Africa's climate challenge is no longer defined by ambition alone, but by execution. As climate risks intensify, the continent faces a widening gap between commitments and capital deployment.

The Africa Impact Report shows how data-driven finance tracking, institutional reform and innovative instruments are quietly reshaping Africa's climate finance landscape, laying foundations for scale, credibility and private investment mobilisation.

From Commitments to Capital

Africa stands at the centre of the global climate conversation, not because it emits the most, but because it absorbs the harshest impacts with the least financial protection. More than half of the world's most climate-vulnerable countries are on the continent, yet Africa continues to receive a disproportionately small share of global climate finance flows.

For years, the debate focused on "how much" finance Africa needs. Increasingly, the question has shifted to "how finance flows, where it goes, and whether it works." Weak data, fragmented institutions and limited project preparation capacity have historically constrained Africa's ability to convert climate ambition into bankable pipelines that attract private capital at scale.

The Africa Impact Report by the Climate Policy Initiative (CPI) argues that this constraint is now being systematically addressed. Through climate finance tracking, policy effectiveness support, financial innovation and institutional capacity building, Africa's climate finance architecture is evolving. The transition is quiet, technical and data-heavy, but its implications for markets, governments and investors are profound.

Africa's Climate Finance Gap Is Structural, Not Symbolic

Africa's climate finance challenge is not rooted in a lack of projects or need, but in weak financial plumbing. CPI's analysis shows that climate finance flows remain fragmented across countries, sectors and institutions, limiting their catalytic impact on private capital mobilisation.

Despite growing global commitments, finance often fails to reach adaptation, food systems, cities and sub-national infrastructure, areas where climate risks intersect most sharply with development needs. The result is a paradox: rising climate vulnerability alongside under-utilised capital.

However, CPI's decade-long tracking work now covers continent-wide and country-level climate finance landscapes, providing governments, DFIs and investors with the most comprehensive data sets available to guide decisions.

This shift, from anecdotal evidence to granular, comparable data, is reshaping how Africa is perceived in global climate finance negotiations.

