The World Economic Situation and Prospects 2026 report paints a world economy that is "steady but subdued": global growth is forecast at 2.7% in 2026, below its pre‑pandemic norm, with inflation easing but price levels still elevated.

Behind the averages, low‑income countries face weak per capita income growth, rising climate shocks and shrinking fiscal space, putting the SDGs further out of reach.

New tariff shocks, AI investment booms and record emissions define a fractured landscape, even as 2025 global deals, such as the Sevilla Commitment, World Social Summit and COP30, promise to upgrade finance, jobs and climate cooperation if countries follow through.

Global growth hopes meet stubborn headwinds

The world enters 2026 showing economic resilience on the surface; however, it remains structurally off course. Growth has held up better than feared after the pandemic, energy shocks and trade tensions.

However, global output is projected to expand by just 2.7% in 2026. This is well below the 3.2% average recorded between 2010 and 2019. Inflation is easing, but elevated prices continue to strain households, especially in developing economies where debt distress, climate shocks and limited fiscal space collide.

The World Economic Situation and Prospects 2026 report describes a decade-defining crossroads. Advanced economies benefit from disinflation, technology investment and steady labour markets.

Many low-income and vulnerable countries, however, face weak per-capita income growth, persistent poverty and shrinking access to markets, finance and technology. Trade fragmentation is accelerating as the SDGs demand urgent momentum.

Still, policy choices matter. Global commitments in 2025, from the Sevilla Financing Accord to COP30, offer a pathway toward jobs, equity and climate-aligned growth. Whether politics allows those promises to endure will shape the next three years

World economy at fragile cruising speed

Global growth is holding steady but losing momentum. After an estimated 2.8% expansion in 2025, world output is projected to ease to 2.7% in 2026, followed by a modest rebound to 2.9% in 2027, still below the 3.2% pre-pandemic average.

Easing monetary policy, rising wages and resilient labour markets are supporting demand, yet high debt burdens and tight fiscal space continue to weigh on public investment and long-term growth prospects.

Beneath the headline figures, divergence is widening. Advanced economies, including the United States, the European Union and Japan, are expected to grow at moderate but stable rates, underpinned by consumer spending, AI-linked investment and supportive policy settings.

Many low-income and vulnerable countries, however, face constrained financing, climate losses and slower income convergence. Extreme poverty, now increasingly concentrated in sub-Saharan Africa and fragile states, is declining only marginally.

Geopolitics and technology add further complexity. A sharp rise in U.S. tariffs in 2025 disrupted trade expectations, even as front-loaded shipments lifted global commerce.

Rapid investment in artificial intelligence and rising competition for critical minerals are accelerating innovation; however, they are also amplifying the risks of asset bubbles, regulatory gaps and an increasingly unequal distribution of growth gains.

