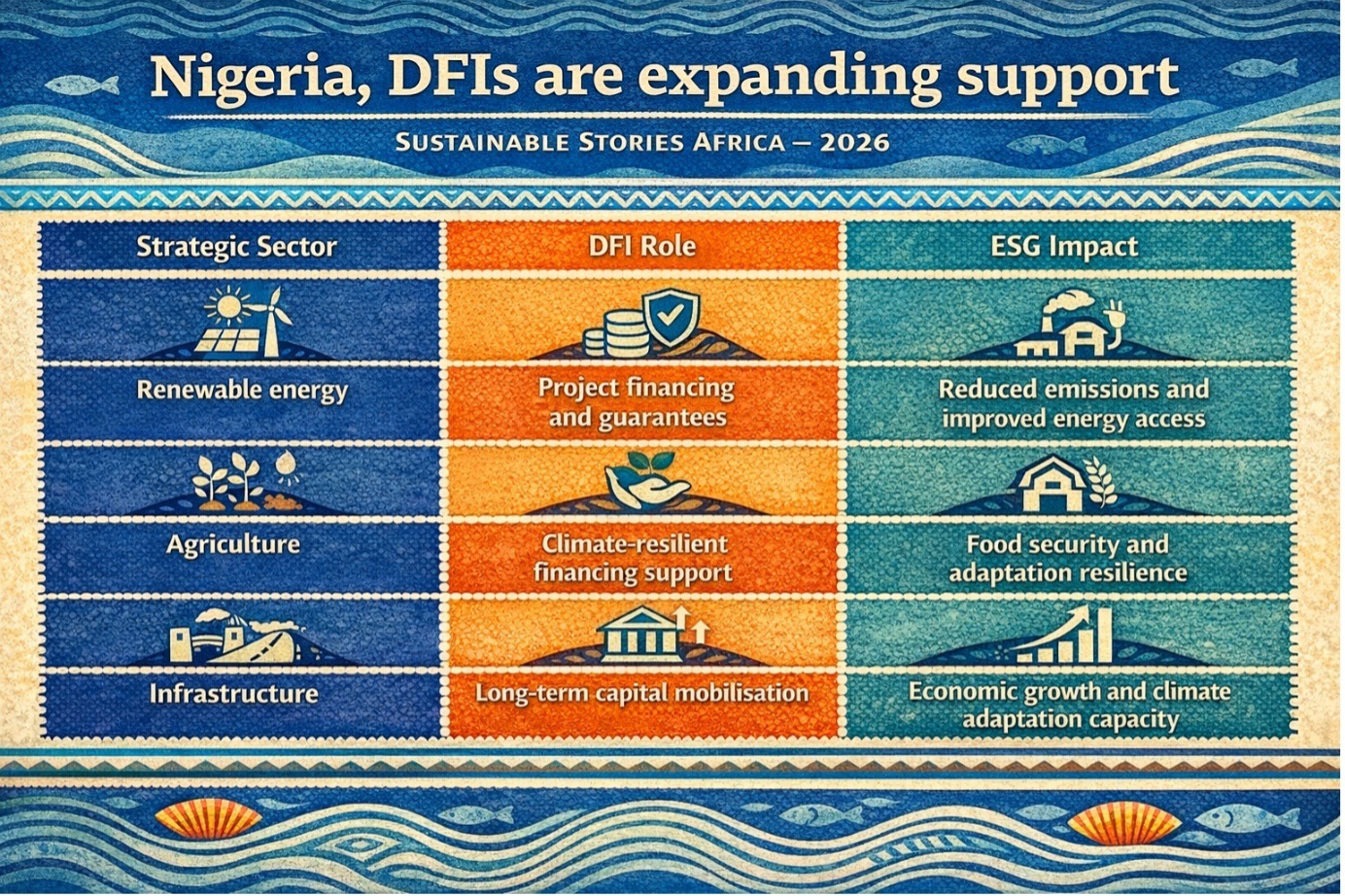

In Nigeria, DFIs are expanding support across key climate-sensitive sectors:

Strategic Sector | DFI Role | ESG Impact |

|---|---|---|

Renewable energy | Project financing and guarantees | Reduced emissions and improved energy access |

Agriculture | Climate-resilient financing support | Food security and adaptation resilience |

Infrastructure | Long-term capital mobilisation | Economic growth and climate adaptation capacity |

These institutions enable climate investment pipelines by addressing financing constraints, credit risks, and structural investment barriers.

Their role has become more critical as global capital markets tighten and private investors demand greater investment certainty.

Climate Finance Capacity Strengthens Economic Competitiveness

Strong development finance institutions enhance Nigeria’s ability to attract global ESG capital by improving investment readiness and strengthening the credibility of the financial ecosystem.

DFIs enable blended finance structures that combine public and private capital, reducing investment risk while accelerating the deployment of climate infrastructure.

