Malawi is running out of fiscal road. Public debt has surged, deficits remain among the highest in Sub‑Saharan Africa, and more than three in four Malawians now live in extreme poverty, with over 50% of domestic revenue swallowed by interest payments.

However, this is not a story of inevitable collapse. The country has a credible, costed roadmap to restore stability through smarter spending, fairer taxation, and tougher governance of state‑owned enterprises, if political will can hold beyond the next election cycle.

Breaking The Cycle Of Fiscal Firefighting

Malawi stands at a critical inflexion point: either pursue decisive fiscal consolidation and structural reform, or risk sliding into a prolonged debt and growth crisis.

The latest Public Finance Review paints a stark picture of stagnating per capita incomes, unsustainable debt dynamics, and repeated policy reversals that have eroded investor confidence and public trust.

At the core of the crisis is a pattern of large deficits, which are election‑inflated, brought about by the high cost of domestic borrowing and quasi‑fiscal losses, crowding out investment in health, education, infrastructure and social protection.

Malawi's Costly Dance With Deficits – Elections, Subsidies, And The Vanishing Fiscal Space

The review is blunt: "Fiscal imbalances sit at the core of Malawi's economic crisis." Per capita GDP growth has been negative in four of the last five years, even as spending soared from 16% of GDP in 2011/12 to 31% in 2024/25, driven mainly by wages, interest and poorly targeted subsidies.

Political cycles have amplified the damage. Over the past five electoral cycles, fiscal deficits in election years were on average 74% higher than in the preceding four years, underscoring how short‑term political incentives repeatedly trump fiscal discipline.

Malawi is facing its fourth acute balance‑of‑payments crisis since the 1990s, driven by an overvalued exchange rate and mounting quasi‑fiscal losses at the central bank. The strain has pushed reserves below one month of import cover and sent the kwacha spiralling into a steep parallel‑market premium.

Where The Money Leaks, Who Really Benefits – Subsidies Up, Services Down, Inequality Deepens

Malawi's public finances are leaking from several pipes connected to the main public finance pipeline. From fuel and electricity subsidies that mostly benefit the rich, to growing quasi‑fiscal losses and a tax system filled with exemptions.

Fuel prices are kept artificially low, and a misaligned exchange rate has created losses for importers that will take years to reverse.

Utilities like ESCOM continue to add fiscal pressure, even as only a fraction of Malawians have electricity or clean water. With most development spending funded by donors, investment in people and infrastructure remains below regional peers.

