Africa enters the second half of the decade facing slowing productivity, rising debt, and accelerating climate risk.

However, Foresight Africa 2025 – 2030 argues that the continent's future will be shaped less by external rescue than by how effectively it mobilises its own strengths.

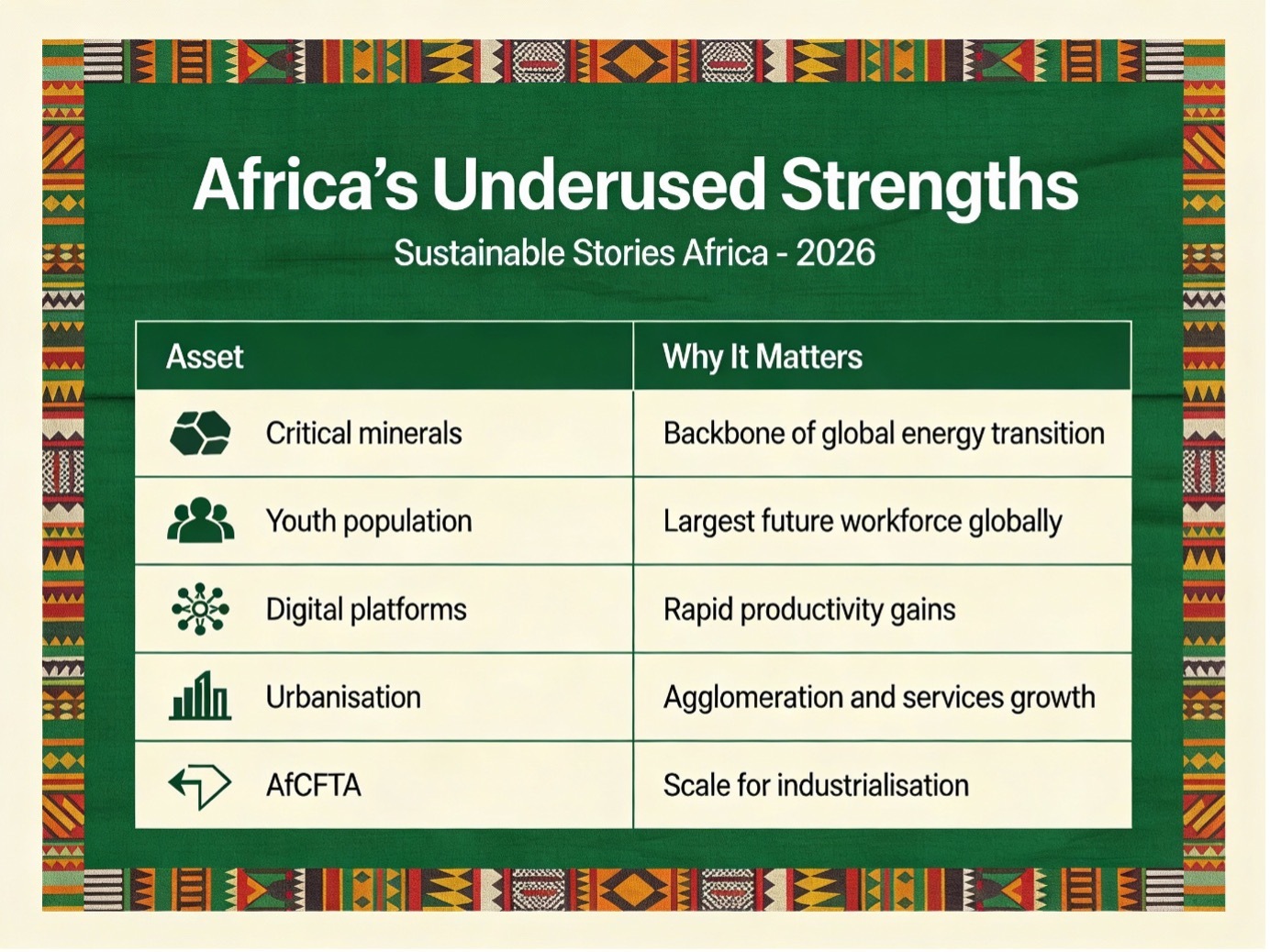

From critical minerals and urbanisation to youth, digitalisation, and regional trade, the report reframes Africa not as a frontier of risk, but as a platform for productive growth, if policy, governance, and investment finally align.

