The International Fund for Agricultural Development (IFAD) has secured $70 million from Nordic investors through a sustainable development bond, signalling renewed confidence in agriculture-focused climate finance.

The bond highlights a growing shift in ESG capital allocation toward rural resilience, food systems, and adaptation infrastructure, areas increasingly viewed as financially and environmentally strategic.

For Africa, where agriculture underpins economic stability, the transaction highlights a widening opportunity to align development priorities with global sustainable investment flows.

Sustainable Bonds Refocus Climate Finance Priorities

The IFAD’s successful $70 million sustainable development bond issuance to Nordic investors marks a significant shift in global ESG capital flows, reinforcing agriculture and rural resilience as central pillars of climate finance strategy.

The transaction reflects growing investor recognition that climate risk is increasingly concentrated in food systems, water security, and rural economies, especially in Africa, where agriculture accounts for over 20% of GDP in many countries.

Rather than prioritising visible renewable infrastructure alone, ESG capital is increasingly targeting systemic resilience and adaptation capacity.

Investor Confidence Signals Agriculture’s Strategic ESG Role

The bond issuance demonstrates a strong institutional appetite for investments aligned with environmental sustainability and social development, particularly in emerging markets vulnerable to climate shocks.

Nordic investors, traditionally among the world’s most ESG-aligned capital providers, are expanding allocations to sustainable agriculture, recognising its dual impact potential: climate resilience and economic stability.