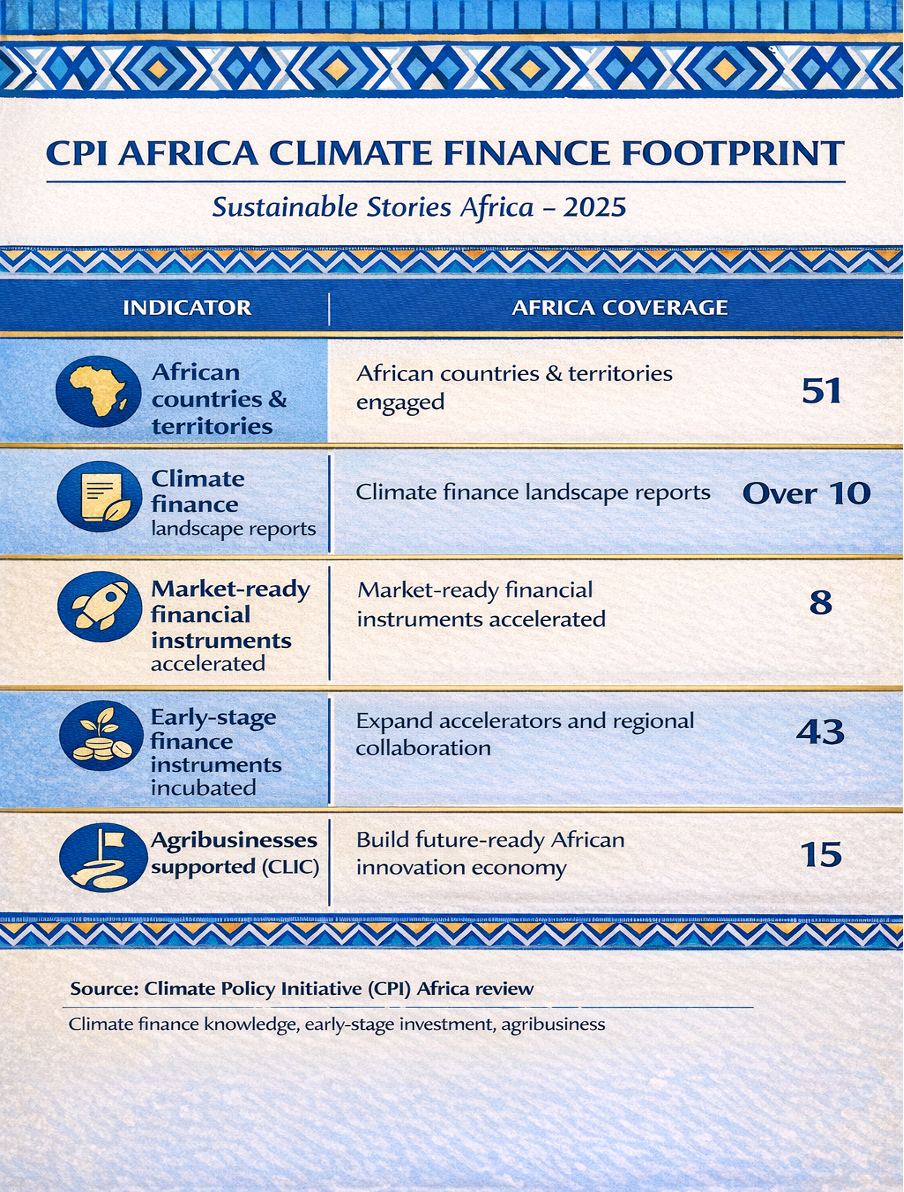

CPI Africa Climate Finance Footprint

| Indicator | Africa Coverage |

|---|---|

| African countries & territories engaged | 51 |

| Climate finance landscape reports | Over 10 |

| Market-ready financial instruments accelerated | 8 |

| Early-stage finance instruments incubated | 43 |

| Agribusinesses supported (CLIC) | 15 |

Building the Financial Architecture Behind Climate Action

CPI's Africa strategy rests on four pillars, which are Assess, Improve, Scale and Bridge, designed to move climate finance from reporting to results.

- Assess focuses on tracking and mapping climate finance flows, informing UNFCCC negotiations, IPCC assessments and national development plans. These datasets now underpin Africa-specific climate finance dashboards used by governments and multilaterals.

- Improve supports governments to institutionalise climate finance tracking and align national taxonomies with global standards. In South Africa, CPI's work with the Presidential Climate Commission has been described as "seminal" in shaping national climate policy.

- Scale centres on financial innovation. Through the Global Innovation Lab for Climate Finance and the Catalytic Climate Finance Facility, CPI has helped mobilise over USD 550 million for Africa-focused instruments, with 38% already reaching market deployment.

- The bridge connects public institutions, private investors and sub-national actors, particularly cities, where climate infrastructure demand is rising fastest.