Unlocking Africa's Growth From Within

Africa is no longer short of ambition. Across capitals and boardrooms, the language of transformation – industrialisation, value addition, demographic dividends, green growth – has become familiar. What remains elusive is execution at scale.

Foresight Africa 2025–2030 (Pages 15–48) makes a deliberate pivot away from dependency narratives. Its argument is clear: Africa's development over the next five years will depend primarily on how well it leverages its internal strengths: human capital, natural resources, cities, digital platforms, and regional markets, rather than waiting for favourable global conditions.

The urgency is stark. While Africa's GDP growth is projected at about 4.2%, productivity growth has slowed sharply, poverty remains widespread, and fiscal space is shrinking. The question, the report suggests, is no longer whether Africa can grow, but how it converts potential into sustained, inclusive prosperity.

Africa's Growth Paradox Is Productivity

Africa's headline growth masks a deeper problem. Real GDP per capita has increased by just 1.1% annually since 1990, leaving nearly 60% of Africans living in poverty and youth unemployment persistently above 25% in many economies across the continent.

At the same time, Africa is urbanising faster than any other region, adding hundreds of millions of working-age people within a single generation. Without productivity-driven growth, this demographic surge risks becoming a liability rather than a dividend.

The report frames this as a defining paradox: "Africa's strengths are real, but under-mobilised."

What Africa Already Has Going For It

The referenced section of the report on Pages 15 – 48 identify five structural strengths that could anchor a new growth model.

- Natural resources – if value is retained – Africa holds around 30% of global mineral reserves, including the bulk of minerals critical to the energy transition: cobalt, manganese, iridium.

However, raw exports still dominate. The report argues that value addition, beneficiation, and regional value chains, not extraction alone, are the real growth unlocks.

- A uniquely young workforce – By 2050, nearly 800 million people of African descent will make up the global labour force. With a median age under 20, no other region has comparable demographic momentum.

The risk, however, is skills mismatch, turning youth into surplus labour rather than productive capital.

- Digital leapfrogging – Internet users have grown by about 17% annually since 2013, while fintech and platform businesses are formalising millions of livelihoods.

Digitalisation, the report notes, is already Africa's quiet productivity engine—but only where regulation, skills, and infrastructure keep pace.

- Cities as growth engines – Africa is set to add more than 500 million urban residents by 2040, with many cities having a population of five million or more, nearly tripling.

If managed well, cities can drive agglomeration, service productivity, and innovation. Managed poorly, they entrench inequality.

- Regional markets – Intra-African trade is still very low at 14% of total trade, far below other regions. Accelerating the AfCFTA is presented as one of the fastest ways to scale markets, reduce costs, and diversify production.

Africa's Underused Strengths

| Asset | Why It Matters |

|---|---|

| Critical minerals | Backbone of global energy transition |

| Youth population | Largest future workforce globally |

| Digital platforms | Rapid productivity gains |

| Urbanisation | Agglomeration and services growth |

| AfCFTA | Scale for industrialisation |

What a Shift to Productivity Could Deliver

The report's core proposition is simple: Africa's growth must become productivity-led.

That is shifting its focus from commodity dependence to diversified value creation; from consumption-driven growth to investment in skills, infrastructure, and firms; and from fragmented national strategies to regional coordination.

If achieved, the gains are substantial. Services already account for 56% of GDP and 39% of employment, indicating where future productivity improvements will matter most. Green manufacturing alone could generate hundreds of thousands of jobs and billions in revenue by 2030 if policy and finance align.

Crucially, the report stresses that productivity growth is also a governance story—dependent on predictable regulation, credible institutions, and efficient public spending.

From Strengths to Strategy

Foresight Africa is explicit about what must change.

- Governments must prioritise productivity sectors, energy, transport, digital, skills, over politically convenient but low-impact spending.

- Investors and development partners must support value-adding industries and regional platforms rather than isolated projects.

- The private sector must be treated as a development actor, not merely a tax base, especially in job-rich services, manufacturing, and agri-processing.

Africa's strengths will not automatically translate into growth. They require coordination, discipline, and time-consistent policy.

Path Forward — Productivity Before Prosperity Fades

Africa's next five years will be defined by whether it converts internal strengths into sustained productivity gains.

By investing in value addition, skills, cities, digital systems, and regional trade, the continent can escape low-growth traps.

The window remains open, but only if strategy becomes the focus, rather than fragmentation, and execution replaces rhetoric.