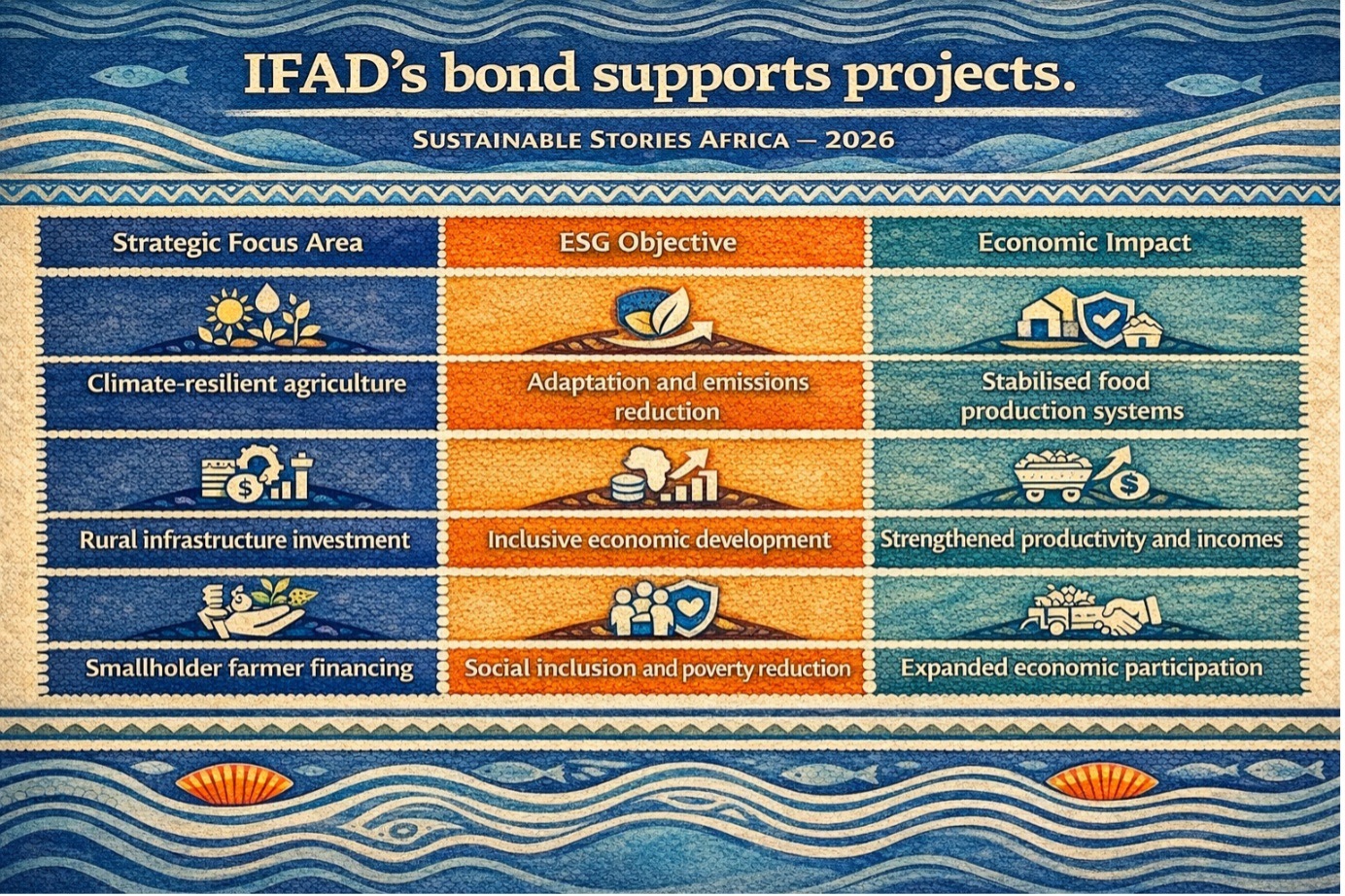

IFAD’s bond supports projects across key development priorities:

Strategic Focus Area | ESG Objective | Economic Impact |

|---|---|---|

Climate-resilient agriculture | Adaptation and emissions reduction | Stabilised food production systems |

Rural infrastructure investment | Inclusive economic development | Strengthened productivity and incomes |

Smallholder farmer financing | Social inclusion and poverty reduction | Expanded economic participation |

This shift reflects a broader evolution of the ESG market toward foundational economic resilience.

Rural Resilience Now Drives Climate Investment

Investors are increasingly recognising that agriculture represents both a climate vulnerability and a climate solution. Sustainable financing enables farmers to adopt resilient practices, strengthen supply chains, and reduce the intensity of emissions.

For African economies, the implications are profound. Improved agricultural resilience strengthens food security, reduces fiscal vulnerability to climate shocks, and enhances economic stability.

