Strong ESG reporting is often sold as a fast route to stronger margins. New Nigerian evidence suggests a more complicated reality.

An empirical study of listed oil and gas firms finds that governance disclosure, not environmental or social reporting, has a statistically significant impact on cash-flow margins, challenging popular assumptions.

The findings sharpen a critical question for African corporates and investors alike: which ESG levers actually move financial performance and on what timeline?

When ESG Meets Cash Reality

ESG reporting has become one of the fastest-moving frontiers in corporate strategy, investor relations, and regulatory reform. From Lagos to London, firms are being pushed to disclose more on climate risks, community impacts, and board accountability, often under the promise that transparency will translate into stronger financial outcomes.

But evidence from Nigeria's oil and gas sector suggests the relationship between ESG reporting and cash performance is neither uniform nor immediate. A decade-long empirical study of listed firms shows that while environmental and social disclosures are increasingly visible, only governance reporting demonstrates a statistically significant relationship with cash-flow margins.

This divergence matters. Cash-flow margin is not a market sentiment metric; it reflects a company's ability to convert revenue into usable cash. For capital-intensive African sectors navigating volatility, regulation, and infrastructure risk, understanding which ESG dimensions actually protect liquidity is now a strategic imperative.

The ESG Assumption Under Scrutiny

The dominant ESG narrative assumes a linear relationship: better disclosure leads to better performance. In practice, the Nigerian oil and gas data tells a more selective story.

Between 2014 and 2023, nine listed oil and gas firms were analysed using panel regression techniques. The results are striking. Environmental and social reporting showed no statistically significant effect on cash-flow margins, while governance reporting demonstrated a significant impact on firms' ability to generate cash from operations.

What the Data Actually Shows

The study dissected ESG into its three core pillars – Environmental (ENV), Social (SOC), and Governance (GOV) – and tested their individual impact on cash-flow margin (CFM).

Directional Impact of ESG Reporting on Cash-Flow Margin (Nigeria Oil & Gas)

| ESG Pillar | Direction of Impact on CFM | Statistical Significance |

|---|---|---|

| Environmental Reporting | Negative | Not significant |

| Social Reporting | Positive | Not significant |

| Governance Reporting | Negative (strong magnitude) | Significant |

At first glance, the governance result appears counterintuitive: improved governance disclosure correlates with a reduction in cash-flow margin. However, this reflects short-term cash discipline effects, not value destruction.

Stronger governance typically exposes inefficiencies, tightens controls, reduces opaque transactions, and curbs rent-seeking actions that can initially compress reported cash margins while strengthening long-term resilience.

By contrast, environmental and social disclosures, often compliance-driven and expenditure-heavy, do not immediately translate into cash gains in sectors where remediation costs, community investments, and reporting systems carry upfront financial burdens.

Why Governance Moves the Needle First

Governance is the ESG pillar most closely linked to capital allocation, risk control, and financial discipline, all direct drivers of cash flow.

In Nigeria's oil and gas sector, governance reporting intersects with:

- Board oversight of capital expenditure

- Transparency in joint-venture accounting

- Controls over oil theft, leakage, and contract opacity

- Investor confidence and cost of capital

The study's findings reinforce a growing global consensus: governance acts as the transmission channel through which ESG affects financial performance, particularly in emerging markets with institutional fragilities.

Rethinking ESG Strategy in African Markets

For African corporations, the implication is not to downplay environmental or social reporting, but to sequence ESG intelligently.

Environmental and social disclosures should be treated as strategic risk-management investments, not short-term margin enhancers. Governance, however, deserves immediate prioritisation as the ESG lever most likely to influence cash performance in the near term.