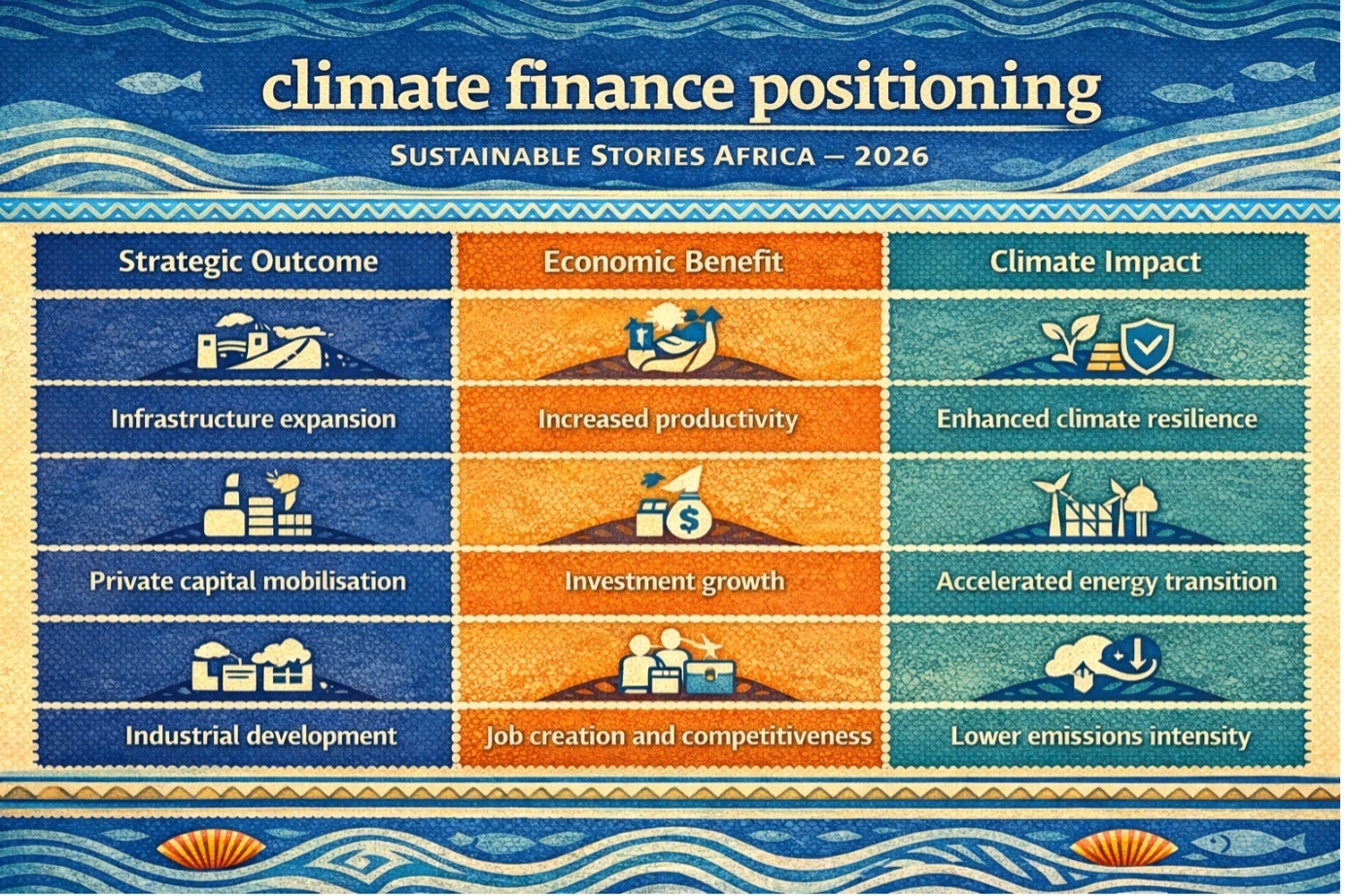

Their climate finance positioning supports broader economic transformation objectives:

Strategic Outcome | Economic Benefit | Climate Impact |

|---|---|---|

Infrastructure expansion | Increased productivity | Enhanced climate resilience |

Private capital mobilisation | Investment growth | Accelerated energy transition |

Industrial development | Job creation and competitiveness | Lower emissions intensity |

Countries with effective DFIs are better positioned to attract sustainable investment flows and strengthen long-term economic resilience.

Institutional Strength Will Define Climate Leadership

Nigeria’s ability to effectively leverage its development finance institutions will determine its success in attracting climate capital and achieving sustainability objectives.

Strengthening and improving governance, transparency, and expanding technical expertise within DFIs will be critical in maintaining investor confidence and ensuring effective capital deployment.

Policy alignment between government climate priorities and DFI investment strategies will further enhance the country’s competitiveness in global ESG capital markets.

DFIs represent not only financing institutions, but strategic instruments of economic transformation.

Path Forward – Strong DFIs Enable Sustainable Economic Transformation

Nigeria’s development finance institutions are expanding climate-focused investment strategies, strengthening governance, and mobilising blended finance structures to accelerate sustainable development.

Continued institutional strengthening and improvements in transparency, as well as the establishment of a climate investment pipeline, will ensure DFIs remain central to Nigeria’s long-term economic and climate resilience strategy.