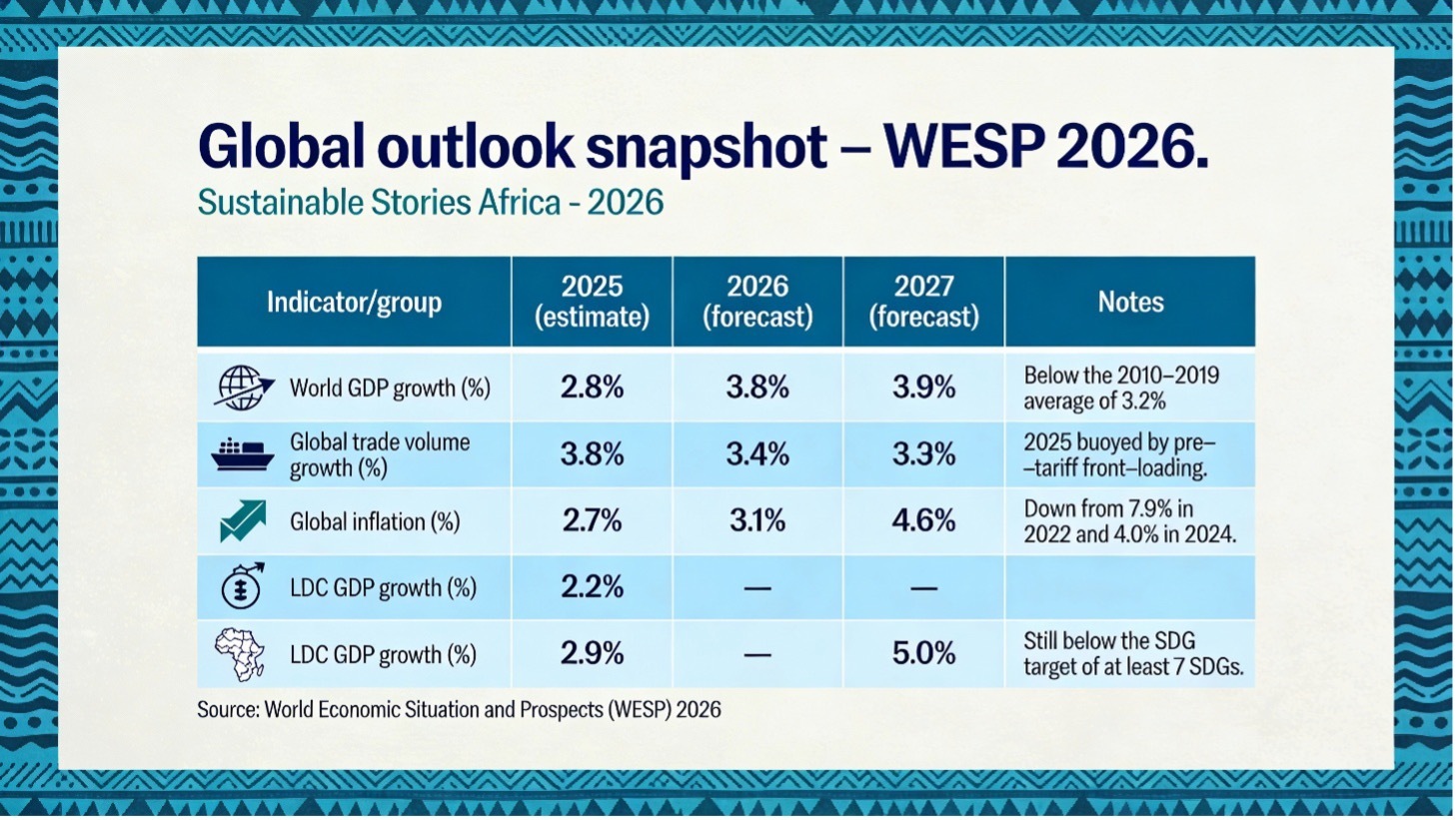

Global outlook snapshot – WESP 2026

| Indicator/group | 2025 (estimate) | 2026 (forecast) | 2027 (forecast) | Notes |

|---|---|---|---|---|

| World GDP growth (per cent) | 2.8% | 2.7% | 2.9% | Below the 2010–2019 average of 3.2% |

| Global trade volume growth (per cent) | 3.8% | 2.2% | — | 2025 buoyed by pre‑tariff front‑loading. |

| Global inflation (per cent) | 3.4% | 3.1% | — | Down from 7.9% in 2022 and 4.0% in 2024. |

| LDC GDP growth (per cent) | 3.9% | 4.6% | 5.0% | Still below the SDG target of at least 7 SDGs. |

Growth gaps, price pain, climate shocks

Global growth in 2026 – 2027 remains uneven across regions. China's expansion is expected to slow down to 4.6% in 2026 and 4.5% in 2027, weighed down by property-sector weakness and lingering trade risks despite a temporary tariff truce.

South Asia continues to outperform, with India projected to grow above 6.6%, supported by resilient consumption, strong public investment and easing financial conditions.

Africa's outlook is improving but remains fragile. Growth is expected to edge above 4% through 2027, driven by investment and consumer demand. However, narrow export bases, high borrowing costs, limited fiscal space and declining aid flows continue to constrain momentum.

Small island developing States face sharper headwinds, with growth slowing as climate risks and tourism dependence weigh on recovery.

Inflation is easing globally but remains uneven. While headline inflation is projected to fall to 3.1% in 2026, around 40% of inflation-targeting economies are still above their targets. Many developing countries face double-digit inflation, with Nigeria's rate remaining above 15% in late 2025.

Climate shocks and rising geopolitical tensions are reshaping the macro-outlook. Extreme weather is driving food price pressures, while growing military spending is diverting resources away from social investment and climate resilience in vulnerable regions.

