Nigeria’s launch of its National Carbon Market Framework marks a turning point in Africa’s climate finance ambitions; however, emerging ESG trends suggest forests alone may not deliver expected carbon revenues.

As deforestation risks intensify and global credit standards tighten, workforce capacity and institutional readiness, rather than solar panels, are becoming decisive factors for climate competitiveness.

In 2026, Africa’s ESG advantage is shifting from natural assets to governance, skills, and implementation credibility.

Carbon Market Launch Challenges ESG Assumptions

Nigeria’s unveiling of its National Carbon Market Framework marks a strategic pivot toward monetising climate assets, positioning the country to capture value from global emissions trading systems while strengthening climate governance.

However, emerging ESG realities in 2026 reveal a counterintuitive shift: natural assets alone, including forests and renewable energy installations, are no longer sufficient to guarantee climate finance inflows.

Instead, institutional capacity, technical expertise, and regulatory credibility are becoming decisive factors shaping Africa’s carbon competitiveness.

The new framework signals Nigeria’s intent to move from climate vulnerability to climate market leadership.

Forest Integrity And Skills Now Define Competitiveness

Nigeria’s carbon market framework aims to establish governance systems for emissions trading, credit certification, and private sector participation.

The initiative reflects growing recognition that carbon markets depend not only on natural carbon sinks but on measurement credibility and institutional readiness.

Globally, carbon credit buyers are increasingly demanding verified emissions reductions, transparent accounting, and strong governance.

Forest-based credits are facing scrutiny due to concerns over permanence, leakage, and the integrity of the verification process.

At the same time, countries with strong technical capacity are attracting greater carbon investment.