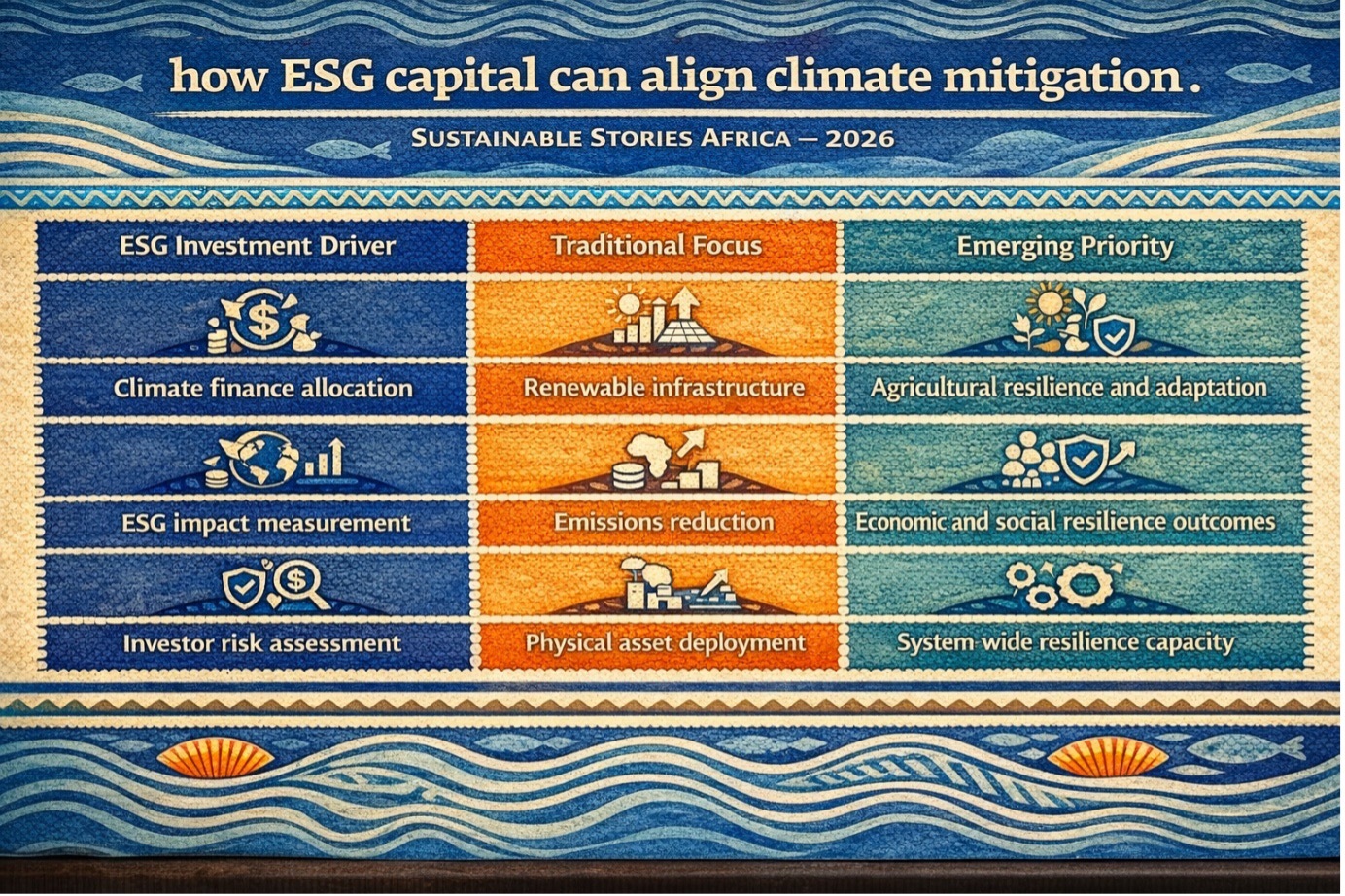

The IFAD bond demonstrates how ESG capital can align climate mitigation with economic development priorities.

ESG Investment Driver | Traditional Focus | Emerging Priority |

|---|---|---|

Climate finance allocation | Renewable infrastructure | Agricultural resilience and adaptation |

ESG impact measurement | Emissions reduction | Economic and social resilience outcomes |

Investor risk assessment | Physical asset deployment | System-wide resilience capacity |

This evolution reflects growing maturity in ESG capital allocation.

Africa Positioned To Capture Climate Capital

Africa stands to benefit significantly from this shift, given its agricultural potential and vulnerability to climate change. Countries with robust governance frameworks, project pipelines, and institutional capacity will attract greater ESG investment flows.

Development institutions and governments are increasingly aligning policies to facilitate access to climate finance, recognising agriculture as central to sustainable growth.

The IFAD bond signals growing investor confidence in development-focused climate investment models, creating opportunities for broader capital mobilisation.

Africa’s climate narrative is expanding, from renewable deployment to systemic economic resilience.

Path Forward – Agricultural Finance Anchors Climate Economic Stability

Climate finance is increasingly prioritising agricultural resilience, rural infrastructure, and inclusive development outcomes.

These investments strengthen economic stability while supporting climate adaptation objectives.

Africa’s ability to attract sustainable capital will depend on governance readiness, project credibility, and institutional capacity, ensuring climate finance delivers measurable economic and environmental impact.

Culled From: IFAD Raises $70M Sustainable Development Bond With Nordic Investors - ESG News