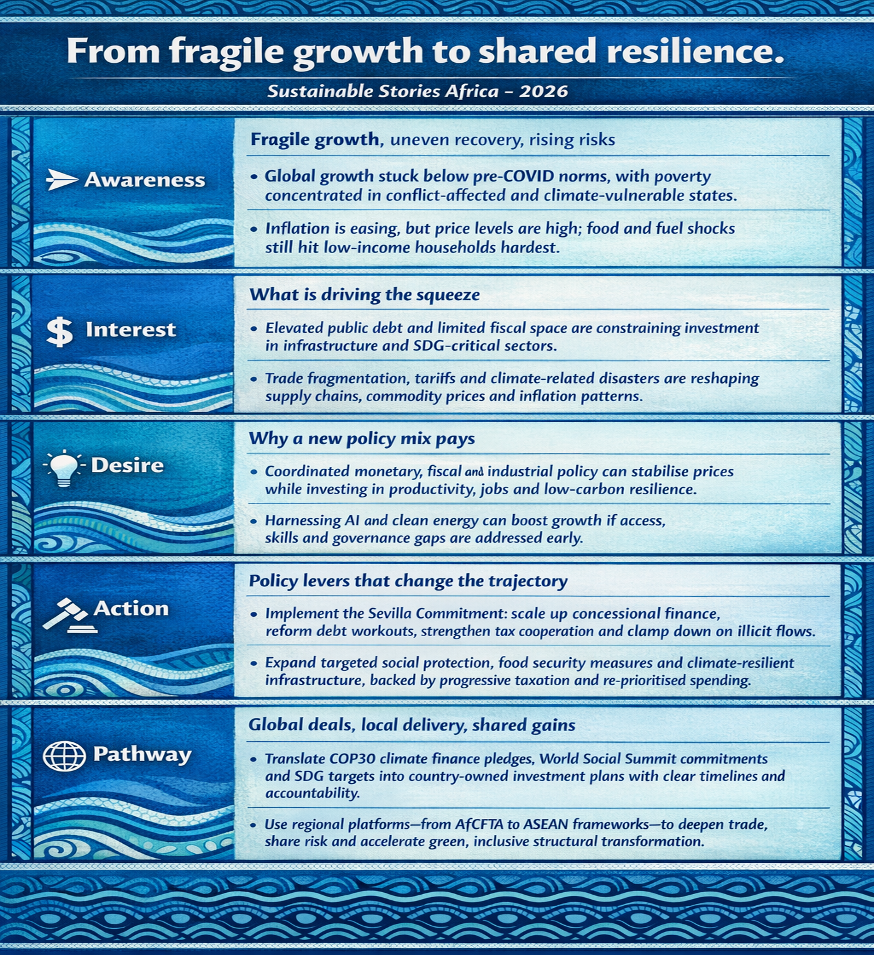

Re‑wiring growth for resilience and equity

The report argues that economic drift is a political choice, not a necessity. With inflation easing and labour markets broadly stable, governments have space to realign macro, social and climate policies, especially if the gains from AI and the green transition are shared more equitably. Recent global agreements provide a framework for that shift.

The 2025 Sevilla Commitment targets scaled-up development finance, debt relief and fairer tax cooperation. The World Social Summit re-centres jobs, equality and rights, while COP30 strengthened climate finance and adaptation support. Together, these accords encourage proactive, SDG-aligned investment over short-term stabilisation.

For developing regions, decisive action could unlock green infrastructure, digital connectivity and gender-responsive social protection through smarter taxation, redirected fossil-fuel subsidies and concessional climate finance. This would support more inclusive growth. The alternative is prolonged fragility, rising inequality and deepening climate risk.

From fragile growth to shared resilience

Path forward: reclaiming the SDG decade

Turning WESP 2026 from diagnosis into delivery requires aligning macro prudence, social protection and climate-smart investment. Governments should protect financial stability while using fiscal policy to safeguard social spending, expand green and digital infrastructure, and reform tax systems. Phasing out regressive fossil-fuel subsidies and strengthening public financial management can help convert limited fiscal space into SDG gains.

Global commitments must be embedded in national budgets and institutions. Sevilla financing reforms, World Social Summit labour agendas and COP30 climate finance tools should guide domestic policy, with regional bodies helping to pool risk and coordinate cross-border investment.

The SDG clock is ticking. Progress is possible, but not automatic. This moment must be used to hard-wire fairness, resilience and digital inclusion into economic strategy.