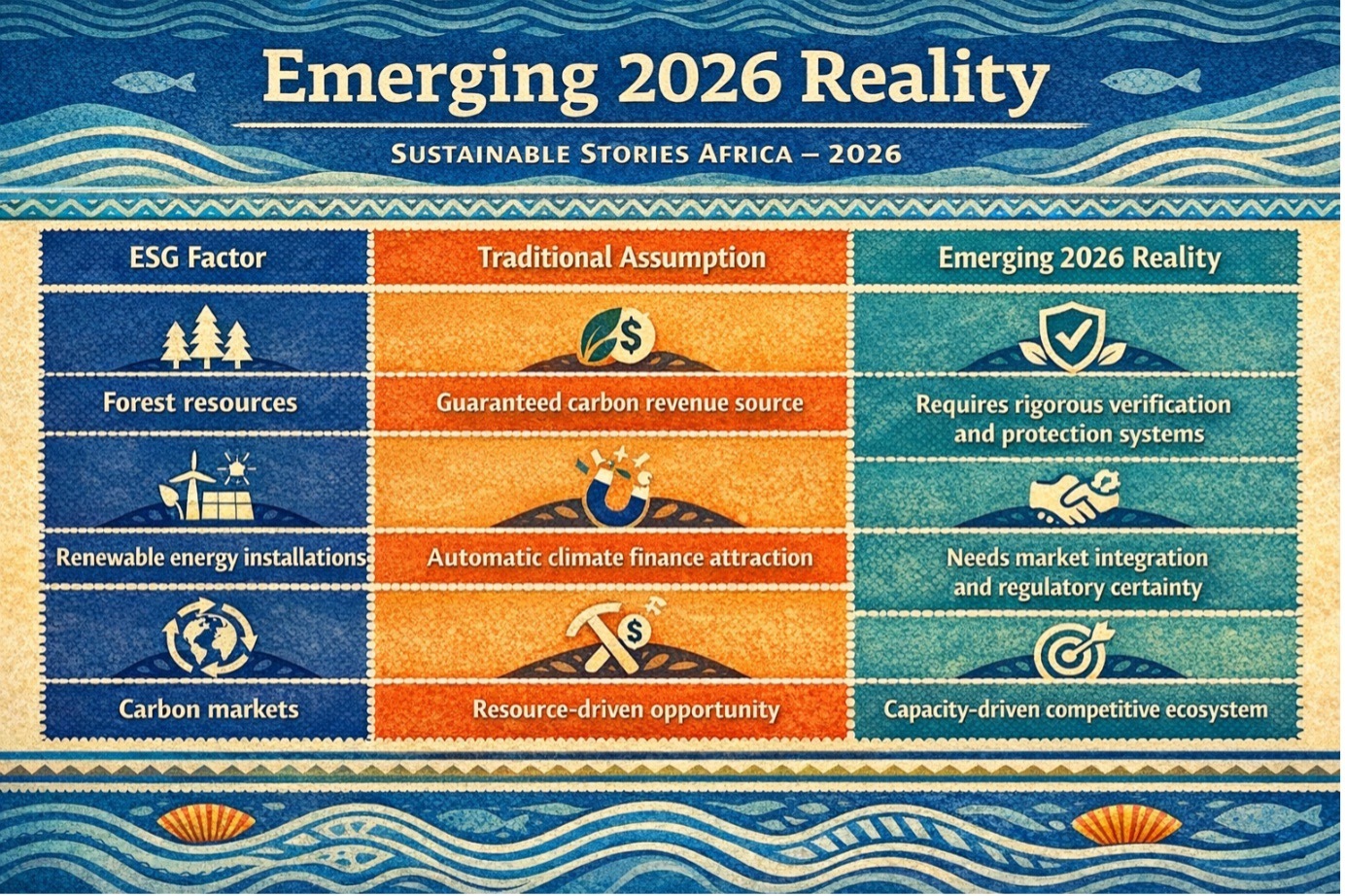

ESG Factor | Traditional Assumption | Emerging 2026 Reality |

|---|---|---|

Forest resources | Guaranteed carbon revenue source | Requires rigorous verification and protection systems |

Renewable energy installations | Automatic climate finance attraction | Needs market integration and regulatory certainty |

Carbon markets | Resource-driven opportunity | Capacity-driven competitive ecosystem |

Nigeria’s framework addresses these gaps by prioritising governance structures, registry systems, and institutional coordination.

Institutional Readiness Unlocks Climate Finance Advantage

The carbon market framework positions Nigeria to attract climate finance flows, create new revenue streams, and stimulate private investment.

Successful implementation could strengthen fiscal resilience while accelerating the industrial development of low-carbon industries.

Carbon markets offer multiple strategic benefits:

