"It is a privilege to join you at this landmark event—the Bank of Industry's Maiden ESG Conference. The theme, 'Thriving in a Changing World: ESG Pathways for Nigerian SMEs,' could not be more timely or urgent.

We meet at a defining moment—one where environmental responsibility, social inclusion, and good governance are no longer optional ideals, but strategic imperatives for growth and survival"

These were the words of Omo tenioye Majekodunmi, Director General – National Council on Climate Change.

ESG Pathways – A Strategic Imperative for Nigerian SMEs

At the heart of Nigeria's first Bank of Industry ESG Conference, leaders set an urgent agenda: SMEs must become champions of environmental, social, and governance principles, not simply for compliance but for competitive advantage.

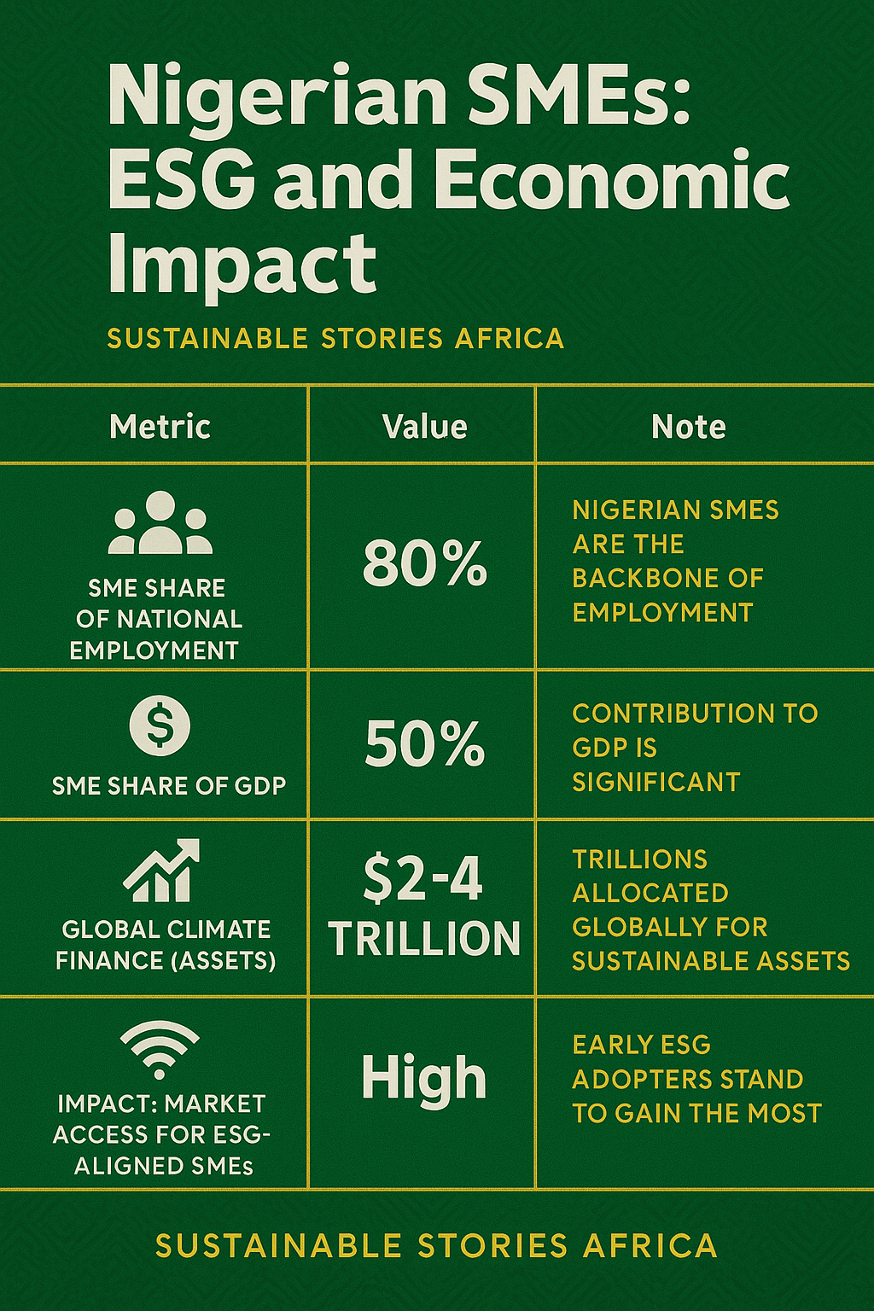

As SMEs account for 80% of national employment and nearly 50% of GDP, the conference introduced the Sustainability Finance Framework (SFF), a blueprint designed to channel inclusive, climate-smart finance, helping Nigerian businesses thrive in the wake of shifting investor priorities and global climate realities.

Finance, Policy, and Practice Driving Sustainable Change

Global capital - trillions of dollars - flows toward sustainable assets, and those Nigerian SMEs embedding ESG principles will access new markets and boost resilience.

The National Council on Climate Change (NCCC) supports this shift with integrated ESG metrics in national policies, sector guidelines (manufacturing, energy, agriculture), and a new climate data repository.

Incentives like tax breaks and credit support reward businesses adopting ESG, while targeted partnerships build their capacity for green, inclusive growth.

| Metric | Value | Note |

|---|---|---|

| SME share of national employment | 80% | Nigerian SMEs are the backbone of employment |

| SME share of GDP | 50% | Contribution to GDP is significant |

| Global climate finance (assets) | $2-4 trillion | Trillions allocated globally for sustainable assets |

| Impact: Market access for ESG-aligned SMEs | High | Early ESG adopters stand to gain the most |

Unlocking Growth for Next-Generation Nigerian Industry

The ESG transition is a business opportunity, not a burden. Investors now demand ethical sourcing, transparency, and carbon footprint accountability.

Early adopters among Nigerian SMEs, implementing sustainability reporting and inclusive governance, will become preferred partners for global trade and finance, as ESG reporting transforms from a checkbox to a strategy.

Charting Nigeria's Path to Lead

With the Bank of Industry and NCCC as catalysts, Nigeria's SMEs have the policy tools, technical support, and financial incentives needed to pursue ESG leadership.

Collaboration between regulators, financiers, and businesses will make sustainability a national development strategy, and not just a compliance exercise.

The call: Build capacity, report performance, seize green finance, and ensure every SME thrives in a rapidly changing world.

Path Forward – ESG Unlocks Prosperity for Nigerian SMEs

Nigeria's ESG push centres on policy alignment, incentives, and skills, thereby empowering SMEs for climate-resilient, competitive growth.

National frameworks, sector guidelines, and global finance drive this strategic transformation.

By unlocking robust support and clear pathways, Nigeria positions its market for sustainable prosperity, anchored in innovation and inclusive development for businesses nationwide.