Amid Africa's swirling climate disruptions and regulatory flux, Stanbic's digital-first strategy emerges as a beacon for sustainable banking.

Unlike traditional risk controls, Stanbic's embrace of digitisation powers rapid, data-driven responses to climate threats while unveiling new avenues for growth.

In this new ESG landscape, digital transformation is not just about modernisation; it is a vital tool for defence.

Stanbic IBTC integrates predictive analytics, AI-driven risk modelling, scenario analysis, and blockchain technology for transparent green bonds and carbon credits.

These methods strengthen regulatory compliance, accelerate lending to green projects, and prevent climate-driven loan portfolio shocks.

This is no mere adaptation. It's a commitment to actionable intelligence, turning vast data streams into forward-looking risk and opportunity insights.

Stanbic goes beyond mitigation, activating a new era where risk identification, tracking, and reporting are integral to sustainable value creation.

It is a fundamental moment. Stanbic exemplifies how African banks can drive resilience not simply as a matter of survival, but as a platform for innovative, sustainable prosperity.

Digital is the Gateway to Resilience

The ESG risks facing African banks are deep, ranging from physical climate impacts to regulatory shocks.

Stanbic's strategic answer is unambiguous: digitise the entire risk process. By deploying integrated platforms for ESG data collection, analysis, and real-time monitoring, Stanbic ensures that every sustainability risk is visible, trackable, and actionable.

Beyond Compliance – Towards Proactive Value Creation

Stanbic's digitisation unlocks scenario analysis, predictive mapping and swift regulatory response.

Data dashboards highlight exposure and opportunity, offering stakeholders a panoramic view of climate and governance risk. This transparency elevates internal controls and feeds into more accurate and persuasive sustainability reporting.

Stanbic's Digital ESG Risk Model

| Component | Digital Tool/Activity | Result |

| Data Acquisition | IoT, Remote Sensing, Internal Audits | Real-time ESG metrics |

| Analysis | AI, Predictive Analytics | Faster risk identification |

| Reporting | Dashboard Portals | Stakeholder transparency |

| Scenario Planning | Simulation Software | Forward-looking resilience testing |

It is a fundamental moment. Stanbic exemplifies how African banks can drive resilience not simply as a matter of survival, but as a platform for innovative, sustainable prosperity.

Catalysing Change – Digital as Opportunity Machine

Stanbic's approach sparks a shift from risk avoidance to opportunity discovery.

Integrating real-time analytics enables the bank to spot new green financing markets, energy transition investments, and resilient SME clients.

The digital strategy makes it easier to comply with evolving regulations and deliver a measurable impact on climate targets.

Best Practice, Replicated Regionwide

To transform Africa's banking sector, Stanbic offers a replicable roadmap.

The pillars: invest in digital infrastructure, train staff in ESG analytics, collaborate for interoperable industry tools, and advocate for regional policy harmonisation.

Infographic: Stanbic's Strategic Digitisation Cycle

- Input: Collect diverse ESG data

- Throughput: Apply analytics for insights

- Output: Drive reporting and opportunity discovery

Path Forward: Stanbic's Digital Playbook for Climate Resilience

Stanbic's priorities are clear: scale digital ESG integration, expand climate risk literacy across the sector, and partner with innovative tech providers.

By investing in ongoing workforce training and advocating for cross-industry data standards, Stanbic promises to extend the gains of digitisation to the broader African banking ecosystem.

The transition from risk to opportunity is not optional but essential, and Stanbic's framework lays down a roadmap others can follow to make their own climate resilience stories.

Africa's financial future depends on data-driven, adaptive action. Stanbic's digital ESG risk strategy offers the blueprint: invest boldly in digitisation, empower teams, and seize the climate-opportunity frontier.

The imperative is clear: transform risk into resilience, and resilience into growth.

