Africa’s water security push has emerged as a defining ESG battleground in 2026, reshaping growth priorities and investor risk assessments across infrastructure, energy, and mining sectors.

At the same time, carbon markets and lithium supply chains are accelerating Africa’s strategic importance in global decarbonisation, amplifying policy urgency and social media scrutiny.

Together, water, carbon, and lithium are redefining Africa’s ESG narrative, from vulnerability to leverage.

Resource Security Redefines Africa’s ESG Future

The African Union’s 2026 water mandate has elevated water security into one of the continent’s most urgent economic and ESG priorities, placing it alongside carbon markets and lithium supply chains as the three dominant forces shaping policy and investor attention.

The AU’s renewed focus on sanitation, climate resilience, and water governance signals a broader shift: Africa’s natural resources are no longer viewed solely as development challenges, but as strategic ESG assets.

Policymakers, investors, and citizens are increasingly framing water access, carbon sequestration, and critical minerals as interconnected pillars of economic sovereignty.

Social media conversations, amplified by youth advocates and ESG analysts, have accelerated public scrutiny of how governments and corporations manage these resources.

Policy Signals Converge Across Three Resources

Africa’s water crisis affects over 400 million people who lack basic access to drinking water, according to continental policy discussions, undermining industrial productivity and public health.

Simultaneously, Africa’s vast carbon sink potential, especially in forests and wetlands, positions the continent as central to global decarbonisation markets.

Lithium, essential for batteries and clean energy storage, has further intensified Africa’s strategic relevance as countries such as Zimbabwe and Namibia expand extraction capacity.

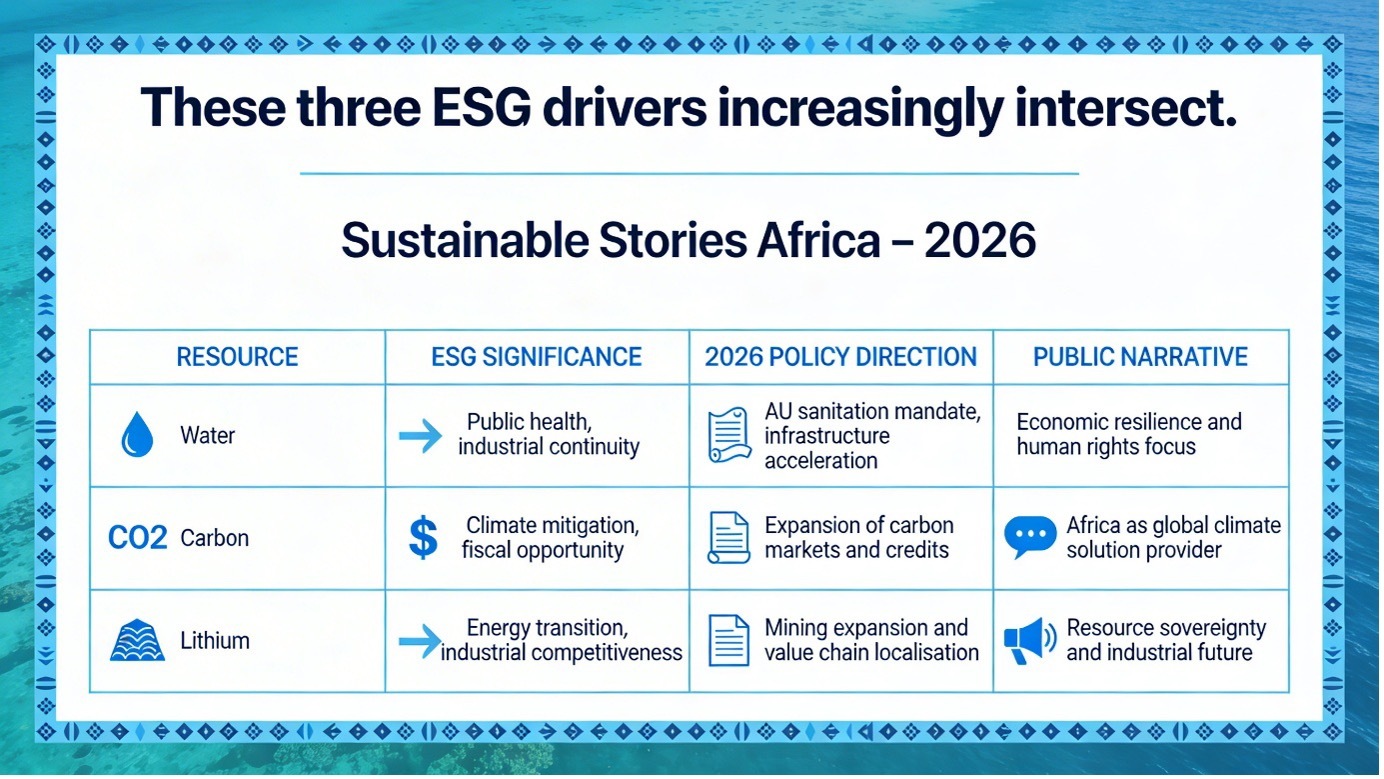

These three ESG drivers increasingly intersect:

Resource | ESG Significance | 2026 Policy Direction | Public Narrative |

|---|---|---|---|

Water | Public health, industrial continuity | AU sanitation mandate, infrastructure acceleration | Economic resilience and human rights focus |

Carbon | Climate mitigation, fiscal opportunity | Expansion of carbon markets and credits | Africa as global climate solution provider |

Lithium | Energy transition, industrial competitiveness | Mining expansion and value chain localisation | Resource sovereignty and industrial future |

Together, these developments reflect a shift from risk exposure to strategic positioning.

Strategic Resources Strengthen Africa’s Global Leverage

Africa’s emerging resource alignment creates an unprecedented opportunity to reshape its economic trajectory.

Carbon markets offer potential revenue streams, water infrastructure strengthens industrial productivity, and lithium enables participation in global clean energy supply chains.

Investors increasingly view Africa’s ESG resource base as a competitive advantage. Countries able to align water governance, carbon monetisation, and mineral industrialisation will attract greater capital, strengthen fiscal stability, and accelerate sustainable growth.

Failure to manage these resources effectively, however, risks reinforcing inequality and limiting long-term value capture.

Leadership Choices Will Determine ESG Outcomes

Governments, regulators, and corporations now face a critical phase of implementation.

Transparent governance frameworks, infrastructure investment, and value chain localisation policies will determine whether Africa captures lasting ESG value.

Institutional reforms, including strengthening water governance, a regulatory carbon market, and responsible mineral extraction, are essential to convert resource potential into economic resilience.

Africa’s ESG narrative is shifting decisively, from passive participant to strategic actor.

Path Forward – Coordinated Resource Governance Secures Africa’s Future

African policymakers are prioritising integrated water security, expansion of the carbon market, and localisation of the lithium value chain. These measures aim to strengthen economic resilience while positioning Africa as a central part of the global ESG transition frameworks.

Successful implementation will depend on governance transparency, infrastructure investment, and regional cooperation, ensuring resource wealth translates into inclusive and sustainable economic transformation.

Culled From: Africa’s 2026 Water Mandate: AU Sets the Course for Sanitation and Sustainable Growth - The Voice of Africa