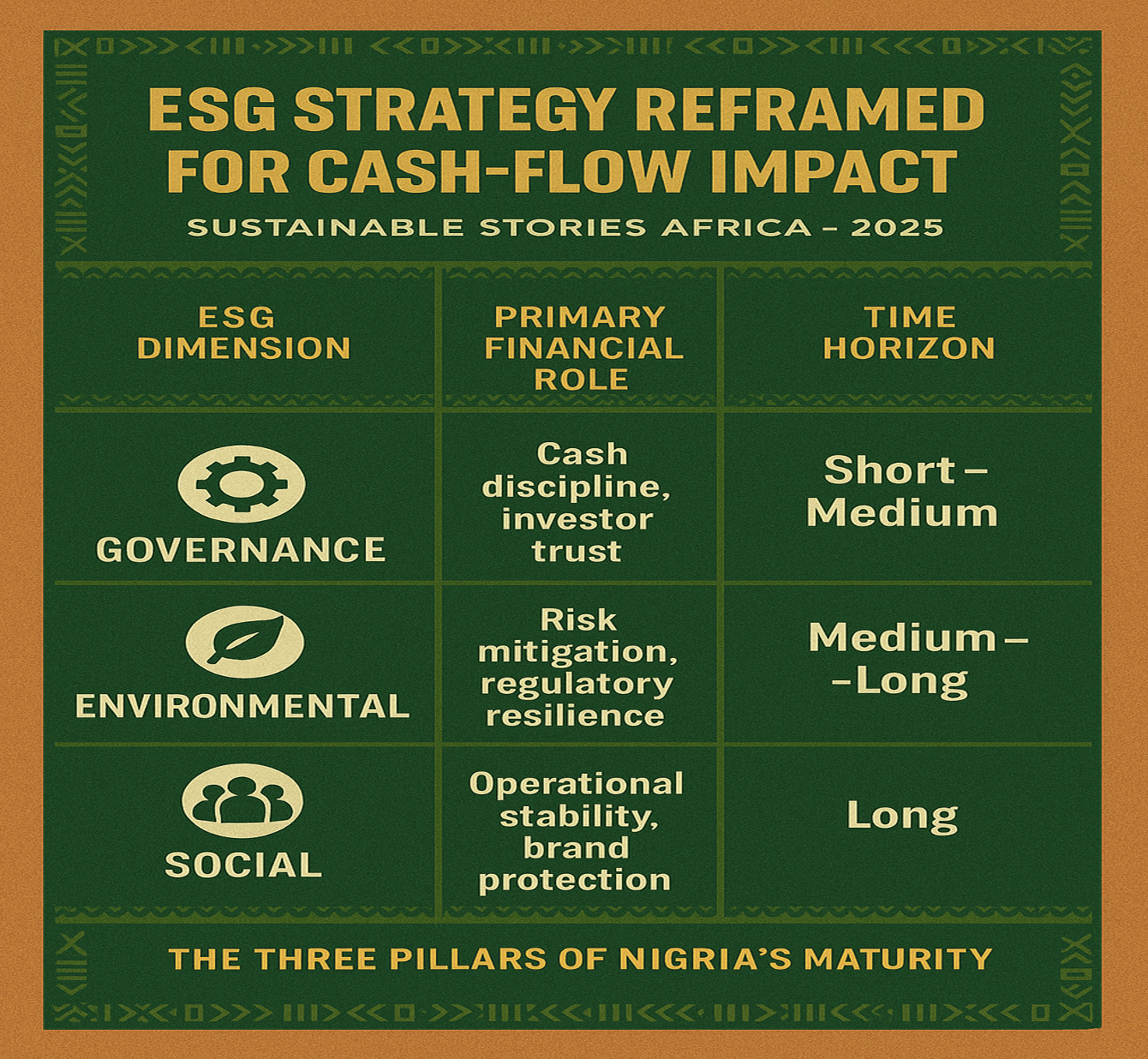

ESG Strategy Reframed for Cash-Flow Impact

| ESG Dimension | Primary Financial Role | Time Horizon |

|---|---|---|

| Governance | Cash discipline, investor trust | Short–Medium |

| Environmental | Risk mitigation, regulatory resilience | Medium–Long |

| Social | Operational stability, brand protection | Long |

For investors, this argues for pillar-specific ESG analysis, rather than headline ESG scores. For regulators, it underscores the importance of governance benchmarks as the foundation of credible sustainability reporting regimes.

PATH FORWARD – Sequencing ESG for Real Financial Impact

African firms must move beyond ESG as optics and embrace governance-first sustainability. Strong boards, transparent controls, and credible disclosures create the financial architecture that allows environmental and social investments to pay off over time.

Policymakers, meanwhile, should anchor ESG frameworks in governance standards, while allowing environmental and social benefits to mature. ESG does not fail cash flow; it demands patience, sequencing, and realism.