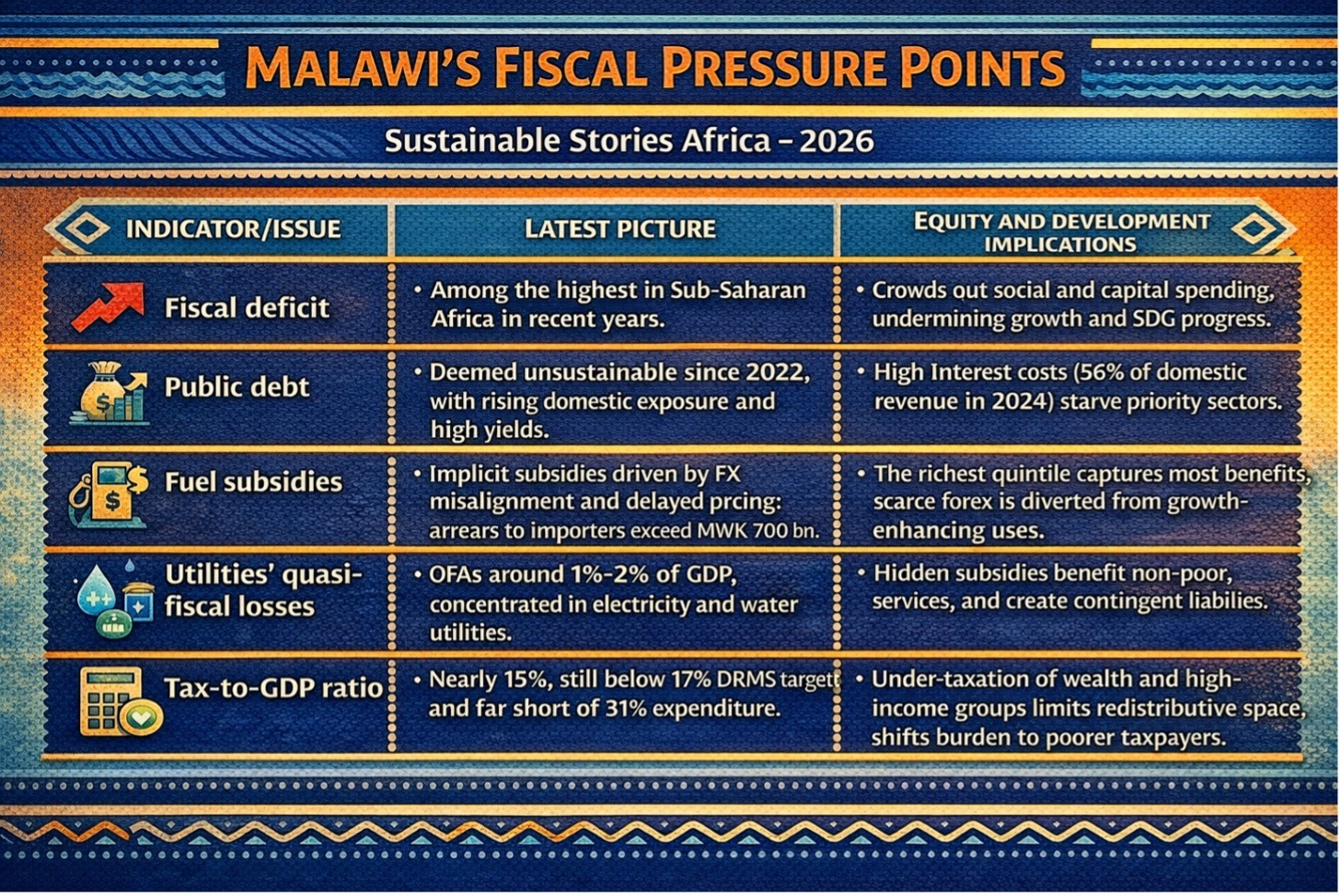

Malawi's Fiscal Pressure Points

| Indicator/Issue | Latest picture | Equity and development implications |

|---|---|---|

| Fiscal deficit | Among the highest in Sub‑Saharan Africa in recent years. | Crowds out social and capital spending, undermining growth and SDG progress. |

| Public debt | Deemed unsustainable since 2022, with rising domestic exposure and high yields. | High interest costs (56% of domestic revenue in 2024) starve priority sectors. |

| Fuel subsidies | Implicit subsidies driven by FX misalignment and delayed pricing; arrears to importers exceed MWK 700 billion. | The richest quintile captures most benefits; scarce forex is diverted from growth‑enhancing uses. |

| Utilities' quasi‑fiscal losses | QFAs around 1–2% of GDP, concentrated in electricity and water utilities. | Hidden subsidies benefit non‑poor, weaken services, and create contingent liabilities. |

| Tax‑to‑GDP ratio | Nearly 15%, still below 17% DRMS target and far short of 31% expenditure. | Under‑taxation of wealth and high‑income groups limits redistributive space, shifts burden to poorer taxpayers. |

On the revenue side, the tax system's progressivity is undermined by exemptions, special economic zone incentives, and a zero‑rate VAT base, riddled with exclusions that cost almost 1.4% of GDP annually.

While the tax‑to‑GDP ratio has grown by three percentage points over the past decade, it remains below targets, and reversals in tax policy have weakened predictability and trust.

A Credible Path To Fiscal Stability – From Crisis Management To Purposeful Consolidation

The Public Finance Review doesn't just highlight Malawi's fiscal challenges; it shows what's at stake. With the right reforms, the country could unlock between 4.3% and 10.3% of GDP in savings, depending on how boldly it moves.

Smarter spending controls, from managing the wage bill to rolling out e‑procurement, whilst cleaning investment plans, could deliver major gains in efficiency.

Meanwhile, rethinking tax incentives, tightening VAT, and modernising revenue collection could increase 4–6.5% of GDP, strengthening Malawi's fiscal foundations.