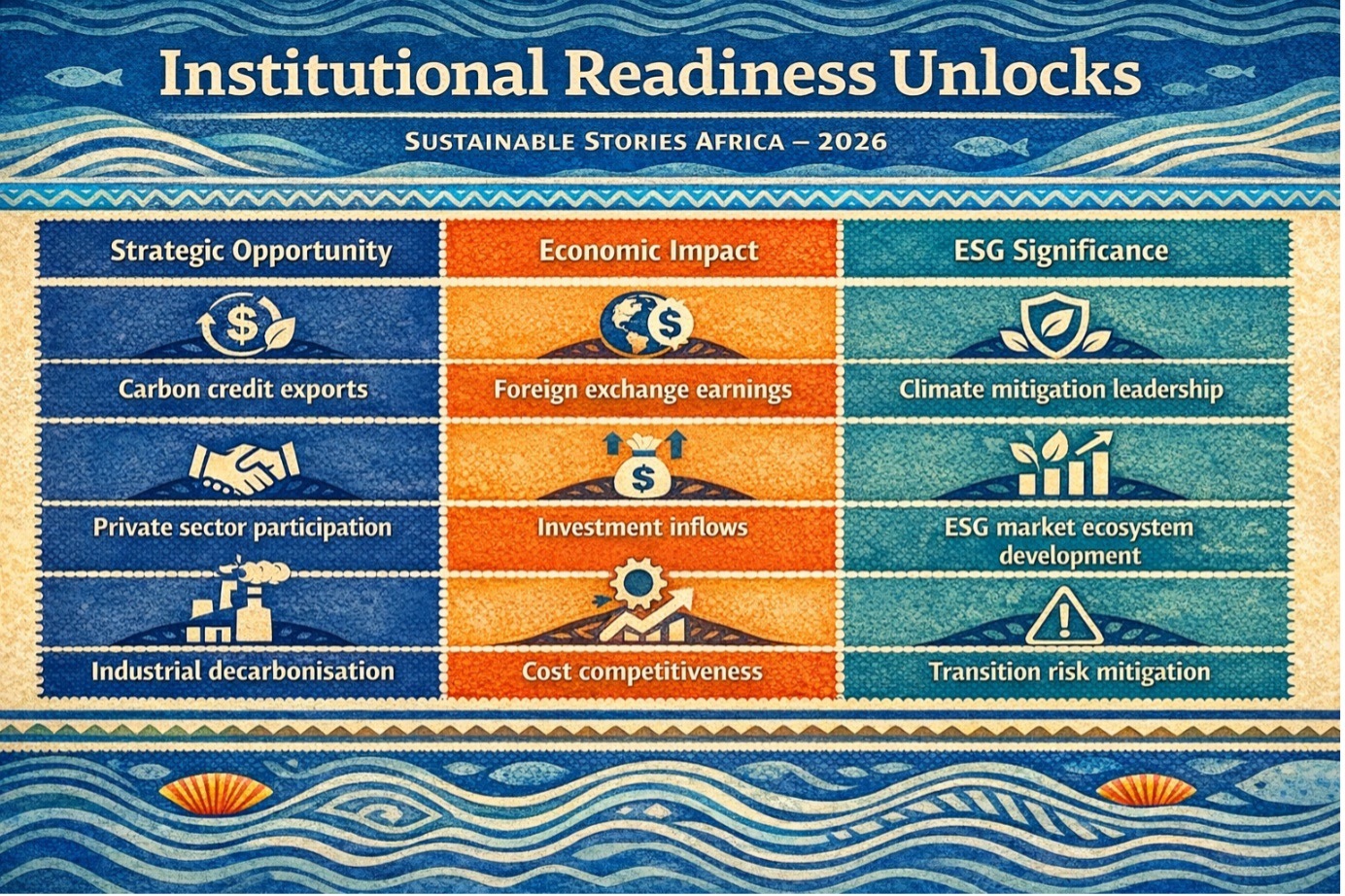

Strategic Opportunity | Economic Impact | ESG Significance |

|---|---|---|

Carbon credit exports | Foreign exchange earnings | Climate mitigation leadership |

Private sector participation | Investment inflows | ESG market ecosystem development |

Industrial decarbonisation | Cost competitiveness | Transition risk mitigation |

Countries with strong governance frameworks will capture a disproportionate share of climate finance inflows.

Nigeria’s proactive approach signals readiness to compete in global carbon markets, strengthening its ESG credibility.

Governance Execution Will Determine Market Success

The effectiveness of Nigeria’s carbon market will depend on regulatory integrity, technical capacity, and institutional coordination.

Transparent monitoring, reporting, and verification systems will be essential to building investor confidence.

Equally critical is workforce development. Skilled professionals capable of carbon accounting, climate finance structuring, and ESG compliance will determine whether Nigeria captures long-term market value.

The carbon market framework represents not only an environmental policy, but an economic competitiveness strategy.

Path-Forward – Capacity And Governance Determine Carbon Leadership

Nigeria is prioritising institutional capacity, regulatory transparency, and technical expertise to operationalise its carbon market framework.

These measures aim to enhance the credibility of climate finance and attract global investment.

Sustained success will depend on workforce development, governance enforcement, and international alignment, ensuring Nigeria converts carbon market participation into durable economic and ESG leadership.

Culled From: Nigeria: Launching the National Carbon Market Framework – ESG BROADCAST - Latest ESG News, Headlines and Updates