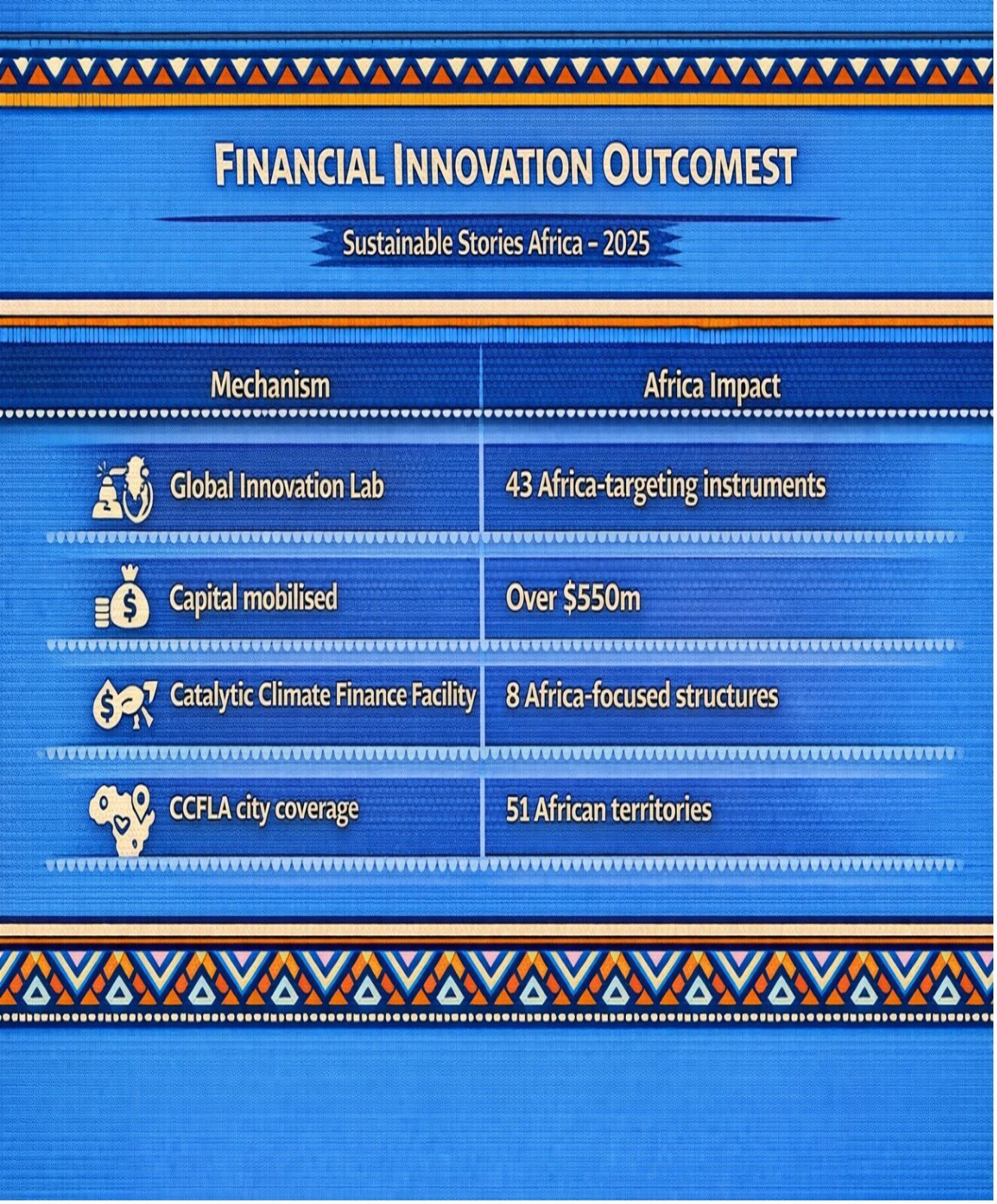

Financial Innovation Outcomes

| Mechanism | Africa Impact |

|---|---|

| Global Innovation Lab | 43 Africa-targeting instruments |

| Capital mobilised | Over $550m |

| Catalytic Climate Finance Facility | 8 Africa-focused structures |

| CCFLA city coverage | 51 African territories |

Unlocking Markets, Not Just Mitigating Risk

The promise of this architecture lies in its market effect. Better data lowers perceived risk. Standardised taxonomies reduce transaction costs. Project preparation facilities unlock municipal and sub-national pipelines long ignored by global capital.

In food systems, CPI-supported agribusinesses under the ClimateShot Investor Coalition have already raised $15 million, demonstrating how impact measurement and investor readiness translate into real capital flows.

In adaptation finance, historically underfunded, CPI's work highlights pathways to crowd in private capital through blended instruments, insurance mechanisms and resilience bonds. These approaches reposition adaptation not as a fiscal burden, but as an investable asset class.

If scaled, this model could redefine Africa's climate narrative—from vulnerability to investability.

Why Policy, Capital and Data Must Move Together

However, progress remains fragile. Climate finance institutions must move faster to integrate tracking into budget processes. Development banks must co-finance at scale. Private investors must recalibrate risk assumptions using Africa-specific data rather than global proxies.

CPI's planned Africa Climate Finance Centre signals the next phase: embedding expertise locally, supporting NDC implementation, costing climate needs within public budgets and accelerating private finance mobilisation on a sustainable basis.

For policymakers, investors and corporates, the call to action is clear: Africa's climate transition will not be financed by pledges alone, but by systems that convert data into deal flow.

PATH FORWARD – Data-Driven Finance, Scaled African Transitions

Africa's climate future hinges on financial credibility as much as climate ambition. Robust data-aligned taxonomies and innovative instruments are steadily closing the gap between global capital and local priorities.

The next decade will test whether these foundations can scale fast enough, turning climate finance from fragmented flows into a coherent, investable ecosystem that delivers resilience, growth and shared prosperity across the continent.