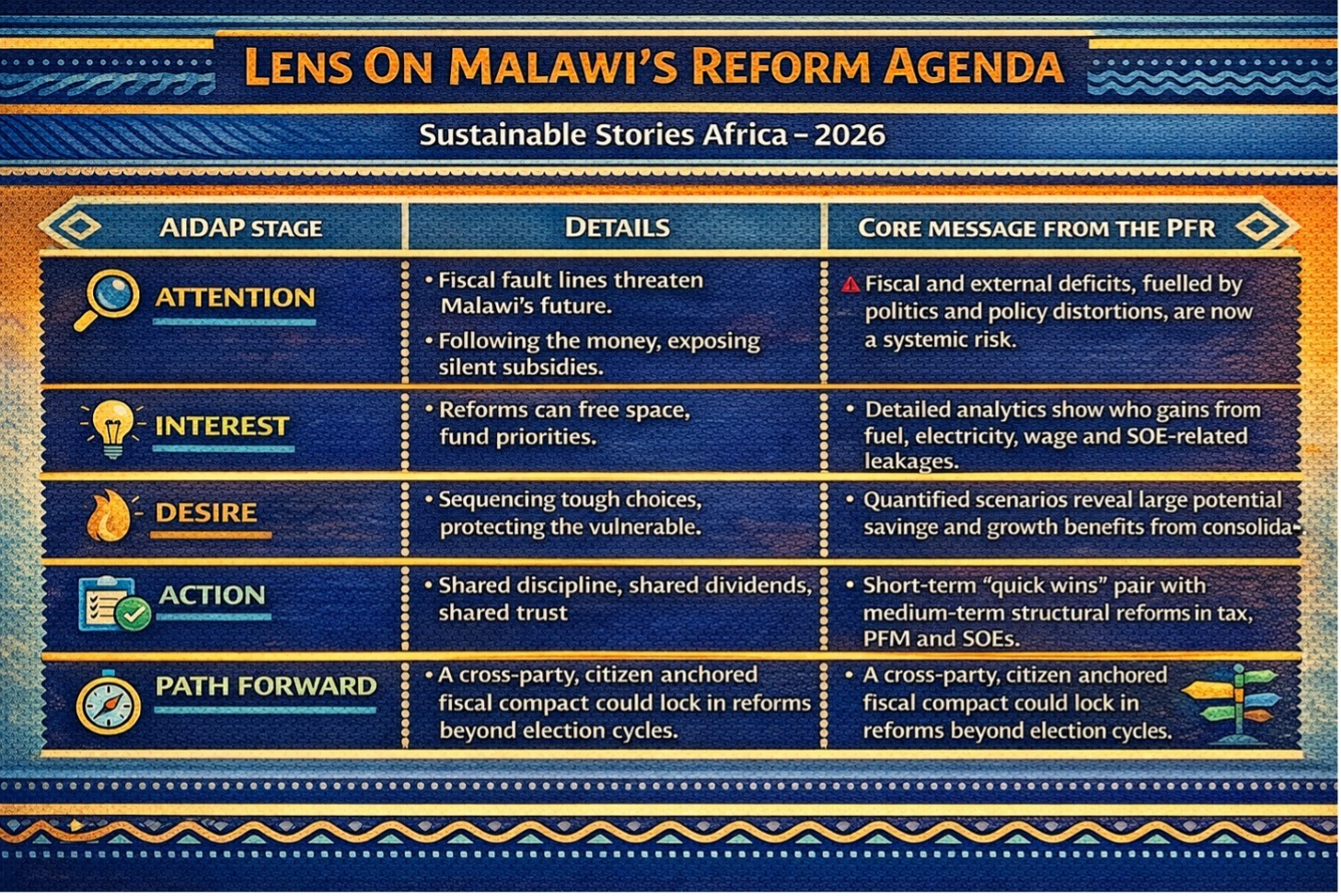

Lens On Malawi’s Reform Agenda

Under the "big push" scenario, full implementation of reforms and reinvestment of one‑third of savings into health, education and electricity access could raise revenues toward 30% of GDP, shift the primary balance into a surplus of about 3.7–3.9% of GDP over 2030–2035, and reduce public debt from about 91% of GDP in 2024 to roughly 61% by 2035.

GDP growth could grow to around 4.7%, compared to about 3.4% under a no‑reform path.

Turning Plans Into Political Commitments – Quick Wins, Hard Reforms, Social Safeguards

The review sets out a practical reform roadmap. From 2026 to 2028, the government can seize early wins by enforcing credible budgets, expanding IFMIS to take out ghost workers, cutting non‑essential spending, scrapping VAT exemptions on non‑essentials, and launching e‑invoicing to boost compliance.

The tougher phase calls for revaluing property, tightening tax incentives, and enforcing cost‑reflective tariffs.

Built‑in safeguards to protect low‑income households through VAT relief on staples, targeted cash transfers, and progressive taxation to ensure those with the most carry more of the adjustment load.

Path Forward – Restoring Confidence, Rebuilding Social Contract – Balancing Discipline, Equity, And Growth Ambition

Malawi has stood at this crossroads before. In the 1990s, runaway deficits and policy drift fueled triple‑digit inflation and a lost decade.

This was reversed only through painful reform. That history should inspire today's leaders to act before crisis forces their hand.

The PFR calls for more than fiscal repair; it envisions a new social contract where transparency and shared sacrifice lead to stronger services and a fairer future.

With courage and clarity, Malawi can trade short‑term pain for lasting, inclusive growth.