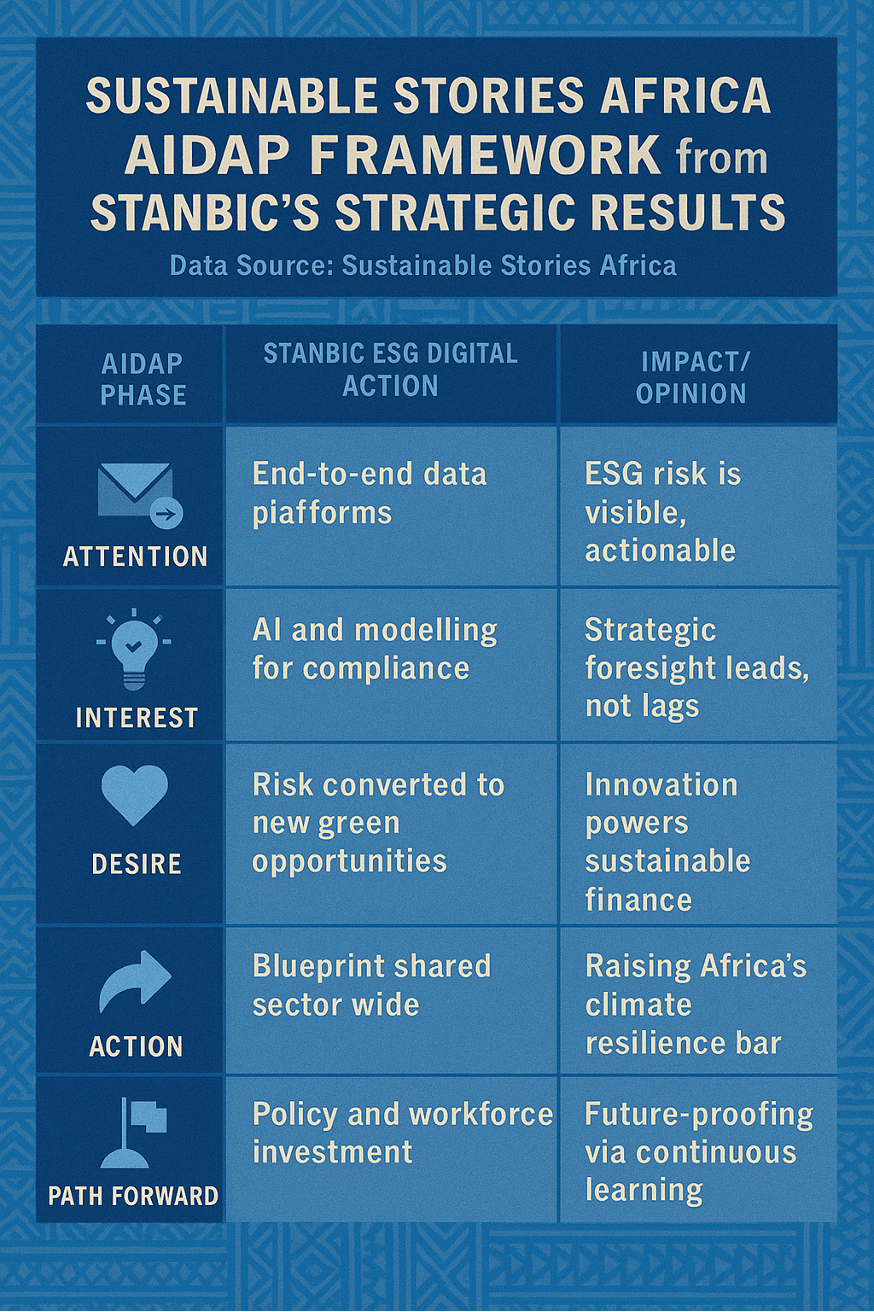

Sustainable Stories Africa A IDAP Framework from Stanbic's Strategic Results

| AIDAP Phase | Stanbic ESG Digital Action | Impact/Opinion |

| Attention | End-to-end data platforms | ESG risk is visible, actionable |

| Interest | AI and modelling for compliance | Strategic foresight leads, not lags |

| Desire | Risk converted to new green opportunities | Innovation powers sustainable finance |

| Action | Blueprint shared sectorwide | Raising Africa's climate resilience bar |

| Path Forward | Policy and workforce investment | Futureproofing via continuous learning |